Explore the Scapia Credit Card for 2024—offering top rewards, cashback, and premium benefits. Discover why it’s the best choice for savvy spenders.

Table of Contents

Introduction to Scapia Credit Card

Are you on the hunt for a new credit card that fits perfectly with your lifestyle? Look no further than the Scapia Credit Card. This card has been making waves in the financial sector, and for good reason. Whether you’re a seasoned credit card user or a newbie just dipping your toes into the world of credit, the Scapia Credit Card promises to offer something for everyone.

What is Scapia Credit Card?

Basic Definition

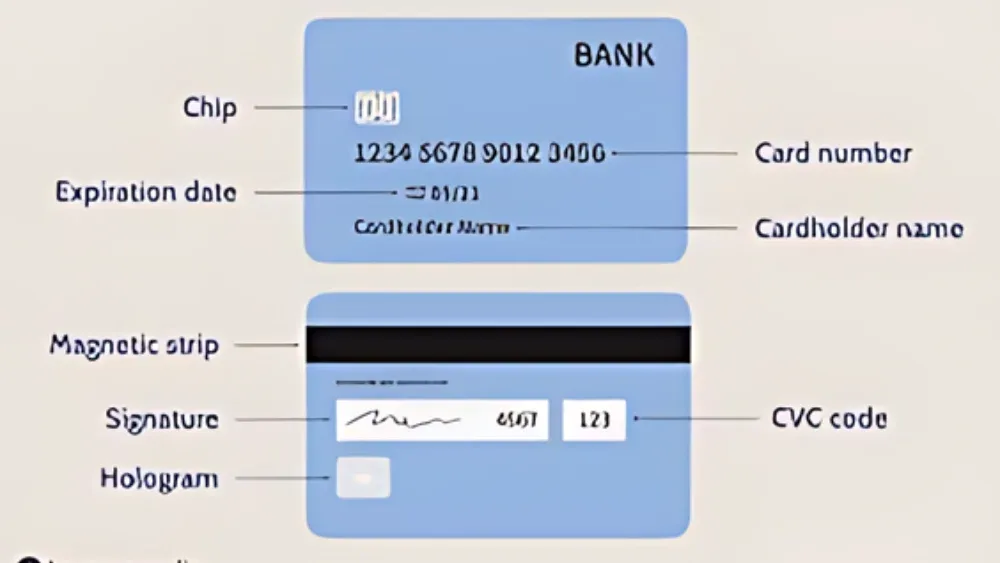

So, what exactly is the Scapia Credit Card? At its core, it’s a credit card designed to meet a variety of financial needs. It offers a blend of rewards, benefits, and features that cater to both everyday spending and special occasions. It’s not just a piece of plastic; it’s a tool that can enhance your financial well-being.

Features

The Scapia Credit Card comes packed with features that set it apart from the competition. From generous cashback offers to travel perks, it’s designed to offer maximum value. The card boasts a sleek design, is user-friendly, and integrates seamlessly with most financial management apps.

Eligibility Criteria

Thinking about applying? You’ll need to meet certain criteria. Typically, you’ll need a good credit score, stable income, and a clean credit history. But don’t let that scare you; the requirements are standard for most premium credit cards.

Benefits of Scapia Credit Card

Rewards Program

One of the standout features of the Scapia Credit Card is its rewards program. Earn points on every dollar you spend, and redeem them for a variety of rewards, from gift cards to travel discounts. It’s like getting paid to use your card!

Cashback Offers

Who doesn’t love cashback? With the Scapia Credit Card, you get a percentage of your spending back as cash. This can add up quickly, making your everyday purchases a little bit sweeter.

Travel Perks

For those who love to travel, this card is a game-changer. Enjoy benefits like free travel insurance, priority boarding, and access to airport lounges. It turns your travel experience from average to extraordinary.

Purchase Protection

Ever worried about the safety of your purchases? The Scapia Credit Card offers robust purchase protection, ensuring that you’re covered in case of theft or damage to items bought with the card.

Who Is the Provider of Scapia Credit Card?

Provider Overview

The Scapia Credit Card is offered by Scapia Financial Services, a reputable name in the financial industry. Known for their customer-centric approach, Scapia Financial Services has a track record of delivering high-quality financial products.

Reputation in the Market

With a strong market presence and positive customer reviews, Scapia Financial Services has established itself as a trustworthy provider. They’re known for their excellent customer service and transparent practices.

Market Value of Scapia Credit Card

Current Trends

The Scapia Credit Card is currently experiencing high demand, thanks to its attractive features and competitive benefits. It’s gaining popularity among consumers who are looking for value and flexibility in their credit cards.

Competitive Position

In the crowded credit card market, the Scapia Credit Card holds its own. Its blend of rewards, perks, and competitive interest rates make it a strong contender against other major players in the industry.

Return Yearly on Scapia Credit Card

Annual Fees

One of the first things you’ll notice is the annual fee. While it might be higher than some other cards, the benefits and rewards you receive often outweigh the cost. It’s important to weigh the fee against the potential returns.

Average Return on Investment

When considering the Scapia Credit Card, you’ll want to look at the average return on investment. Given the cashback offers, rewards points, and travel perks, many users find that they get more value than the annual fee they pay.

Credit card

FAQs About Scapia Credit Card: Best Credit Card For 2024

What is the annual fee for the Scapia Credit Card?

The annual fee for the Scapia Credit Card varies depending on the specific card type and benefits. It’s best to check with Scapia Financial Services for the most accurate information.

How can I apply for the Scapia Credit Card?

You can apply for the Scapia Credit Card online through their official website or visit a local branch. The application process is straightforward and can be completed in a few steps.

Are there any foreign transaction fees?

The Scapia Credit Card typically does not charge foreign transaction fees, making it an excellent choice for international travelers.

What is the credit limit for new users?

The credit limit for new users varies based on individual creditworthiness and financial status. Scapia Financial Services will assess your application and determine an appropriate limit.

How does the rewards program work?

The rewards program is designed to be user-friendly. Earn points on your purchases, and redeem them for rewards like gift cards, travel discounts, and more. The more you use the card, the more points you accumulate.

For some information, check here

HDFC Diners Metal Black Infinia Credit Card

Introduction

Welcome to the elite world of credit cards! If you’re looking for a card that not only makes a statement but also offers top-notch benefits, the HDFC Diners Metal Black Infinia Credit Card might be exactly what you need. This card combines luxury with functionality, providing a range of premium perks designed for those who demand the best. Let’s dive into what makes this card stand out from the crowd.

What is the HDFC Diners Metal Black Infinia Credit Card?

The HDFC Diners Metal Black Infinia Credit Card is a high-end offering from HDFC Bank, crafted for those who appreciate the finer things in life. Made from metal, this card is more than just a piece of plastic; it’s a symbol of luxury and exclusivity. It’s designed for individuals who want to enjoy top-tier benefits while making a statement about their premium lifestyle.

Features of the HDFC Diners Metal Black Infinia Credit Card

Design and Build

One of the first things you’ll notice about the HDFC Diners Metal Black Infinia Credit Card is its sleek, metal finish. It’s not just about aesthetics; the metal build adds a sense of durability and premium feel. This card isn’t just a transaction tool—it’s a luxury accessory that complements a high-end lifestyle.

Premium Status

Owning this card automatically elevates you to the top tier of cardholders. It’s not merely about spending money; it’s about enjoying an elite lifestyle. From exclusive lounge access to personalized concierge services, this card offers an array of features that cater to your every need.

Benefits of the HDFC Diners Metal Black Infinia Credit Card

Travel Benefits

For travel enthusiasts, this card is a dream come true. It provides complimentary access to over 1,000 airport lounges worldwide, ensuring you have a comfortable place to relax before your flight. Additionally, it offers comprehensive travel insurance coverage and protection against flight delays, making your travel experience as smooth as possible.

Dining Benefits

If you love dining out, this card has you covered. Enjoy significant discounts at premium restaurants and gain access to exclusive dining experiences. Whether you’re planning a casual meal or a fine dining experience, you’ll benefit from substantial savings and exclusive perks.

Lifestyle and Entertainment Benefits

This card extends its benefits beyond travel and dining. It covers various lifestyle and entertainment needs, including discounts on movie tickets and access to exclusive events. It’s designed to enhance your social life and provide enjoyable experiences.

Rewards and Cashback

One of the most attractive features of this card is its rewards program. Earn reward points on every purchase, which can be redeemed for a wide range of options, from travel bookings to shopping vouchers. Additionally, cashback opportunities ensure that you maximize the value of your spending.

Annual Fee and Waivers

While the HDFC Diners Metal Black Infinia Credit Card does come with a high annual fee, it’s often balanced by the numerous benefits and rewards. HDFC Bank offers options to waive the annual fee based on your spending patterns and loyalty, making it a worthwhile investment for frequent spenders.

Eligibility Criteria

To qualify for this prestigious card, you need to meet certain eligibility criteria, including a high-income bracket and a strong credit score. The specific requirements may vary, so it’s best to check with HDFC Bank for detailed information.

How to Apply for the HDFC Diners Metal Black Infinia Credit Card

Application Process

Applying for the HDFC Diners Metal Black Infinia Credit Card is straightforward. You can complete your application online through HDFC Bank’s website or visit a branch in person. The online application form is user-friendly and designed to make the process as smooth as possible.

Required Documents

You’ll need to provide several documents to apply for this card, including proof of identity, address, income, and your credit score. Having these documents ready can expedite the application process.

Approval Timeline

After submitting your application and documents, HDFC Bank will review them. The approval process typically takes a few days, during which you might be contacted for additional information.

Provider of the HDFC Diners Metal Black Infinia Credit Card

About HDFC Bank

HDFC Bank, established in 1994, is one of India’s largest and most respected private sector banks. It offers a wide range of financial products and services, including credit cards, loans, and investment solutions. The bank is known for its robust financial services and customer-centric approach.

HDFC Bank’s Reputation

HDFC Bank has built a solid reputation for excellence in customer service and innovation. It’s renowned for its reliability and cutting-edge financial solutions, making it a trusted choice for many.

Market Value of the HDFC Diners Metal Black Infinia Credit Card

Comparative Analysis

When compared to other premium credit cards, the HDFC Diners Metal Black Infinia stands out due to its unique combination of luxury and practical benefits. It’s tailored for individuals who seek an exceptional banking experience and are willing to invest in a card that offers both prestige and utility.

Cost-Benefit Analysis

The card’s cost is justified by its extensive range of benefits. From travel perks to dining discounts and lifestyle advantages, the card provides significant value, making it a smart investment for frequent users.

Return on Investment

The return on investment for this card can be substantial, thanks to its high rewards rate and exclusive perks. By maximizing the card’s benefits, you can enjoy considerable returns on your spending.

Yearly Returns and Benefits

Over the course of a year, cardholders can expect to receive significant benefits, including rewards, cashback, and exclusive access. The card’s design is meant to enhance both your daily life and special occasions.

Credit card

FAQs About HDFC Diners Metal Black Infinia Credit Card

What is the annual fee for the HDFC Diners Metal Black Infinia Credit Card?

The annual fee for this card is on the higher side but can often be waived based on your spending and loyalty.

How do I earn reward points with this card?

You earn reward points on every purchase made with the card, which can be redeemed for various rewards and benefits.

What are the travel benefits included with the card?

The card offers complimentary access to airport lounges, travel insurance, and protection against flight delays.

Can the annual fee be waived?

Yes, the annual fee can be waived depending on your spending patterns and loyalty to the bank.

How can I check my credit card application status?

You can check the status of your application online through HDFC Bank’s website or by contacting their customer service.