Here we will discuss about which SBI credit card is best for online shopping. What are the benefits and rewards for using this credit card and who is eligible for this credit card.

Table of Contents

Introduction of Which SBI credit card is best for online shopping

State Bank of India (SBI) is one of the largest and most trusted banks in India, known for its vast range of banking products and services. Among these, SBI credit cards are highly popular, offering a variety of benefits tailored to meet different customer needs. Whether you’re looking for a card that provides cashback, travel benefits, or exclusive rewards, SBI has a credit card to suit your requirements.

SBI offers a wide range of credit cards, each designed to cater to the specific needs of its diverse customer base. These cards come with a host of benefits like reward points, cashback, discounts, and travel-related perks, making them highly attractive to customers. With over 20 types of credit cards, SBI ensures that there is a card for every kind of spender, from students to high-net-worth individuals.

SBI credit cards are issued in association with global payment networks like Visa, Mastercard, and American Express, making them widely accepted both domestically and internationally. The bank’s long-standing reputation for reliability and trustworthiness further enhances the appeal of these credit cards.

History of Which SBI Credit Card Is Best For Online Shopping

State Bank of India ventured into the credit card industry in 1998 when it Started its first credit card. ab initio the trust offered amp few base card game just across the age it swollen its portfolio to admit amp comprehensive run of card game catering to disparate Customer segments. The partnership with Visa and Mastercard allowed SBI to offer globally accepted credit cards.

Over time SBI continuously Improved and Improved its credit card offerings by adding value-added benefits like reward points exclusive discounts and partnerships with various merchants and service providers.

Types of SBI Credit Cards

1. SBI Board Elite (1)

Target Audience: Superior users who want a luxury and rewards.

Important Benefits:

- Complimentary Access to global and native airport lounges

- 2x honor points along dining shopping and entertainment

- Free Membership to sole clubs and offers along dining movies and more

- Annual fee wavier if spending exceeds Rs. 5Lakh annually

2. SBI Card PRIME (2)

Target Audience: Users who want a blend of rewards and savings.

Important Benefits:

- 2x reward points on online shopping and dining.

- Discounts on movie tickets and dining.

- Complimentary airport lounge access.

- Annual fee waiver on spending ₹1 lakh annually.

3. SBI Board Simply Save

Target Audience: Budget-conscious individuals look for amp value-for-money reference card

Important Benefits:

- 10x honor points along online shopping dining and section stock purchases

- 1x honor head along complete different transactions

- No annual fee

4. SBI Card Elite (American Express)

Target Audience: Premium customers who want luxury and exclusive benefits.

Important Benefits:

- Unlimited airport lounge access worldwide.

- 5x reward points on dining movies and entertainment.

- Complimentary golf games and spa access.

- Special offers on shopping and luxury brands.

5. SBI Board Unnati

Target Audience: first-time reference board holders and those with modest reference history

Important Benefits:

- No annual fee for starting year

- 1% honor points along every purchase

- good for construction reference account for newcomers

6. SBI Card FBB

Target Audience: Fashion and influencers who shop frequently at FBB stores.

Important Benefits:

- Exclusive discounts on fashion purchases at FBB.

- 5x reward points on shopping at FBB and Big Bazaar.

- Earn points for every purchase and redeem them for discounts.

Key Features of SBI Credit Cards

SBI credit cards come with a wide array of features designed to provide convenience, rewards, and value. Some of the prominent features include:

- Reward Points

- Most SBI credit cards offer reward points for every purchase made. These points can be redeemed for a variety of rewards, such as merchandise, vouchers, cashback, and more.

- Cashback Offers

- Several SBI cards offer cashback on specific categories like groceries, fuel, or online shopping. This is ideal for users who want to save on everyday spending.

- Travel Benefits

- SBI credit cards come with attractive travel benefits, including complimentary access to airport lounges, discounts on hotel bookings, and free travel insurance.

- EMI Conversion

- SBI offers the flexibility to convert big-ticket purchases into easy EMIs, allowing users to manage their payments better.

- Fuel Surcharge Waiver

- SBI credit cards offer a waiver on fuel surcharge at select petrol stations when you use your card to pay for fuel.

- Zero Liability Protection

- If your SBI credit card is lost or stolen, you are protected from any fraudulent transactions made after you report the loss to the bank.

- Welcome Benefits

- Many SBI cards offer welcome benefits such as bonus reward points or discounts on initial spends.

Eligibility for SBI Credit Cards

To apply for an SBI credit card, you need to meet certain eligibility criteria:

- Age

- The applicant must be at least 21 years old and not more than 60 years old (age requirements may vary for specific cards).

- Income

- A steady monthly income is required. The exact minimum income requirement varies based on the card type. For example, premium cards like SBI Card ELITE require a higher income than entry-level cards.

- Credit Score

- A good credit score (typically 750 or above) improves the chances of getting your application approved.

- Documents Required

- Proof of identity (Aadhaar, PAN, Passport, etc.)

- Proof of address (Utility bills, rent agreement, etc.)

- Proof of income (Salary slips, ITR, etc.)

- Passport-sized photographs.

How to Apply for an SBI Credit Card

You can apply for an SBI credit card through the following methods:

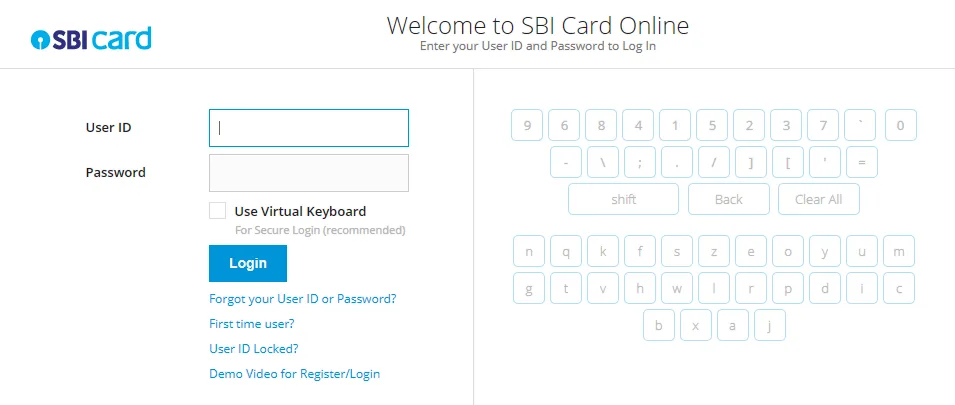

- Online Application:

Visit the official SBI website or use the SBI Card App to apply online. You can choose the credit card that suits your needs, fill out the application form, and upload the required documents. - Offline Application:

You can also visit your nearest SBI branch and submit a physical application form along with the necessary documents. - Pre-approved Offers:

If you’re an existing customer of SBI, you might receive pre-approved offers for credit cards, which simplifies the application process.

Features of SBI Credit Cards

SBI Credit Cards offer a range of features designed to provide convenience, rewards, and added benefits to their customers. Depending on the type of card, these features can vary, but generally, the following are the key features available with most SBI credit cards:

1. Reward Points System

Most SBI credit cards come with a reward points system, where customers earn points for every purchase they make. These points can be redeemed for a wide variety of rewards, such as:

- Gift vouchers from popular brands.

- Merchandise from the SBI Card Rewards catalog.

- Airline miles for travel-related rewards.

- Cashback credited to the card account.

For example, the SBI Card ELITE offers 2x reward points on dining, shopping, and entertainment, while the SBI Card Simply SAVE provides 10x reward points for online shopping and dining.

2. Fuel Surcharge Waiver

Many SBI credit cards offer a fuel surcharge waiver at select petrol stations. This feature allows cardholders to save on fuel expenses by waiving the surcharge when the card is used for fuel purchases. This benefit applies to transactions between ₹400 and ₹4,000.

3. Easy EMI Conversion

SBI provides the facility to convert large purchases into easy EMIs. This feature allows you to break your credit card bills into smaller, manageable monthly installments. You can choose the tenure for the EMI (typically 3, 6, 9, or 12 months) depending on the amount spent and the card type.

4. Zero Liability on Fraudulent Transactions

SBI offers zero liability protection if your card is lost or stolen. This means that if you report your card as lost or stolen within the required time frame (usually 24 hours), you won’t be liable for any fraudulent transactions that occur after the reporting.

5. Complimentary Airport Lounge Access

SBI premium credit cards such as the SBI Card ELITE and SBI Card PRIME provide complimentary access to domestic and international airport lounges. This is a valuable perk for frequent travelers, allowing them to relax and enjoy the amenities at lounges before their flights. The number of visits may vary depending on the card type.

6. Travel Insurance

Many SBI credit cards come with complimentary travel insurance for cardholders who use their cards to book tickets. This coverage can include:

- Trip cancellation insurance.

- Lost baggage insurance.

- Accidental death insurance during travel.

- Travel delay coverage.

Cards like the SBI Card ELITE provide comprehensive travel insurance benefits to frequent flyers.

7. Special Offers and Discounts

SBI credit cards frequently come with exclusive offers and discounts across various categories, such as:

- Shopping: Discounts at major retail outlets, online stores, and fashion brands.

- Dining: Special offers at restaurants and dining chains.

- Entertainment: Discounts on movie tickets and subscriptions (e.g., BookMyShow, Netflix, etc.). These offers are regularly updated and vary depending on the cardholder’s spending patterns.

8. Annual Fee Waiver

Several SBI credit cards offer an annual fee waiver if the cardholder spends a certain amount during the year. For example:

- SBI Card ELITE: Annual fee is waived off if you spend ₹5 lakh or more in a year.

- SBI Card PRIME: Waiver available on spending ₹1 lakh or more annually.

This feature helps cardholders avoid paying the annual fee by simply meeting the spending requirements.

9. Contactless Payments

SBI credit cards are equipped with contactless payment technology. This feature allows you to make secure payments by simply tapping your card on the POS terminal, without needing to enter a PIN for transactions below ₹5,000. It’s a faster and more convenient way to pay.

10. Customizable Credit Limit

SBI credit cards allow you to request for a customized credit limit based on your eligibility. You can increase or decrease your limit by contacting customer service, which is especially useful for managing your spending and improving your credit score.

11. Concierge Services

Premium cards like the SBI Card ELITE come with concierge services. These services offer assistance with a wide range of tasks, such as:

- Booking travel tickets and hotel reservations.

- Making restaurant reservations.

- Getting exclusive event access or recommendations.

- Assistance with gift shopping and deliveries.

12. Mobile App & Online Banking

SBI provides a user-friendly mobile app and online banking platform that allow you to manage your credit card account easily. Through the app, you can:

- Check your account balance.

- Pay bills.

- Redeem reward points.

- View and download your statements.

- Track your spending.

13. Balance Transfer Facility

If you have an outstanding balance on another credit card, you can transfer that balance to your SBI credit card through the balance transfer facility. This feature often comes with lower interest rates, making it easier to pay off your credit card debt over time.

14. Emergency Card Replacement

If your SBI credit card is lost, stolen, or damaged, you can request for an emergency card replacement. This service allows you to get a replacement card quickly, ensuring that you don’t face any major inconveniences while your primary card is being reissued.

15. Global Acceptance

SBI credit cards are accepted worldwide, thanks to partnerships with leading payment networks like Visa, Mastercard, and American Express. This makes the card highly convenient for international transactions, whether you are shopping, dining, or traveling abroad.

Advantages Of SBI Credit Cards

1. Wide Range of Cards

SBI offers a broad selection of credit cards designed for various customer needs. Whether you’re looking for cashback, travel benefits, shopping rewards, or fuel surcharge waivers, there’s an SBI card that fits your requirements. Some of the popular cards include:

- SBI Card ELITE for premium benefits.

- SBI Card Simply SAVE for reward points on everyday purchases.

- SBI Card Unnati for first-time users with no annual fee for the first 4 years.

2. Reward Points System

One of the standout features of SBI credit cards is the reward points system. Customers earn reward points on every purchase they make, which can be redeemed for a variety of rewards such as merchandise, gift vouchers, cashback, or even flight miles. The more you spend, the more rewards you earn.

3. Excellent Travel Perks

SBI credit cards, particularly the premium ones like SBI Card ELITE and SBI Card PRIME, come with valuable travel perks. These include:

- Complimentary airport lounge access (domestic and international).

- Travel insurance coverage for accidents, trip cancellations, and lost baggage.

- Exclusive deals on flight and hotel bookings. These benefits make SBI cards especially attractive to frequent travelers.

4. Fuel Surcharge Waiver

SBI credit cards offer a fuel surcharge waiver at select petrol stations. This allows cardholders to save on fuel costs by waiving the surcharge on fuel transactions ranging from ₹400 to ₹4,000. This benefit can be particularly helpful for regular drivers.

5. Flexible EMI Options

SBI allows customers to convert large purchases into easy EMIs with a flexible repayment tenure ranging from 3 to 12 months. This feature provides relief to cardholders by making large-ticket purchases more manageable, particularly for expensive items like electronics or appliances.

6. Zero Liability on Fraudulent Transactions

In case your card is lost or stolen, SBI offers zero liability protection for unauthorized transactions made after the card is reported lost. This feature ensures that you are not held accountable for fraudulent activities, adding an extra layer of security to your card.

7. Access to Exclusive Offers

SBI credit cardholders can access a variety of exclusive offers and discounts. These can include special deals on shopping, dining, travel, and entertainment. For instance, you can avail discounts on movie tickets, cashback on online purchases, and exclusive shopping offers at leading retail outlets.

8. Contactless Payments

SBI credit cards are equipped with contactless payment technology, which enables fast and secure transactions without needing to insert or swipe the card. This feature allows you to simply tap your card on the payment terminal for transactions under ₹5,000.

9. Mobile App & Online Services

SBI’s mobile app and online banking platform make it easy to manage your credit card account. You can track your spending, make payments, view statements, redeem reward points, and access customer service — all from the convenience of your phone or computer.

Disadvantages of SBI Credit Cards

1. High Annual Fees for Premium Cards

While SBI offers a range of credit cards, some of the premium cards, such as the SBI Card ELITE, come with a high annual fee. For example, the annual fee for SBI Card ELITE is ₹4,999, which may not justify the cost for users who don’t frequently use the card’s premium features like airport lounge access and travel insurance.

2. High-Interest Rates

SBI credit cards can have high-interest rates (around 3.35% per month) on outstanding balances if the cardholder fails to pay the full balance by the due date. This can make carrying a balance expensive for customers who don’t clear their dues on time.

3. Strict Eligibility Criteria for Premium Cards

Some of the premium cards, like the SBI Card ELITE, have strict eligibility requirements, including high-income thresholds and a good credit score. If you don’t meet these criteria, it may be challenging to qualify for these cards.

4. Limited International Acceptance (for American Express Cards)

While SBI credit cards issued in partnership with Visa and Mastercard are widely accepted worldwide, cards issued in association with American Express (e.g., SBI Card ELITE American Express) may have limited acceptance in certain countries or merchant locations compared to Visa and Mastercard.

5. Reward Points Redemption Can Be Complicated

Although SBI credit cards offer a rewards program, the redemption process can sometimes be cumbersome. Some users report that redeeming reward points for certain items may involve navigating through multiple steps on the website or app, and there may be limited choices for certain rewards.

6. Customer Service Issues

While SBI is known for providing extensive customer service, some users have reported delayed responses or unresolved issues when contacting the customer care team. This can be frustrating if you face any problems related to billing disputes, fraud, or card management.

7. Charges on Foreign Transactions

SBI credit cards charge a foreign transaction fee for purchases made abroad or in foreign currencies. This fee is typically around 3.5% of the transaction amount, which can add up if you frequently make international purchases.

8. Complicated Fee Structure

SBI credit cards have a complicated fee structure that may include charges for late payments, over-limit transactions, and even activation fees for certain cards. Some users might find it difficult to understand all the fees associated with using their card, leading to surprises in their billing statements.

FAQs

Which SBI credit card is best for earning reward points on online shopping?

SBI Card Simply SAVE is one of the best options for earning reward points on online shopping. This card offers 10x reward points on online purchases, making it ideal for individuals who frequently shop online. Additionally, you earn 1 reward point per ₹100 spent on other purchases. which SBI credit card is best for online shopping

Does the SBI Card ELITE offer any benefits for online shopping?

Yes, SBI Card ELITE is an excellent choice for online shopping, especially if you’re looking for premium rewards. You earn 2x reward points on dining, entertainment, and online shopping. Additionally, the card comes with a host of luxury benefits like airport lounge access and exclusive deals with e-commerce partners. which SBI credit card is best for online shopping

Can I get discounts on online shopping with SBI credit cards?

Yes, many SBI credit cards, including SBI Card Simply SAVE and SBI Card PRIME, offer exclusive discounts on popular e-commerce platforms like Amazon, Flipkart, and others. These discounts are typically offered through seasonal promotions and special tie-ups with retailers. which SBI credit card is best for online shopping

Which SBI card gives the highest reward points for online shopping?

The SBI Card Simply SAVE offers the highest reward points for online shopping with 10x reward points on purchases made through e-commerce websites and online platforms. This is one of the best credit cards for frequent online shoppers looking to maximize their rewards. which SBI credit card is best for online shopping

Does SBI offer cashback on online purchases?

While SBI credit cards primarily focus on reward points, some cards, like the SBI Card Simply CLICK, offer cashback on specific online platforms. The cashback can be redeemed for statement credits or used for future purchases. However, for broader cashback options, you may need to check specific offers from time to time. which SBI credit card is best for online shopping

Can I use my SBI credit card for e-wallet payments and still earn rewards?

Yes, SBI credit cards are accepted on most major e-wallet platforms like Paytm, Phone Pe , and Google Pay. You can earn reward points on such transactions, especially if you’re using cards like SBI Card Simply SAVE (which offers 10x reward points for online purchases) or SBI Card PRIME. which SBI credit card is best for online shopping

Are there any specific SBI cards for shopping on Amazon or Flipkart?

Yes, SBI has special partnerships with popular e-commerce sites like Amazon and Flipkart. Some SBI credit cards, such as SBI Card Simply SAVE or SBI Card ELITE, provide exclusive discounts and rewards on purchases made through these platforms. Keep an eye on promotional offers for additional savings during festive sales or special events. which SBI credit card is best for online shopping

Is there an SBI card that offers additional benefits for fashion shopping online?

For fashion shopping, the SBI Card FBB is a great option. It offers 5x reward points on purchases made at FBB, Big Bazaar, and partner fashion stores. While this is not exclusive to online shopping, it can still be beneficial if you frequently shop for fashion items at these retailers. which SBI credit card is best for online shopping

What are the fees for online purchases using SBI credit cards?

There are no extra charges for making online purchases with SBI credit cards unless you’re using the card internationally. The standard fees apply for cash withdrawals, late payments, or foreign currency transactions. However, when you use your card for online shopping within India, you can enjoy reward points and discounts without any additional cost. which SBI credit card is best for online shopping

How do I redeem my reward points for online shopping?

To redeem your reward points for online shopping, you can visit the SBI Card Rewards Portal or use the SBI Card mobile app. You can redeem the points for a variety of products, gift vouchers, or cashback, which can be used on e-commerce platforms like Amazon, Flipkart, and other partnered brands. which SBI credit card is best for online shopping

Can I convert my online shopping purchases into EMIs?

Yes, SBI credit cards offer the option to convert your online shopping purchases into EMIs (Equated Monthly Installments). You can choose a flexible repayment tenure ranging from 3 to 12 months, depending on the card and the amount spent. This is available for both large and small online purchases. which SBI credit card is best for online shopping

Which SBI credit card offers the best overall value for online shopping?

For online shopping and overall value, SBI Card Simply SAVE is one of the best choices. It offers 10x reward points on online purchases, which can be redeemed for a wide variety of rewards. It also has a low annual fee, making it an excellent option for shoppers who want to maximize their online spending benefits. which SBI credit card is best for online shopping