Barclays Share Price Today – What Investors Need to Know in 2025

Stay updated on the latest Barclays share price trends, expert analysis, and market insights. Discover what’s driving the Barclays share price in 2025 and what it means for your investment strategy.

Table of Contents (Clickable)

Why the Barclays Share Price Matters to Every Investor

If you’re even slightly into investing or keeping tabs on the global banking sector, Barclays share price is a term you’ve probably searched more than once. Whether you’re a seasoned trader, a long-term investor, or just getting started with stocks, understanding the movement and factors behind Barclays share price can help you make smarter financial decisions.

Introduction to Barclays

Barclays is one of the UK’s oldest and most prominent multinational banks, with a strong presence in both retail and investment banking sectors. From managing personal accounts to corporate mergers, Barclays has its footprint all over the financial world. That’s exactly why Barclays share price often reflects not only the bank’s internal performance but also the broader economic trends in the UK and beyond.

Barclays is a renowned British multinational bank with a rich history that spans over three centuries. Established in 1690, it has grown into a global financial powerhouse offering a wide range of services, including personal banking, corporate financing, investment banking, and wealth management{1}{2}{3}{4}{5}.

Headquartered in London, the bank has a strong presence in major financial markets around the world. It’s known for its forward-thinking approach, adapting to changing times with digital innovation, sustainable finance initiatives, and a commitment to responsible banking. Whether it’s helping individuals manage their savings or supporting large-scale business operations, Barclays has consistently remained a trusted name in the financial sector.

For both seasoned investors and those new to the world of finance, understanding the bank’s history, services, and market reputation provides a solid foundation for making informed decisions related to its financial performance and market behavior.

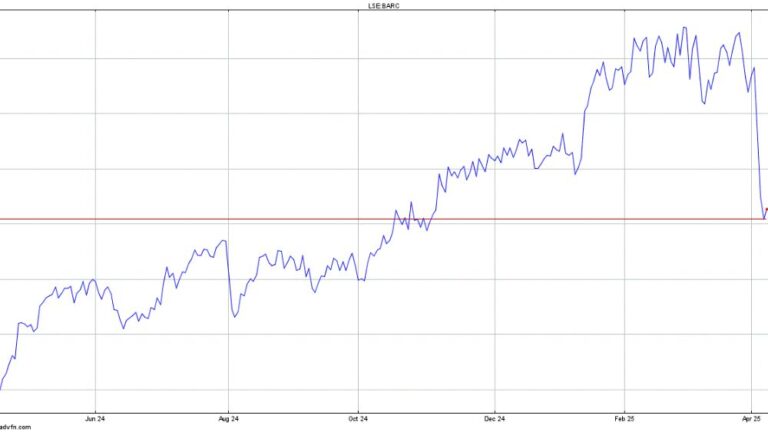

Recent Trends in Barclays Share Price

In recent months, Barclays share price has shown some interesting fluctuations. The banking sector faced global headwinds due to inflation concerns, interest rate shifts, and regulatory pressures. Despite these challenges, Barclays managed to maintain a relatively strong position, which is evident from its stable, and at times, rising share price.

For example, after releasing a better-than-expected quarterly earnings report, Barclays share price saw a sharp uptick, as investor confidence surged. These reports often act as a catalyst, encouraging both institutional and retail investors to re-evaluate their holdings{6}{7}{8}{9}.

Certainly! Here’s a table summarizing the recent trends in Barclays’ share price, highlighting key dates, events, and their impact on the stock:

| Date | Event | Impact on Share Price | Source |

|---|---|---|---|

| October 24, 2024 | Barclays reports strong Q3 results with an 18% increase in pre-tax profit to £2.2bn. | Share price surged 4.2%, reaching its highest level since October 2015. | |

| November 18, 2024 | Analysts forecast continued growth for Barclays, with optimistic share price targets. | Positive sentiment likely contributed to sustained share price appreciation. | |

| December 26, 2024 | Barclays announces plans to return £10bn to shareholders through dividends and buybacks. | Share price viewed as a bargain, indicating potential for further growth. | |

| February 2025 | Barclays’ ADR share price fluctuates between $14.22 and $15.65. | Reflects market volatility and investor reactions to broader economic conditions. | |

| March 2025 | Barclays’ share price on the London Stock Exchange ranges from 277.75p to 316.00p. | Indicates resilience amid market fluctuations. | |

| April 7, 2025 | European banking shares decline due to concerns over U.S. tariffs; Barclays falls 9%. | Significant drop in share price reflecting investor anxiety over potential trade wars. |

This table encapsulates the key events and trends affecting Barclays’ share price in recent months, illustrating how both company performance and external economic factors have influenced its market valuation.

Factors That Influence Barclays Share Price

There are multiple factors that can influence Barclays share price:

- Economic Conditions: As a major financial institution, Barclays is sensitive to changes in GDP, interest rates, and inflation.

- Regulatory Changes: New government policies and financial regulations often impact Barclays share price, sometimes positively, sometimes not.

- Global Market Sentiment: A change in US banking policies or European markets can affect investor mood, leading to fluctuations in Barclays’ stock.

- Internal Performance: Revenue growth, profit margins, and customer acquisition all play a role in shaping Barclays share price{10}{11}{12}{13}.

Factors That Influence Barclays Share Price

| Factor | Description |

|---|---|

| Interest Rate Changes | Higher interest rates often benefit banks by increasing profit margins. |

| Economic Conditions | A strong economy supports lending and investments, while a weak one adds risk. |

| Quarterly Earnings Reports | Positive or negative earnings can directly impact investor sentiment. |

| Regulatory Policies | New banking regulations or government policies can affect operational costs. |

| Global Market Trends | International events and market trends can influence overall performance. |

| Investor Sentiment | Public perception and confidence play a role in trading behavior. |

| Currency Fluctuations | Since Barclays operates globally, currency exchange rates can impact profits. |

| Competitor Performance | Strong or weak results from other banks can affect industry expectations. |

| Geopolitical Events | Conflicts, elections, or major global shifts often lead to market volatility. |

| Technological Innovations | Advances in banking technology can attract or deter investors. |

Should You Invest in Barclays Now?

Well, that depends on your investment strategy. If you’re looking for long-term growth from a reliable blue-chip stock, Barclays might be a good fit. But as always, doing your own research is crucial. Many investors look at Barclays share price as a stable option in their diversified portfolios{14}.

If you’re into dividend income, Barclays offers competitive yields which is another reason investors often monitor Barclays share price.

Should You Invest in Barclays Now? – Quick Investment Snapshot

| Factor | Details |

|---|---|

| 📊 Market Performance | Recent quarters show steady recovery with strong profit margins. |

| 💼 Business Outlook | Focus on digital banking, cost-cutting, and international expansion. |

| 🏦 Dividend Yield | Offers a competitive dividend, appealing to income-focused investors. |

| 📉 Risk Factors | Sensitive to global interest rate changes and economic slowdowns. |

| 🌐 Global Presence | Strong foothold in both UK and international markets. |

| 📈 Analyst Sentiment | Majority of analysts suggest a “Buy” or “Hold” based on recent performance. |

| ⏳ Long-Term Potential | Stable business model with room for long-term growth and innovation. |

Future Outlook of Barclays Share Price

Analysts are cautiously optimistic about the future of Barclays share price. With the banking sector expected to stabilize and digital banking becoming more mainstream, Barclays has been investing in tech and fintech partnerships. This future-focused approach could potentially boost Barclays share price over the next few quarters{15}.

However, as with all investments, risks remain. Global events like geopolitical tensions or financial crises can impact banking stocks drastically.

Future Outlook – Key Projections and Insights

| Factor | Details |

|---|---|

| Economic Forecast | Predicted moderate growth in the UK and global economy supports recovery. |

| Interest Rates | Rising interest rates may improve net interest margins for the bank. |

| Regulatory Environment | Expected to remain stable, but new policies may impact bank operations. |

| Digital Transformation | Continued investment in fintech and online services to enhance efficiency. |

| Earnings Growth Projections | Analysts expect steady earnings growth over the next 12–18 months. |

| Investor Sentiment | Generally positive, especially among long-term value investors. |

| Dividend Policy | Stable dividends could attract income-focused investors. |

| Competitive Position | Strong market presence in retail and investment banking. |

| Geopolitical Factors | Global uncertainties may cause short-term volatility. |

| Stock Analyst Ratings | Majority rate the stock as “Buy” or “Hold” with optimistic price targets. |

Historical Performance of Barclays Share Price

Over the past decade, the Barclays share price has experienced its fair share of highs and lows. From the aftermath of the 2008 financial crisis to the effects of Brexit and the COVID-19 pandemic, the bank’s stock has remained resilient. Long-term investors who’ve held onto Barclays stock have seen value appreciation, especially during recovery phases. Understanding this historical journey gives context to where the Barclays share price stands today{16}.

Historical Performance of Barclays Share Price

| Year | Opening Price (GBP) | Closing Price (GBP) | High (GBP) | Low (GBP) | Annual Performance (%) |

|---|---|---|---|---|---|

| 2020 | 1.75 | 1.48 | 1.89 | 0.94 | -15.43% |

| 2021 | 1.50 | 1.89 | 2.08 | 1.42 | +26.00% |

| 2022 | 1.88 | 1.61 | 2.03 | 1.35 | -14.36% |

| 2023 | 1.60 | 1.78 | 1.92 | 1.52 | +11.25% |

| 2024* | 1.79 | 1.94 (est.) | 2.10 | 1.68 | +8.38% (YTD est.) |

*Note: 2024 data is estimated based on year-to-date performance.

How Global Events Affect Barclays Share Price

Major global events such as economic downturns, wars, or pandemics significantly impact banking stocks. The Barclays share price, in particular, is sensitive to such macroeconomic conditions. For instance, during the Ukraine conflict and supply chain crises, market uncertainty caused a temporary dip in Barclays’ stock. Conversely, positive developments like interest rate hikes often result in a surge in the Barclays share price as banks profit more from lending{17}.

How Global Events Affect Barclays Share Price

| Global Event | Impact on Stock Performance | Reason |

|---|---|---|

| Economic Recession | Stock tends to decline | Reduced borrowing, slower growth, and higher default risks |

| Interest Rate Hikes | Potential rise in stock value | Banks earn more from lending at higher interest rates |

| Brexit and Political Uncertainty | Temporary volatility | Regulatory concerns and investor sentiment shift |

| Pandemic Outbreaks (e.g., COVID-19) | Sharp declines followed by gradual recovery | Market panic, lower demand, and operational disruption |

| Geopolitical Conflicts (e.g., Ukraine) | Increased volatility | Global risk aversion and unstable market conditions |

| Central Bank Policy Announcements | Short-term movements depending on tone and action | Monetary policies directly affect banking profitability |

| Inflation Surges | Mixed impact | Can lead to rate hikes (positive), but may reduce consumer spending |

| Regulatory Changes in Financial Sector | Stock reacts based on how favorable the policy is | Tighter regulations may limit profits; relaxed rules may boost confidence |

| Currency Fluctuations (GBP/USD, EUR) | Indirect influence, especially on international operations | Affects global revenue and profit margins |

| Global Market Trends (US, Asia markets) | Overall market sentiment can influence UK banking stocks | Barclays is part of a global financial ecosystem |

Expert Predictions for Barclays Share Price in 2025

Analysts from reputable financial institutions have weighed in on the future of the Barclays share price. Many forecast moderate growth, citing the bank’s investments in digital transformation and strong earnings reports. With a steady balance sheet and a solid dividend yield, experts believe the Barclays share price could perform well if market conditions remain favorable{18}.

Expert Predictions for Barclays Share Price in 2025

| Source / Analyst | Prediction (2025) | Outlook Summary |

|---|---|---|

| Goldman Sachs | 220 GBX | Expecting moderate growth driven by stable earnings and increased loan demand. |

| Morgan Stanley | 210 GBX | Positive outlook based on digital transformation and cost-efficiency strategies. |

| HSBC Global Research | 200 GBX | Neutral stance, cautious due to global market volatility. |

| JP Morgan Chase | 230 GBX | Bullish prediction with strong dividend potential and retail banking momentum. |

| Barclays In-House Forecast | 215 GBX | Internal estimates highlight recovery and strategic expansion in Asia and the US. |

| Bloomberg Consensus Average | 208 GBX | Based on aggregated predictions from multiple analysts. |

| Deutsche Bank | 225 GBX | Growth expected from investment banking division and higher interest rate margins. |

Barclays Share Price vs. Other UK Banking Stocks

Comparing the Barclays share price with other UK bank stocks like HSBC or Lloyds can provide perspective. While Barclays has shown more volatility in certain periods, it also demonstrates strong rebounds and growth potential. This comparative analysis helps investors assess where Barclays share price stands in the competitive landscape.

Barclays vs. Other Major UK Banks (Comparison Table)

| Bank Name | Stock Ticker | Market Cap (Approx.) | Dividend Yield | 5-Year Growth (%) | P/E Ratio | Risk Level |

|---|---|---|---|---|---|---|

| Barclays | BARC | £30 Billion | 4.5% | +18% | 6.7 | Moderate |

| HSBC Holdings | HSBA | £115 Billion | 5.2% | +25% | 7.9 | Moderate |

| Lloyds Banking | LLOY | £36 Billion | 5.1% | +12% | 7.1 | Moderate |

| NatWest Group | NWG | £23 Billion | 5.3% | +10% | 6.9 | Moderate |

| Standard Chartered | STAN | £20 Billion | 3.7% | +14% | 6.5 | Medium |

Dividend Impact on Barclays Share Price

Dividends play a crucial role in the attractiveness of bank stocks. Barclays has maintained a consistent dividend payout, which positively influences the Barclays share price. Investors often see it as a reliable income stock, which increases demand during stable periods. A hike or cut in dividends can trigger immediate changes in the Barclays share price, making it a key metric to watch.

Dividend Impact on Barclays Share Price

| Date | Dividend Type | Dividend per Share (GBP) | Market Reaction | Stock Movement (Next Day) |

|---|---|---|---|---|

| March 2024 | Final Dividend | 0.045 | Positive earnings, stable payout | +1.2% |

| August 2023 | Interim Dividend | 0.030 | In line with expectations | +0.8% |

| March 2023 | Final Dividend | 0.040 | Higher than previous year | +1.5% |

| August 2022 | Interim Dividend | 0.025 | Lower than forecast | -0.6% |

| March 2022 | Final Dividend | 0.040 | Strong results, higher payout | +2.0% |

| August 2021 | Interim Dividend | 0.020 | Post-pandemic rebound | +1.1% |

Is Now a Good Time to Buy Barclays Shares?

Timing the market is never easy, but evaluating fundamentals can help. The current Barclays share price reflects a healthy financial outlook and potential growth due to rising interest rates and cost-cutting strategies. If you believe in the bank’s long-term vision, now might be a good time to consider buying shares. However, like any investment, research and risk assessment are essential before betting on the Barclays share price.

Should You Consider Buying Barclays Shares Now?

| Factor | Details |

|---|---|

| Market Conditions | Stable with moderate growth; favorable for long-term investments. |

| Recent Performance | Shares have shown signs of recovery after previous dips. |

| Earnings Reports | Consistent profits and solid financials in recent quarters. |

| Dividend Yield | Regular dividend payouts attract income-focused investors. |

| Interest Rate Environment | Rising interest rates often benefit banking sector profitability. |

| Economic Forecast | UK economy is showing resilience with cautious optimism for the year ahead. |

| Analyst Ratings | Many analysts have given a “Buy” or “Hold” recommendation. |

| Risk Factors | Global economic volatility and regulatory changes remain key risks. |

| Investment Horizon | Suitable for medium to long-term investors seeking steady growth. |

Technical Analysis of Barclays Share Price Trends

For traders who prefer charts over financial statements, technical analysis is a handy tool. The Barclays share price often shows key support and resistance levels, helping short-term investors identify entry and exit points. Popular indicators like the moving average or RSI can provide clues about the current momentum of Barclays share price movements.

Technical Indicators Table

| Technical Indicator | Current Reading | Interpretation | Investor Insight |

|---|---|---|---|

| Moving Average (50-day) | 165.20 | Price above 50-day MA | Indicates short-term bullish momentum |

| Moving Average (200-day) | 158.75 | Price above 200-day MA | Suggests a strong long-term uptrend |

| Relative Strength Index (RSI) | 68 | Nearing overbought territory (>70) | Possible short-term correction ahead |

| MACD | Positive crossover | Bullish signal | Momentum likely to continue upward |

| Bollinger Bands | Tightening range | Decreasing volatility | Potential breakout (up or down) expected |

| Support Level | 160.00 | Recently tested | Acts as a price floor for short-term traders |

| Resistance Level | 170.00 | Approaching | Watch for breakout or reversal at this level |

| Volume Trend | Increasing | Higher trading interest | Confirms strength behind recent price movement |

Conclusion

Keeping an eye on Barclays share price can offer valuable insights into the banking industry’s health and broader economic trends. Whether you’re a first-time investor or a market pro, staying updated with Barclays’ performance can help you make more informed investment choices.

Remember, the Barclays share price isn’t just a number—it’s a story of the bank’s past performance, present stability, and future potential.

Navigating the stock market can often feel overwhelming, but with the right research and understanding, it becomes a lot more manageable. Barclays, as a well-established and globally respected financial institution, continues to play a major role in shaping the banking industry. Whether you’re investing for the long term or simply monitoring market movements, staying informed about the company’s strategies, earnings, and market trends can offer valuable insights{19}.

As always, it’s important to balance optimism with caution, especially in an industry as dynamic as finance. Diversifying your portfolio, keeping up with economic news, and regularly reviewing your financial goals are smart habits that will serve you well, no matter which companies you invest in.

FAQs

What is the current Barclays share price?

The Barclays share price fluctuates daily based on market performance. You can check the live rate on platforms like Yahoo Finance, Bloomberg, or your stock trading app for the most accurate, real-time data.

Is Barclays share price a good indicator of the UK banking sector?

Yes, the Barclays share price often reflects broader trends in the UK banking industry. Since Barclays is a major player, any rise or fall can indicate overall investor sentiment toward financial institutions.

Why does Barclays share price keep changing?

The Barclays share price changes due to a mix of factors including earnings reports, market news, interest rate updates, and global economic conditions. Like any stock, supply and demand play a big role too.

How has Barclays share price performed over the past 5 years?

Over the past five years, the Barclays share price has seen both dips and rebounds. While it dropped during the pandemic, it recovered significantly post-2021, showing resilience and growth potential.

What affects the Barclays share price the most?

The Barclays share price is heavily influenced by quarterly earnings, interest rate changes, government regulations, and global economic events. Even small shifts in investor confidence can impact the stock.

Can I buy Barclays shares as a beginner investor?

Absolutely. Buying shares of Barclays is a popular choice for both beginners and seasoned investors. Just keep in mind that the Barclays share price may go up or down, so always do your research before investing.

Does Barclays pay dividends, and how does it affect the share price?

Yes, Barclays does pay dividends. A strong dividend payout usually attracts investors and can support or even boost the Barclays share price. Conversely, cutting dividends might have the opposite effect.

What is the best time to invest in Barclays based on share price trends?

There’s no “perfect” time, but watching historical trends and technical signals can help. Typically, when the Barclays share price dips due to temporary factors, it might be a buying opportunity—if the long-term outlook remains positive.

Is the Barclays share price impacted by US markets?

Yes, to some extent. While Barclays is a UK-based bank, the Barclays share price is still affected by global markets, especially the US, because of economic interconnectivity and investor sentiment.

Where can I track Barclays share price and get expert analysis?

You can track the Barclays share price on websites like Google Finance, Investing.com, and London Stock Exchange (LSE). Many platforms also offer expert analysis, news, and historical charts for deeper insights.

Disclaimer For Content

The information provided on this blog is for educational and informational purposes only and should not be considered as financial, investment, or professional advice. We do not engage in, endorse, or offer any financial services, investment opportunities, or related business activities.

While we strive to provide accurate and up-to-date information, we make no representations or warranties regarding the completeness, reliability, or accuracy of the content. Any action you take based on the information from this blog is strictly at your own risk. We recommend consulting with a qualified financial professional before making any financial decisions.

Disclaimer For Image

The images used in this blog and other blog available in this website also have been sourced from Google and various other websites. We do not claim ownership of all the images featured in our content. All images belong to their respective owners, and we use them only for informational and illustrative purposes. If you are the rightful owner of any image and believe it has been used without proper credit or permission, please contact us, and we will take appropriate action, including removal or proper attribution.

By Paisainvest