Here you will find the complete information related to sbi reliance rupay credit card . The key benefits, features and eligibility criteria for this credit card.

Table of Contents

Introduction (1)

The SBI Reliance RuPay Credit Card is a collaborative offering by two major entities in India—State Bank of India (SBI) and Reliance Industries Limited. This credit card aims to cater to the growing demands of Indian consumers by integrating affordability, convenience, and tailored benefits. Designed for both urban and semi-urban customers, the card leverages the RuPay payment network, which has gained popularity for its wide acceptance and customer-centric features.

This credit card is particularly attractive for individuals who are part of the Reliance ecosystem, offering benefits such as exclusive discounts, cashback, and rewards on purchases made across Reliance’s retail outlets and services. Additionally, the card’s association with the RuPay network ensures seamless transactions, enhanced security, and affordability, making it an ideal choice for a broad spectrum of users.

In this blog post, we will delve into the history of this card, its unique features, the benefits it offers, and why it stands out in the competitive credit card market.

History of the SBI Reliance RuPay Credit Card (2)

The Genesis of Collaboration

The SBI Reliance RuPay Credit Card is the product of a strategic collaboration between three prominent entities:

- State Bank of India (SBI): As the largest public-sector bank in India, SBI has been at the forefront of financial innovation, offering a wide range of credit card products tailored to various customer needs.

- Reliance Industries Limited (RIL): A leader in retail, telecom, and energy sectors, Reliance has consistently focused on enhancing consumer experiences.

- RuPay Payment Network: An indigenous payment system developed by the National Payments Corporation of India (NPCI), RuPay provides a secure and cost-effective platform for digital transactions.

This collaboration is rooted in a shared vision of empowering Indian consumers by combining SBI’s financial expertise, Reliance’s retail dominance, and RuPay’s technological capabilities.

Timeline of Development

- Conceptualization (Early 2020s): The idea for the SBI Reliance RuPay Credit Card emerged as Reliance sought to integrate its retail and telecom businesses with financial services to provide a holistic ecosystem for customers. SBI, already a key player in the credit card space, was the natural partner for such an initiative.

- Launch and Introduction (2022): The card was officially launched with the aim of capturing a large customer base, especially those loyal to Reliance’s offerings such as Reliance Retail, Jio, and Reliance Petroleum. The launch coincided with the rising popularity of RuPay as a preferred payment network, driven by its acceptance and security features.

- Market Penetration (2023 onwards): The SBI Reliance RuPay Credit Card gained significant traction through targeted marketing campaigns, offering exclusive benefits on Reliance products and services. Its affordability and feature-rich design helped it appeal to both first-time credit card users and seasoned customers.

Positioning in the Market

The card’s unique value proposition lies in its focus on the Reliance ecosystem, coupled with RuPay’s affordability. Unlike traditional credit cards dominated by international networks like Visa and Mastercard, this card emphasizes local benefits and a cost-effective structure. It targets a diverse audience, from urban professionals to semi-urban households, making it a versatile financial product.

Different Types Of Sbi Reliance Rupay Credit Card (3)

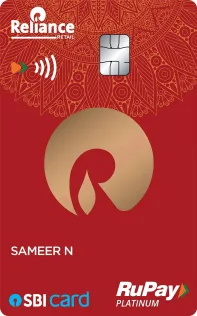

Reliance SBI Card: This card is designed for everyday shoppers, providing benefits such as:

- Welcome Benefits: Receive Reliance Retail vouchers worth ₹500 and discount vouchers totaling ₹3,200 upon card activation.

- Rewards: Earn reward points on purchases made at Reliance Retail stores and other outlets.

- Annual Fee: ₹499 plus GST.

- Renewal Fee: ₹499 plus GST from the second year onwards; however, the renewal fee is waived if annual spends exceed ₹1,00,000.

- Add-on Cards: Available for family members above 18 years at no additional cost.

- Additional Benefits: Access to utility bill payment facilities, balance transfer on EMI, and Flexipay options.

- Contactless Advantage: Facilitates quick and secure transactions for daily purchases.

- Worldwide Acceptance: Use the card at over 24 million outlets globally.

- Cash Withdrawals: Withdraw cash from over 1 million Visa or MasterCard ATMs worldwide.

- Utility Bill Payment Facility: Pay electricity, telephone, mobile, and other utility bills using the Easy Bill Pay facility.

- Balance Transfer on EMI: Transfer outstanding balances from other banks’ credit cards to the Reliance SBI Card at a lower interest rate and repay in EMIs.

- Flexipay: Convert purchases of ₹2,500 or more into easy monthly installments.

- Fuel Surcharge Waiver: 1% waiver on fuel surcharge for transactions between ₹400 and ₹3,000, exclusive of GST and other charges, with a maximum waiver of ₹100 per billing cycle.

- Fees and Charges: For detailed information on fees and other applicable charges, refer to the Most Important Terms & Conditions.

- Order of Payment Settlement: Details available in the Most Important Terms & Conditions.

- Additional Information: Cheques payable outside clearing zones are not accepted. Payments should be made through local cheques or drafts payable in Delhi only. All taxes would be charged as applicable on all the above fees, interest, and charges. The value proposition of the co-branded product may be funded jointly by SBI Card and the co-brand partner based on the financial arrangement between both parties. Accordingly, there may be fee and revenue sharing between the two parties.

- Customer Assistance: For assistance, call the SBI Card helpline at 39 02 02 02 (prefix local STD code) or 1860 180 1290.

- Terms and Conditions: All information is correct as per July 2018 and is subject to change at the discretion of SBICPSL. SBI Card’s Most Important Terms and Conditions are also available at www.sbicard.com.

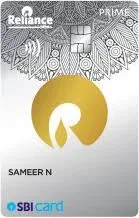

Reliance SBI Card PRIME: A premium version offering enhanced benefits, including:

- Welcome Benefits: Receive Reliance Retail vouchers worth ₹3,000 and discount vouchers totaling ₹11,999 upon card activation.

- Rewards: Earn higher reward points on purchases at Reliance Retail stores and other outlets.

- Annual Fee: ₹2,999 plus GST.

- Renewal Fee: ₹2,999 plus GST from the second year onwards; renewal fee is waived if annual spends exceed ₹1,00,000.

- Add-on Cards: Available for family members above 18 years at no additional cost.

- Additional Benefits: Includes all features of the Reliance SBI Card, with enhanced rewards and higher value vouchers.

Comparison Table

| Feature | Reliance SBI Card | Reliance SBI Card PRIME |

|---|---|---|

| Annual Fee | ₹499 + GST | ₹2,999 + GST |

| Renewal Fee | ₹499 + GST (waived on ₹1,00,000 annual spend) | ₹2,999 + GST (waived on ₹1,00,000 annual spend) |

| Welcome Benefits | ₹500 Reliance Retail voucher + ₹3,200 worth vouchers | ₹3,000 Reliance Retail voucher + ₹11,999 worth vouchers |

| Reward Points | Earn reward points on Reliance Retail and other purchases | Earn higher reward points on Reliance Retail and other purchases |

| Add-on Cards | Available at no additional cost for family members above 18 | Available at no additional cost for family members above 18 |

| Fuel Surcharge Waiver | 1% on transactions between ₹400 and ₹3,000 (max ₹100 per month) | 1% on transactions between ₹400 and ₹3,000 (max ₹100 per month) |

| Utility Bill Payment Facility | Yes | Yes |

| Balance Transfer on EMI | Yes | Yes |

| Flexipay | Yes (convert purchases over ₹2,500 into EMIs) | Yes (convert purchases over ₹2,500 into EMIs) |

| Worldwide Acceptance | Accepted globally at over 24 million outlets | Accepted globally at over 24 million outlets |

| Cash Withdrawals | Available from over 1 million Visa or MasterCard ATMs worldwide | Available from over 1 million Visa or MasterCard ATMs worldwide |

| Additional Benefits | Contactless payments, 24/7 customer support, and more | Contactless payments, premium rewards, 24/7 customer support, and more |

Key Differences:

- Annual Fee & Renewal Fee: Reliance SBI Card PRIME has a higher fee compared to the regular Reliance SBI Card.

- Welcome Benefits: Reliance SBI Card PRIME offers more substantial welcome benefits than the standard Reliance SBI Card.

- Reward Points: Reliance SBI Card PRIME provides enhanced reward points, making it more beneficial for high spenders.

- Additional Benefits: The PRIME card offers a more premium experience with higher rewards and better voucher offers.

Both cards share many core features, but the PRIME card offers enhanced rewards and benefits for more frequent or higher spenders.

Features of the SBI Reliance RuPay Credit Card

- Cashback on Reliance Purchases:

- Special cashback offers on purchases made at Reliance Retail, Reliance Digital, and Reliance Fresh outlets.

- Additional discounts on Jio prepaid and postpaid recharges, as well as purchases on the JioMart platform.

- Reward Points Program:

- Earn points on every transaction, which can be redeemed for exclusive rewards, gift cards, or bill payments.

- Higher reward rates for transactions within the Reliance ecosystem.

- Fuel Surcharge Waiver:

- Fuel surcharge waiver on transactions at Reliance Petroleum outlets.

- Capped monthly limits to ensure affordability.

- Affordable Annual Fee:

- Minimal or zero joining fees, with the possibility of waiving the annual fee on achieving a specific spending threshold.

- Enhanced Security:

- RuPay’s robust security protocols ensure safe and secure transactions, including tokenization and encryption.

- Built-in fraud detection mechanisms.

- Wide Acceptance:

- Accepted across all major online and offline merchants in India.

- Compatibility with popular digital wallets like Google Pay, PhonePe, and Paytm.

- Contactless Payments:

- NFC-enabled cards allow for quick and hassle-free contactless transactions.

- EMI Conversion:

- Facility to convert large purchases into easy EMIs with flexible repayment tenures.

- Add-On Cards:

- Option to issue add-on cards for family members, allowing shared benefits and spending limits.

Benefits of the SBI Reliance RuPay Credit Card

1. Financial Savings

The card provides significant savings through cashback, discounts, and rewards, particularly for Reliance customers. This makes it a cost-effective choice for those who frequently shop at Reliance outlets or use Jio services.

2. Comprehensive Rewards Program

The robust rewards program incentivizes spending within the Reliance ecosystem, ensuring that users receive maximum value for their transactions.

3. Accessibility and Affordability

With minimal fees and no hidden charges, the card is accessible to a broader demographic, including first-time credit card users.

4. Promoting Digital Payments

By leveraging the RuPay network, the card encourages digital payments, aligning with India’s vision of a cashless economy.

5. Personalized Experience

The card is tailored to the needs of Reliance customers, providing a seamless and integrated shopping and payment experience.

Additional Benefits Of Sbi Reliance Rupay Credit Card

1. Contactless Payments

- Both cards allow for quick, secure transactions using contactless technology, making it easier to pay for everyday purchases.

2. Utility Bill Payments

- Cardholders can use the SBI Reliance Credit Card to pay for various utility bills, such as electricity, mobile, and telephone bills, through the Easy Bill Pay facility.

3. Balance Transfer on EMI

- You can transfer the outstanding balance from other credit cards to your Reliance SBI Credit Card at a lower interest rate and pay it off in easy EMIs, helping manage debt more efficiently.

4. Flexipay

- Purchases of ₹2,500 or more can be converted into easy monthly installments (EMIs) under the Flexipay option, providing flexibility in payment.

5. Fuel Surcharge Waiver

- A 1% surcharge waiver is available on fuel transactions made between ₹400 and ₹3,000, subject to a maximum waiver of ₹100 per month (excluding GST and other charges).

6. Worldwide Acceptance

- The cards are accepted at over 24 million outlets globally, making it easy to use for shopping and other transactions worldwide.

7. Cash Withdrawals

- You can withdraw cash from over 1 million Visa and MasterCard ATMs across the globe.

8. Exclusive Reliance Retail Offers

- Cardholders can enjoy exclusive offers, discounts, and rewards on purchases at Reliance Retail stores, including brands like Reliance Digital, Reliance Trends, and more.

9. Reward Points

- Both cards offer reward points on every transaction, with the PRIME card offering enhanced rewards for higher-value purchases. These points can be redeemed for gift vouchers or other rewards.

10. 24/7 Customer Support

- Access to round-the-clock customer support for any queries or issues related to the card.

11. Add-on Cards

- Add-on cards are available at no extra cost for family members above the age of 18, allowing them to benefit from the same features and rewards.

12. Easy Bill Pay

- Allows you to set up and pay for your utility bills using the card directly, which can be conveniently paid via the SBI Card app or online banking.

Why the SBI Reliance RuPay Credit Card Stands Out

- Focus on Indian Consumers: The card’s RuPay affiliation emphasizes affordability and security, catering specifically to Indian consumers.

- Reliance Ecosystem Benefits: Exclusive perks for Reliance customers ensure loyalty and repeated usage, making the card a valuable addition for Reliance patrons.

- Local Payment Network Advantage: RuPay’s widespread acceptance, cost-effectiveness, and advanced security protocols make it a strong contender against global payment networks.

- Targeted Marketing: The card’s promotional campaigns highlight its benefits for specific consumer groups, such as Jio users and Reliance shoppers.

Advantages

- Exclusive Rewards on Reliance Retail Purchases:

- Cardholders earn reward points on every purchase, especially with Reliance Retail outlets such as Reliance Digital, Reliance Trends, and more. The PRIME version offers enhanced reward points for Reliance-related transactions.

- Low Annual Fee:

- The standard Reliance SBI Card has an affordable annual fee of ₹499 (waived if ₹1,00,000 is spent annually). This makes it a budget-friendly option for those looking for a rewards-based card without high upfront costs.

- Welcome Benefits:

- The card offers attractive welcome benefits, including Reliance Retail vouchers (₹500 for the standard card and ₹3,000 for the PRIME card), making it a good option for new cardholders.

- Fuel Surcharge Waiver:

- A 1% fuel surcharge waiver on transactions between ₹400 and ₹3,000 can be beneficial for frequent travelers or those who make regular fuel purchases.

- Utility Bill Payment Facility:

- The card provides an easy way to pay utility bills (e.g., electricity, phone, internet) directly using the credit card, which adds convenience.

- Flexipay and EMI Options:

- Allows converting purchases over ₹2,500 into EMIs (Flexipay), and also provides Balance Transfer on EMI, which is useful for managing larger purchases or credit card debt.

- Contactless Payments:

- The contactless feature provides quicker and more secure transactions for daily purchases.

- Global Acceptance:

- The card is accepted worldwide at over 24 million outlets, making it a convenient option for international travel or online shopping.

- Cash Withdrawal:

- Cardholders can withdraw cash from over 1 million ATMs globally, though there may be fees associated with cash advances.

- Add-on Cards at No Extra Cost:

- The ability to provide add-on cards to family members above 18 years at no additional charge allows for shared benefits.

Disadvantages

- High Annual Fee for PRIME Version:

- The Reliance SBI Card PRIME comes with a relatively high annual fee of ₹2,999 (₹2,999 renewal fee). This may not be worth it for users who don’t spend frequently or don’t take full advantage of the rewards.

- Limited Reward Points Redemption Options:

- Although the card offers reward points, they can only be redeemed for Reliance-related vouchers or products, which may limit flexibility for cardholders who prefer more varied redemption options.

- Fees for Cash Withdrawals:

- Cash withdrawals from ATMs come with high interest rates and cash advance fees, making it an expensive option compared to other cards if used frequently for cash withdrawals.

- High Interest Rates:

- If the credit card balance is not paid in full, the interest charges on the outstanding balance can be quite high, which is a common drawback with most credit cards.

- Renewal Fee Waiver is Spend-Dependent:

- To waive the annual and renewal fees, the cardholder needs to meet a spending threshold of ₹1,00,000 annually. This can be difficult for some users, particularly those who do not make high-value purchases.

- Limited Access to Premium Benefits:

- While the PRIME version offers more benefits, it still doesn’t provide access to some premium features found on higher-end cards, such as concierge services, access to exclusive lounges, etc.

- Limited Redemption Options for Rewards:

- While the card’s reward points are a benefit, they are often limited to Reliance-specific redemption options. This can be a disadvantage for those who want more flexibility in how they use their points.

- Foreign Transaction Fees:

- The card may charge foreign transaction fees on international purchases, which could make it more expensive for global shoppers or travelers.

How to Apply for the SBI Reliance RuPay Credit Card

You can apply for the SBI Reliance RuPay Credit Card through the following methods:

- Online Application:

- Visit the official SBI Card website and fill out the application form for the Reliance SBI Card.

- Provide necessary details such as your name, contact information, income details, and employment information.

- You can submit documents online by uploading scanned copies.

- Offline Application:

- Visit an SBI branch near you and request an application form for the Reliance SBI Credit Card.

- Fill out the form and submit the required documents (listed below).

- A bank representative will assist with the process and help you with any queries.

- Through the SBI Card Mobile App:

- Download the SBI Card app from Google Play Store or Apple App Store.

- Apply for the card directly through the app, and track your application status.

Eligibility Criteria

To be eligible for the SBI Reliance RuPay Credit Card, you need to meet the following criteria:

- Age:

- The applicant must be between 21 to 60 years of age (for primary cardholder). Age eligibility may vary slightly for add-on cardholders (usually 18 years and above).

- Income:

- Salaried individuals: Minimum monthly income of ₹20,000.

- Self-employed individuals: Must have a minimum annual income of ₹3,00,000.

- Note: Income requirements may vary depending on the type of card (standard or PRIME).

- Cibil Score:

- A good credit score (typically 750 or higher) is preferable, though SBI may approve applications with lower scores, depending on other factors like income and previous banking history.

- Nationality:

- The applicant must be a resident Indian.

- Other:

- The applicant should have a valid phone number and email address for communication and updates.

- No major delinquencies or defaults in the applicant’s credit history.

Documents Required

You need to submit the following documents to apply for the SBI Reliance RuPay Credit Card:

- Identity Proof (any one of the following):

- Aadhar Card

- Passport

- Voter ID

- PAN Card

- Driver’s License

- Address Proof (any one of the following):

- Aadhar Card (if the address is mentioned)

- Passport

- Utility Bill (electricity, water, gas, etc.)

- Rent Agreement

- Bank Statement (recent)

- Income Proof (any one of the following):

- Salaried Individuals:

- Last 3 months’ salary slip.

- Latest Form 16 or Income Tax Return (ITR) or bank statement for the last 6 months.

- Self-Employed Individuals:

- ITR for the last 2 years.

- Bank Statement for the last 6 months.

- Profit and Loss Account or Balance Sheet for the last 2 years.

- Salaried Individuals:

- Photographs:

- Passport-sized photographs (2-3).

- Signature Proof:

- Signature verification documents such as a passport or PAN card (optional, may be required for certain applications).

Application Process Overview:

- Choose the Card: Select either the standard or PRIME version of the Reliance SBI RuPay Credit Card based on your spending and rewards preferences.

- Fill Out the Application: Provide your personal details, income, and contact information.

- Submit Documents: Upload the necessary documents (proof of identity, address, income, etc.) to verify your eligibility.

- Verification: SBI will verify the submitted information and documents. They may also call you for verification.

- Approval & Activation: If your application is approved, the credit card will be sent to your registered address. Once received, you will need to activate the card through the SBI Card website or mobile app.

Tracking the Application Status:

You can track the status of your application using:

- The SBI Card website or mobile app.

- By calling the customer care helpline at 1860 180 1290.

If your application is approved, you will receive your card within a few days, depending on the delivery process.

Conclusion

The SBI Reliance RuPay Credit Card is an excellent option for those who frequently shop at Reliance Retail stores or want a budget-friendly credit card that offers attractive rewards, low annual fees, and useful benefits like fuel surcharge waivers, utility bill payments, and EMI conversion options. Whether you opt for the standard or PRIME version, this card provides a range of perks tailored to enhance your shopping experience and financial flexibility.

However, it’s important to weigh the advantages against the potential disadvantages, such as the limited reward point redemption options and the high renewal fee for the PRIME version. If you’re someone who spends regularly at Reliance outlets or needs a card for everyday purchases with added benefits, this credit card could be a great fit.

By meeting the eligibility criteria and submitting the required documents, you can easily apply for the SBI Reliance RuPay Credit Card and start enjoying its numerous advantages. Always make sure to manage your credit responsibly, paying off balances on time to avoid high interest rates and fees.

Overall, the SBI Reliance RuPay Credit Card offers significant value for regular shoppers and those looking to manage their expenses efficiently, making it a solid choice for a wide range of users.

FAQs

What is the SBI Reliance RuPay Credit Card?

The SBI Reliance RuPay Credit Card is a co-branded credit card offered by SBI Card in collaboration with Reliance Retail, available on the RuPay payment network. It offers various benefits like rewards on purchases at Reliance Retail stores, fuel surcharge waivers, and more.sbi reliance rupay credit card

reliance sbi credit cards

How can I apply for the SBI Reliance RuPay Credit Card?

You can apply for the card through the following methods:

Online via the SBI Card website or mobile app.

Offline by visiting an SBI branch and submitting the application form and required documents.sbi reliance rupay credit card

reliance sbi credit cards

What is the eligibility criteria for the SBI Reliance RuPay Credit Card?

The eligibility criteria include:

Age between 21 to 60 years.

A minimum monthly income of ₹20,000 (for salaried individuals) or an annual income of ₹3,00,000 (for self-employed individuals).

A good credit score (preferably 750 or higher).

Indian residency.sbi reliance rupay credit card

reliance sbi credit cards

What are the benefits of the SBI Reliance RuPay Credit Card?

Key benefits include:

Reward points on purchases at Reliance Retail outlets and other stores.

Welcome benefits with Reliance Retail vouchers.

Fuel surcharge waiver of 1% on transactions between ₹400 and ₹3,000.

Flexipay option to convert purchases into EMIs.

Utility bill payment facility.

Worldwide acceptance at millions of outlets.sbi reliance rupay credit card

reliance sbi credit cards

What is the annual fee for the SBI Reliance RuPay Credit Card?

The standard SBI Reliance RuPay Credit Card has an annual fee of ₹499 (waived on ₹1,00,000 annual spend).

The SBI Reliance RuPay Credit Card PRIME has a higher annual fee of ₹2,999 (waived on ₹1,00,000 annual spend).sbi reliance rupay credit card

What is the renewal fee for the card?

For the standard card, the renewal fee is ₹499, which is waived if you spend more than ₹1,00,000 in a year.

For the PRIME card, the renewal fee is ₹2,999, also waived on ₹1,00,000 annual spend.sbi reliance rupay credit card

Can I redeem my reward points for anything other than Reliance vouchers?

Reward points are primarily redeemable for Reliance-related products and vouchers. The standard Reliance SBI Credit Card offers limited flexibility in terms of point redemption.sbi reliance rupay credit card

What documents are required to apply for the card?

Required documents include:

Identity proof (Aadhar card, PAN card, passport, etc.)

Address proof (Utility bill, Aadhar card, passport, etc.)

Income proof (Salary slips, bank statements, ITR, etc.)

Photographs (Passport-sized)

Signature proof (if necessary)sbi reliance rupay credit card

How do I track my SBI Reliance RuPay Credit Card application?

You can track the status of your application through the SBI Card website or mobile app. Alternatively, you can call SBI Card customer support at 1860 180 1290.sbi reliance rupay credit card

Are there any hidden charges on the SBI Reliance RuPay Credit Card?

Common charges include:

Interest rates on outstanding balances.

Cash withdrawal fees (with high interest charges).

Late payment fees if the bill is not paid on time.

Foreign transaction fees for international purchases sbi reliance rupay credit card

How can I activate my SBI Reliance RuPay Credit Card?

Once you receive your card, you can activate it by:

Calling the SBI Card customer support number.

Activating it through the SBI Card mobile app or website. sbi reliance rupay credit card

Can I add an authorized user to my SBI Reliance RuPay Credit Card?

Yes, you can add add-on cardholders (family members aged 18 years or older) at no additional charge. Add-on cardholders can enjoy the same benefits and features of the primary card. sbi reliance rupay credit card

How can I pay my SBI Reliance RuPay Credit Card bill?

You can pay your bill via:

Net banking or SBI Card mobile app.

Auto-debit for automatic bill payments.

NEFT or RTGS through any bank.

Cheque or cash at SBI branches. sbi reliance rupay credit card