Here you will find the full information related to what is the indian bank savings account minimum balance. The key benefits, features and penalties for not maintaining the balance.

Table of Contents

Indian Bank Savings Account Minimum Balance (1)

1. Introduction

- Overview of Indian Bank and Its Banking Services

- Indian Bank is a major public sector bank in India, offering a range of financial products, including savings accounts, fixed deposits, loans, and digital banking services.

- It has a strong nationwide presence with branches, ATMs, and online banking facilities.

- Importance of Maintaining a Minimum Balance in a Savings Account

- Ensures account activity remains active and operational.

- Helps avoid penalty charges imposed for non-maintenance of balance.

- May offer additional benefits like free transactions, interest earnings, and access to special banking services.

- Who This Article is For

- Existing Indian Bank customers looking to understand minimum balance requirements.

- Potential customers considering opening a savings account with Indian Bank.

- Students, salaried employees, and senior citizens who want to explore banking options.

- Anyone interested in managing their banking efficiently and avoiding unnecessary charges.

What is a Savings Account Minimum Balance? (2)

Definition of Minimum Balance

A minimum balance is the least amount of money that an account holder must maintain in their savings account to avoid penalties or service charges. This amount varies based on the type of savings account and the bank’s policies.

Purpose of Having a Minimum Balance Requirement

- Operational Costs: Helps the bank cover administrative and maintenance costs.

- Financial Stability: Ensures a stable deposit base for banks to manage liquidity.

- Encourages Account Usage: Encourages customers to maintain a healthy banking habit and keep their accounts active.

- Access to Benefits: Some accounts with a minimum balance requirement provide additional perks like free ATM withdrawals, higher interest rates, and waived service fees.

How Banks Decide the Minimum Balance

- Account Type: Different accounts (regular savings, premium, student, senior citizen) have varying balance requirements.

- Banking Location: Minimum balance requirements may differ for urban, semi-urban, and rural branches.

- Competition and Market Trends: Banks adjust their minimum balance policies to stay competitive with other banks.

- Operational Costs and Services Offered: Higher service levels (e.g., premium banking) often come with higher minimum balance requirements.

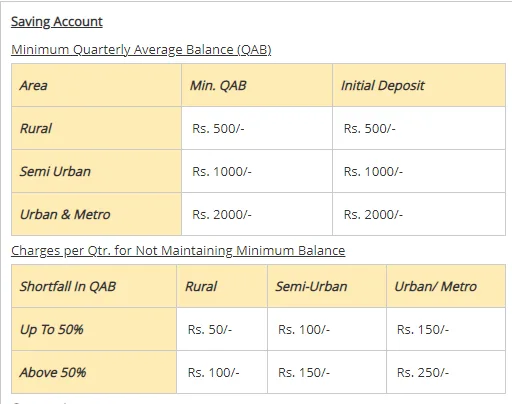

Indian Bank Savings Account Minimum Balance

Understanding the minimum balance requirements for various savings accounts at Indian Bank is crucial to avoid penalties and manage your finances effectively. Below is an overview based on the latest available information:

Minimum Balance Requirements by Account Type

- Regular Savings Account:

- With Cheque Facility: Minimum balance of ₹1,000.

- Without Cheque Facility: Minimum balance of ₹500.

- SB Platinum Account:

- For Individuals: Average monthly balance of ₹7,50,000.

- For Non-Individuals: Average monthly balance of ₹10,00,000.

- IB Mahila Shakti for Women:

- Average monthly balance of ₹1,000.

- IB Kishore (Minors aged 10 to 18 years):

- No minimum balance requirement.

- Indian Bank GenX (Ages 18 to 40 years):

- Average monthly balance of ₹1,000.

- Indian Bank Sammaan (Individuals over 60 years old):

- No minimum balance requirement.

- IB DIGI Online SB Account:

- No minimum balance requirement.

- Small Account:

- No minimum balance requirement.

- SB for Students under Government Scholarship and SB for Direct Benefit Transfer:

- No minimum balance requirement.

- IB Corp SB – Payroll Package Scheme for Salaried Class:

- No minimum balance requirement. scripbox.com

Penalties for Non-Maintenance of Minimum Balance

If an account holder fails to maintain the required minimum balance, Indian Bank may impose penalties. The specific charges can vary depending on the account type and the extent of the shortfall. For instance, in some banks, the penalty might be a fixed amount or a percentage of the shortfall. It’s advisable to consult Indian Bank’s official schedule of charges or contact the bank directly for precise information.

Maintaining the stipulated minimum balance in your Indian Bank savings account is essential to avoid penalties and enjoy uninterrupted banking services. If you anticipate difficulties in maintaining the required balance, consider exploring account options with lower or no minimum balance requirements.

Types Of Savings Account

Indian Bank offers a variety of savings accounts tailored to meet the diverse needs of its customers. Below is a detailed overview of some of the key savings account types and their respective minimum balance requirements:

1. Regular Savings Account

- Minimum Balance Requirement:

- With Cheque Facility: ₹1,000

- Without Cheque Facility: ₹500

- Features:

- Basic savings account suitable for general banking needs.

- Provides access to standard banking services, including passbook and debit card facilities.

2. Premium Savings Accounts

a. SB Platinum Account

- Minimum Balance Requirement:

- For Individuals: Average Monthly Balance of ₹7,50,000

- For Non-Individuals: Average Monthly Balance of ₹10,00,000

- Features:

- Designed for high-net-worth individuals and corporate professionals.

- Offers a sweep facility to convert excess balances into short-term deposits.

- Provides premium services, including personalized cheque books and higher transaction limits.

b. SB Gold Account

- Minimum Balance Requirement:

- ₹10,000

- Features:

- Suitable for professionals, businessmen, and salaried individuals.

- Includes benefits like free demand drafts up to a certain limit and personal accident insurance coverage.

c. SB Silver Account

- Minimum Balance Requirement:

- ₹5,000

- Features:

- Ideal for individuals seeking additional banking benefits.

- Offers perks such as personal accident insurance and free demand drafts up to a specified amount.

3. Zero Balance Accounts

a. Basic Savings Bank Deposit Account (BSBDA)

- Minimum Balance Requirement:

- No minimum balance required.

- Features:

- Aimed at individuals who previously lacked access to banking facilities.

- Provides essential banking services without the burden of maintaining a minimum balance.

- Includes benefits like a free debit card and a limited number of free transactions per month.

b. Pradhan Mantri Jan Dhan Yojana (PMJDY) Account

- Minimum Balance Requirement:

- No minimum balance required.

- Features:

- Part of a national financial inclusion program.

- Offers benefits such as a RuPay debit card, overdraft facilities, and access to government subsidies.

4. Salary Accounts

a. IB Corp SB Account

- Minimum Balance Requirement:

- No minimum balance required.

- Features:

- Tailored for salaried employees across various sectors.

- Provides benefits like free personalized cheque books, complimentary RTGS/NEFT transactions, and overdraft facilities.

5. Senior Citizen Accounts

a. IB Sammaan Account

- Minimum Balance Requirement:

- No minimum balance required.

- Features:

- Exclusively designed for individuals aged 60 years and above.

- Offers perks such as free cash withdrawals at non-home branches, discounted locker rentals, and concessions on loan interest rates.

Indian Bank’s diverse range of savings accounts ensures that customers can select an account that best aligns with their financial needs and lifestyle. For the most accurate and up-to-date information, it’s advisable to consult Indian Bank’s official resources or visit a local branch.

Charges And Fees Of The Bank Account

Indian Bank has specific policies regarding the maintenance of minimum balances in savings accounts. According to available information, Indian Bank does not impose charges for non-maintenance of the minimum balance in certain accounts. For instance, the bank does not charge any fee if you do not maintain the minimum balance of ₹500 in a regular savings account. cleartax.in

However, it’s important to note that policies can vary based on the type of account and may change over time. For the most accurate and up-to-date information, it’s advisable to consult Indian Bank’s official resources or contact their customer service directly.

In general, banks may have different charges for non-maintenance of minimum balance based on the branch location (urban vs. rural) and may levy penalties on a monthly or quarterly basis. These penalties are typically deducted directly from the account holder’s balance. If the account balance is insufficient to cover the penalty, it could lead to a negative balance. m.economictimes.com

To avoid any penalties, it’s recommended to maintain the required minimum balance as specified by your bank and to stay informed about any policy changes.

How to Avoid Minimum Balance Penalties

If you’re concerned about maintaining the required minimum balance in your Indian Bank savings account, here are some effective ways to avoid penalties:

1. Tips to Maintain Minimum Balance

- Track Your Balance Regularly: Use mobile banking, internet banking, or SMS alerts to monitor your account balance and avoid falling below the required limit.

- Set Up a Monthly Reminder: Schedule a reminder to check and maintain the minimum balance before penalties are imposed.

- Automate Deposits: Set up an automatic transfer from another bank account or deposit a fixed amount monthly to ensure your balance stays above the required limit.

- Use Fixed Deposits as Backup: Some banks allow you to link your savings account with a fixed deposit to maintain the minimum balance requirement.

- Reduce Unnecessary Withdrawals: Avoid frequent withdrawals that might cause your balance to drop below the minimum threshold.

2. Alternative Account Types (Zero Balance Accounts)

If maintaining a minimum balance is difficult, consider switching to a zero-balance savings account, such as:

- Basic Savings Bank Deposit Account (BSBDA): No minimum balance requirement, suitable for basic banking needs.

- Pradhan Mantri Jan Dhan Yojana (PMJDY): Special government-backed savings account with no minimum balance requirement.

- Salary Accounts: Most salary accounts, like Indian Bank’s IB Corp SB account, have no minimum balance requirement as long as salary credits continue.

- Senior Citizen and Student Accounts: Some accounts designed for senior citizens and students do not require a minimum balance.

3. Auto Sweep Facility and Linked Accounts

- Auto Sweep Facility:

- This feature automatically transfers excess funds from your savings account to a fixed deposit, ensuring better returns.

- If your savings balance drops below the required minimum, funds from the fixed deposit are transferred back to maintain compliance.

- Linked Accounts:

- If you have multiple accounts, linking them can help maintain the minimum balance across accounts.

- Some banks offer balance aggregation, allowing you to meet the minimum requirement collectively across linked accounts.

Eligibility Criteria Of The Bank

Indian Bank offers zero-balance savings accounts designed to promote financial inclusion and provide essential banking services without the requirement of maintaining a minimum balance. Here’s an overview of these accounts:

Eligibility Criteria

- Basic Savings Bank Deposit Account (BSBDA):

- Available to all individuals, especially those who previously lacked access to banking facilities.

- There are no specific eligibility restrictions; however, an individual can hold only one BSBDA in a bank.

- Pradhan Mantri Jan Dhan Yojana (PMJDY) Account:

- Aimed at unbanked individuals, particularly from low-income groups.

- Applicants must not have an existing bank account.

- Valid KYC documents are required for account opening.

Features and Benefits

- No Minimum Balance Requirement:

- Account holders are not obligated to maintain a minimum balance, eliminating concerns about penalty charges.

- Basic Banking Services:

- Access to essential services such as passbook issuance, ATM/debit cards, and internet banking.

- Direct Benefit Transfers (DBT):

- Facilitates the receipt of government subsidies and benefits directly into the account.

- Limited Free Transactions:

- A certain number of free withdrawals and deposits per month; exceeding this limit may incur nominal charges.

- Simplified KYC Process:

- Basic identification documents like Aadhaar and PAN are typically sufficient for account opening.

How to Apply

To open a zero-balance savings account with Indian Bank, follow these steps:

- Visit the Nearest Branch:

- Locate and visit the closest Indian Bank branch.

- Consult with a Bank Representative:

- Inform the representative of your intention to open a zero-balance savings account, specifying the type (e.g., BSBDA or PMJDY).

- Complete the Application Form:

- Accurately fill out the account opening form provided by the bank.

- Submit Required Documents:

- Provide necessary KYC documents, such as:

- Proof of Identity (Aadhaar card, PAN card, etc.)

- Proof of Address

- Recent passport-sized photographs

- Provide necessary KYC documents, such as:

- Verification Process:

- The bank will verify your documents and may conduct a brief interview to confirm your details.

- Account Activation:

- Upon successful verification, the bank will activate your account and provide relevant details, including your account number and debit card.

How to Check Minimum Balance Requirement in Indian Bank

If you want to check the minimum balance for indian bank savings account, here are several convenient methods:

1. Internet Banking & Mobile Banking

- Internet Banking:

- Log in to Indian Bank Net Banking using your credentials.

- Navigate to the “Account Details” or “Balance Inquiry” section to check your balance and any applicable minimum balance requirement.

- Mobile Banking App:

- Download the IndOASIS app from the Google Play Store or Apple App Store.

- Log in using your registered mobile number and MPIN.

- Check your balance and account details, including the minimum balance requirement.

2. SMS Banking & Missed Call Services

- SMS Banking:

- Send “BAL <Account Number>” to the designated Indian Bank SMS service number (usually 94443 94443).

- You will receive an SMS with your account balance.

- Missed Call Service:

- Give a missed call to 092895 92895 from your registered mobile number.

- You will receive an SMS with your account balance details.

3. Visiting a Branch

- If you prefer in-person assistance, visit your nearest Indian Bank branch.

- Request the bank staff to provide details about your account’s minimum balance requirement.

- You can also check using the Passbook Update service at the branch.

Steps to Open a Savings Account in Indian Bank

Opening a savings account with Indian Bank is straightforward, whether you choose to apply online or visit a branch in person. Here are the steps to guide you through the process:

1. Eligibility & Documents Required

Eligibility:

- Indian Residents (both individuals and joint accounts).

- Minors (with guardian consent and documents).

- Senior Citizens (who may have additional benefits).

- Non-Residents (NRIs) – for specific NRI accounts.

Documents Required:

- Proof of Identity:

- Passport, Aadhaar Card, Voter ID, PAN Card, or any government-issued ID.

- Proof of Address:

- Aadhaar Card, utility bills, voter ID, or rental agreement.

- Passport-sized Photographs:

- Typically two recent passport-sized photographs.

- Additional KYC Documents (if applicable):

- For minors, guardians must provide valid ID and address proof.

- For NRIs, a copy of the passport, visa, and residence permit may be required.

2. Online vs. Offline Account Opening

Online Account Opening (Convenient for Tech-Savvy Customers):

- Via Indian Bank’s Website:

- Visit Indian Bank’s official website.

- Navigate to the “Open an Account” section and choose the type of savings account you wish to open.

- Fill out the online application form with personal and contact details.

- Upload KYC documents as instructed.

- Complete the verification process (some accounts may require video KYC).

- Once verified, you will receive your account details via email or SMS.

- Via Mobile Banking (IndOASIS App):

- Download the IndOASIS app from the Play Store or App Store.

- Open the app and follow the steps to apply for a savings account.

- Upload the necessary KYC documents and complete the online process.

Offline Account Opening (For those preferring in-person assistance):

- Visit the Nearest Indian Bank Branch:

- Go to any nearby Indian Bank branch with the required documents.

- Request the account opening form and fill it out.

- Submit your KYC documents and photographs to the bank representative.

- The bank will process your request and issue the account details once your documents are verified.

3. Time Required for Account Activation

- Online Account Opening:

- Instant Activation: For accounts with full KYC verification via video, the process can be completed within a few hours, and the account may be activated almost immediately.

- With Document Verification: In some cases, it may take 1-3 business days for document verification and account activation.

- Offline Account Opening:

- Activation Time: The account can typically be activated within 1-2 business days after submission of the necessary documents and verification by the bank.

- Account Details: You will receive your account number, debit card, and other relevant information either immediately or within a few days.

Additional Notes:

- Minimum Balance Requirements: Be sure to check the minimum balance requirement for your chosen account type before opening it.

- No Fees for Opening: Indian Bank does not charge a fee for opening a savings account.

Benefits of Maintaining the Minimum Balance in Your Savings Account

Maintaining the minimum balance in your savings account is not only about avoiding penalties, but it can also provide several advantages in the long run. Here are some key benefits of keeping your account balance above the required minimum:

1. Avoiding Penalties

- No Penalty Fees:

- If you maintain the required minimum balance, you can avoid the penalties typically imposed by banks for non-compliance.

- Penalties can range from a fixed charge to a percentage of the shortfall, so keeping the minimum balance ensures you don’t incur these costs.

2. Eligibility for Additional Banking Benefits

- Better Access to Loans:

- Maintaining a good balance can improve your creditworthiness and increase your chances of loan approval (such as personal loans, home loans, or auto loans).

- Banks often look at the customer’s account activity and average balance when assessing loan eligibility.

- Exclusive Offers and Discounts:

- Many banks provide special offers to customers who maintain a certain minimum balance, including discounts on banking fees or interest rate reductions for loans.

- You may also be eligible for exclusive deals such as free insurance, premium banking services, or access to financial products with better terms.

- Credit Card Approvals:

- Regularly maintaining the minimum balance can make you eligible for a credit card, as banks often consider your savings account activity when determining your creditworthiness.

- A higher balance might also result in better credit limits and lower interest rates on the credit card.

3. Interest Rate Benefits

- Earn More Interest:

- Some accounts offer higher interest rates based on your account balance. By maintaining the required minimum balance, you can benefit from compounded interest, leading to better returns on your savings.

- Additionally, some banks offer premium savings accounts with higher interest rates, which might require maintaining a higher balance.

- Sweep-In Facility:

- Many banks provide a sweep-in facility, where excess funds in your savings account are transferred to fixed deposits. This allows you to earn higher interest while ensuring that your savings are actively working for you.

4. Access to Premium Banking Services

- Personalized Banking Services:

- Maintaining a higher balance can make you eligible for premium banking services, such as dedicated relationship managers, faster processing of transactions, and customized financial advice.

- You may also gain access to higher transaction limits and enhanced banking features like free demand drafts or higher withdrawal limits.

5. Improved Financial Health

- Financial Discipline:

- Regularly maintaining a minimum balance encourages better money management and financial discipline, helping you avoid unnecessary spending and keeping track of your savings.

- It can serve as a tool to set financial goals and monitor your progress more effectively.

Advantages Of This Bank Account

- Avoidance of Penalties

- No Penalty Fees:

By maintaining the minimum balance, you can avoid incurring penalty charges, which can add up over time. These charges are typically applied when the balance falls below the required limit.

- No Penalty Fees:

- Eligibility for Loans and Credit

- Improved Loan Approval Chances:

Regularly maintaining the minimum balance shows the bank that you’re financially stable, which could increase your chances of getting approved for personal loans, home loans, or car loans. - Better Credit Card Opportunities:

A well-maintained account balance could make you more eligible for credit cards, with potential benefits like higher credit limits and lower interest rates.

- Improved Loan Approval Chances:

- Interest Rate Benefits

- Higher Interest Earnings:

Banks may offer higher interest rates for accounts with a higher balance. Maintaining a minimum balance can help you earn more on your savings over time. - Sweep-In Facility:

Some banks offer a sweep-in facility, where excess balance is converted into a fixed deposit to earn higher interest rates, further boosting your returns.

- Higher Interest Earnings:

- Access to Premium Banking Services

- Dedicated Relationship Managers:

Higher account balances may qualify you for premium services, including dedicated relationship managers who can offer personalized financial advice. - Exclusive Banking Offers:

You might be eligible for special offers such as fee waivers, priority service, or lower interest rates on loans and overdrafts.

- Dedicated Relationship Managers:

- Increased Financial Control

- Better Money Management:

Regularly maintaining the minimum balance encourages responsible money management and financial discipline, ensuring that your funds are used efficiently.

- Better Money Management:

Disadvantages Of This Bank Account

- Potentially Restrictive for Low-Income Customers

- Difficult for Some Customers:

For those with limited financial resources, maintaining a minimum balance can be challenging. This might result in falling short of the required balance and incurring penalties. - No Flexibility in Spends:

The requirement to maintain a minimum balance may restrict some account holders from using their savings for immediate needs.

- Difficult for Some Customers:

- Minimum Balance Penalties

- Penalties for Non-Compliance:

If you fail to maintain the minimum balance, the bank will impose penalties, which can range from a fixed fee to a percentage of the shortfall. These fees can accumulate and lower the overall savings in the account.

- Penalties for Non-Compliance:

- Complexity in Account Management

- Requires Regular Monitoring:

You need to regularly check your balance to ensure that it stays above the required threshold. This can be an inconvenience if you forget to monitor your account or don’t have a good tracking system in place. - Additional Account Requirements:

Some accounts that offer premium benefits require a significantly higher minimum balance, which may not be feasible for everyone.

- Requires Regular Monitoring:

- Limited Access to Funds

- Restricted Withdrawals:

In certain cases, accounts with a minimum balance requirement may limit the number of withdrawals or impose fees for excessive withdrawals. This could be restrictive for those who need access to their funds regularly.

- Restricted Withdrawals:

- Account Fees for Low-Balance Holders

- Fees for Non-Compliance in Specific Accounts:

Accounts with a minimum balance requirement may impose additional charges for low balances, which could impact the savings of those who aren’t able to maintain the required balance.

- Fees for Non-Compliance in Specific Accounts:

Customer Reviews And Feedback

Customer reviews of Indian Bank’s savings accounts are mixed, highlighting both positive experiences and areas for improvement. indian bank savings account minimum balance

Positive Aspects:

- Customer Service: Some customers appreciate the bank’s attentive service. For instance, one review notes, “Indian Bank has a very good customer service and this savings account has a normal rate of interest.” bankbazaar.com

- Account Accessibility: Long-term customers have expressed satisfaction with the bank’s services. A reviewer mentions, “Almost 40 years, I am using Indian Bank savings account because it was recommended and opened this account when I was in young age. They are handling the customer very well.” bankbazaar.com

Areas for Improvement:

- Online Banking Services: Some users have reported issues with the bank’s online platforms. One review states, “Net banking are very poor. Sometimes it is not working.” m.mouthshut.com

- Customer Support: There are concerns about the responsiveness of customer service. A customer notes, “Customer service was very poor. but the charges applied like ATM charges, fine for minimum balance…” m.mouthshut.com

- Mobile Application Performance: Some users have experienced difficulties with the mobile app. A review mentions, “It is very irritating. For this reason I suffer too harassment. It is always slow and fails to finish the transaction within time.”

Conclusion

Maintaining a savings account with Indian Bank can be a beneficial option for many customers, particularly those who can easily meet the minimum balance requirement. The advantages include avoiding penalties, earning interest on savings, and qualifying for additional banking benefits such as loan eligibility, credit card approvals, and premium banking services. indian bank minimum balance savings account

However, some customers have reported challenges with the bank’s online banking services, mobile app performance, and customer support. These issues may cause inconvenience for those who prefer digital banking or require quick assistance. indian bank minimum balance in savings account

Overall, Indian Bank is a solid choice for individuals looking for traditional banking services, but it’s important to consider both the pros and cons, especially if online or mobile banking is a priority. If you’re able to manage the minimum balance and don’t mind some of the digital limitations, Indian Bank’s savings accounts offer valuable benefits. minimum balance for indian bank savings account

FAQs

What is the minimum balance requirement for an Indian Bank savings account?

The minimum balance requirement varies based on the type of account and the area (urban, semi-urban, or rural). You can check the specific requirements on the Indian Bank website or by visiting the nearest branch. indian bank savings account minimum balance

What happens if I don’t maintain the minimum balance in my Indian Bank account?

If the minimum balance is not maintained, the bank will levy a penalty, which can vary depending on the account type and the shortfall in the balance. indian bank savings account minimum balance

How do I check my account balance to ensure I meet the minimum requirement?

You can check your balance via Indian Bank’s mobile banking app, internet banking, SMS banking, or missed call services. indian bank savings account minimum balance

Can I open a savings account with Indian Bank if I do not have a minimum balance?

Indian Bank offers zero-balance accounts like the Basic Savings Bank Deposit Account (BSBDA) and Pradhan Mantri Jan Dhan Yojana (PMJDY) accounts, which do not require a minimum balance. indian bank savings account minimum balance

How can I avoid paying penalties for not maintaining the minimum balance?

Ensure you regularly monitor your balance and keep enough funds in your account. You can also opt for zero-balance accounts if applicable. indian bank savings account minimum balance

What are the benefits of maintaining the minimum balance in my savings account?

Maintaining the minimum balance ensures you avoid penalties, improve your eligibility for loans, enjoy higher interest rates, and gain access to premium banking services. indian bank savings account minimum balance

Can I access online banking and mobile banking without maintaining the minimum balance?

Yes, you can access these services, but you still need to maintain the minimum balance to avoid penalties. indian bank savings account minimum balance

What are the charges for non-maintenance of minimum balance in Indian Bank?

Charges vary depending on the type of account and the area. They can range from a fixed fee to a percentage of the shortfall in the minimum balance. indian bank savings account minimum balance

What is the interest rate offered on savings accounts in Indian Bank?

Interest rates on savings accounts are typically revised periodically. You can check the latest rates on the Indian Bank website. indian bank savings account minimum balance

Can I open a joint savings account with Indian Bank?

Yes, Indian Bank allows you to open a joint savings account with a spouse, family member, or other eligible persons. indian bank savings account minimum balance

Is there an age limit to open a savings account with Indian Bank?

There is no specific age limit for opening a savings account. Minors can open an account with a guardian, and senior citizens may be eligible for special benefits. indian bank savings account minimum balance

How can I apply for an Indian Bank savings account?

You can apply for a savings account online via the Indian Bank website or mobile app, or you can visit your nearest branch to apply in person. indian bank savings account minimum balance

Do I need to submit KYC documents to open a savings account with Indian Bank?

Yes, KYC (Know Your Customer) documents such as proof of identity, proof of address, and photographs are required to open a savings account. indian bank savings account minimum balance

Can I withdraw money if I do not maintain the minimum balance?

Yes, you can still withdraw money, but you may incur penalties if your balance falls below the minimum requirement. indian bank savings account minimum balance

What is the process to close my savings account with Indian Bank?

You need to submit a request for account closure at your nearest branch and clear any pending charges or dues before the account can be closed. indian bank savings account minimum balance

Are there any special savings accounts for senior citizens at Indian Bank?

Yes, Indian Bank offers special savings accounts for senior citizens that may include higher interest rates and other benefits. indian bank savings account minimum balance

What is the maximum amount I can withdraw from my savings account at Indian Bank?

The withdrawal limit may vary based on the account type and the area of operation. You can check your account’s withdrawal limits via internet banking or by contacting the bank. indian bank savings account minimum balance

Can I transfer money to another bank from my Indian Bank savings account?

Yes, you can transfer money to other banks using NEFT, RTGS, IMPS, or via internet/mobile banking. indian bank savings account minimum balance

How can I link my savings account to my mobile number?

You can link your mobile number to your savings account by visiting the bank branch or via SMS banking registration. indian bank savings account minimum balance

What is a sweep-in facility, and how does it work with Indian Bank?

A sweep-in facility automatically transfers excess funds from your savings account to a fixed deposit, allowing you to earn higher interest rates on your surplus balance. indian bank savings account minimum balance

Disclaimer :-

The information provided on this blog is for educational and informational purposes only and should not be considered as financial, investment, or professional advice. We do not engage in, endorse, or offer any financial services, investment opportunities, or related business activities.

While we strive to provide accurate and up-to-date information, we make no representations or warranties regarding the completeness, reliability, or accuracy of the content. Any action you take based on the information from this blog is strictly at your own risk. We recommend consulting with a qualified financial professional before making any financial decisions.