Here you will get the information related to best IndusInd credit card .Which is the best IndusInd credit card for individuals to apply and in which you get more rewards.

Table of Contents

Introduction to Best IndusInd Credit Card (1)

Best IndusInd Credit card have become an indispensable financial tool, offering convenience, rewards, and a host of other benefits. Among the multiple options available, Best IndusInd Bank credit card stand out for their exceptional range, tailored to suit diverse customer needs. Whether you’re a frequent traveler, a shopaholic, or someone who values cashback and rewards, IndusInd Bank has something for everyone. This blog explores the best IndusInd credit card, delving into its features, history, and benefits to help you make an informed choice.

History of Best IndusInd Bank Credit Card (2)

Best IndusInd Credit Card was established in 1994 as one of the first new-generation private sector banks in India. Named after the Indus Valley Civilization, the bank symbolizes innovation and forward-thinking. Over the years, IndusInd Bank has expanded its portfolio of financial services, introducing credit cards tailored to modern lifestyles.

The credit card segment of IndusInd Bank began with the goal of delivering premium financial products that cater to the evolving needs of consumers. By collaborating with global payment networks like Visa and Mastercard, the bank has ensured that its credit cards are accepted worldwide. Over time, IndusInd Bank has built a reputation for offering innovative credit card solutions, packed with privileges and benefits.

IndusInd Bank introduced its credit card offerings in 2011, marking its entry into the growing credit card market in India. Although the bank had been operational since 1994, it initially focused on traditional banking products like savings accounts, fixed deposits, and loans. The launch of credit cards was a significant milestone, reflecting IndusInd Bank’s ambition to diversify its retail banking portfolio and cater to the evolving needs of its customers.

Key Milestones in the History of IndusInd Bank Credit Cards (3)

- 2011 – Entry into the Credit Card Market

IndusInd Bank entered the credit card market with premium and lifestyle-focused cards. The bank aimed to differentiate itself by offering products that combined luxury, convenience, and high reward value. - 2013 – Expansion of Product Portfolio

Over the next few years, the bank expanded its credit card offerings, introducing cards for middle-income groups, frequent travelers, and budget-conscious individuals. The focus was on creating specialized credit cards to cater to diverse customer preferences. - Partnerships with Global Payment Networks

IndusInd Bank collaborated with Visa and Mastercard to ensure global acceptance of its credit cards. This allowed customers to use their cards seamlessly for international travel and online shopping. - Innovative Features and Offers

To attract customers, IndusInd introduced innovative features such as customizable rewards programs, premium travel privileges, and lifestyle benefits like free golf sessions and concierge services. - Recognition in the Industry

IndusInd Bank credit cards soon gained popularity for their unique features and excellent customer service. The bank received several accolades for its financial products and services, further solidifying its position in the credit card segment.

Why the Launch Was Significant (5)

The launch of best indusind credit card by IndusInd Bank in 2011 was strategic, coinciding with India’s rapid digitalization and growing consumerism. With an increasing number of people opting for cashless transactions and seeking financial tools to enhance their purchasing power, credit cards became a necessity. IndusInd Bank capitalized on this trend by offering competitive products that catered to both premium and general customer segments.

Current Standing

Today, IndusInd Bank is recognized as one of the leading credit card issuers in India, offering a wide range of cards tailored to suit various lifestyles. It continues to innovate and expand its portfolio, ensuring it stays relevant in the dynamic credit card market.

Why Choose an Best IndusInd Bank Credit Card? (7)

Best IndusInd Bank credit cards offer a blend of luxury, affordability, and functionality. Here are some reasons why they stand out:

- Tailored Features: Cards designed for travel, shopping, dining, and lifestyle preferences.

- Global Acceptance: Powered by Visa and Mastercard, ensuring international usability.

- Reward Programs: Lucrative rewards on every spend, redeemable across various categories.

- Security: Robust security features like EMV chips and instant fraud reporting.

Best IndusInd Bank Credit Cards

1.IndusInd Bank Pinnacle Credit Card

Overview

This is one of the best IndusInd credit card which is designed for those who aspire to a premium lifestyle. With exclusive benefits on travel, dining, and entertainment, this card offers unparalleled luxury.

Key Features

- Reward Points: Earn 2.5 reward points for every ₹100 spent on weekdays and 1.5 reward points on weekends.

- Lounge Access: Complimentary access to domestic and international airport lounges.

- Golf Benefits: Free golf games and coaching sessions.

- Dining Privileges: Exclusive discounts at top restaurants through the Culinary Treats Program.

Why Choose This Card?

This card is perfect for high-net-worth individuals who prioritize luxury and lifestyle benefits. It combines exclusivity with substantial rewards, making it a top-tier option.

2. IndusInd Bank Legend Credit Card

Overview

The Legend Credit Card is tailored for individuals who want the best of rewards and privileges across multiple categories.

Key Features

- Reward Points: Earn 1 reward point for every ₹100 spent.

- Insurance Coverage: Complimentary insurance coverage for air accident and lost card liability.

- Lounge Access: Complimentary domestic and international lounge visits.

- Entertainment: Exclusive offers on movie tickets via BookMyShow.

Why Choose This Card?

Best IndusInd credit card offers a balanced mix of rewards and security, ideal for individuals looking for a versatile credit card.

3. IndusInd Bank Platinum Aura Edge Credit Card

Overview

Best IndusInd credit card is designed for individuals who want high-value rewards on everyday spending.

Key Features (6)

- Rewards: Earn up to 4x reward points on select spending categories.

- Savings: Discounts on dining and shopping.

- Security: Zero lost card liability in case of theft or loss.

- Fuel Surcharge Waiver: Enjoy a fuel surcharge waiver at select fuel stations.

Why Choose This Card?

The Best IndusInd credit card is an excellent choice for budget-conscious individuals who value rewards and savings.

4. IndusInd Bank Iconia Credit Card (7)

Overview

The Iconia Credit Card is ideal for frequent travelers and those who appreciate premium lifestyle benefits.

Key Features

- Reward Points: Earn 1.5 reward points for every ₹100 spent on weekdays and 2 reward points on weekends.

- Travel Benefits: Complimentary travel insurance and priority pass membership.

- Shopping Benefits: Exclusive offers on online and offline shopping.

- Dining Offers: Access to premium dining privileges.

Why Choose This Card?

This best IndusInd credit card is best suited for individuals who enjoy traveling and indulging in luxurious experiences.

5. IndusInd Bank Platinum Credit Card

Overview

The Platinum Credit Card is a no-frills option that offers great value and rewards on everyday transactions.

Key Features

- Reward Points: Earn 1 reward point for every ₹150 spent.

- Savings: Discounts on fuel and dining.

- Convenience: Easy EMI conversion options.

- Global Usage: Accepted at millions of outlets worldwide.

Why Choose This Card?

This best IndusInd credit card is perfect for individuals seeking simplicity and affordability in a credit card.

Choosing the Best IndusInd Bank Credit Card

When selecting the best credit card, it’s important to consider your lifestyle and spending habits. Here are some tips to help you decide:

- Travelers: Opt for cards like the Pinnacle or Iconia that offer travel benefits and lounge access.

- Shoppers: Choose a card with high reward points on shopping, like the Platinum Aura Edge.

- Budget-Conscious Individuals: Select a card with minimal fees and solid rewards, such as the Platinum Credit Card.

General Features of IndusInd Bank Credit Cards

- Reward Points Program

- Earn reward points on every transaction, which can be redeemed for gifts, travel, vouchers, or cashback.

- Many best IndusInd credit card offer accelerated rewards on specific categories like travel, dining, or shopping.

- Travel Benefits

- Complimentary domestic and international airport lounge access.

- Travel insurance coverage for flight delays, lost baggage, and other incidents.

- Dining Privileges

- Discounts at top restaurants through the Culinary Treats Program.

- Special offers on fine dining experiences.

- Fuel Surcharge Waiver

- Enjoy a waiver on fuel surcharge at select fuel stations across India.

- Entertainment Benefits

- Exclusive discounts on movie tickets via platforms like BookMyShow.

- Buy-one-get-one offers on entertainment and events.

- Security Features

- EMV chip-enabled cards for enhanced security.

- Zero liability on lost cards if reported immediately.

- Customizable Benefits

- Some cards allow customization of reward structures or benefits to suit individual needs.

- EMI Conversion

- Convert large purchases into affordable EMIs with flexible repayment options.

- Golf Privileges

- Complimentary rounds of golf or golf lessons with select premium cards.

- Concierge Services

- Premium cardholders can avail of 24/7 concierge services for travel bookings, dining reservations, and more.

Features of Specific IndusInd Bank Credit Cards

1. IndusInd Bank best IndusInd credit card Pinnacle Credit Card

- Earn 2.5 reward points for every ₹100 spent on weekdays and 1.5 points on weekends.

- Complimentary domestic and international airport lounge access.

- Free golf games and lessons.

- Travel insurance with high coverage limits.

2. IndusInd Bank Legend Credit Card best IndusInd credit card

- 1 reward point for every ₹100 spent on all transactions.

- Complimentary travel insurance and air accident cover.

- Domestic and international lounge visits.

- Exclusive offers on dining and entertainment.

3. IndusInd Bank Iconia Credit Card

- Earn 2 reward points for every ₹100 spent on weekends and 1.5 points on weekdays.

- Complimentary Priority Pass membership for lounge access.

- Free insurance coverage for lost cards and personal accidents.

- Special discounts on shopping and dining.

4. IndusInd Bank Platinum Aura Edge Credit Card

- Earn up to 4x reward points on specific categories like dining, travel, and utilities.

- Discounts on dining and shopping.

- Zero lost card liability.

- Waiver on fuel surcharge at select stations.

5. IndusInd Bank Platinum Credit Card

- 1 reward point for every ₹150 spent on transactions.

- Easy EMI options for big-ticket purchases.

- Discounts on dining and fuel purchases.

- Global acceptance at millions of merchants worldwide.

6. IndusInd Bank Celesta Credit Card

- Exclusive for high-net-worth individuals.

- Complimentary golf games, travel insurance, and dining privileges.

- Luxury concierge services.

- Unlimited domestic and international lounge access.

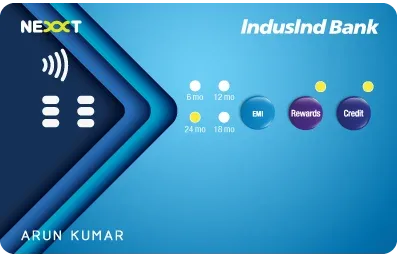

7. IndusInd Bank Nexxt Credit Card

- India’s first interactive credit card with a display screen for selecting payment options.

- Options for EMI, reward points, or credit payment directly on the card.

- Contactless payment feature for secure and quick transactions.

8. IndusInd Bank Platinum Select Credit Card

- Focused on mid-range customers.

- Reward points on travel and dining.

- Fuel surcharge waivers and shopping discounts.

- Flexible repayment options with EMI conversion.

Exclusive Benefits for IndusInd Bank Credit Cardholders

- Low Joining Fees and Welcome Benefits

- Many cards have low or zero joining fees.

- Attractive welcome rewards, such as vouchers, cashback, or bonus reward points.

- Global Acceptance

- Partnered with Visa, Mastercard, and American Express for worldwide usability.

- Add-on Cards

- Option to get supplementary cards for family members with customizable spending limits.

- Personalized Offers

- Access to exclusive deals on shopping, travel, and dining through partnerships with leading brands.

How IndusInd Bank Credit Cards Stand Out

- Flexibility in reward point redemption options.

- Cards designed for niche segments, such as travelers, golfers, and premium lifestyle enthusiasts.

- State-of-the-art technology, including contactless payments and advanced security features.

IndusInd Bank’s credit cards provide a mix of affordability, luxury, and functionality, making them a strong contender in the Indian credit card market. Whether you’re looking for a basic card for everyday transactions or a premium card for elite privileges, IndusInd Bank has something to match your preferences.

Eligibility Criteria for IndusInd Bank Credit Cards

- Age

- Primary Cardholder: Typically between 21 years and 65 years.

- Add-on Cardholder: Must be at least 18 years old.

- Income

- A steady and regular income is mandatory.

- Specific income requirements vary depending on the credit card (e.g., premium cards may require a higher income).

- Residency

- Applicants must be Indian residents or non-resident Indians (NRIs).

- Credit Score

- A good credit score (typically 750 or above) is essential for approval.

- Applicants with a lower score may be considered for entry-level credit cards.

- Employment Status

- Salaried Individuals: Must be employed with a reputable organization.

- Self-Employed Individuals: Should have a stable business with sufficient income.

Who Can Apply for an IndusInd Bank Credit Card?

- Salaried Professionals

- Employed in a stable job with a regular income stream.

- Meets the minimum salary requirement as per the card category.

- Self-Employed Individuals

- Business owners or freelancers with consistent and verifiable income.

- Must meet the minimum annual income requirement.

- Students and Young Adults

- Can apply for add-on cards under a primary cardholder’s account.

- Entry-level cards are available for individuals with limited credit history, provided they meet the income requirements.

- Existing IndusInd Bank Customers

- Bank account holders or those with a prior credit relationship with IndusInd Bank have an advantage due to an established relationship.

Documents Required to Apply for an IndusInd Bank Credit Card

Applicants must provide the following documents for verification:

1. Proof of Identity (Any one of the following)

- Aadhaar Card

- PAN Card

- Passport

- Voter ID

- Driving License

2. Proof of Address (Any one of the following)

- Aadhaar Card

- Utility Bills (Electricity, Water, or Gas – not older than 3 months)

- Passport

- Rent Agreement

- Bank Account Statement

3. Proof of Income

- For Salaried Individuals:

- Latest salary slips (last 3 months)

- Form 16 or Income Tax Return (ITR)

- Bank statement showing salary credits (last 3–6 months)

- For Self-Employed Individuals:

- Latest ITR (Income Tax Return)

- Business financial statements (audited if required)

- Bank statement of the business (last 6 months)

4. Additional Documents

- Recent passport-sized photographs.

- PAN Card (mandatory for all applications).

- Existing credit card statement (if applying for a balance transfer or demonstrating credit history).

Steps to Apply for an IndusInd Bank Credit Card

- Online Application

- Visit the official IndusInd Bank website.

- Select the desired credit card and fill out the online application form.

- Upload the required documents.

- Offline Application

- Visit a nearby IndusInd Bank branch.

- Fill out a credit card application form.

- Submit the required documents for verification.

- Pre-Approved Offers

- Existing customers with a good transaction history may receive pre-approved credit card offers with minimal documentation.

Tips for Approval

- Maintain a Good Credit Score:

A credit score above 750 increases your chances of approval and may get you better offers. - Meet the Income Criteria:

Ensure your monthly or annual income meets the eligibility for the selected card. - Submit Complete Documents:

Missing documents can delay processing or lead to rejection. Double-check before submission. - Choose the Right Card:

Apply for a card that aligns with your income level and spending habits to increase approval chances.

Pros of IndusInd Bank Credit Cards

1. Wide Range of Options

- IndusInd Bank provides credit cards for various customer segments, including premium, mid-range, and entry-level cards.

- Specialized cards for frequent travelers, shoppers, and lifestyle enthusiasts.

2. Reward Points Program

- Earn reward points on all eligible transactions, with higher rewards on categories like dining, travel, and shopping.

- Flexible redemption options, including cashback, vouchers, and travel bookings.

3. Travel Benefits

- Complimentary domestic and international airport lounge access for premium cardholders.

- Travel insurance for flight delays, lost baggage, and other inconveniences.

4. Dining and Entertainment Offers

- Discounts and exclusive deals on dining through the Culinary Treats Program.

- Buy-one-get-one offers and discounts on movie tickets via BookMyShow or other platforms.

5. Fuel Surcharge Waiver

- Waiver on fuel surcharge at select petrol pumps across India, reducing your expenses on fuel.

6. Premium Benefits

- High-end cards offer concierge services, free golf games, and luxury experiences.

- Exclusive privileges for affluent customers, such as IndusInd Pinnacle or Celesta credit cards.

7. Security Features

- EMV chip-enabled cards for secure transactions.

- Zero liability on fraudulent transactions if the card is reported lost or stolen promptly.

8. Flexible EMI Options

- Easy EMI conversion for high-value purchases, allowing better financial management.

9. No Annual Fee Options

- Some cards come with zero joining or annual fees, making them cost-effective for budget-conscious users.

10. Global Acceptance

- Partnered with Visa and Mastercard, ensuring the card is accepted worldwide.

Cons of IndusInd Bank Credit Cards

1. High Eligibility Criteria for Premium Cards

- Premium credit cards like the IndusInd Pinnacle or Celesta require a high income or excellent credit score, limiting their accessibility.

2. Limited Reward Categories on Some Cards

- Certain cards have restricted reward structures, offering higher points only on specific categories like dining or travel, which may not suit all users.

3. High Interest Rates

- Interest rates on unpaid balances can be high (typically 2.5%–3.5% per month), which is standard for credit cards but can be costly for revolving credit users.

4. Annual and Renewal Fees for Premium Cards

- While some cards have no annual fees, premium cards often have higher annual charges, which might not justify the benefits unless used frequently.

5. Limited Add-On Features for Entry-Level Cards

- Budget-friendly cards often lack premium perks like lounge access, golf privileges, or travel insurance.

6. Strict Documentation Requirements

- The application process can be time-consuming due to the requirement of multiple documents for verification.

7. Penalties and Hidden Charges

- Late payment fees, over-limit charges, and cash withdrawal fees can add up if not managed carefully.

- Detailed scrutiny of terms and conditions is needed to avoid unexpected charges.

8. Customer Support Issues

- Some users have reported delays in resolving disputes or accessing customer care, particularly for complex queries.

9. Limited Network of Offers

- Dining, shopping, and lifestyle offers may not always align with your preferred merchants or brands.

Who Should Get an IndusInd Bank Credit Card?

Ideal for:

- Individuals seeking premium benefits such as lounge access, golf privileges, and concierge services.

- Frequent travelers who want travel insurance and international usability.

- Shoppers looking for lucrative rewards and discounts on lifestyle spends.

- Budget-conscious users opting for no-annual-fee cards with basic benefits.

Not Ideal for:

- People with limited or inconsistent income, as eligibility can be stringent.

- Those who don’t use premium card benefits like lounge access or golf, as annual fees might outweigh the rewards.

- Individuals who carry forward balances regularly, as interest rates can be steep

Conclusion

IndusInd Bank credit cards stand out as versatile financial tools, offering tailored solutions for diverse lifestyles and spending patterns. Whether you’re a frequent traveler, a dining enthusiast, or someone seeking premium lifestyle perks, there’s a card designed to meet your needs. The combination of lucrative reward programs, exclusive benefits like lounge access and concierge services, and robust security features makes these cards an appealing choice for many.

However, like any credit card, the true value lies in how wisely you use it. While premium cards deliver exceptional perks, they come with eligibility requirements and fees that may not suit everyone. Similarly, entry-level cards may lack high-end benefits but still provide valuable savings for everyday transactions.

Before choosing an IndusInd Bank credit card, it’s essential to assess your financial habits, spending priorities, and eligibility to ensure the card aligns with your needs. With responsible usage, you can unlock the full potential of the rewards and privileges, enhancing both your financial management and lifestyle.

FAQs

How can I apply for an IndusInd Bank credit card?

You can apply for an IndusInd Bank credit card online through the bank’s official website or by visiting a nearby branch. The application requires you to fill out a form and submit the necessary documents, such as proof of identity, address, and income. best IndusInd credit card

What are the eligibility criteria for an IndusInd Bank credit card?

The general eligibility criteria include:

Minimum age of 21 years (18 years for add-on cards).

A stable income (varies by card type).

A good credit score, typically 750 or above.

Indian residency or NRI status. best IndusInd credit card

What types of IndusInd Bank credit cards are available?

IndusInd Bank offers a variety of credit cards, including:

Premium cards (e.g., Pinnacle, Celesta) with lifestyle and travel benefits.

Reward cards (e.g., Iconia) for accelerated points on purchases.

Entry-level cards (e.g., Platinum Aura) for budget-friendly benefits. best IndusInd credit card

Can I get a credit card without a high income?

Yes, IndusInd Bank offers entry-level credit cards with relatively lower income requirements. However, eligibility depends on your financial profile and credit score. best IndusInd credit card

Are IndusInd Bank credit cards globally accepted?

Yes, IndusInd Bank credit cards are accepted worldwide as they are issued in partnership with Visa, Mastercard, or American Express. best IndusInd credit card

What documents are required to apply for an IndusInd Bank credit card?

The key documents include:

Proof of identity (Aadhaar, PAN, Passport, etc.).

Proof of address (Utility bills, Aadhaar, etc.).

Proof of income (Salary slips, ITR, or bank statements).

Additional documents may be required based on the card type. best IndusInd credit card

How can I redeem reward points?

You can redeem your reward points through IndusInd Bank’s rewards portal for:

Gift vouchers.

Travel bookings.

Cashback.

Merchandise and more.

The redemption options vary depending on the card you hold. best IndusInd credit card

Are there any fuel surcharge waivers?

Yes, most IndusInd Bank credit cards offer a fuel surcharge waiver at select petrol pumps across India, usually for transactions between ₹400 and ₹4,000.best IndusInd credit card

How can I check my credit card statement?

You can check your IndusInd Bank credit card statement through:

The bank’s internet banking portal.

The mobile banking app.

Email statements sent to your registered email ID. best IndusInd credit card

What should I do if my credit card is lost or stolen?

Immediately report the loss to IndusInd Bank’s 24/7 customer care at 1860-267-7777 or use the mobile app to block the card. The bank offers zero liability on fraudulent transactions if the loss is reported promptly. best IndusInd credit card

Can I convert my transactions into EMIs?

Yes, IndusInd Bank allows you to convert eligible high-value transactions into EMIs through their mobile app, internet banking, or customer care. best IndusInd credit card

Is there a joining or annual fee for IndusInd Bank credit cards?

Some cards come with no joining or annual fees, while premium cards may have higher fees. The fees and waivers depend on the card type and usage. best IndusInd credit card

How do I increase my credit card limit?

You can request a credit limit increase by contacting IndusInd Bank’s customer service or visiting a branch. You may need to provide updated income documents for approval. Best IndusInd credit card

What is the interest rate on IndusInd Bank credit cards?

The interest rate varies by card type and typically ranges from 2.5% to 3.5% per month on outstanding balances. Best IndusInd credit card

Can I get an add-on credit card for my family members?

Yes, you can apply for supplementary (add-on) credit cards for your family members, such as your spouse, parents, or children (18 years and above).best IndusInd credit card

What are the penalties for late payment?

Late payment charges depend on the outstanding amount and can vary across cards. It’s advisable to pay your dues on time to avoid penalties and negative impacts on your credit score. Best IndusInd credit card

Are there any benefits for travelers?

Yes, many benefits are given for travelers with credit card. Best IndusInd credit card