Log in to Spot Loan Login in India for quick and easy access to tailored loan solutions. Empower your financial journey today with secure online access.

Table of Contents

Introduction

In today’s fast-paced world, financial needs can arise unexpectedly. Spot Loan offers a seamless solution for individuals seeking quick and reliable loan access in India. With a user-friendly login portal, you can navigate your financial journey with ease. Whether you’re looking to fund a personal project, manage emergencies, or invest in your dreams, Spot Loan is designed to empower you with tailored options that fit your needs. Let’s explore how you can unlock your financial potential today.

What is Spot Loan

Spot Loan is a financial service that provides quick access to personal loans, often designed to meet urgent financial needs. It typically features a straightforward application process, allowing borrowers to receive funds rapidly—sometimes within 24 to 48 hours. Spot Loan aims to empower individuals by offering tailored loan solutions, making it easier for them to manage personal projects, emergencies, or investments. The service usually includes a user-friendly online portal for easy application and management of loans, with flexible repayment options and competitive interest rates.

How do I log in to my Spot Loan account

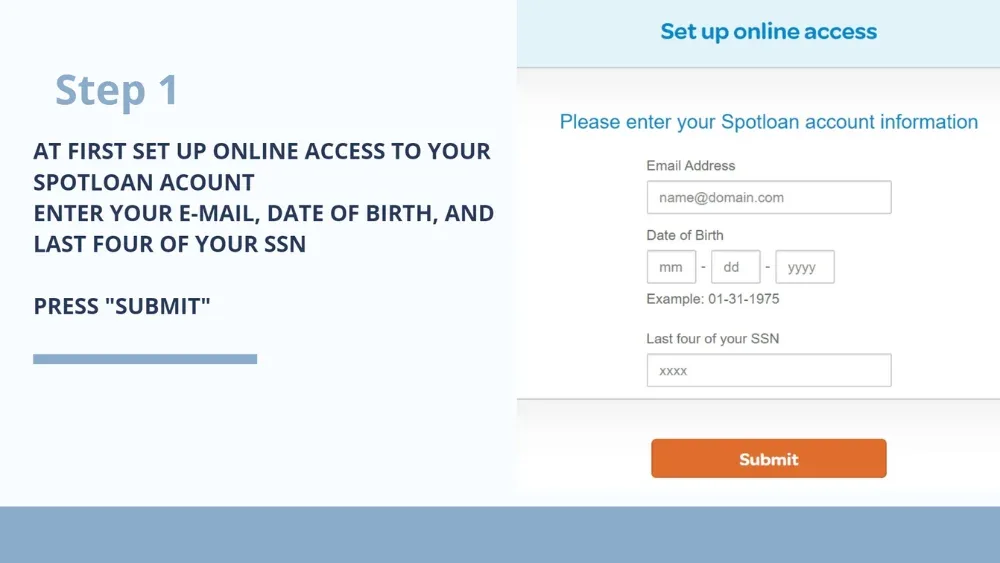

Visit the Website/App

To log in to your Spot Loan account, start by visiting the official Spot Loan website or opening the Spot Loan mobile app. Ensure that you are using a secure and trusted internet connection to protect your personal information.

Locate the Login Section

On the homepage, look for the “Login” or “Sign In” button. This is typically located in the top right corner of the page. Clicking on this will take you to the login screen.

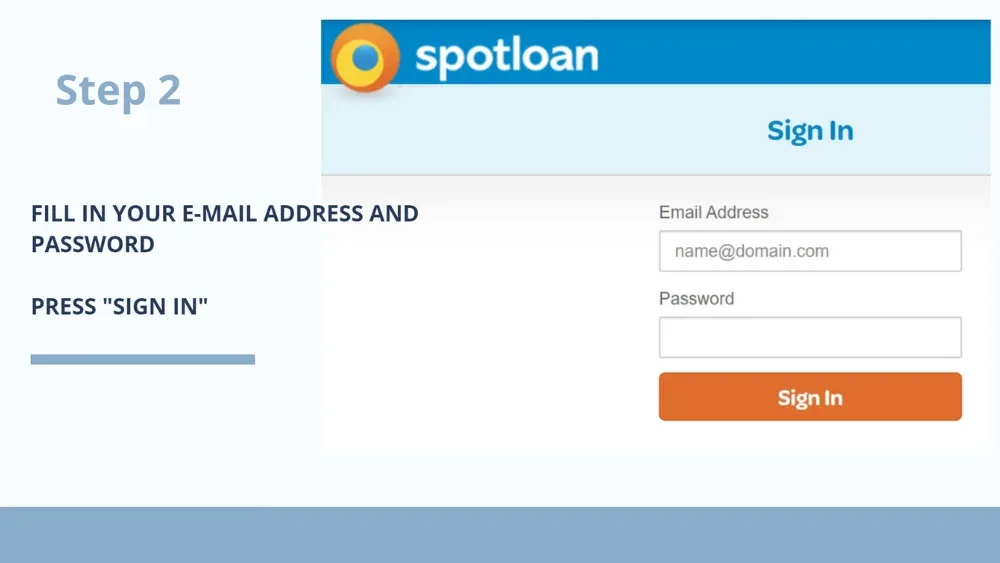

Enter Credentials

Once on the login page, enter your registered email address or mobile number in the designated field. Make sure there are no typos, as this will affect your ability to log in. Then, enter your password in the password field. If you have difficulty remembering your password, consider using a password manager.

Complete Captcha (if prompted)

In some cases, you may be prompted to complete a captcha verification. This step helps ensure that you’re a real user and not an automated bot. Follow the on-screen instructions to complete this process.

Click on Login

After entering your credentials and completing any necessary captcha, click the “Login” button to proceed. If your details are correct, you will be redirected to your account dashboard.

Forgot Password?

If you can’t remember your password, click on the “Forgot Password?” link. This will typically take you to a page where you can enter your email address or mobile number to receive instructions for resetting your password. Follow the provided steps carefully to create a new password.

Security Tips

For added security, always ensure you’re logging in from a secure network, such as your home Wi-Fi, rather than public networks. Keep your login credentials private and avoid sharing them with anyone. If you ever suspect that your account may be compromised, change your password immediately and contact customer support for further assistance.

What documents do I need to apply for a Spot Loan

Proof of Identity

You can use an Aadhar Card, PAN Card, Voter ID, or Passport.

Proof of Address

Acceptable documents include a utility bill (such as electricity or water), a rental agreement, or a recent bank statement.

Income Verification

If you’re salaried, provide salary slips for the last 2-3 months and bank statements for the last 3-6 months. If self-employed, include income tax returns (ITR) for the last financial year.

Employment Details

You may need to submit an employment letter or contract. If self-employed, business registration documents are required.

Bank Account Details

A cancelled cheque or bank statement is necessary to verify your bank account.

Photograph

A recent passport-sized photograph may also be needed.

How Quickly Can I Get a Spot Loan?

Application Processing

Once you submit your application along with the required documents, the lender typically begins the review process immediately. This includes verifying your identity, assessing your creditworthiness, and evaluating the documentation provided. Most lenders aim to complete this initial processing within a few hours to a day. Having all your documents ready and correctly filled out can help speed up this stage.

Approval Time

If your application meets the lender’s criteria and all required documents are in order, you can often receive loan approval within 24 hours. Some lenders may even provide instant approval through automated systems, depending on the complexity of your application and your credit profile. If additional information or documentation is needed, this may delay the approval process.

Disbursement of Funds

Once you receive approval, the next step is the disbursement of funds. Most lenders will initiate the transfer of funds to your designated bank account within 24 to 48 hours. The actual time it takes for the money to appear in your account may vary based on your bank’s processing times.

Additional Factors

Several factors can influence the overall timeline:

- Loan Amount: Larger loans may require more extensive verification.

- Credit History: A strong credit profile may speed up the process, while concerns about credit history could lead to longer review times.

- Lender Policies: Different lenders have varying policies and procedures, which can affect the speed of processing and disbursement.

- Bank Processing Times: The time it takes for your bank to process incoming funds can vary, so always consider your bank’s typical transfer times.

What are the interest rates for Spot Loans

| Loan Amount | Interest Rate | Loan Tenure |

|---|---|---|

| ₹10,000 – ₹50,000 | 12% – 18% | 6 – 12 months |

| ₹50,001 – ₹1,00,000 | 10% – 16% | 12 – 24 months |

| ₹1,00,001 – ₹5,00,000 | 9% – 15% | 12 – 36 months |

| ₹5,00,001 and above | 8% – 14% | 12 – 60 months |

Can I prepay my loan

Benefits of Prepayment

- Interest Savings: Prepaying your loan can reduce the total interest paid over the loan tenure, as you’re paying off the principal amount faster.

- Financial Freedom: Paying off your loan early can give you peace of mind and greater financial flexibility.

Conditions for Prepayment

- Prepayment Penalties: Some lenders may charge a fee for early repayment, so it’s important to check the loan agreement for any penalties.

- Minimum Prepayment Amount: Certain lenders may have a minimum amount that you must prepay.

Process

To prepay your loan, you typically need to:

- Contact your lender to express your intent to prepay.

- Confirm any applicable fees or terms.

- Provide the necessary payment information.

Important Considerations

- Review your loan agreement for specific terms regarding prepayment.

- Evaluate your financial situation to ensure that prepaying is beneficial compared to other financial obligations.

Who can apply for a Spot Loan

Age Requirement

Applicants must usually be at least 21 years old to qualify for a Spot Loan.

Income Source

Individuals with a stable income source can apply. This includes:

- Salaried employees with regular income.

- Self-employed individuals with proof of business income.

- Freelancers with consistent earnings.

Credit Profile

While some lenders may consider applicants with lower credit scores, having a good credit history generally increases the chances of approval and may result in better interest rates.

Residency Status

Applicants must be residents of India and have valid identification documents, such as an Aadhar Card or PAN Card.

Documentation

You will need to provide the necessary documentation to verify your identity, income, and address.

Bank Account

Having an active bank account is essential for the disbursement of funds and repayment of the loan.

Conclusion

In conclusion, the Spot Loan login process offers users a simple and efficient way to manage their loan applications and account details online. By providing secure access to your account, Spot Loan ensures that you can easily track your loan status, make repayments, and access essential information whenever needed. Understanding how to log in and navigate the platform enhances your overall experience, allowing you to focus on your financial goals. Whether you’re a first-time borrower or a returning customer, utilizing the Spot Loan login feature empowers you to take charge of your financial journey with ease and confidence. Always ensure you keep your login credentials secure to protect your personal information.

KCC Loan

FAQs About Spot Loan login

What is the Spot Loan login process?

To log in, visit the Spot Loan website or app, click on the “Login” button, enter your registered email or mobile number and password, then click “Login.”

I forgot my password. How can I reset it?

Click on the “Forgot Password?” link on the login page, enter your registered email or mobile number, and follow the instructions sent to you to reset your password.

Why can’t I log in to my Spot Loan account?

Possible reasons include incorrect credentials, account lock due to multiple failed attempts, or server issues. Check your details and try again.

Is my personal information secure when I log in?

Yes, Spot Loan uses advanced encryption and security measures to protect your personal information and ensure secure transactions.

Can I access my account from multiple devices?

Yes, you can log in to your Spot Loan account from multiple devices, such as your computer, smartphone, or tablet, as long as you have internet access.

What should I do if I encounter technical issues while logging in?

If you experience technical difficulties, try clearing your browser cache or using a different browser. If the problem persists, contact customer support for assistance.

How can I update my account information after logging in?

Once logged in, navigate to your account settings or profile section to update your personal information, such as your contact details or bank account information.

Can I log in to my account without a registered email or mobile number?

No, you must have a registered email address or mobile number to create and access your Spot Loan account.