Here we will discuss about turkish virtual credit card. Introduction to the card, features of the card, login process of the card, eligibility, and to check the comparison of other turkish virtual card.

Table of Contents

Introduction to Turkish Virtual Credit Card (.)

In an increasingly digital world, the demand for secure and convenient payment methods has surged, particularly in Turkey. Turkish virtual credit cards have emerged as a popular solution, offering users a safe and efficient way to shop online without exposing their actual credit card details. These virtual cards are linked to traditional bank accounts or credit cards, allowing users to generate unique card numbers for each transaction.

This innovative payment method not only enhances security by reducing the risk of fraud but also provides greater control over spending and budget management. With features tailored to meet the needs of tech-savvy consumers, Turkish virtual credit cards are transforming the way individuals approach online purchases, travel bookings, and subscription services. As digital payments continue to evolve, understanding the benefits and functionalities of virtual credit cards can empower users to make informed financial decisions.

What is a Turkish Virtual Credit Card? (1)

A Turkish virtual credit card is a digital representation of a credit or debit card that exists only online. It is issued by banks or financial institutions and linked to your actual bank account or credit card. Users can generate multiple virtual card numbers for various online transactions, enhancing security and control.

Key Features

Unique Card Numbers

Each virtual card comes with its own card number, expiration date, and CVV, distinct from your primary card. This helps protect your main card information from potential fraud.

Single-Use or Multi-Use

Depending on the provider, virtual cards can be single-use (ideal for one-time transactions) or multi-use (allowing for repeated use with the same card number).

Integration with Banking Apps

Many Turkish banks offer virtual card services through their mobile apps, enabling users to create, manage, and track their virtual cards easily.

Control and Customization

Users can set limits on spending, adjust expiry dates, and even disable cards when they’re no longer needed, providing greater control over finances.

Which Card Is Best In Turkish Virtual Credit Cards

Iş Bankasl Virtual Credit Card

- Instant issuance through the mobile app.

- Customizable limits and expiration dates.

- Comprehensive transaction tracking.

- Best for users who prefer a widely recognized bank with robust customer service.

Garanti BBVA Virtual Card

- Easy integration with the Garanti app.

- Ability to create single-use or multi-use cards.

- Strong security features, including alerts for transactions.

- Best for customers looking for flexibility in card usage.

Yapı Kredi Virtual Card

- Quick setup and user-friendly interface.

- Detailed spending analysis and budget tracking tools.

- Supports various currencies for international purchases.

- Best for users who frequently shop online in different currencies.

QNB Finansinvest Virtual Card

- Ideal for online trading and investment transactions.

- Offers good security measures and transaction monitoring.

- Custom limits based on user preferences.

- Best for investors looking for a secure way to manage trading activities.

Halkbank Virtual Card

- Simple to create via the Halkbank app.

- Good for one-time online purchases.

- Competitive fees for certain transactions.

- Best for customers seeking basic functionality without added complexity.

Factors to Consider

When choosing a virtual credit card, consider the following:

- Fees: Look into any transaction fees, annual fees, or currency conversion charges.

- Security Features: Ensure the card offers robust security measures like transaction alerts and fraud protection.

- Ease of Use: Check if the card is easy to manage through a mobile app or online platform.

- Customer Support: Opt for a provider with strong customer service options in case you need assistance.

How Can I Login To My Turkish Virtual Credit Card Online

Step-by-Step Guide to Log In

Visit Your Bank’s Website or App:

Open the official website of your bank or launch the mobile banking app associated with your virtual credit card.

Find the Login Section:

Look for a “Login” or “Sign In” button, usually located at the top right corner of the homepage.

Enter Your Credentials:

Input your username or customer ID and password. If you’re using an app, you may be prompted to enter a PIN or use biometric authentication (fingerprint or facial recognition) if enabled.

Two-Factor Authentication (if applicable):

Some banks may require additional verification. You might receive a code via SMS or email that you’ll need to enter to complete the login process.

Access Your Account:

Once logged in, navigate to the section related to virtual cards. This may be under “Cards,” “Payments,” or a similar menu.

Manage Your Virtual Card:

Here, you can view your virtual card details, check transaction history, set spending limits, and make any necessary adjustments.

Can We Use A Turkish Virtual Credit Card In ATM

No, Turkish virtual credit cards typically cannot be used at ATMs. Virtual credit cards are designed primarily for online transactions and do not have a physical card associated with them. Here are some key points to consider:

Key Points

Online Use Only

Virtual credit cards are intended for online purchases, subscriptions, and other digital transactions. They usually do not have a physical form, which means they cannot be inserted into ATM machines.

Link to a Physical Card

Some virtual cards are linked to a physical credit or debit card, but you would need to use that physical card at an ATM for cash withdrawals.

Limited Functionality

Virtual cards may not support features such as cash withdrawals, balance inquiries, or other ATM services.

Turkish Virtual Credit Card Eligibility Criteria

Eligibility Criteria

Age Requirement:

You usually need to be at least 18 years old to apply for a virtual credit card.

Bank Account:

You must have an active bank account with the issuing bank. Some banks may require you to be a customer for a specific duration before you can apply.

Identification:

Valid identification, such as a Turkish national ID or a residence permit for foreigners, is often required.

Credit History:

Some banks may check your credit history or score, particularly if you are applying for a credit-based virtual card. A positive credit history can improve your chances of approval.

Income Verification:

Depending on the bank, you may need to provide proof of income or employment to demonstrate your financial stability.

Application Process:

You must complete the application process through the bank’s website or mobile app, which may involve providing personal details and agreeing to terms and conditions.

No Outstanding Debts:

Some banks may consider your existing debts or obligations when evaluating your eligibility.

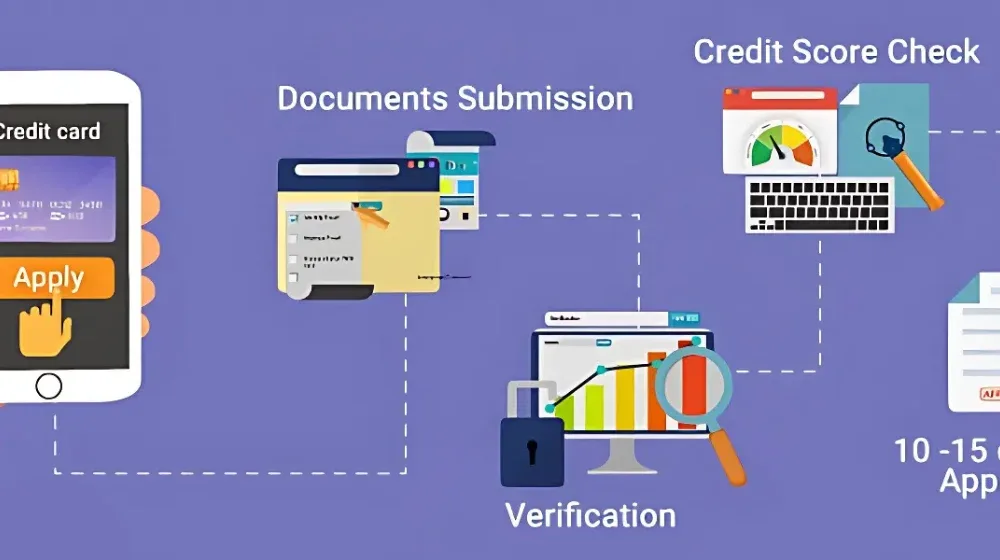

How To Apply Turkish Virtual Credit Card

Step-by-Step Application Process

Complete Guide:

Choose a Bank:

Select a bank or financial institution that offers virtual credit cards. Popular options include İş Bankası, Garanti BBVA, Yapı Kredi, and others.

Visit the Bank’s Website or Mobile App:

Go to the official website or download the mobile app of your chosen bank.

Create an Account (if necessary):

If you don’t already have an account with the bank, you may need to create one. This usually involves providing personal information, such as your name, ID number, and contact details.

Navigate to Virtual Card Services:

Once logged in, look for the section related to virtual credit cards. This may be under “Cards,” “Online Banking,” or a similar category.

Fill Out the Application Form:

Complete the application form by providing necessary details, including your income, purpose for the card, and any limits you wish to set.

Submit Identification:

You may need to upload or provide a copy of your valid ID (e.g., Turkish ID or residence permit) and possibly proof of income.

Review Terms and Conditions:

Carefully read through the terms and conditions associated with the virtual card. Make sure you understand the fees, limits, and other important details.

Submit Your Application:

After completing the form and reviewing the terms, submit your application.

Confirmation:

Once your application is processed, you’ll receive a confirmation from the bank. This may include details on how to access and manage your virtual card.

Start Using Your Card:

- After approval, you can generate your virtual card number through the bank’s app or website and start using it for online transactions.

Required Documents To Apply Turkish Virtual Credit Card

Required Documents

Valid Identification:

A Turkish national ID card or a residence permit for foreigners.

Proof of Income:

This may include:

Recent payslips.

Bank statements showing regular deposits.

Employment verification letter.

Tax return documents (for self-employed individuals).

Application Form:

Completed application form provided by the bank, which includes personal information, income details, and intended usage of the card.

Address Verification:

A document to verify your address, such as:

Recent utility bills (electricity, water, gas).

Bank statements with your address.

Additional Documents:

Some banks may require additional documentation, such as:

A signed consent form for credit history checks.

Any other documents specific to the bank’s requirements.

Fees And Charges Of Turkish Virtual Credit Card

Common Fees and Charges

| Fee Type | Description |

|---|---|

| Annual Fee | Fee for maintaining the virtual card (may be free for some banks). |

| Transaction Fees | Fees for certain transactions, especially international purchases. |

| Cash Withdrawal Fees | Not applicable as virtual cards cannot be used at ATMs. |

| Foreign Transaction Fees | Fees for purchases made in foreign currencies (typically a percentage). |

| Card Replacement Fee | Fee for issuing a new virtual card number if lost or changed. |

| Late Payment Fees | Charges for failing to make timely payments (if applicable). |

| Over-limit Fees | Charges for exceeding the spending limit set on the card. |

Conclusion

Turkish virtual credit cards represent a modern and secure payment solution for consumers increasingly reliant on digital transactions. With their unique card numbers, customizable spending limits, and enhanced security features, these cards provide a practical alternative to traditional credit cards, particularly for online shopping and subscriptions.

The benefits of using virtual credit cards, such as improved fraud protection, budget management, and ease of use, make them appealing to a wide range of users. However, it’s essential to be aware of the potential fees and charges associated with these cards and to understand the eligibility criteria before applying.

As the digital payment landscape continues to evolve, Turkish virtual credit cards offer a flexible and user-friendly option that can help consumers navigate their financial needs safely and efficiently. By selecting the right card and understanding its features, users can make the most of their online shopping experience while maintaining control over their finances.

FAQs About Turkish Virtual Credit Card

How do I get a Turkish virtual card?

To get a Turkish virtual card, choose a bank offering the service, create an account on their website or app, complete the application form with required documents (ID and proof of income), and submit it. After approval, you’ll receive your virtual card details for online transactions.

Can foreigners get a credit card in Turkey?

Yes, foreigners can get a credit card in Turkey, but there are specific requirements. Typically, you need to have:

Residency: A valid residence permit or long-term visa.

Identification: A passport and possibly a Turkish ID number.

Proof of Income: Documentation to show your financial stability, such as bank statements or employment letters.

How to buy a Turkish prepaid card?

To buy a Turkish prepaid card, choose a provider like Turkcell or Vodafone, visit a retail store or their website, select the card type, complete the purchase, and follow activation instructions.

Does Turkey have Google card?

Turkey does not have a specific “Google Card.” However, you can use Google Pay in Turkey with compatible credit and debit cards issued by local banks. This allows you to make contactless payments through your mobile device. Check with your bank to see if they support Google Pay.

How do I get an eSIM Turkey?

To get an eSIM in Turkey, choose a provider like Turkcell or Vodafone, visit their store or website, request the eSIM, provide identification, and scan the QR code to activate it on your device.

What is the best credit card to use in Turkey?

The best credit card to use in Turkey often depends on your needs, but popular options include:

Is Bankası Credit Card: Widely accepted with good rewards programs.

Garanti BBVA Credit Card: Offers travel benefits and cashback options.

Yapı Kredi Credit Card: Known for flexibility and various payment plans.

QNB Finansinvest Card: Good for international use and online shopping.

Can tourists get a credit card?

Yes, tourists can get a credit card in Turkey, but there are specific requirements. Generally, you’ll need:

Identification: A valid passport.

Proof of Address: This may include hotel bookings or other documents.

Bank Account: Some banks may require you to open a local account.

Does the RuPay card work in Turkey?

Yes, RuPay cards can work in Turkey, especially if they are co-branded with international networks like Visa or Mastercard. However, acceptance may vary by merchant. It’s advisable to check with your bank for any specific conditions, fees, and to inform them about your travel plans to avoid issues while using your card abroad.

Is Turkey visa free for Indians?

No, Turkey is not visa-free for Indian citizens. Indians need to obtain a visa before traveling to Turkey. However, they can apply for an e-Visa online if they meet certain criteria, such as holding a valid Schengen visa or a residence permit from specific countries. It’s important to check the latest visa requirements and procedures before planning your trip.

How to get a Turkish prepaid card?

To get a Turkish prepaid card, choose a provider like Turkcell or Vodafone, visit a store or their website, select the card type, pay for it, and follow activation instructions.

What is the best currency to use in Turkey?

The best currency to use in Turkey is the Turkish Lira (TRY), as it is the official currency. While some places may accept euros or US dollars, using the lira will generally provide better exchange rates and avoid extra fees. It’s advisable to carry some cash for smaller vendors and rural areas, while credit cards are widely accepted in larger cities.

What is the strongest credit card in the world?

The strongest credit card in the world often refers to the Centurion Card from American Express, commonly known as the “Black Card.” This invitation-only card is known for its exclusivity and premium benefits, including:

Personal concierge service

Access to luxury travel perks

No preset spending limit

High rewards on purchases

How to get Turkey virtual number?

To get a Turkish virtual number, choose a provider like Twilio or Turkcell, sign up for an account, select an available Turkish number, complete the payment, and follow setup instructions.