Introduction

Is a Stock Market Crash in July 2024?: Investors around the world are anxiously awaiting the year 2024, with concerns about a potential stock market crash looming in their minds. Media headlines and financial experts have fueled these fears, leaving many wondering if their portfolios are at risk. However, a deeper analysis of the data suggests a different story. In this article, we will delve into the key factors that indicate there is no secular turning point in 2024, meaning a stock market crash is unlikely. Instead, we may see a strong pullback after reaching all-time highs. Let’s explore the evidence and gain a clearer understanding of the market forecast for 2024.

Table of Contents

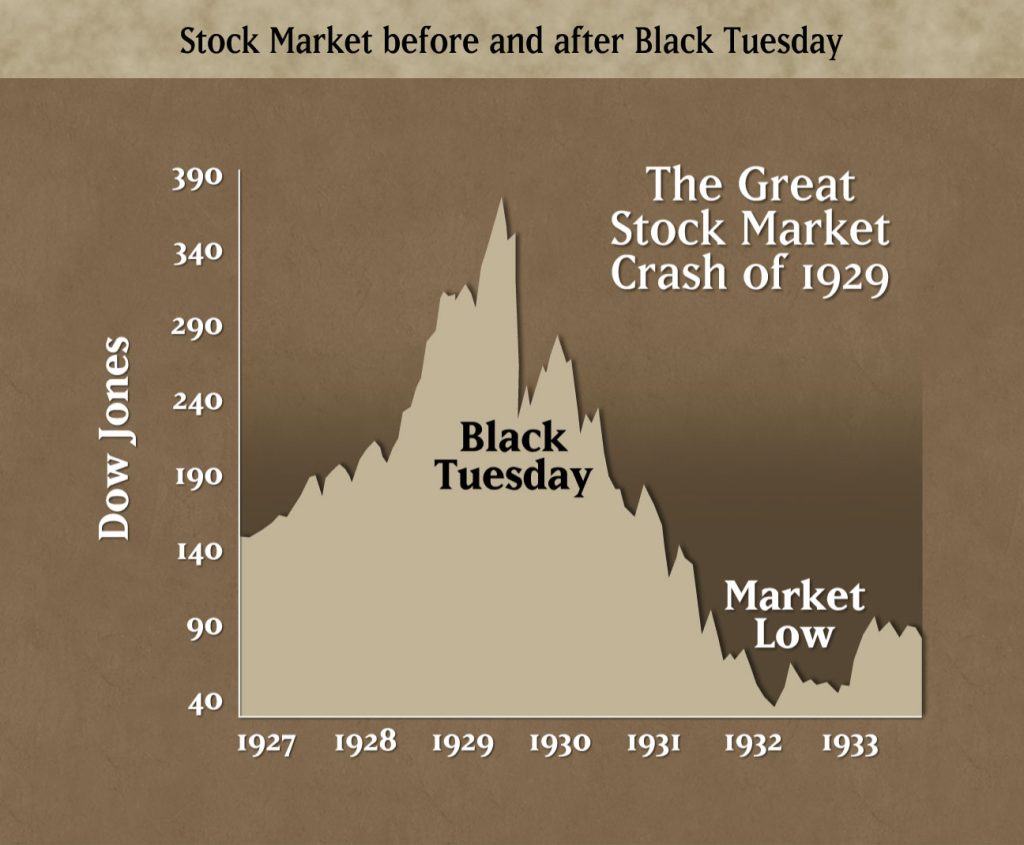

A History of Stock Market Crashes

Before we dive into the specifics of the current market situation, let’s take a step back and examine the historical context of stock market crashes. While the term “stock market crash” is often used loosely, true crashes are rare occurrences. There have only been four recognized stock market crashes since 1900: the Panic of 1907, the Wall Street Crash of 1929, Black Monday in 1987, and the crash of 2008-2009. It’s important to note that the dotcom crash in 2000, while significant, did not qualify as a stock market crash as it primarily affected the NASDAQ index rather than the broader market.

No Secular Bearish Turning Point in Sight

To assess the likelihood of a stock market crash in 2024, we must first identify any signs of a bearish turning point. A secular turning point refers to a long-term shift in market trends that could potentially lead to a crash. However, based on a comprehensive analysis of various indicators, there is no evidence of a secular turning point in 2024. This conclusion is supported by data points such as the absence of an inverted yield curve, the stable US Dollar chart, and timeline readings. These factors were also considered in our previous forecast for 2023, which accurately predicted the absence of a bearish turning point. The conclusion remains the same for 2024: no secular bearish turning point is on the horizon.

Volatility and Its Implications

Volatility is a key factor that often contributes to market uncertainty and investor fear. However, a closer look at the volatility index (VIX) reveals a different story. The VIX has been setting a series of lower highs, indicating a structural breakdown in volatility. While volatility levels have remained elevated, they have not reached extreme levels that would typically precede a stock market crash. Despite persisting fears and uncertainty, the absence of a significant increase in volatility suggests that a crash is not imminent.

Inflation Trends in 2024

Another important factor to consider in assessing the likelihood of a stock market crash is inflation. Inflation rates have been gradually decelerating, as evidenced by year-on-year inflation readings and reports on consumer price index (CPI), personal consumption expenditures (PCE), and producer price index (PPI). Monthly readings also confirm the downward trend in inflation. This moderation in inflation is a positive sign for market stability, as it reduces the risk of sudden shocks that could trigger a crash. Furthermore, inflation expectations are bottoming out, indicating a more stable economic environment.

Chart Analysis: The Bullish Reversal

Chart analysis is a valuable tool in understanding market trends and forecasting future movements. Upon examining the S&P 500 chart, we observe a bullish reversal pattern rather than any indication of a market crash. The index has been steadily climbing, suggesting a positive outlook for the market. While it is important to remain cautious and monitor market conditions, the absence of any alarming chart patterns supports the argument against a crash in 2024.

Rotation and Market Breadth

Market rotation refers to the shifting of investor preferences from one sector or asset class to another. In 2024, we expect to witness an epic stock market rotation, indicating a healthy and dynamic market. This rotation is a positive sign, as it indicates a broader participation of investors and a diversification of portfolios. Additionally, market breadth has been improving, with the number of advancing stocks surpassing decliners. This rejection of the stock market crash idea suggests a more resilient market environment.

Contrarian Readings and Consensus Viewpoints

In the world of investing, it is crucial to adopt a contrarian approach and carefully consider consensus viewpoints. Contrarian readings indicate that the market often defies popular sentiment and expectations. Currently, the bull vs. bear ratio reveals contrarian readings, suggesting that the market sentiment may be overly pessimistic. By analyzing these contrarian indicators, we gain a deeper understanding of the market’s potential direction and reduce the influence of herd mentality.

Anecdotal Evidence and the Role of Financial Media

Anecdotal evidence and the influence of financial media can significantly impact investor sentiment and perceptions of market stability. It is essential to critically evaluate and interpret media narratives, as they can often be sensationalized or biased. By maintaining a balanced perspective and relying on factual data, investors can make more informed decisions and avoid unnecessary panic. While financial media may occasionally amplify the fear of a market crash, it is important to remember that the media’s primary goal is to capture attention rather than provide accurate predictions.

Consumer Sentiment and Spending

The relationship between consumer sentiment and market performance is a crucial aspect to consider. While consumer sentiment may be negative, it does not necessarily translate to poor market performance. Consumer spending, which accounts for a significant portion of GDP, has remained robust despite negative sentiment. This divergence suggests that consumer behaviour and market performance are not always directly correlated. Therefore, negative consumer sentiment should not be viewed as a harbinger of a market crash.

Credit Markets and Stress Levels

Stress levels in credit markets can serve as an early warning sign of potential market instability. Fortunately, the current credit market conditions do not indicate any significant stress. The absence of stress in credit markets suggests that the probability of a stock market crash is relatively low. It is crucial to monitor credit market conditions closely as changes in credit spreads and default rates could signal a shift in market dynamics.

Broker/Dealers’ Outlook

Brokers/dealers, who play a critical role in financial markets, provide valuable insights into market expectations. Currently, brokers/dealers are expressing a bullish outlook, which aligns with the absence of a secular turning point and the positive indicators discussed earlier. These professionals closely analyze market conditions, and their optimism serves as an additional indication that a crash is unlikely in 2024.

EPS Estimates and Productivity Trends

Earnings per share (EPS) estimates for S&P 500 companies are an essential factor in assessing market health. Currently, EPS estimates are flat, indicating stable corporate earnings. This stability, combined with productivity growth and low unemployment rates projected for 2024, suggests a positive environment for businesses. These factors contribute to overall market stability and diminish the likelihood of a crash.

Conclusion: No Market Crash in 2024

Based on a comprehensive analysis of various factors, including historical data, chart patterns, inflation trends, market breadth, and contrarian readings, we can confidently conclude that a stock market crash is unlikely in 2024. While concerns and fears may persist, the absence of a secular turning point and the positive indicators discussed throughout this article support a more optimistic outlook. Investors must remain cautious, monitor market conditions, and make informed decisions based on factual data rather than succumbing to irrational fears.

Follow for more: https://paisainvests.com/

Case study of Harshad Mehta – Wikipedia

Disclaimer: The following analysis is based on available data and expert opinions, but it should not be considered financial advice. Predicting stock market movements, including the possibility of a crash in July 2024, involves inherent uncertainties and risks. Investors should conduct thorough research and consult with financial professionals before making any investment decisions.