Explore everything about fixed income mutual fund, their benefits, risks, types, and how they can fit into your investment strategy for steady returns in 2025.

Table of Contents

Introduction

A fixed income mutual fund is a type of investment vehicle that primarily invests in securities offering regular income, such as bonds, treasury bills, and other

. These funds are designed to provide investors with steady income over time while preserving the principal amount. The returns from fixed income mutual funds typically come from interest payments and capital gains, making them a popular choice for conservative investors or those looking for lower-risk options.

Key types of fixed income mutual funds include:

- Government Bond Funds: Invest in government-issued securities, offering high safety but lower returns.[1]

- Corporate Bond Funds: Focus on bonds issued by corporations, balancing moderate risk and potentially higher returns.[2]

- Municipal Bond Funds: Invest in tax-free municipal bonds, ideal for investors seeking tax-efficient income.[3]

- Short-Term and Long-Term Bond Funds: Tailored to the maturity period of the bonds, catering to different investment time horizons.[4]

Importance

Stability and Risk Mitigation

Fixed income funds are less volatile compared to equity investments. They provide a cushion against market fluctuations, especially during economic downturns, helping to preserve capital.

Steady Income Stream

These funds generate regular income through interest payments, making them a reliable source of cash flow for retirees, conservative investors, or those seeking supplemental income.

Portfolio Balance

By including fixed income funds, investors can balance the higher risk associated with equities. This ensures that while one part of the portfolio may experience volatility, the fixed income component offers stability.

Hedge Against Inflation

Certain fixed income funds, like Treasury Inflation-Protected Securities (TIPS), are specifically designed to combat inflation, ensuring that purchasing power is not eroded over time.

Liquidity

Most fixed income mutual funds are highly liquid, allowing investors to buy or sell units with ease. This makes them a flexible option for meeting short-term financial goals or emergencies.

Tax Efficiency

Some fixed income funds, such as municipal bond funds, offer tax-exempt interest income, providing an additional advantage for investors in higher tax brackets.

What Are Fixed Income Mutual Fund?

Fixed income mutual funds pool money from multiple investors to invest in a diversified portfolio of debt instruments, such as government bonds, corporate bonds, treasury bills, and other fixed-income securities. These funds aim to provide regular income and preserve capital while exposing investors to minimal risk compared to equity investments.

Here’s a step-by-step look at how they work:

- Pooling of Funds

Investors contribute money to the fund, which is managed by professional fund managers. The total capital is used to purchase a diversified mix of fixed-income securities. - Earning Returns

The securities in the fund generate returns primarily through:- Interest Income: Regular payments made by the issuers of bonds or debt instruments.

- Capital Gains: Profits from selling securities at a higher price than their purchase price.

- Distribution of Income

The income earned from interest payments and capital gains is either reinvested into the fund or distributed to investors as dividends, depending on the type of fund chosen (growth or dividend options). - Professional Management

Fund managers actively monitor the market to optimize returns by adjusting the portfolio mix, reinvesting matured securities, and mitigating risks. - NAV (Net Asset Value)

The performance of a fixed income mutual fund is reflected in its NAV, which is calculated daily based on the market value of the securities in the portfolio.

Features

Regular Income

Fixed income mutual funds are designed to provide a steady income stream, primarily from interest payments on the debt securities in the portfolio.

Lower Risk

These funds are less volatile compared to equity funds, making them a safer option for conservative investors or those nearing retirement.

Diversification

By investing in a variety of bonds and fixed-income securities, these funds reduce the risk associated with individual securities.

Liquidity[5]

Investors can redeem their units at any time, providing flexibility to access their money as needed.

Variety of Options

Fixed income mutual funds cater to different investment needs, offering options like short-term, long-term, corporate bond, and government securities funds.

Professional Management

Managed by experienced fund managers, these funds ensure optimal selection of securities and risk management.

Tax Efficiency

Certain fixed income funds, such as municipal bond funds, offer tax benefits, making them attractive for investors in higher tax brackets.

Suitability for Goals

These funds align with various financial goals, such as generating income, preserving capital, or balancing a portfolio.

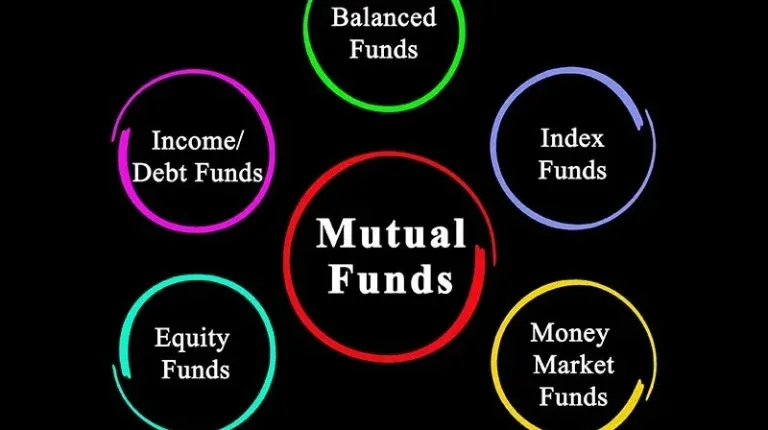

Types of Fixed Income Mutual Funds

Government Bond Funds

These funds primarily invest in bonds issued by government entities, such as treasury bonds, treasury bills, or government agencies.

Key Features:

- High safety due to government backing.

- Lower risk of default compared to corporate bonds.

- Suitable for conservative investors seeking stability.

Ideal For:

Investors looking for a low-risk option with steady returns, especially during economic uncertainties.

Corporate Bond Funds

Corporate bond funds invest in debt securities issued by companies to raise capital for operations or expansion.

Key Features:

- Offer higher returns than government bond funds due to increased risk.

- Risk levels vary based on the credit rating of the issuing company.

- Typically have moderate to high liquidity.

Ideal For:

Investors seeking higher yields while accepting slightly higher risk.

Money Market Funds

Money market funds invest in short-term debt instruments such as treasury bills, certificates of deposit (CDs), and commercial paper.

Key Features:

- Highly liquid and low-risk.

- Focus on capital preservation and short-term returns.

- NAV generally remains stable, offering minimal price volatility.

Ideal For:

Investors looking for a safe place to park funds temporarily or meet short-term financial goals.

Municipal Bond Funds

These funds invest in bonds issued by state or local governments to finance public projects such as schools, roads, or hospitals.

Key Features:

- Interest income is often exempt from federal taxes, and sometimes state and local taxes.

- Lower yields compared to corporate bond funds due to tax benefits.

- Slightly higher risk than government bonds.

Ideal For:

Tax-sensitive investors in higher income brackets seeking tax-efficient income.

Hybrid Funds with Fixed Income Focus

Hybrid funds combine equity and fixed income investments, with a heavier allocation toward fixed income securities.

Key Features:

- Provide a mix of growth potential and stability.

- Reduced risk compared to equity-focused funds.

- Income and capital appreciation opportunities.

Ideal For:

Investors looking for a balanced approach to risk and return with an emphasis on fixed income stability.

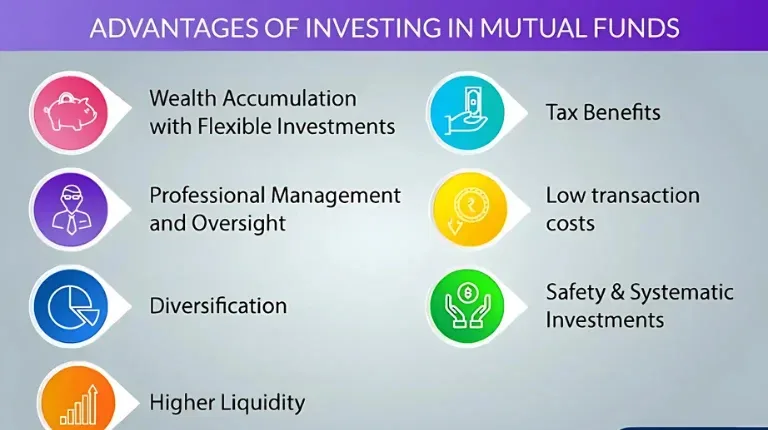

Advantages of Fixed Income Mutual Fund

1. Regular Income Stream

Fixed income mutual funds provide a consistent income through interest payments, making them ideal for retirees or income-seeking investors. This steady cash flow offers financial stability.

2. Lower Risk Compared to Equity Funds

These funds are less volatile, offering a safer alternative to equity investments. They preserve capital while delivering modest returns, making them suitable for conservative investors.

3. Portfolio Diversification Benefits

By balancing riskier equity investments, fixed income mutual funds reduce overall portfolio volatility. Their stability ensures consistent performance, enhancing financial resilience.

4. Liquidity Benefits

Fixed income mutual funds are highly liquid, allowing investors to redeem units quickly. This flexibility is beneficial for meeting short-term financial needs or emergencies.

5. Tax Advantages

Certain fixed income mutual funds, like municipal bond funds, provide tax-exempt interest income. This makes them a tax-efficient choice for high-income investors.

Risks Associated with Fixed Income Mutual Fund

Fixed income mutual funds, while offering stability and regular income, come with inherent risks that investors should be aware of. These risks can impact the overall performance of the fund and should be carefully considered when making investment decisions. Below are some of the primary risks associated with fixed income mutual funds:

1. Interest Rate Risk

Interest rate risk is one of the most significant risks faced by fixed income mutual funds. When interest rates rise, the value of existing bonds or fixed-income securities typically declines. This is because newly issued securities offer higher yields, making older bonds less attractive in the market. For investors in fixed income mutual funds, this can lead to a reduction in the market value of their investments, especially for funds focused on longer-term bonds or those with lower coupon rates. Conversely, when interest rates fall, the value of existing bonds rises, benefiting bondholders.

2. Credit Risk

Credit risk, also known as default risk, pertains to the possibility that the issuer of a fixed-income security may fail to meet its debt obligations. Corporate bonds, in particular, are susceptible to credit risk, as the financial health of the issuing company can impact its ability to repay interest or principal. If a bond issuer’s credit rating is downgraded, the value of the fund may decrease, and investors could experience losses if the issuer defaults on payments. While government-backed securities carry minimal credit risk, funds investing in corporate bonds must assess and manage this risk carefully.

3. Inflation Risk

Inflation risk, also called purchasing power risk, impacts the real returns of fixed income investments. As inflation rises, the purchasing power of fixed interest payments decreases, meaning that the returns generated may not be sufficient to maintain an investor’s standard of living. For fixed income mutual funds, especially those that focus on long-term bonds or low-yield securities, this risk can reduce the real value of returns over time. Inflation risk is a key concern for investors looking for long-term growth, as rising prices erode the real value of returns.

4. Reinvestment Risk

Reinvestment risk occurs when the returns generated by a fixed income mutual fund must be reinvested into securities at lower interest rates than those initially earned. As bonds mature and cash flows from interest payments are received, the fund manager must reinvest this money into new securities. If prevailing interest rates have declined, the reinvestment of proceeds at lower rates can reduce the overall yield of the fund. This can significantly impact funds with shorter-term holdings or those actively managing portfolios in a changing interest rate environment.

How to Choose the Right Fixed Income Mutual Fund

When selecting a fixed income mutual fund, it’s essential to align your investment strategy with your financial goals, risk tolerance, and specific needs. Here are key factors to consider:

Understanding Your Financial Goals

Before investing, it’s crucial to understand your financial objectives. Are you seeking steady income for retirement, capital preservation, or growth over the long term? Depending on your goals, you can choose between conservative funds focused on safety and income or more aggressive funds that aim for higher returns with a higher risk level.

Evaluating Fund Performance

Assessing historical performance is an important step in choosing the right fixed income mutual fund. Look at how the fund has performed in various market conditions—especially during periods of rising or falling interest rates. Additionally, consider whether the fund meets your return expectations without exposing you to excessive risk.

Analyzing Expense Ratios

Expense ratios are the fees charged by the fund for managing investments. Lower expense ratios are ideal, as they reduce the overall cost of investing. However, be cautious, as funds with lower fees may also have lower returns. Strike a balance between cost-effectiveness and performance.

Credit Quality Considerations

Credit quality is a significant factor, especially when investing in corporate bonds or funds with exposure to lower-rated securities. Higher credit quality generally means lower risk, but it may come with lower yields. Evaluate the credit ratings of the bonds held in the fund and choose those with a risk level aligned with your tolerance.

Investment Horizon and Liquidity Needs

Your investment horizon plays a key role in choosing a fixed income mutual fund. If you have a short-term goal, opt for funds with shorter maturities or more liquid securities. For long-term goals, funds with longer duration bonds may offer higher returns. Additionally, consider how easily you can access your investments when needed, ensuring liquidity is not compromised.

Taxation of Fixed Income Mutual Funds

Investing in fixed income mutual funds offers regular income and capital appreciation, but it also comes with tax implications that investors must understand to optimize returns. Below are the key aspects of taxation related to fixed income mutual funds:

1. Taxation on Interest Income

Interest income earned from fixed income mutual funds is subject to taxation. The interest generated from bonds, government securities, or corporate bonds held within these funds is taxed as per the investor’s income tax bracket. Short-term capital gains are taxed as per the individual’s income tax rate, while long-term capital gains are taxed at a reduced rate.

2. Long-term vs Short-term Capital Gains Taxation

The tax treatment of capital gains depends on the duration for which the fixed income mutual fund is held.

- Short-term Capital Gains: Gains from investments held for less than 3 years are considered short-term. These are taxed as per the investor’s income tax slab, making them potentially subject to higher tax rates.

- Long-term Capital Gains: Investments held for more than 3 years are classified as long-term. The capital gains from such investments are taxed at a flat rate of 20% with indexation benefits, which adjusts the cost of acquisition for inflation. This often leads to a lower tax liability compared to short-term gains.

3. Tax-saving Strategies

To minimize the tax burden on fixed income mutual funds, consider the following strategies:

- Holding Period: Opt for a longer holding period to qualify for lower long-term capital gains tax rates.

- Tax-efficient Funds: Choose funds that invest in tax-efficient securities, such as municipal bonds, which offer tax-exempt income at both state and federal levels.

- Dividend Reinvestment: Reinvesting dividends can help in deferring tax on the income until the sale of units, thereby managing the tax impact better.

- Tax-loss Harvesting: Selling underperforming fixed income securities within the fund at a loss to offset gains from other investments can help reduce taxable income.

4. Additional Considerations

- Capital Gains Surcharge: Depending on the total income, an additional surcharge may apply to capital gains beyond a certain threshold.

- TDS on Interest Income: For certain securities, such as bonds, a Tax Deducted at Source (TDS) may apply to interest income above a specified limit, making it essential for investors to track their TDS liabilities.

- Assessment of Fund Types: Funds like government bonds or liquid funds typically have minimal tax impact, while corporate bonds may lead to a higher tax burden due to their higher yield and risk.

Fixed Income Mutual Fund vs Other Investment Options

Fixed Income Mutual Funds vs Equity Mutual Funds

Fixed income mutual funds and equity mutual funds serve different investment purposes.

- Risk vs Return: Equity funds are riskier but offer the potential for higher returns, while fixed income funds provide lower risk but moderate returns.

- Volatility: Equity funds experience higher volatility, whereas fixed income funds provide more stability with steady income.

- Suitability: Fixed income mutual funds are ideal for conservative investors seeking regular income and capital preservation, while equity funds are better suited for growth-oriented investors.

Fixed Income Mutual Funds vs Fixed Deposits

Both fixed income mutual funds and fixed deposits offer capital protection and regular income, but they differ in key areas:

- Liquidity: Fixed income mutual funds offer higher liquidity with the ability to redeem units anytime, whereas fixed deposits have a fixed maturity period.

- Returns: Fixed income mutual funds typically provide higher returns compared to fixed deposits, especially during periods of fluctuating interest rates.

- Tax Efficiency: Mutual funds may offer tax benefits, especially for long-term capital gains, while fixed deposits are taxed at the investor’s applicable slab rate.

Fixed Income Mutual Funds vs Direct Bonds

Investing in direct bonds versus fixed income mutual funds involves different approaches:

- Diversification: Fixed income mutual funds provide instant diversification across multiple bonds, reducing individual security risk, whereas direct bonds require careful selection and monitoring.

- Management: Mutual funds are professionally managed, offering expert oversight and risk management, unlike individual bonds which require investor involvement.

- Liquidity: Bonds are less liquid, whereas mutual funds allow for easy entry and exit based on NAV (Net Asset Value).

Fixed Income Mutual Funds vs ETFs (Exchange-Traded Funds)

Both offer exposure to fixed income securities, but they differ in structure and trading:

- Structure: Mutual funds pool money from investors to buy securities, while ETFs are traded like stocks on exchanges.

- Liquidity: ETFs provide high liquidity during market hours, while mutual funds are processed at the end of the trading day based on NAV.

- Cost: ETFs generally have lower expense ratios compared to mutual funds, offering a cost-efficient investment option.

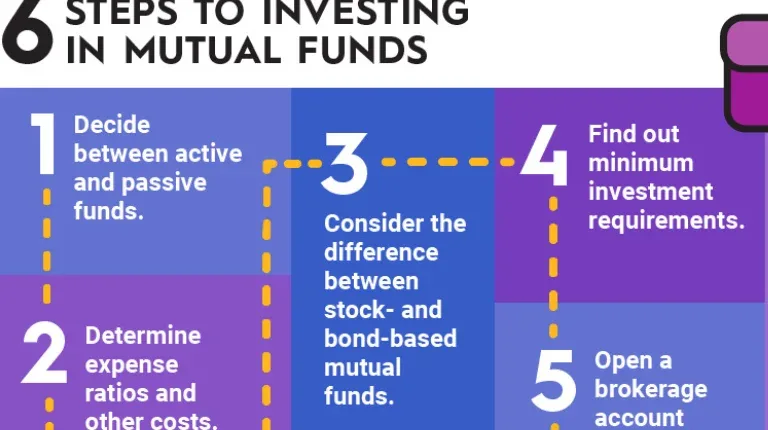

How to Invest in Fixed Income Mutual Funds

Steps to Get Started

Assess Your Financial Goals: Begin by understanding your investment objectives—whether you are seeking steady income, capital preservation, or a balance between risk and return.

Choose the Right Fund: Based on your goals, select a fixed income mutual fund that suits your risk tolerance and time horizon. Options include government bond funds, corporate bond funds, or municipal bond funds.

Open an Investment Account: You can invest in fixed income mutual funds through banks, brokers, or mutual fund apps. Create an account by providing necessary documentation such as ID proof and PAN card.

Fund Your Account: Deposit the required amount into your investment account. You can choose lump sum investments or opt for systematic investment plans (SIPs) for regular contributions.

Monitor and Manage: Track the performance of your chosen fund and make adjustments if needed based on market conditions and your evolving financial goals.

Platforms for Investing

Investors have several options when it comes to platforms for investing in fixed income mutual funds:

- Brokers: Traditional brokerage firms provide access to a wide range of mutual funds, including fixed income options.

- Mutual Fund Apps: Mobile applications like [X] and [Y] provide easy access to a variety of fixed income funds, allowing seamless investing with real-time tracking.

- Direct Fund Houses: Some fund houses offer direct investing options through their websites, eliminating the need for middlemen and reducing costs.

Factors to Consider Before Investing

Before investing in fixed income mutual funds, consider the following factors:

- Risk Tolerance: Assess how much risk you are willing to take—whether it’s low-risk government bonds or higher-risk corporate bonds.

- Investment Horizon: Determine the timeframe for your investment. Longer-term bonds offer higher yields but may carry more interest rate risk.

- Expense Ratios: Look for funds with low expense ratios to maximize returns.

- Credit Quality: Evaluate the credit ratings of the bonds held within the fund to understand the associated default risk.

Best Fixed Income Mutual Funds in 2025

Dodge & Cox International Stock Fund (DODFX)

- Focus: This fund primarily invests in international equities, offering diversification beyond domestic markets.

- Performance: It has a value-oriented approach, focusing on undervalued stocks with strong potential for growth.

- Why Consider: Suitable for investors looking to expand beyond U.S. borders and benefit from global economic growth.

American Century Mid Cap Value Fund (ACMVX)

- Focus: This fund targets mid-sized companies with strong growth potential.

- Strategy: It seeks undervalued stocks, aiming for long-term capital appreciation while managing risks effectively.

- Why Consider: Ideal for investors looking for growth in mid-sized companies with a balanced approach to risk and return.

T. Rowe Price Tax-Free High Yield Fund (PRFHX)

- Focus: Specializes in municipal bonds, offering tax-exempt income.

- Performance: Actively managed to optimize returns while managing credit risks.

- Why Consider: Provides tax-free income, making it attractive for high-net-worth investors or those in higher tax brackets.

Vanguard Short Duration Bond ETF (VSDB)

- Focus: Invests in short-duration U.S. investment-grade bonds.

- Strategy: Aims to provide current income with lower volatility and exposure to structured products and emerging markets.

- Why Consider: Best for conservative investors seeking lower risk with shorter-term bonds and reduced price fluctuations.

PIMCO Income Fund (PONAX)

- Focus: Offers a diversified portfolio of income-producing securities.

- Strategy: Active management approach to provide maximum total return, navigating various market conditions.

- Why Consider: Suitable for investors seeking comprehensive income solutions with a proven fixed-income manager.

Key Considerations Before Investing

- Risk Tolerance:

- Assess how much risk you are willing to take. Funds like PIMCO Income Fund (PONAX) or Dodge & Cox International Stock Fund (DODFX) may offer higher returns but come with increased volatility.

- Investment Horizon:

- Choose funds that align with your financial goals and the time you can commit to investing. Short-duration funds like Vanguard Short Duration Bond ETF (VSDB) are ideal for short-term goals, while PIMCO Income Fund (PONAX) may be better for long-term income.

- Expense Ratios:

- Lower expense ratios are preferable as they reduce the cost of managing your investments. However, it’s important to balance low fees with performance, as higher-cost funds like T. Rowe Price Tax-Free High Yield Fund (PRFHX) might offer additional management expertise.

- Tax Implications:

- Funds such as T. Rowe Price Tax-Free High Yield Fund (PRFHX) offer tax-exempt benefits, which can be beneficial for investors looking to minimize tax liabilities.

- Diversification:

- Diversified portfolios reduce risk, and funds like Dodge & Cox International Stock Fund (DODFX) provide international exposure, enhancing diversification beyond domestic markets.

Who Should Invest in Fixed Income Mutual Funds?

Conservative Investors: Fixed income mutual funds are ideal for investors seeking lower risk and stable returns.

Retirees: Those approaching or in retirement can benefit from regular income and capital preservation offered by fixed income funds.

Risk-averse Individuals: Investors who prefer minimizing volatility and protecting principal are drawn to these funds.

Diversification: Fixed income funds help balance portfolios, especially when paired with equity investments.

Tax Benefits Seekers: Municipal bond funds provide tax-exempt income, making them attractive for those looking to reduce tax liabilities.

Steady Income Seekers: Individuals looking for predictable, regular income can rely on fixed income mutual funds.

Conclusion

In summary, fixed income mutual funds offer a reliable way to diversify investment portfolios while managing risk. From providing steady income to reducing volatility, these funds are well-suited for conservative investors, retirees, and those looking for capital preservation. Additionally, tax-exempt options like municipal bond funds can enhance after-tax returns for high-income individuals.

As we’ve explored, fixed income mutual funds play a vital role in balancing risk and return, making them an essential component of a diversified investment strategy. Whether you’re seeking stability, income, or diversification, these funds offer a range of options to meet various financial goals.

We encourage you to explore fixed income mutual funds as part of your investment journey. Consider researching different funds, understanding their strategies, and assessing how they align with your long-term financial objectives. With careful evaluation, fixed income mutual funds can help create a well-rounded, resilient portfolio.

FAQs

What are fixed income mutual funds?

Fixed income mutual funds invest in fixed-income securities such as bonds, government securities, and other debt instruments to provide regular income and capital preservation.

How do fixed income mutual funds generate returns?

They generate returns through interest payments from bonds and capital appreciation when the bond’s value increases.

What types of securities do fixed income mutual funds invest in?

They invest in government bonds, corporate bonds, municipal bonds, and money market instruments.

Are fixed income mutual funds suitable for all investors?

No, they are best suited for conservative investors, retirees, and those looking for steady income with lower risk.

What is the difference between short-term and long-term fixed income funds?

Short-term funds invest in securities with lower maturity periods and lower risk, while long-term funds invest in higher-duration securities for potentially higher returns but with more risk.

What are the risks associated with fixed income mutual funds?

Risks include interest rate risk, credit risk, inflation risk, and reinvestment risk.

How are fixed income mutual funds taxed?

Interest income is taxed as per the investor’s income tax bracket, and capital gains are taxed as short-term or long-term, depending on the holding period.

What is the difference between government bond funds and corporate bond funds?

Government bond funds invest in sovereign securities with lower risk, while corporate bond funds invest in corporate debt, which may carry higher yields but with higher risk.

Can I withdraw from fixed income mutual funds anytime?

Yes, most fixed income mutual funds offer liquidity, allowing you to redeem units at any time, subject to NAV (Net Asset Value) and exit load (if applicable).

What is the difference between fixed income mutual funds and equity mutual funds?

Fixed income funds focus on income and capital preservation, whereas equity funds focus on growth through investments in stocks, carrying higher risk.

What is the difference between fixed income mutual funds and equity mutual funds?

They offer tax-free income at federal and, in some cases, state levels, which can be beneficial for high-income investors.

How do expense ratios affect fixed income mutual funds?

Lower expense ratios help maximize returns by reducing the costs associated with managing the fund, but higher expense funds may offer more professional management.

What is reinvestment risk in fixed income mutual funds?

Reinvestment risk occurs when the returns from maturing bonds need to be reinvested at lower interest rates, affecting the overall return.

Can fixed income mutual funds provide high returns?

While they generally offer lower returns compared to equities, they provide more stable returns with lower volatility.

How can I choose the right fixed income mutual fund?

Consider factors such as risk tolerance, investment horizon, credit quality, and expense ratios when selecting a fixed income mutual fund.

By paisainvests