Equitas Bank Saving Account Interest Rates

Equitas Bank Savings Account Interest Rates

Here you can get the detailed information related to equitas bank savings account. The key benefits , features and opening process of the bank account.

Table of Contents

Introduction To Equitas Bank Savings Account

Equitas Small Finance Bank is one of India’s leading small finance banks, established with a mission to provide accessible and affordable banking services. It was founded in 2007 and received a small finance bank license from the Reserve Bank of India (RBI) in 2016. The bank caters to a wide range of customers, including individuals, small businesses, and rural communities, offering products like savings accounts, fixed deposits, loans, and more.

Importance of a Savings Account

A savings account is a fundamental banking product designed to help individuals manage their finances effectively while earning interest on their deposits. It serves multiple purposes:

- Financial Security: It ensures a safe place to keep money, protecting it from theft and loss.

- Interest Earnings: Unlike current accounts, savings accounts earn interest, helping your money grow over time.

- Easy Access to Funds: With features like ATM cards, online banking, and UPI, you can access your funds anytime, anywhere.

- Encouragement to Save: The account promotes disciplined savings habits, helping individuals build a financial cushion for emergencies.

Why Choose Equitas Bank for Savings

Equitas Small Finance Bank stands out for its customer-centric approach and innovative banking solutions. Here are some compelling reasons to choose Equitas Bank for a savings account:

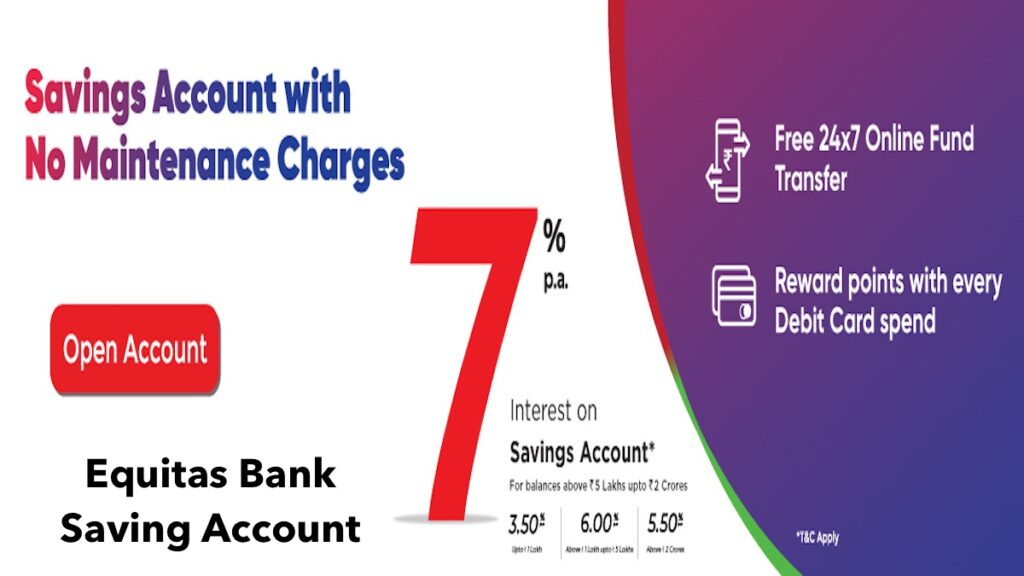

1. Attractive Interest Rates

Equitas Bank offers competitive interest rates on savings accounts, often higher than those provided by traditional banks. This ensures better returns on your savings.

2. Variety of Savings Accounts

The bank provides a range of savings accounts tailored to meet the needs of different customer segments, including:

- Regular Savings Account – Ideal for daily banking needs.

- Digital Savings Account – Fully online account opening with minimal paperwork.

- Selfe Savings Account – A zero-balance account that can be opened instantly through the mobile app.

- Senior Citizen Account – Special benefits and higher interest rates for senior citizens.

3. Zero Balance Requirement

Many of Equitas Bank’s savings accounts come with a zero-balance feature, eliminating the pressure to maintain a minimum balance.

4. Easy and Convenient Banking

With a robust digital banking platform, Equitas Bank offers seamless online banking, mobile banking, and UPI services. Customers can easily manage their accounts, transfer funds, pay bills, and more.

5. Secure and Reliable

Equitas Bank ensures top-notch security with advanced encryption and authentication methods, safeguarding customers’ funds and personal information.

6. Additional Benefits and Offers

Customers can enjoy various value-added services such as:

- Free debit cards with attractive reward programs.

- Unlimited free ATM withdrawals at Equitas Bank ATMs.

- Exclusive offers on shopping, dining, and entertainment through partner merchants.

7. Customer Support and Accessibility

Equitas Bank is known for its exceptional customer service, with dedicated support available through call centers, chat support, and a network of branches across the country.

Types of Savings Accounts Offered by Equitas Bank

Equitas Small Finance Bank provides a variety of savings accounts tailored to meet the diverse needs of its customers. Here’s a detailed look at the different types of savings accounts offered:

1. Regular Savings Account

The Regular Savings Account is designed for everyday banking needs, providing essential features with ease of access and flexibility.

Key Features and Benefits:

- Competitive Interest Rates: Earn attractive interest on your savings.

- Minimum Balance Requirement: Some variants require a nominal balance, while others offer zero-balance options.

- Free Debit Card: Access your funds easily through a complimentary debit card.

- Digital Banking Facilities: Manage your account seamlessly with internet banking, mobile banking, and UPI services.

- Unlimited Transactions: Enjoy a high limit on free transactions across ATMs and digital platforms.

This account is perfect for individuals looking for a straightforward and reliable savings solution.

2. Selfe Savings Account

The Selfe Savings Account is a fully digital, zero-balance savings account that can be opened instantly through the Equitas Bank mobile app or website. It is designed for tech-savvy customers who prefer online banking.

Key Features and Benefits:

- Zero Balance Requirement: No need to maintain a minimum balance.

- Instant Account Opening: Open the account within minutes using Aadhaar and PAN verification.

- Virtual Debit Card: Get a virtual debit card for secure online transactions.

- Attractive Interest Rates: Earn competitive interest on your savings.

- Paperless and Convenient: Completely digital onboarding and account management.

This account is ideal for millennials and digital-first customers seeking a hassle-free banking experience.

3. Senior Citizen Savings Account

Designed specifically for senior citizens, this account provides enhanced benefits and personalized services to cater to the needs of elderly customers.

Key Features and Benefits:

- Higher Interest Rates: Special interest rates for senior citizens to maximize returns.

- Priority Customer Service: Dedicated relationship managers for personalized assistance.

- Free Health Checkups: Access to exclusive health benefits and medical checkups.

- Concession on Locker Charges: Special discounts on locker rentals for safe-keeping of valuables.

- Unlimited Free Transactions: Enjoy unlimited free transactions at Equitas Bank ATMs.

This account is best suited for retirees and elderly individuals looking for safety, convenience, and superior returns on their savings.

4. Kids Savings Account

The Kids Savings Account is designed to help parents inculcate a habit of savings in their children while offering attractive interest rates and features suitable for young account holders.

Key Features and Benefits:

- Parental Control: Linked to the parent’s account for easy monitoring and control.

- Attractive Interest Rates: Competitive interest rates to encourage savings.

- Free Education Insurance Cover: Insurance benefits to secure the child’s education.

- Personalized Debit Card: A specially designed debit card for kids with spending limits.

- Fun Learning and Rewards: Special rewards and educational tools to teach children about money management.

This account is ideal for parents looking to secure their child’s future while teaching them the importance of saving.

5. NRI Savings Account

Equitas Bank also caters to Non-Resident Indians (NRIs) by offering specialized NRI Savings Accounts, including NRE (Non-Resident External) and NRO (Non-Resident Ordinary) accounts.

Key Features and Benefits:

- High-Interest Rates: Competitive interest rates on NRE and NRO accounts.

- Repatriation Benefits: Freely repatriate both principal and interest on NRE accounts.

- Tax Benefits: Interest earned on NRE accounts is tax-free in India.

- Global Access: International debit card for easy access to funds worldwide.

- Easy Account Management: Comprehensive online banking facilities for seamless account management from anywhere.

Key Features of Equitas Bank Savings Accounts

Equitas Bank offers a range of savings accounts with modern features and customer-centric benefits. Here’s a closer look at the key features and advantages that make Equitas Bank savings accounts stand out:

1. Attractive Interest Rates

Equitas Bank provides competitive interest rates on savings accounts, often higher than those offered by traditional banks. This helps customers grow their savings efficiently.

Benefits:

- High Returns on Savings: Earn more on your deposits with attractive interest rates.

- Interest Payouts: Interest is credited quarterly, enhancing compounding benefits.

- Special Rates for Senior Citizens: Senior citizen accounts enjoy even higher interest rates, ensuring better financial security post-retirement.

2. Zero Balance Facility

Equitas Bank offers zero-balance savings accounts, eliminating the need to maintain a minimum balance. This feature provides financial flexibility and ease of account maintenance.

Benefits:

- No Penalty Fees: Avoid charges for non-maintenance of minimum balance.

- Financial Freedom: Spend your savings without worrying about maintaining a balance.

- Ideal for Digital Users: Zero-balance digital accounts like the Selfe Savings Account provide maximum convenience.

3. Digital Banking Services

Equitas Bank is at the forefront of digital banking with a robust online platform and mobile banking app. This ensures a seamless banking experience from the comfort of your home.

Benefits:

- Internet and Mobile Banking: Manage your account, check balances, transfer funds, and more through secure digital platforms.

- UPI Integration: Link your savings account with UPI apps for quick and easy payments.

- 24/7 Access: Bank anytime, anywhere with round-the-clock digital services.

- Instant Account Opening: Open digital savings accounts instantly using Aadhaar and PAN verification.

4. Debit Card and ATM Access

All savings accounts come with a complimentary debit card, offering easy access to funds and secure transactions.

Benefits:

- Free Debit Card: Enjoy cashless transactions and online shopping with a free debit card.

- Wide ATM Network: Access funds from any Equitas Bank ATM or partner network ATMs.

- Reward Programs: Earn rewards and cashback on debit card purchases.

- Global Access: NRI account holders get international debit cards for easy global transactions.

5. Bill Payments and Transfers

Equitas Bank provides convenient payment solutions, making it easy to manage utility bills, EMIs, and money transfers.

Benefits:

- Online Bill Payments: Pay utility bills, credit card dues, and EMIs directly through net banking or the mobile app.

- Instant Fund Transfers: Send money instantly via NEFT, RTGS, IMPS, or UPI.

- Scheduled Payments: Set up standing instructions for recurring payments like loan EMIs or SIPs.

- Secure Transactions: Advanced security measures ensure safe and secure online payments.

Interest Rates and Calculation

Understanding the interest rates and their calculation methods is crucial for maximizing the benefits of your savings account. Below is a detailed overview of Equitas Small Finance Bank’s current interest rates, the methodology for interest calculation, and a comparison with other banks.

Current Interest Rates

As of January 10, 2025, Equitas Small Finance Bank offers the following interest rates on savings account balances:

| Daily Closing Balance | Interest Rate (%) |

|---|---|

| Up to ₹1 lakh | 3.00% |

| Above ₹1 lakh up to ₹10 lakhs | 5.00% |

| Above ₹10 lakhs up to ₹25 lakhs | 7.00% |

| Above ₹25 lakhs up to ₹1 crore | 7.25% |

| Above ₹1 crore up to ₹25 crores | 7.50% |

| Above ₹25 crores | 7.80% |

These rates are structured in tiers, meaning different portions of your balance earn interest at different rates. equitasbank.com

How Interest is Calculated

Interest on Equitas savings accounts is calculated daily based on the closing balance and is credited quarterly. The tiered structure applies rates to specific portions of the balance. Here’s how it works:

- Balance up to ₹1 lakh: Earns 3.00% interest.

- Next ₹9 lakhs (₹1 lakh to ₹10 lakhs): Earns 5.00% interest.

- Next ₹15 lakhs (₹10 lakhs to ₹25 lakhs): Earns 7.00% interest.

- Next ₹75 lakhs (₹25 lakhs to ₹1 crore): Earns 7.25% interest.

- Next ₹24 crores (₹1 crore to ₹25 crores): Earns 7.50% interest.

- Amount above ₹25 crores: Earns 7.80% interest.

Example Calculation:

If your daily closing balance is ₹30 lakhs, the interest calculation would be:

- First ₹1 lakh: 3.00% of ₹1,00,000 = ₹3,000

- Next ₹9 lakhs: 5.00% of ₹9,00,000 = ₹45,000

- Next ₹15 lakhs: 7.00% of ₹15,00,000 = ₹1,05,000

- Remaining ₹5 lakhs: 7.25% of ₹5,00,000 = ₹36,250

Total Annual Interest: ₹3,000 + ₹45,000 + ₹1,05,000 + ₹36,250 = ₹1,89,250

Daily Interest Accrual: ₹1,89,250 / 365 ≈ ₹518.49 per day

This daily interest accrual is credited to your account on a quarterly basis. equitasbank.com

Comparison with Other Banks

Equitas Small Finance Bank offers competitive interest rates compared to other banks in India. Here’s a comparison:

| Bank | Balance Range | Interest Rate (%) |

|---|---|---|

| Equitas SFB | Up to ₹1 lakh | 3.00% |

| ₹1 lakh to ₹10 lakhs | 5.00% | |

| ₹10 lakhs to ₹25 lakhs | 7.00% | |

| ₹25 lakhs to ₹1 crore | 7.25% | |

| ₹1 crore to ₹25 crores | 7.50% | |

| Above ₹25 crores | 7.80% | |

| State Bank of India | Up to ₹10 crores | 2.70% |

| Above ₹10 crores | 3.00% | |

| HDFC Bank | Below ₹50 lakhs | 3.00% |

| ₹50 lakhs and above | 3.50% | |

| ICICI Bank | Below ₹50 lakhs | 3.00% |

| ₹50 lakhs and above | 3.50% | |

| Axis Bank | Below ₹50 lakhs | 3.00% |

| ₹50 lakhs and above | 3.50% |

Note: Interest rates are subject to change. It’s advisable to check the latest rates directly with the banks. m.economictimes.com

In summary, Equitas Small Finance Bank offers attractive interest rates, especially for higher balance tiers, making it a competitive option for maximizing returns on your savings.

Eligibility Criteria and Documents Required

Equitas Small Finance Bank offers a variety of savings accounts designed to cater to different customer needs. To open a savings account, certain eligibility criteria must be met, and specific documents are required for verification. Here’s a detailed look at who can open an account, the documents needed, and the minimum balance requirements.

1. Who Can Open an Account?

Equitas Bank savings accounts are accessible to a wide range of customers. Here are the eligibility criteria for different types of accounts:

- Individuals: Any Indian resident above the age of 18 can open a savings account.

- Minors: Accounts can be opened for minors, operated jointly with a parent or legal guardian.

- Senior Citizens: Special savings accounts are available for individuals aged 60 and above.

- NRIs: Non-Resident Indians (NRIs) are eligible to open NRE/NRO savings accounts.

- Joint Accounts: Accounts can be opened jointly with up to three account holders.

- Trusts, Societies, and Associations: Select savings account options are available for non-individual entities.

2. Required Documents

To open a savings account with Equitas Bank, the following documents are required for KYC (Know Your Customer) verification:

A. Proof of Identity (Any one of the following):

- Aadhaar Card

- Passport

- Voter ID Card

- Driving License

- PAN Card

B. Proof of Address (Any one of the following):

- Aadhaar Card (if not used as Identity Proof)

- Passport

- Utility Bill (Electricity, Water, Gas) – Not older than 3 months

- Rent Agreement with the latest utility bill

- Bank Account Statement from another bank (Not older than 3 months)

C. For Minors:

- Birth Certificate of the minor

- Aadhaar Card of the minor (if available)

- ID proof of the parent or guardian operating the account

D. For NRIs:

- Valid Passport and Visa/PIO/OCI Card

- Overseas Address Proof (Utility Bill, Bank Statement, or Driving License)

- Indian Address Proof (if available)

- Recent Passport Size Photographs

E. Additional Documents for Specific Accounts:

- Senior Citizen Account: Proof of age (e.g., Aadhaar Card, Passport).

- Joint Account: KYC documents for all account holders.

3. Minimum Balance Requirements

Equitas Bank offers various savings accounts with flexible balance requirements, including zero-balance options. Here are the minimum balance requirements for different types of accounts:

- Regular Savings Account: ₹10,000 in urban areas and ₹5,000 in rural areas.

- Selfe Savings Account: Zero balance requirement.

- Senior Citizen Account: ₹10,000 or as specified by the bank.

- Kids Savings Account: Zero balance requirement, but linked to a parent’s account.

- NRI Savings Account: ₹10,000 for NRE and NRO accounts.

Note: Failure to maintain the required minimum balance may attract non-maintenance charges, except for zero-balance accounts.

How to Open an Equitas Bank Savings Account

Equitas Small Finance Bank offers a convenient and user-friendly account opening process with both online and offline options. Here’s a detailed step-by-step guide on how to open a savings account with Equitas Bank.

1. Online Account Opening Process

Equitas Bank provides a fully digital account opening experience, especially through its Selfe Savings Account. You can open an account instantly using your smartphone or computer. Here’s how:

Step 1: Visit the Official Website or Mobile App

- Go to the Equitas Bank Website or download the Equitas Mobile Banking App from the Google Play Store or Apple App Store.

- Click on ‘Open Account’ or navigate to the ‘Selfe Savings Account’ section.

Step 2: Choose Your Account Type

- Select the type of savings account you want to open, such as the Selfe Savings Account or any other digital savings option.

Step 3: Enter Basic Details

- Provide your full name, mobile number, email address, and PAN card details.

- Verify your mobile number through an OTP sent to your registered number.

Step 4: Complete KYC Verification

- Use your Aadhaar number for e-KYC verification.

- Authenticate using the OTP sent to your Aadhaar-linked mobile number.

- Alternatively, you can upload scanned copies of your KYC documents, such as PAN and Aadhaar.

Step 5: Set Up Account Details

- Choose your preferred account variant (e.g., zero balance or regular savings).

- Select your debit card type and delivery options.

Step 6: Review and Submit

- Review the application form for accuracy.

- Accept the terms and conditions.

- Submit the application.

Step 7: Account Activation

- Once the application is processed, you will receive your account number and other details via SMS and email.

- You can start using your account immediately with internet banking and a virtual debit card.

Benefits of Online Account Opening:

- Instant account activation.

- Zero paperwork – fully digital onboarding.

- No need to visit the branch.

- Virtual debit card for online transactions.

2. Offline Account Opening at Branch

For those who prefer the traditional method, Equitas Bank also allows account opening at its branches. Here’s how to do it:

Step 1: Visit the Nearest Equitas Bank Branch

- Locate the nearest branch using the Branch Locator on the Equitas website.

- Visit the branch with the required documents.

Step 2: Collect and Fill the Account Opening Form

- Request the savings account opening form from the bank executive.

- Fill in your personal details, contact information, and nominee details.

Step 3: Submit KYC Documents

- Submit photocopies of your KYC documents along with the original for verification:

- Proof of Identity (Aadhaar Card, Passport, Voter ID, etc.)

- Proof of Address (Utility Bill, Rent Agreement, Passport, etc.)

- Recent Passport Size Photographs

- For joint accounts, KYC documents of all applicants are required.

Step 4: Initial Deposit

- Make the initial deposit as per the minimum balance requirement for the chosen account type.

- The deposit can be made in cash or through cheque.

Step 5: Account Verification and Activation

- The bank will verify your documents and process the application.

- Once approved, you will receive your account number, passbook, and debit card.

- The account is usually activated within 1-2 working days.

Benefits of Offline Account Opening:

- Personalized assistance from bank staff.

- Suitable for customers who are not comfortable with digital processes.

- Detailed guidance on account features and benefits.

3. Step-by-Step Guide to Open an Account

Whether you choose the online or offline method, here’s a quick overview of the process:

- Choose Account Type: Decide on the type of savings account that suits your needs.

- Prepare Documents: Gather the necessary KYC documents for identity and address proof.

- Fill Application Form: Either online on the website/app or manually at the branch.

- KYC Verification: Complete the KYC process either electronically (online) or physically (offline).

- Initial Deposit: Make the required initial deposit, if applicable.

- Account Activation: Receive account details and start banking immediately.

Selfe Savings Account – Digital Banking Revolution

Equitas Small Finance Bank’s Selfe Savings Account is a revolutionary digital banking product designed for the tech-savvy generation. It offers the convenience of instant account opening, attractive interest rates, and comprehensive digital banking features. Here’s everything you need to know about the Selfe Savings Account.

1. What is Selfe Savings Account?

The Selfe Savings Account is a fully digital, zero-balance savings account offered by Equitas Small Finance Bank. It allows users to open an account instantly through the bank’s website or mobile app without visiting a branch. The account is designed to provide a seamless banking experience with a host of digital services.

Key Features:

- Instant Account Opening: Open the account within minutes using Aadhaar-based e-KYC verification.

- Zero Balance Requirement: No minimum balance is required, providing financial flexibility.

- High-Interest Rates: Enjoy attractive interest rates on your savings, ensuring better returns.

- Virtual Debit Card: Get a virtual debit card instantly for online transactions and shopping.

- Digital Banking Services: Access to internet banking, mobile banking, and UPI integration for seamless transactions.

- Secure Transactions: Enhanced security features for safe and secure digital banking.

Who Can Open a Selfe Account?

- Any Indian resident above the age of 18.

- Must have a PAN card and Aadhaar linked with a mobile number for OTP verification.

- Available for both salaried and self-employed individuals.

2. How to Open Selfe Account Instantly

Opening a Selfe Savings Account is quick, easy, and entirely digital. Follow these steps to get started:

Step 1: Visit the Official Website or Download the Mobile App

- Go to the Equitas Bank Website or download the Equitas Mobile Banking App from the Google Play Store or Apple App Store.

- Select ‘Open Selfe Account’ on the homepage or in the app menu.

Step 2: Provide Basic Details

- Enter your full name, mobile number, email address, and PAN card details.

- Verify your mobile number using the OTP sent to your registered number.

Step 3: Complete e-KYC Verification

- Enter your Aadhaar number and verify through the OTP sent to your Aadhaar-linked mobile number.

- Alternatively, you can upload scanned copies of your PAN and Aadhaar for verification.

Step 4: Customize Your Account

- Choose your preferred account features, such as a virtual debit card or physical debit card delivery.

- Select optional add-ons like insurance coverage or investment options.

Step 5: Set Up Internet Banking and Mobile Banking

- Create your internet banking credentials (username and password).

- Set up UPI and mobile banking access for quick and easy transactions.

Step 6: Review and Submit

- Review the details entered for accuracy.

- Accept the terms and conditions.

- Submit the application for processing.

Step 7: Instant Account Activation

- Upon successful verification, your Selfe Savings Account is activated instantly.

- You will receive your account number, IFSC code, and other details via SMS and email.

- The virtual debit card is instantly available for online transactions.

Benefits of Instant Account Opening:

- No paperwork or branch visit required.

- Account activation within minutes.

- Instant access to internet banking and mobile banking.

3. Benefits of Selfe Account

The Selfe Savings Account offers several unique benefits that make it an ideal choice for digital banking users:

1. Zero Balance Requirement

- No minimum balance required, providing complete financial flexibility.

- Ideal for students, freelancers, and digital natives who prefer cashless transactions.

2. Attractive Interest Rates

- Competitive interest rates, typically higher than traditional savings accounts.

- Interest is calculated daily and credited quarterly, enhancing compounding benefits.

3. Virtual Debit Card and ATM Access

- Instant virtual debit card for online shopping and payments.

- Option to request a physical debit card for ATM withdrawals and in-store purchases.

- Secure transactions with OTP authentication and 24/7 fraud monitoring.

4. Comprehensive Digital Banking Services

- Access to internet banking, mobile banking, and UPI integration.

- Easy fund transfers via NEFT, RTGS, IMPS, and UPI.

- Online bill payments, recharges, and investment options.

5. 24/7 Customer Support

- Dedicated customer support through phone, email, and live chat.

- Online grievance redressal system for quick resolution of issues.

6. Secure Banking Experience

- Aadhaar-based e-KYC ensures secure and verified account opening.

- Multi-factor authentication and encryption for secure digital transactions.

Mobile and Internet Banking

Equitas Small Finance Bank provides comprehensive digital banking solutions with its mobile and internet banking platforms. These services offer convenience, security, and flexibility, enabling customers to manage their finances anytime, anywhere. Here’s an in-depth look at the features, registration process, and security measures.

1. Features of Equitas Mobile Banking

Equitas Mobile Banking App is designed to provide a seamless and user-friendly experience. It offers a range of features to help customers efficiently manage their banking needs on the go.

Key Features:

- Account Management: View account balance, transaction history, and account statements.

- Funds Transfer: Transfer money instantly using NEFT, RTGS, IMPS, and UPI.

- Bill Payments and Recharges: Pay utility bills, recharge mobile/DTH, and make credit card payments.

- Virtual Debit Card: Access a virtual debit card for secure online shopping.

- Cheque Services: Request cheque books, stop cheque payments, and track cheque status.

- Investment and Insurance: Invest in fixed deposits, recurring deposits, and insurance products.

- Loan Management: Check loan details, EMIs, and make loan payments.

- QR Code Payments: Scan and pay using UPI-enabled QR codes for quick transactions.

- Customer Support: 24/7 access to customer service through chat and call options.

Additional Benefits:

- User-friendly interface with easy navigation.

- Multi-layered security features including PIN, biometric authentication, and OTP verification.

- Real-time alerts for transactions and account activities.

How to Download the App:

- Available on Google Play Store for Android and Apple App Store for iOS devices.

- Search for “Equitas Mobile Banking” and download the official app.

2. How to Register for Internet Banking

Equitas Bank’s Internet Banking platform allows customers to access their accounts and perform various banking activities securely from their computer or smartphone. Here’s how to register:

Step 1: Visit the Official Website

- Go to the Equitas Bank Website.

- Click on ‘Internet Banking’ in the top navigation menu.

- Select ‘Register’ under the Personal Banking section.

Step 2: Enter Account Details

- Provide your account number, registered mobile number, and date of birth.

- Verify your identity using the OTP sent to your registered mobile number.

Step 3: Create Login Credentials

- Create a unique User ID and set a secure password.

- Ensure the password is strong with a combination of uppercase, lowercase, numbers, and special characters.

Step 4: Set Security Questions

- Choose security questions and provide answers for added security.

- These questions will be used for identity verification during password recovery.

Step 5: Review and Submit

- Review the registration details and accept the terms and conditions.

- Submit the application for processing.

Step 6: First-Time Login

- After successful registration, log in using your User ID and password.

- Change the password on the first login for enhanced security.

Step 7: Activate Transactions

- To activate fund transfers and other transactions, set up a transaction PIN.

- The transaction PIN is required for authorizing payments and transfers.

Features of Internet Banking:

- Account Overview: Check account balance, download statements, and view transaction history.

- Funds Transfer: Transfer money through NEFT, RTGS, IMPS, and UPI.

- Bill Payments: Pay utility bills, taxes, and other payments seamlessly.

- Fixed and Recurring Deposits: Open, manage, and close FD and RD accounts online.

- Investment Services: Invest in mutual funds, insurance, and other financial products.

- Credit Card Management: Pay credit card bills and view credit card statements.

- Service Requests: Request cheque books, stop payments, and update personal details.

3. Security Measures and Tips

Equitas Bank ensures the highest level of security for its mobile and internet banking platforms. Here are some of the key security measures and safety tips:

A. Security Measures Implemented by Equitas Bank:

- Multi-Factor Authentication: Dual-layer security with User ID, password, OTP, and transaction PIN.

- Biometric Authentication: Fingerprint and face recognition for mobile app access.

- End-to-End Encryption: All data is encrypted to protect against unauthorized access.

- Time-Out Feature: Automatic logout after a period of inactivity to prevent unauthorized access.

- Fraud Monitoring: Real-time fraud detection and monitoring systems for suspicious transactions.

- Secure Access Codes: OTPs and PINs for secure transactions and account modifications.

B. Safety Tips for Users:

- Keep Login Credentials Secure: Never share your User ID, password, or PIN with anyone.

- Use Strong Passwords: Use a complex password with a mix of characters, numbers, and symbols.

- Enable Two-Factor Authentication: Always enable 2FA for added security.

- Regular Password Changes: Change your password periodically for enhanced security.

- Avoid Public Wi-Fi: Avoid using public or unsecured Wi-Fi networks for online banking.

- Logout After Each Session: Always log out after completing your banking transactions.

- Beware of Phishing Scams: Do not click on suspicious links or share sensitive information over email or phone.

- Install Security Software: Use antivirus and anti-malware software on your devices.

- Monitor Account Activity: Regularly check your account statements and transaction alerts.

- Report Lost Devices: If your mobile device is lost or stolen, report it to the bank immediately.

C. Customer Support for Security Issues:

- In case of suspicious activity, contact Equitas Bank’s 24/7 customer support.

- Block your debit card or freeze your account through the mobile app or by calling customer care.

Fees and Charges Of Equitas Bank Savings Account

Equitas Small Finance Bank offers a wide range of savings account products with competitive benefits. However, like most banks, there are some fees and charges associated with certain banking services. Here’s a breakdown of the common fees and charges applicable to different types of accounts, including account maintenance, ATM withdrawals, and other services.

1. Account Maintenance Charges

Equitas Bank typically offers savings accounts with zero balance requirements or minimum balance maintenance, depending on the type of account. However, failure to maintain the required balance may result in penalty charges.

- Regular Savings Account:

- Minimum balance requirement varies by location (₹5,000 in rural areas, ₹10,000 in urban areas).

- Non-Maintenance Fee: ₹150–₹300 per month if the minimum balance requirement is not met.

- Selfe Savings Account:

- Zero Balance Account: No minimum balance requirement.

- Account Maintenance Fee: There are no maintenance charges for Selfe accounts.

- Senior Citizens Savings Account:

- Minimum balance requirements are typically ₹10,000.

- Non-Maintenance Fee: ₹150–₹300 per month if the minimum balance is not maintained.

- Kids Savings Account:

- Zero balance requirement for minors.

- Non-Maintenance Fee: None applicable if balance is maintained.

- NRI Savings Account:

- Minimum balance requirement of ₹10,000 for NRE and NRO accounts.

- Non-Maintenance Fee: ₹300 per month if the minimum balance is not maintained.

2. ATM Withdrawal Fees

Equitas Bank provides free ATM withdrawals at its own network of ATMs and at other partner ATMs. However, there are charges for using ATMs outside the bank’s network, both for domestic and international withdrawals.

- Equitas Bank ATMs:

- Free Withdrawals: Unlimited free withdrawals per month at Equitas ATMs.

- Other Bank ATMs (Within India):

- Free Withdrawals: Up to 5 free transactions per month.

- Charges for Additional Withdrawals: ₹20–₹25 per transaction after the free limit.

- International ATMs:

- Charges per Withdrawal: ₹150–₹200 per transaction.

- Currency Conversion Fee: 2%–3% of the transaction amount (applies for foreign currency withdrawals).

- ATM Balance Inquiry Fees (Non-Equitas ATMs):

- ₹10–₹15 per transaction.

3. Other Service Charges

There are several other services provided by Equitas Bank for which charges may apply, depending on the nature of the transaction or service requested.

- Cheque Book Charges:

- First 20 leaves per year: Free

- Subsequent Leaves: ₹100–₹150 per booklet of 25 leaves.

- Stop Payment of Cheques:

- Charges per Request: ₹150–₹200 per cheque or range of cheques.

- Account Statement Charges (Printed):

- First 1 per month: Free

- Subsequent Statements: ₹50 per statement.

- Cheque Bounce Charges:

- Inward (Unpaid Cheques): ₹350–₹400 per cheque for insufficient funds or other reasons.

- Outward (Return Cheques): ₹250–₹300 per cheque.

- Demand Draft (DD):

- Charges for Demand Drafts: ₹50–₹100 for amounts up to ₹10,000, and higher for larger amounts.

- Card Replacement (Debit Card):

- Charges: ₹100–₹150 for replacement of a lost or damaged card.

- Mobile and Internet Banking Charges:

- No Charges for Registration: Free for both mobile banking and internet banking.

- Service Charges: Usually free unless the transaction involves charges, such as fund transfers to other banks.

- RTGS/NEFT/IMPS Transfer Charges:

- NEFT Charges: Free for amounts above ₹2 lakh; ₹5–₹20 for smaller amounts.

- RTGS Charges: ₹25–₹50 depending on the amount.

- IMPS Charges: ₹5–₹15 per transaction depending on the amount.

- Foreign Currency Conversion Charges:

- Conversion Fee: 2%–3% of the transaction amount for foreign transactions (applies for debit card or ATM withdrawals in foreign currencies).

- International Remittance Charges (NRI Accounts):

- Charges for receiving money from abroad vary and depend on the remittance channel, currency, and amount.

4. Fee Waivers

Equitas Bank often offers fee waivers under certain conditions, such as:

- For Senior Citizens: Reduced or waived service charges for accounts with low balances or specific services like cheque book requests.

- For Students/Minors: No fees for account maintenance or other basic services.

- For NRI Accounts: Reduced charges for fund transfers or remittances when certain conditions are met.

Customer Support and Assistance

Equitas Small Finance Bank provides excellent customer support to help resolve any issues or queries customers may have regarding their accounts or banking services. Whether you need assistance with a transaction, have a service request, or want to clarify any fees or charges, Equitas Bank ensures you have access to a variety of support channels.

1. How to Contact Customer Support

Equitas Bank offers multiple ways for customers to get in touch with their support team. Below are the primary contact options:

- Phone Support:

- Customer Care Number: Call the bank’s helpline for immediate assistance on any banking queries or service requests.

- Toll-Free Number: 1800-103-1222 (Available 24/7)

- Non-Toll-Free Number: 044- 4287 1000 (For customers outside India or specific requests)

- Email Support:

- For general queries or feedback: customersupport@equitasbank.com

- For specific issues like account-related concerns or technical support: grievance@equitasbank.com

- Branch Visit:

- If you need in-person assistance, visit any nearby Equitas Bank branch. You can get details on branch locations via the branch locator or the bank’s website.

2. Online Support Options

Equitas Bank provides several online options to help customers resolve their queries or get support quickly:

- Equitas Bank Website:

Visit the Equitas Bank Official Website for answers to frequently asked questions (FAQs), account services, and other banking information. The site also provides links to service requests, form downloads, and grievance redressal. - Live Chat:

Equitas Bank offers live chat support on their website. You can connect with a customer service representative to get real-time assistance with your banking issues or queries. Simply click on the chat icon on the website to start a conversation. - Mobile Banking App:

The Equitas Bank Mobile Banking App allows you to access support directly from within the app. You can raise service requests, report issues, and get assistance with account-related concerns through the in-app help section. - Social Media Support:

- Equitas Bank is active on social media platforms like Twitter and Facebook. You can reach out to the bank’s official accounts for assistance or updates:

- Twitter: @EquitasBank

- Facebook: Equitas Bank

- Equitas Bank is active on social media platforms like Twitter and Facebook. You can reach out to the bank’s official accounts for assistance or updates:

- Email Ticketing System:

You can raise an email ticket for specific issues via the customer support section of the website. After submitting your request, the system generates a ticket and sends you updates until the issue is resolved.

3. Branch Locator and Helpline Numbers

If you prefer to visit a branch for assistance or need to find the nearest Equitas Bank branch, use the following options:

- Branch Locator:

Visit the Equitas Bank Branch Locator page to find the nearest branch based on your city or area. The locator provides branch addresses, contact numbers, working hours, and services available at each location. - Helpline Numbers for Branches and Regional Offices:

- Main Helpline (For General Inquiries): 1800-103-1222

- Regional Offices/Local Helplines: Depending on your region, specific helplines are available for local branches. You can find these numbers on the branch locator page or by calling the general customer care number.

4. Grievance Redressal Process

If you’re unable to resolve your issue through the standard customer support channels, Equitas Bank offers a formal grievance redressal process:

- Step 1: Contact Customer Support

Start by reaching out to Equitas Bank’s customer support team via phone or email. Most issues can be resolved through these channels. - Step 2: Escalate to the Branch Manager

If the issue is not resolved within a reasonable time, escalate it to the branch manager or a senior official. You can request their contact details via phone or email. - Step 3: Submit a Formal Complaint

If you are not satisfied with the resolution, you can submit a formal complaint to the bank’s Grievance Redressal Officer at grievance@equitasbank.com. Ensure you include all relevant details such as account information, a description of the issue, and previous communication. - Step 4: External Ombudsman (If Necessary)

If you’re still unsatisfied with the resolution, you may escalate your complaint to the Banking Ombudsman. You can file a complaint with the Ombudsman through the Reserve Bank of India (RBI). More information is available on the RBI website.

Advantages Of Equitas Bank Savings Account

A. Attractive Interest Rates:

- Equitas Bank offers competitive interest rates, which is one of the key benefits for customers looking to grow their savings. Interest is calculated daily and credited monthly, helping customers earn interest on their deposits consistently.

B. Zero Balance Facility:

- Several savings accounts, such as the Selfe Savings Account, come with zero balance requirements, making them ideal for individuals who prefer flexibility and don’t want to worry about maintaining a minimum balance.

C. Digital Banking Solutions:

- Equitas Bank provides a robust mobile banking app and internet banking facilities, making it easier for customers to perform various transactions such as fund transfers, bill payments, and account management from anywhere at any time.

D. Wide Range of Account Options:

- The bank offers several types of savings accounts tailored to specific customer segments, including regular savings accounts, senior citizen accounts, NRI accounts, kids accounts, and the Selfe digital savings account. This provides a solution for people with diverse needs.

E. Easy Access to ATMs and Branches:

- Equitas Bank provides easy access to ATMs across India, including unlimited withdrawals at its own network of ATMs. Customers can also visit any of the bank’s branches for in-person assistance.

F. Senior Citizen Benefits:

- Senior citizens can avail of higher interest rates on deposits and may have reduced or waived charges on services like cheque books or account maintenance.

G. Customer Support:

- Equitas Bank offers 24/7 customer support via phone, email, and live chat. There’s also a branch locator for convenient in-person assistance.

H. Investment and Insurance Products:

- The bank offers access to investment products like fixed deposits, recurring deposits, and insurance plans, allowing customers to diversify their financial portfolio within the same banking relationship.

I. Security Features:

- The bank ensures robust security for digital transactions, including multi-factor authentication, encryption, and real-time fraud monitoring, keeping customer accounts and transactions safe.

Disadvantages Of Equitas Bank Saving Account Interest Rates

A. Non-Maintenance Charges for Some Accounts:

- For certain types of savings accounts, there are penalties for not maintaining the minimum balance. For example, if the balance falls below the required amount in regular savings accounts, customers may incur monthly charges. This may be an inconvenience for customers with fluctuating balances.

B. ATM Withdrawal Charges for Non-Network ATMs:

- While Equitas offers unlimited free withdrawals at its own ATMs, using ATMs outside its network can incur charges after a certain limit. This may not be ideal for customers who frequently use third-party ATMs.

C. Limited Branch Network in Some Areas:

- Equitas Bank has a limited presence in certain rural or remote areas, which might be inconvenient for customers who prefer in-person banking. While digital banking helps bridge this gap, there might still be instances where physical access to the bank is necessary.

D. Charges on Some Services:

- Certain services, such as cheque book issuance, cheque returns (bounced cheques), and stop-payment requests, may involve additional charges. While these fees are standard across banks, they could add up over time if used frequently.

E. Foreign Transaction Fees:

- If you use your Equitas debit card for international transactions, you may face foreign currency conversion charges, which can be higher than domestic transaction fees. This can be a drawback for customers who frequently travel abroad or shop online in foreign currencies.

F. Limited Global ATM Access:

- Although the bank offers international ATM withdrawals, the availability of ATMs within the global network may be limited, resulting in higher charges for accessing cash abroad.

G. Limited Options for Overdraft Facilities:

- While Equitas offers a variety of services, overdraft facilities may not be as comprehensive or flexible compared to those offered by larger, more established banks. This could be a limitation for customers seeking more flexibility in credit services.

Comparison with Other Banks

When choosing a savings account, it’s essential to compare the offerings of different banks. Here’s a comparison of Equitas Bank savings accounts with savings accounts from three major banks: HDFC, ICICI, and State Bank of India (SBI). This will help you evaluate which bank provides the best features based on your preferences.

1. Equitas vs. HDFC Savings Account

Interest Rates:

- Equitas Bank: Offers interest rates of around 3.50%–7% depending on the type of savings account and balance maintained. The interest is calculated daily and credited monthly.

- HDFC Bank: Offers interest rates of 3%–3.50% on savings accounts. The interest is also calculated daily and credited quarterly.

Minimum Balance Requirements:

- Equitas Bank: Most accounts have zero balance options, especially with the Selfe Savings Account. Regular accounts may require ₹5,000–₹10,000 as a minimum balance.

- HDFC Bank: HDFC requires a minimum balance of ₹10,000–₹25,000 depending on the type of savings account and location (metro or rural).

Account Types:

- Equitas Bank: Offers a wide range of savings accounts, including Selfe Savings Account (digital), Senior Citizens, Kids, and NRI accounts.

- HDFC Bank: Provides multiple savings accounts such as regular, senior citizen, women’s, children’s, and salary accounts. It also offers special accounts for high-net-worth individuals (HNI) under the Privilege Banking scheme.

ATM Access:

- Equitas Bank: Unlimited free withdrawals at its ATMs; charges apply for other bank ATMs after a certain number of withdrawals.

- HDFC Bank: Provides free withdrawals at HDFC ATMs and a limited number of free withdrawals at other bank ATMs each month (usually up to 5 transactions).

Digital Banking:

- Equitas Bank: Strong mobile banking and internet banking features, including easy fund transfers, bill payments, and instant digital account opening (Selfe).

- HDFC Bank: Excellent mobile and internet banking facilities, including HDFC PayZapp and the HDFC mobile app, which offer a wide variety of banking services.

Customer Support:

- Equitas Bank: 24/7 customer support via phone, email, and live chat.

- HDFC Bank: 24/7 customer support, but may have longer wait times during peak hours. HDFC has an extensive branch network for in-person assistance.

2. Equitas vs. ICICI Savings Account

Interest Rates:

- Equitas Bank: Offers competitive interest rates ranging from 3.50% to 7% based on account type and balance.

- ICICI Bank: Interest rates are between 3% and 3.50%, similar to HDFC Bank, with higher rates for larger balances or specialized accounts.

Minimum Balance Requirements:

- Equitas Bank: Zero balance accounts like the Selfe Savings Account, with a minimum balance of ₹5,000–₹10,000 for regular accounts.

- ICICI Bank: Requires a minimum balance of ₹10,000–₹25,000 depending on the type of savings account and location.

Account Types:

- Equitas Bank: Includes Selfe Savings Account (digital), senior citizen, NRI, and kids savings accounts.

- ICICI Bank: Offers a wide range of savings accounts such as the regular savings account, women’s account, senior citizen account, kids’ account, and a premium account with higher privileges.

ATM Access:

- Equitas Bank: Provides unlimited withdrawals at Equitas ATMs with charges for withdrawals beyond the free limit at other bank ATMs.

- ICICI Bank: Free withdrawals at ICICI ATMs and a limited number of free withdrawals at other banks’ ATMs (usually up to 5 per month).

Digital Banking:

- Equitas Bank: Offers a user-friendly mobile app and internet banking, with easy-to-use features like instant money transfers and online bill payments.

- ICICI Bank: Strong digital offerings with advanced mobile banking services, including iMobile, internet banking, and a virtual assistant for customer service.

Customer Support:

- Equitas Bank: 24/7 support through phone, email, and live chat, plus branch locator services.

- ICICI Bank: Extensive customer support, but some users report longer wait times on calls. Offers assistance through a chatbot and an extensive network of branches.

3. Equitas vs. SBI Savings Account

Interest Rates:

- Equitas Bank: Offers interest rates ranging from 3.50% to 7% based on the account type and balance.

- SBI (State Bank of India): Interest rates are typically around 3%–3.25% for savings accounts, making it slightly lower than Equitas Bank’s rates.

Minimum Balance Requirements:

- Equitas Bank: Most accounts, especially the Selfe Savings Account, offer zero balance options, while others require ₹5,000–₹10,000.

- SBI: Requires a minimum balance of ₹1,000–₹3,000 depending on the account type and location (urban/rural).

Account Types:

- Equitas Bank: Offers a wide range of savings account options, including Selfe digital accounts, senior citizens, kids accounts, and NRI accounts.

- SBI: Provides a wide selection of accounts, including regular savings accounts, premium accounts, women’s savings accounts, senior citizens, and more.

ATM Access:

- Equitas Bank: Free withdrawals at Equitas ATMs, but charges apply for third-party ATM usage after a certain number of transactions.

- SBI: Free withdrawals at SBI ATMs and a limited number of free withdrawals at other bank ATMs (usually up to 3 per month).

Digital Banking:

- Equitas Bank: Offers strong mobile and internet banking facilities, with digital-only account opening through the Selfe Savings Account.

- SBI: Provides good digital banking services with the SBI YONO app, internet banking, and other online features. However, it may not be as seamless as Equitas’ purely digital offerings.

Customer Support:

- Equitas Bank: 24/7 customer support via phone, email, and live chat.

- SBI: SBI also offers 24/7 customer support, but due to its larger customer base, the response times may vary, and customers often report longer wait times.

Conclusion

Equitas Bank stands out for its competitive interest rates, ranging from 3.50% to 7%, which is significantly higher than many other banks, making it a strong contender for those looking to grow their savings. The bank offers a wide range of savings accounts, including regular accounts, Selfe digital accounts, senior citizen accounts, kids accounts, and NRI accounts, catering to various customer needs. Several savings account options, particularly the Selfe Savings Account, do not require a minimum balance, making it easier for customers to maintain their accounts without worrying about fees.

Equitas Bank also excels in its digital banking services, with robust mobile banking and internet banking offerings that allow customers to manage their accounts, transfer funds, and pay bills seamlessly. While Equitas offers unlimited withdrawals at its own ATMs, customers may incur charges for using ATMs outside the network after a limited number of transactions. The bank provides 24/7 customer support via multiple channels, ensuring help is available whenever needed.

In comparison with larger banks like HDFC, ICICI, and SBI, Equitas offers more competitive interest rates, but larger banks may provide broader service networks and more extensive customer service options. For tech-savvy individuals, those seeking higher returns, senior citizens, and families with children, Equitas provides tailored accounts that offer better returns and benefits. Additionally, the zero balance facility offered by accounts like the Selfe Savings Account makes it a hassle-free option for customers who do not want to worry about maintaining a minimum balance.

Equitas Bank is a great choice for customers who prioritize higher savings returns and digital convenience. It is particularly ideal for those who enjoy digital banking or want a low-maintenance account. However, for individuals who need broader physical banking access or require a more extensive range of banking products, larger banks like HDFC, ICICI, or SBI may be more suitable.

Overall, if you are looking for higher interest rates, a digital-first banking experience, and zero balance requirements, Equitas Bank is worth considering. However, if you prefer a wider range of physical branches and additional financial products, you may want to explore other banks.

FAQs

What is a savings account?

A savings account is a type of bank account that allows you to deposit money and earn interest over time.

What types of savings accounts does Equitas Bank offer?

Equitas Bank offers regular savings accounts, Selfe Savings Account, Senior Citizen Savings Account, Kids Savings Account, and NRI Savings Account.

How do I open an Equitas Bank savings account?

You can open a savings account online via Equitas’ website or mobile app (for Selfe accounts) or visit a branch for assistance with account opening.

What is the minimum balance required for an Equitas savings account?

Equitas offers zero balance accounts like the Selfe Savings Account. Regular savings accounts require a minimum balance of ₹5,000–₹10,000 depending on the type.

Can I open a savings account without visiting the bank?

Yes, you can open a Selfe Savings Account entirely online through the bank’s app or website.

What are the benefits of a Selfe Savings Account?

The Selfe Savings Account offers zero balance maintenance, higher interest rates, and instant online account opening, making it ideal for digital-first customers.

What is the interest rate on Equitas savings accounts?

The interest rate ranges from 3.50% to 7% depending on the account type and balance maintained.

How is the interest calculated on savings accounts?

Interest is calculated daily and credited to your account on a monthly basis.

Can I withdraw cash from any ATM using my Equitas savings account?

Yes, you can withdraw cash from any ATM, but you will incur charges for using ATMs outside Equitas Bank after a certain number of free withdrawals.

Are there any charges for using Equitas ATMs?

There are no charges for withdrawing money from Equitas Bank ATMs, but fees apply for third-party ATM withdrawals after a certain limit.

How do I register for Equitas internet banking?

You can register for internet banking by visiting the Equitas Bank website and following the registration steps or through the mobile app.

Is there a charge for transferring money online?

Equitas offers free domestic fund transfers, but charges may apply for international transfers or for using specific services.

Can I access my savings account balance through an ATM?

Yes, you can check your balance through any ATM or using Equitas’ mobile banking services.

What documents are required to open a savings account with Equitas Bank?

You’ll need documents like proof of identity (Aadhar card, passport, voter ID), proof of address (electricity bill, rental agreement), and passport-sized photos.

Is there any charge for a cheque book?

Equitas may charge a nominal fee for cheque book issuance depending on the account type. Some accounts may offer a free cheque book.

Are there any special accounts for senior citizens?

Yes, Equitas offers a Senior Citizen Savings Account with special benefits like higher interest rates and minimal charges.

Can I open a savings account for my child?

Yes, Equitas offers a Kids Savings Account, designed for children below 18, with features like higher interest rates and limited withdrawal restrictions.

Can I open an NRI savings account with Equitas Bank?

Yes, Equitas offers a NRI Savings Account for Non-Resident Indians to manage their finances in India.

What is the penalty for not maintaining the minimum balance?

Equitas may charge a penalty for not maintaining the required minimum balance in certain savings accounts. The charges vary by account type.

What is the process for closing an Equitas savings account?

You can close your account by submitting a request to your nearest branch or through the bank’s customer support service, provided all dues are cleared.

Can I link my Equitas savings account to Paytm, Google Pay, or other wallets?

Yes, you can link your Equitas savings account to various payment apps like Paytm, Google Pay, PhonePe, etc., for easy transactions.

Can I open a joint savings account with Equitas Bank?

Yes, you can open a joint savings account with another person, subject to the bank’s terms and conditions.

How can I transfer money between Equitas accounts?

You can transfer money using NEFT, RTGS, IMPS, or through the mobile app and internet banking facilities.

Does Equitas Bank offer credit cards?

Equitas primarily focuses on savings and loan products, but credit cards are not a part of their offerings at the moment.

How can I contact Equitas Bank customer support?

You can reach customer support through email, phone, or by visiting a branch. The customer service helpline is available 24/7.

What should I do if I lose my Equitas debit card?

Immediately contact Equitas Bank customer support to block the card and request a new one.

Are there any fees for transferring money to another bank?

Equitas offers free transfers for NEFT, IMPS, and RTGS within India. Fees may apply for international transfers.

Can I access my savings account abroad?

Yes, you can access your savings account abroad using Equitas Bank’s ATM network or international transactions via your debit card.

Is Equitas Bank FD rate competitive?

Yes, Equitas offers competitive fixed deposit interest rates that vary based on tenure and deposit amount.

Can I track my account activity through a mobile app?

Yes, you can view transaction history, account balance, and manage all banking services via the Equitas mobile app.

Disclaimer-:

The information provided on this blog is for educational and informational purposes only and should not be considered as financial, investment, or professional advice. We do not engage in, endorse, or offer any financial services, investment opportunities, or related business activities.

While we strive to provide accurate and up-to-date information, we make no representations or warranties regarding the completeness, reliability, or accuracy of the content. Any action you take based on the information from this blog is strictly at your own risk. We recommend consulting with a qualified financial professional before making any financial decisions.

Disclaimer For Image-:

The images used in this blog have been sourced from Google and various other websites. We do not claim ownership of all the images featured in our content. All images belong to their respective owners, and we use them only for informational and illustrative purposes. If you are the rightful owner of any image and believe it has been used without proper credit or permission, please contact us, and we will take appropriate action, including removal or proper attribution.