Credit Card Sellix simplifies online payments with secure credit card, cryptocurrency, and automated solutions for digital product sales and subscription services.

Table of Contents

Introduction

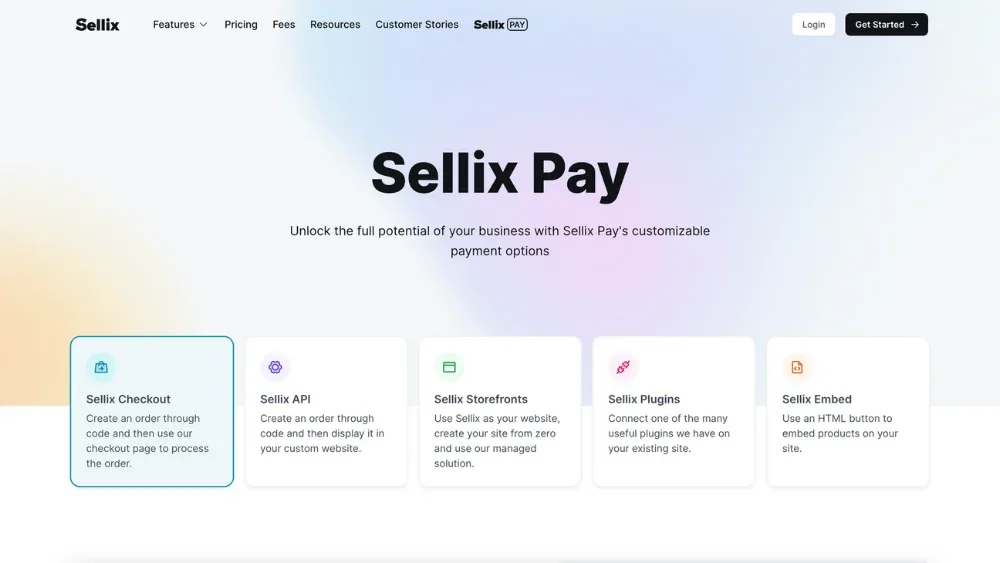

Credit Card Sellix is a digital platform designed for businesses and entrepreneurs looking to streamline the process of selling credit card-related services or digital goods online. Built with simplicity, security, and automation in mind, Sellix integrates powerful tools to handle payments, customer management, and fraud prevention, all within a single dashboard.

Whether you’re offering subscriptions, digital assets, or premium financial services, Credit Card Sellix ensures secure transactions and supports multiple payment methods, including major credit cards, cryptocurrency, and more. With features like automated invoicing, analytics, and API integration, it’s the go-to solution for scaling e-commerce operations while maintaining customer trust.

What is Credit Card Sellix?

Credit Card Sellix is a versatile e-commerce platform that enables individuals and businesses to securely sell digital goods, services, and subscriptions online. Known for its seamless integration of credit card payment processing, Sellix provides a user-friendly solution for managing transactions, customer data, and fraud prevention—all in one place.

Key Features of Credit Card Sellix

Seamless Payment Processing

Credit Card Sellix supports multiple payment methods, including major credit cards, cryptocurrencies, and alternative payment options, ensuring a smooth and flexible checkout experience for customers.

Advanced Fraud Protection

With robust fraud detection tools, Sellix safeguards transactions, protecting both sellers and buyers from unauthorized activities and chargebacks.

Automation and Efficiency

Automated invoicing, order confirmations, and delivery systems save time and reduce manual work, allowing sellers to focus on scaling their businesses.

Customizable Storefronts

Create a personalized storefront that reflects your brand identity, enhancing customer trust and engagement with a professional online presence.

Analytics and Reporting

Access detailed insights into your sales performance, customer behavior, and transaction trends through built-in analytics tools.

API and Integrations

Easily integrate Sellix with existing systems or third-party applications using its API, enhancing functionality and streamlining operations.

Global Accessibility

With multi-currency support and a user-friendly interface, Sellix is designed to cater to businesses and customers worldwide, breaking geographical barriers.

Security and Compliance

Sellix ensures top-notch security with SSL encryption and adheres to international compliance standards, offering peace of mind for sellers and buyers alike.

How Does Credit Card Sellix Work?

Step 1: Set Up Your Account

Create an account on the Sellix platform and configure your storefront. Customize it to reflect your brand identity with options for logos, themes, and personalized settings.

Step 2: Add Your Products or Services

List the digital goods, services, or subscriptions you want to sell. Sellix allows you to easily upload products, set prices, and define delivery options.

Step 3: Integrate Payment Methods

Choose from a wide range of supported payment methods, including major credit cards, cryptocurrencies, and alternative payment options, to cater to a global customer base.

Step 4: Secure and Automate Transactions

Sellix automatically handles invoicing, order confirmations, and digital product deliveries. Its built-in fraud protection ensures secure and reliable transactions for your business.

Step 5: Manage Orders and Analytics

Monitor your sales, customer interactions, and transaction history through the Sellix dashboard. Access detailed analytics to optimize your business strategies.

Step 6: Scale Your Business

With API integrations, multi-currency support, and a user-friendly interface, Sellix enables you to grow your e-commerce operations effortlessly while maintaining a professional and secure online presence.

Benefits of Using Credit Card Sellix

Increased Sales Opportunities

Sellix supports multiple payment methods, including credit cards and cryptocurrencies, making it easier for businesses to cater to a diverse and global customer base.

Enhanced Security

With advanced fraud detection and SSL encryption, both sellers and buyers can trust the platform for secure and reliable transactions.

Streamlined Operations

Automated processes for invoicing, product delivery, and order management save time and reduce the need for manual intervention.

Customization and Branding

Create a storefront that reflects your brand’s identity, helping to build trust and attract loyal customers.

Comprehensive Analytics

Gain insights into customer behavior, sales performance, and transaction trends, enabling data-driven decision-making for business growth.

Global Accessibility

Sellix’s multi-currency and multi-language support make it ideal for businesses targeting international markets.

Easy Integration

The platform’s API and integration capabilities allow seamless connection with other tools and systems, enhancing functionality and efficiency.

Time and Cost Efficiency

By consolidating multiple functions into one platform, Sellix reduces operational complexity and costs associated with managing separate tools.

Security Measures in Credit Card Sellix

Advanced Fraud Detection

Sellix employs sophisticated fraud prevention tools to detect and block suspicious activities, ensuring safe and secure transactions for both sellers and buyers.

SSL Encryption

All communications and transactions on the platform are protected with SSL encryption, safeguarding sensitive data from potential cyber threats.

Secure Payment Processing

Sellix integrates with trusted payment gateways, ensuring compliance with industry standards for secure handling of credit card and other payment information.

Two-Factor Authentication (2FA)

To enhance account security, Sellix provides two-factor authentication, adding an extra layer of protection against unauthorized access.

Data Privacy Compliance

Sellix adheres to international data protection regulations, such as GDPR, ensuring that user information is handled with the highest level of confidentiality.

Anti-Phishing Protection

Built-in safeguards help detect and prevent phishing attempts, protecting users from fraudulent schemes.

Regular Security Updates

Sellix continuously monitors and updates its platform to address potential vulnerabilities and stay ahead of emerging threats.

Customizable Security Settings

Sellers can implement additional security measures, such as IP whitelisting and transaction limits, to tailor protection based on their specific needs.

Who Can Benefit from Credit Card Sellix?

Small and Medium-Sized Businesses

Entrepreneurs and small business owners can use Credit Card Sellix to easily sell digital products or services online without the need for complex setups or expensive infrastructure. Its user-friendly interface and customizable storefronts make it ideal for those looking to establish a professional online presence with minimal effort.

Digital Goods Sellers

If you sell digital products such as e-books, software, online courses, or music, Sellix offers a seamless platform to manage transactions, automate deliveries, and protect intellectual property.

Subscription-Based Services

Businesses offering subscription services (like SaaS or membership sites) can benefit from Sellix’s recurring billing and automated invoicing features, ensuring smooth and continuous transactions for both customers and sellers.

Online Marketplaces

Sellix enables marketplaces to offer a variety of digital products from different vendors, providing an all-in-one payment processing and fraud prevention solution.

Freelancers and Content Creators

Freelancers, influencers, and content creators can use Sellix to sell their services, digital downloads, or access to exclusive content, streamlining payment collection and managing customer relationships efficiently.

E-commerce Entrepreneurs

Anyone running an online store selling digital or physical goods can leverage Sellix’s payment processing, analytics, and global reach to grow their business and streamline operations.

International Sellers

With support for multiple currencies and languages, Credit Card Sellix is an excellent platform for businesses aiming to sell to a global audience, eliminating barriers to cross-border transactions.

Affiliates and Resellers

Those involved in affiliate marketing or reselling digital products can use Sellix to manage their commissions, handle payments, and track sales performance with ease.

How to Set Up Credit Card Payments on Sellix

Step 1: Create a Sellix Account

First, sign up for an account on the Sellix platform. Once you’ve registered, log in to your dashboard to access your settings and store configuration options.

Step 2: Set Up Your Storefront

Customize your storefront by adding your logo, product listings, and descriptions. You can personalize your store’s appearance and choose the types of digital products or services you’ll be selling.

Step 3: Connect a Payment Gateway

To accept credit card payments, you need to connect a supported payment gateway to your Sellix account. Sellix integrates with several trusted payment providers, such as Stripe, PayPal, and others, to handle credit card transactions.

- Go to the Settings section of your Sellix dashboard.

- Select Payment Settings or Payment Methods.

- Choose your preferred payment gateway (e.g., Stripe).

- Follow the on-screen instructions to link your payment gateway account to your Sellix store. This usually involves entering API keys or logging in to your payment provider account to authorize the connection.

Step 4: Configure Payment Methods

Once your payment gateway is linked, configure the payment methods you wish to accept. Sellix allows you to accept credit card payments along with other methods like PayPal and cryptocurrencies. Ensure that credit cards are enabled for payments.

Step 5: Test Your Payment Integration

Before going live, it’s essential to test the payment process. Use Sellix’s sandbox or test mode (if available) to run some test transactions with credit cards to ensure everything is working smoothly.

Step 6: Enable Automatic Invoicing and Product Delivery

Set up automated invoicing for when a customer completes a purchase. You can also configure automatic delivery of digital products once payment is confirmed. This ensures a smooth transaction process for both you and your customers.

Step 7: Go Live and Start Selling

Once everything is set up and tested, you’re ready to start accepting credit card payments through Sellix. Your customers can now make secure payments via credit cards on your store, and you can track sales, manage orders, and grow your business.

Challenges and Solutions with Credit Card Sellix

1. Challenge: Payment Gateway Issues

Occasionally, payment gateways (like Stripe or PayPal) may experience downtime, or there may be compatibility issues when connecting to Sellix. This can lead to temporary disruptions in processing credit card payments.

Solution:

To mitigate payment gateway issues, regularly check the status of your integrated gateways through their status pages or dashboards. Additionally, consider adding multiple payment methods to your store, allowing customers to choose an alternative payment option if one gateway fails.

2. Challenge: Fraud and Chargebacks

Even with fraud prevention tools in place, online sellers may still experience chargebacks or fraudulent transactions, particularly with digital goods.

Solution:

Implement Sellix’s built-in fraud prevention features, which include automated fraud detection, CAPTCHA verification, and IP blocking. You can also require additional verification for high-value transactions and closely monitor order patterns to spot suspicious activity early.

3. Challenge: Currency and Localization Issues

Selling to an international audience can be challenging due to currency conversion, language barriers, and regional payment preferences.

Solution:

Sellix supports multi-currency payments and customizable language options. Ensure your store is set up to cater to global customers by enabling relevant currencies and languages in your payment settings. This allows customers from different regions to complete transactions in their local currency and preferred language, improving the overall shopping experience.

4. Challenge: Platform Learning Curve

New users might find the Sellix platform complex, especially when configuring payment methods or integrating third-party services.

Solution:

Take advantage of Sellix’s support resources, including documentation, FAQs, and customer service, to help you set up and troubleshoot any issues. Additionally, participate in community forums or explore tutorial videos to learn the ins and outs of the platform.

5. Challenge: Delayed Payment Processing

Some credit card payments may take longer than expected to process, leading to delays in product delivery or order fulfillment.

Solution:

Be transparent with customers about expected delivery times, especially for transactions that involve manual verification. Using a reliable payment processor and enabling instant payment confirmations can reduce delays. If delayed payments become a frequent issue, consider adding a backup payment processor to ensure faster transactions.

6. Challenge: Product Delivery Automation Failures

Automated delivery of digital products could face issues, such as missing files or failed email notifications, which could negatively affect customer satisfaction.

Solution:

Regularly test your automated delivery process by placing test orders to ensure that digital products are delivered promptly. Double-check your email templates, delivery triggers, and product links to make sure they’re functioning properly. In case of issues, Sellix’s support team can help you resolve product delivery failures quickly.

7. Challenge: Limited Customer Support Availability

As a seller, you may encounter issues that require immediate assistance, but limited customer support hours or long response times can be frustrating.

Solution:

Make use of Sellix’s self-service help center, which offers guides, FAQs, and troubleshooting tips. For urgent matters, contact Sellix support via email or live chat, and be sure to describe the issue clearly to receive the fastest assistance possible.

Comparison of Credit Card Sellix with Other Payment Platforms

Credit Card Sellix vs. PayPal

Payment Processing

- Credit Card Sellix: Supports multiple payment methods, including credit cards, cryptocurrencies, and alternative options, offering a customizable payment experience for digital goods, subscriptions, and services.

- PayPal: Primarily focuses on credit card and PayPal account payments. While it’s widely accepted, it doesn’t support cryptocurrency payments or as many local payment methods as Sellix.

Fees

- Credit Card Sellix: Charges a transaction fee depending on the payment method, with different rates for credit card payments and cryptocurrencies. Sellers can also set up their own pricing structures for different payment options.

- PayPal: Known for higher transaction fees, especially for international payments. PayPal also charges additional fees for currency conversion and certain types of transactions.

Global Reach

- Credit Card Sellix: Supports multiple currencies and languages, allowing businesses to sell globally with ease.

- PayPal: Also supports international transactions and is available in many countries, but limitations on local payment options may hinder some regional transactions.

Security

- Credit Card Sellix: Implements SSL encryption, two-factor authentication (2FA), and advanced fraud protection for secure transactions.

- PayPal: Also provides robust security features, including buyer and seller protection, but with less granular control over fraud prevention for the seller.

Credit Card Sellix vs. Stripe

Payment Methods

- Credit Card Sellix: Offers flexibility in accepting not only credit card payments but also cryptocurrencies and alternative methods.

- Stripe: Primarily focuses on credit card payments and supports some local payment methods, but doesn’t support cryptocurrency transactions natively.

Customization

- Credit Card Sellix: Provides a high degree of customization for storefronts, including digital product sales, automated invoicing, and integration options for advanced sellers.

- Stripe: While it offers a highly flexible API for custom solutions, Stripe doesn’t offer built-in storefronts or digital goods management. Sellers must integrate Stripe with other e-commerce platforms or websites.

Ease of Use

- Credit Card Sellix: Designed for users who may not have extensive technical knowledge. Setting up an online store is straightforward, and payment methods are easy to configure.

- Stripe: More developer-centric, requiring custom integration into websites or applications. While it offers extensive documentation, it may be challenging for non-technical users.

Security

- Credit Card Sellix: Includes SSL encryption, 2FA, and fraud detection features for securing transactions.

- Stripe: Also provides robust security features, including tokenized payments, PCI compliance, and strong fraud prevention tools.

Credit Card Sellix vs. Shopify Payments

Target Audience

- Credit Card Sellix: Ideal for digital product sellers, subscription services, and marketplaces, with a focus on simplicity and automation for smaller businesses and entrepreneurs.

- Shopify Payments: Best suited for physical goods sellers and businesses looking for a full-fledged e-commerce platform, including inventory management, physical product sales, and integrated payment solutions.

Integration and Ease of Setup

- Credit Card Sellix: Easy-to-use for setting up digital products, payments, and automations. The platform is more plug-and-play for entrepreneurs selling digital items.

- Shopify Payments: Fully integrated with Shopify’s platform, making it easier to manage both physical and digital goods on a single platform. Setup can be more complex for non-Shopify users.

Fees

- Credit Card Sellix: Transaction fees depend on the payment method, and it’s designed to cater to digital products with low overhead.

- Shopify Payments: Has lower fees for using Shopify Payments compared to third-party gateways, but there are monthly fees for using Shopify and additional costs for premium features.

Global Availability

- Credit Card Sellix: Supports multi-currency transactions and is highly flexible for global digital sales.

- Shopify Payments: Available in fewer countries and may require third-party payment processors for international transactions.

Credit Card Sellix vs. WooCommerce with Stripe

Platform Type

- Credit Card Sellix: A hosted solution focused on digital product sales with integrated payment methods.

- WooCommerce with Stripe: A WordPress plugin that allows sellers to build fully customizable e-commerce sites. Stripe is used as the payment processor for credit card transactions.

Customization

- Credit Card Sellix: Offers customization for storefronts but is more limited compared to the extensive options WooCommerce offers for full e-commerce sites.

- WooCommerce with Stripe: Provides complete control over the website design and payment process but requires more technical expertise and hosting.

Fees

- Credit Card Sellix: Simple transaction fees, including support for digital goods.

- WooCommerce with Stripe: Stripe’s fees apply, which are generally lower than PayPal’s but may involve additional charges for certain payment methods. WooCommerce also requires hosting and maintenance costs.

Security

- Credit Card Sellix: Provides comprehensive security features, including SSL, 2FA, and fraud protection.

- WooCommerce with Stripe: Stripe handles payment security with PCI-compliant features, and WooCommerce can be secured with additional plugins like SSL and security measures.

User Testimonials: Success with Credit Card Sellix

“A Game-Changer for My Digital Product Sales”

Sarah T. – Digital Product Creator

“I started using Credit Card Sellix to sell my e-books and online courses, and the experience has been amazing. The platform is so easy to use, and I love how quickly I could set up my store. The integration with multiple payment methods, especially credit cards, has made it easier for my international customers to buy my products. I no longer have to worry about manual invoicing or product delivery; Sellix automates everything seamlessly. It’s helped me grow my sales, and I’ve seen a huge increase in conversions since switching to Sellix!”

“Seamless Payment Processing and Global Reach”

Alex M. – Subscription Service Owner

“As an entrepreneur running a subscription-based service, I needed a platform that could handle recurring payments and deliver a smooth experience for my customers. Credit Card Sellix has exceeded my expectations. With its global payment options and automated billing system, I can focus on providing value to my subscribers without worrying about payment issues. The fraud protection tools also give me peace of mind knowing that my business is secure. Sellix has been essential in growing my international customer base!”

“Simplified Store Management for Small Businesses”

Monica L. – Small Business Owner

“Running a small online business, I needed a platform that allowed me to sell digital products without the hassle of complicated integrations. Credit Card Sellix made it simple to start accepting credit card payments and cryptocurrencies, all while keeping fees low. The user-friendly dashboard helps me track orders and manage my products effortlessly. The fact that I can customize my storefront and automate delivery has saved me so much time. I’m so glad I made the switch!”

“Security and Ease of Use, Perfect Combination”

David R. – Freelance Designer

“I’ve been using Sellix for a few months now to sell my design templates, and I couldn’t be happier. The security features, like 2FA and fraud protection, give me confidence that my transactions are safe. Setting up payments was incredibly easy, and the integration with Stripe for credit card payments has worked flawlessly. The ability to set up automated digital product deliveries means I can focus on creating, not managing transactions. Sellix has been the perfect solution for my business!”

“Supportive and Responsive Customer Service”

Olivia J. – Affiliate Marketer

“Credit Card Sellix has been fantastic for my affiliate marketing business. I can quickly set up offers and accept payments via credit cards, making it easy for my customers to complete their purchases. Whenever I’ve had a question, the customer support team has been incredibly responsive and helpful. The platform’s ability to handle different payment methods, including credit cards and cryptocurrencies, has helped me cater to a wider audience, and my sales have definitely improved.”

“Highly Recommended for Digital Entrepreneurs”

James W. – Online Course Creator

“I’ve used several platforms to sell my online courses, but Credit Card Sellix is by far the best. Not only does it support multiple payment options, including credit cards, but it also allows for easy integration with other tools I use. The fraud detection system is robust, and I appreciate the peace of mind it provides. Thanks to Sellix, I’ve been able to scale my course sales without any issues. It’s a great tool for anyone in the digital product space!”

How Credit Card Sellix Enhances E-commerce Experience

Simplified Payment Processing

Credit Card Sellix streamlines payment acceptance by offering a range of payment methods, including credit cards, cryptocurrencies, and alternative payment options. This flexibility makes it easy for businesses to cater to a wider audience, whether customers prefer traditional payment methods or newer options like crypto. Sellix ensures secure and seamless transactions, reducing friction at checkout and improving conversion rates.

Global Reach and Multi-Currency Support

Sellix enhances the e-commerce experience by allowing businesses to sell globally. It supports multiple currencies and languages, enabling merchants to expand their customer base internationally without the need for complex configurations. This global accessibility ensures that customers can complete purchases in their local currency, which boosts customer trust and satisfaction.

Automated Product Delivery

For digital product sellers, Credit Card Sellix automates product delivery once a payment is confirmed. This means that after a customer completes a transaction, they immediately receive access to their digital products—whether it’s an e-book, software, or subscription—without any delay. The automation not only enhances the customer experience by ensuring fast delivery, but also saves sellers time and reduces the potential for human error.

Fraud Prevention and Security

One of the key benefits of Credit Card Sellix is its robust security measures. The platform implements advanced fraud detection tools, SSL encryption, and two-factor authentication (2FA), all of which help prevent unauthorized access and protect sensitive customer information. By offering these security features, Sellix ensures a safe environment for both merchants and customers, building trust and reducing the risk of chargebacks.

Customizable Storefronts

Credit Card Sellix allows merchants to personalize their storefronts, which creates a unique and branded shopping experience. Sellers can customize their store’s design, product listings, and checkout pages to match their business identity, improving the overall user experience. The platform’s simplicity and ease of use mean that even non-technical users can quickly set up an attractive and professional-looking store.

Flexible Subscription Management

For businesses offering subscription-based products or services, Credit Card Sellix provides powerful tools for managing recurring payments. Sellers can easily set up subscription plans, manage billing cycles, and automate payment collection. This functionality is perfect for businesses that rely on recurring revenue, such as SaaS companies or membership sites.

Detailed Analytics and Reporting

Credit Card Sellix provides insightful analytics and reporting tools that allow merchants to track sales, view transaction histories, and monitor customer behavior. These data-driven insights help e-commerce businesses make informed decisions about their marketing strategies, product offerings, and customer engagement. With access to detailed reports, sellers can optimize their operations and maximize profits.

Seamless Integration with Other Tools

Sellix integrates with various third-party tools and services, such as email marketing platforms, analytics tools, and customer relationship management (CRM) systems. This flexibility allows merchants to connect their e-commerce store with the tools they already use, creating a unified and efficient business ecosystem. Integration with popular payment gateways, like Stripe and PayPal, ensures smooth transaction processing and customer satisfaction.

Fast Setup and User-Friendly Interface

Setting up Credit Card Sellix is quick and easy, with a user-friendly interface designed for both beginners and experienced e-commerce sellers. The platform doesn’t require any coding or technical expertise, making it accessible for entrepreneurs who want to focus on their business rather than dealing with complicated setup processes. This ease of use significantly reduces the time it takes to start selling online.

Cost-Effective for Digital Entrepreneurs

Credit Card Sellix offers competitive pricing with low transaction fees, making it an affordable option for digital entrepreneurs, freelancers, and small businesses. The platform allows merchants to set up an online store without worrying about high monthly fees or hidden charges. This cost-effectiveness helps businesses allocate resources toward growth and marketing, rather than paying for expensive e-commerce solutions.

Future of Credit Card Sellix in Digital Payments

As the world of digital payments continues to evolve, Credit Card Sellix is poised to remain a key player in shaping the future of online transactions. With its focus on offering flexible, secure, and user-friendly solutions for digital product sales and services, Sellix is set to expand its impact across multiple industries. Here’s how the future of Credit Card Sellix in digital payments might unfold:

Expansion of Payment Options

As more businesses look for ways to cater to global markets, Sellix’s ability to support multiple payment methods, including credit cards, cryptocurrencies, and alternative options, will become even more valuable. The rise of digital currencies and decentralized finance (DeFi) could prompt Sellix to further integrate cryptocurrency payment methods, providing merchants with even more flexibility in how they accept payments. By incorporating emerging payment systems, Sellix will cater to an increasingly tech-savvy, global consumer base.

Enhanced Security Features

With digital fraud continuing to be a challenge, the need for enhanced security features will grow. Credit Card Sellix’s commitment to security through tools like two-factor authentication (2FA), SSL encryption, and fraud prevention is already a key strength. However, as cyber threats become more sophisticated, it’s likely that Sellix will integrate more advanced security measures, such as AI-driven fraud detection, biometric verification, and additional encryption protocols, ensuring that both merchants and customers continue to feel safe and secure in their transactions.

AI and Automation Integration

The future of e-commerce lies in automation, and Sellix is well-positioned to leverage artificial intelligence (AI) and machine learning to streamline business operations even further. AI-driven tools could be used for dynamic pricing, customer segmentation, and personalized marketing, helping sellers optimize their sales strategies. Additionally, automated customer service features like chatbots and self-service options will enhance user experience, providing immediate support for both merchants and customers.

Increased Focus on Mobile Payments

As mobile commerce (m-commerce) grows rapidly, especially in emerging markets, Sellix is likely to enhance its mobile payment capabilities. Optimizing its platform for mobile devices and integrating with mobile wallets such as Apple Pay, Google Pay, and digital banking apps could further expand Sellix’s reach. Ensuring smooth, secure mobile transactions will be key to tapping into the growing mobile-first consumer base.

Scalability and Customization for Large Enterprises

As more small and medium-sized businesses thrive with digital products and services, Credit Card Sellix may look to expand its offerings for larger enterprises. This could include additional customization options, more advanced analytics, and enterprise-level features for handling larger transaction volumes and complex product offerings. With an eye on scalability, Sellix could introduce tailored solutions for different industries, including SaaS providers, e-learning platforms, and content creators, allowing larger companies to manage and optimize their e-commerce operations effectively.

Integration with Emerging Technologies

In the coming years, we can expect Sellix to further integrate with new technologies like blockchain, augmented reality (AR), and the Internet of Things (IoT). Blockchain could enable even more secure and transparent transactions, while AR could revolutionize the shopping experience for digital products by allowing customers to preview or interact with products virtually before making a purchase. These innovations will not only improve the customer experience but also offer businesses unique ways to engage with their audiences.

Sustainable Payment Solutions

As sustainability becomes a higher priority for businesses and consumers, Credit Card Sellix may embrace more eco-friendly payment solutions. This could include integrating with payment networks that are carbon neutral or offering features that allow businesses to support green initiatives. Offering sustainable payment options will appeal to environmentally conscious customers and help businesses align with broader sustainability goals.

Conclusion

Credit Card Sellix stands out as a versatile and reliable payment processing platform, offering a comprehensive solution for digital product sellers, service providers, and businesses of all sizes. With its seamless integration of credit card payments, cryptocurrency options, and advanced security features, Sellix empowers entrepreneurs to reach a global audience and streamline their operations with ease.

The platform’s user-friendly interface, automated product delivery, and robust fraud prevention measures make it an ideal choice for anyone looking to sell online, while its flexible payment options cater to the diverse preferences of today’s consumers. Moreover, Sellix’s continuous improvements and adaptability ensure that it remains ahead of the curve in a rapidly evolving digital payments landscape.

FAQs About Credit Card Sellix

What is Credit Card Sellix?

Credit Card Sellix is an online payment processing platform that allows businesses to accept payments via credit cards, cryptocurrencies, and other methods securely.

How do I set up Credit Card Sellix for my business?

Setting up Credit Card Sellix is simple. Create an account on Sellix, configure your payment methods, customize your store, and start accepting payments for your products or services.

Can I sell digital products using Credit Card Sellix?

Yes, Credit Card Sellix is ideal for selling digital products like e-books, software, online courses, and more, with automated delivery after payment is made.

What payment methods does Credit Card Sellix support?

Sellix supports a wide range of payment methods, including credit cards, PayPal, cryptocurrencies, and more, allowing businesses to offer flexible payment options.

Is Credit Card Sellix secure?

Yes, Credit Card Sellix uses robust security features like SSL encryption, two-factor authentication (2FA), and fraud detection to ensure safe transactions.

Can I use Credit Card Sellix for subscription-based services?

Yes, Credit Card Sellix allows businesses to set up recurring payments and manage subscription plans efficiently, making it perfect for subscription-based services.

Are there any transaction fees?

Credit Card Sellix charges low transaction fees, with details available upon registration. Fees may vary based on the payment method used and the plan selected.

Does Credit Card Sellix offer customer support?

Yes, Sellix provides customer support to assist with any issues or questions related to the platform, ensuring a smooth experience for both merchants and customers.

Can I customize my Sellix store?

Yes, Credit Card Sellix offers customizable storefronts where you can personalize the design, product listings, and checkout pages to match your brand identity.

Does Credit Card Sellix support international sales?

Yes, Sellix supports global payments and multiple currencies, allowing businesses to sell internationally and accept payments from customers around the world.

How fast are payments processed on Sellix?

Payments are processed quickly, with instant payment confirmations for digital products. The funds are typically available in your account within a short period, depending on the payment method.

Can I integrate Credit Card Sellix with other platforms?

Yes, Credit Card Sellix integrates with various third-party tools, including email marketing services, CRMs, and analytics platforms, for a seamless business experience.

What types of products can I sell on Sellix?

You can sell a wide variety of digital products, including software, e-books, online courses, subscriptions, and even physical goods, depending on your business model.

Does Credit Card Sellix offer analytics?

Yes, Credit Card Sellix provides comprehensive analytics and reporting tools that allow you to track sales, customer behavior, and performance to optimize your business.

How do I handle chargebacks or disputes on Sellix?

Sellix provides tools to help manage chargebacks and disputes. Their fraud protection features and transaction monitoring reduce the risk of chargebacks, and support is available to assist with resolving issues.

Is there a mobile app for Credit Card Sellix?

Currently, Credit Card Sellix does not have a dedicated mobile app, but the platform is mobile-friendly and fully accessible through any browser on smartphones and tablets.

Does Sellix provide marketing tools?

Yes, Sellix offers various marketing features, including discounts, coupon codes, and affiliate programs, which can help you promote your products and attract more customers.

Can I sell physical products with Credit Card Sellix?

While Credit Card Sellix is primarily designed for digital products, you can also sell physical items. You will need to handle shipping and inventory management outside of the platform.

How do I receive payments from Credit Card Sellix?

Payments are typically processed through payment gateways like Stripe and PayPal, and the funds are transferred to your linked account according to the provider’s processing times.

Can I set up recurring billing for services?

Yes, Credit Card Sellix allows you to create recurring billing plans, making it perfect for subscription-based services or memberships with automatic payments.

By Paisainvests