Explore the world of Canadian metal credit cards, their benefits, eligibility, rewards, and how to choose the best one for your needs. Premium, secure, and exclusive.

Table of Contents

Introduction

The Canadian Metal Credit Card is a premium credit card offering a range of exclusive benefits and features designed to cater to high-net-worth individuals and frequent travelers. With a sleek metal design, this card not only exudes luxury but also provides extensive rewards, travel perks, and security features. Cardholders enjoy benefits like access to airport lounges, travel insurance, concierge services, and cashback on eligible purchases. It is the perfect choice for those looking for both style and substance, offering a seamless and rewarding experience for its users.

What Are Metal Credit Cards?

Metal credit cards are a premium class of credit cards made with materials such as stainless steel, titanium, or other metals, offering a distinct, heavy, and luxurious feel compared to traditional plastic cards. These cards often come with enhanced benefits, features, and rewards, targeting high-net-worth individuals and frequent travelers.

Beyond their sleek, stylish appearance, metal credit cards typically provide a range of exclusive perks, such as:

- Higher Rewards: Metal cards often offer generous reward points, cashback, or miles on various spending categories like travel, dining, and entertainment.

- Travel Benefits: Many metal cards come with complimentary airport lounge access, travel insurance, concierge services, and priority boarding options.

- Enhanced Security: With advanced security features like EMV chip technology, these cards offer protection against fraud and unauthorized transactions.

- Exclusive Offers: Metal credit cards often provide access to exclusive events, private sales, and high-end rewards programs.

Why Choose a Metal Credit Card in Canada?

A metal credit card in Canada offers numerous benefits that make it an attractive option for those seeking premium features, exclusive rewards, and enhanced status. Here are several reasons why you might choose a metal credit card in Canada:

Exclusive Perks and Rewards

Metal credit cards often come with exceptional rewards programs. You can earn points, cashback, or miles on a wide range of purchases, especially in categories like travel, dining, and entertainment. These rewards can be redeemed for flights, hotel stays, and even exclusive experiences, adding significant value to your everyday spending.

Premium Travel Benefits

If you’re a frequent traveler, a metal credit card can offer valuable benefits like complimentary access to airport lounges, travel insurance, concierge services, and priority boarding. These features can elevate your travel experience and provide peace of mind when you’re on the go.

Enhanced Security

Metal credit cards often come with advanced security features like EMV chip technology, two-factor authentication, and real-time alerts to protect against fraud. The added security, combined with physical durability, ensures that your card is both secure and long-lasting.

Status and Luxury

The weight and sleek design of a metal card immediately set it apart from standard plastic credit cards. Carrying a metal credit card often conveys a sense of prestige and luxury, reflecting your financial standing. For many cardholders, the sense of exclusivity and status associated with metal cards is a key factor in their decision.

High Credit Limits and Flexibility

Metal credit cards often come with higher credit limits and greater flexibility for spending, allowing you to manage larger purchases more easily. For individuals with strong credit scores and high spending needs, these cards can be a convenient and rewarding option.

Access to Exclusive Events and Offers

Many metal credit cards offer cardholders access to exclusive events, private sales, and VIP experiences, ranging from concerts to special dining events. These offerings can help you make the most of your lifestyle and connect with like-minded individuals.

Additional Travel and Lifestyle Benefits

Besides the typical travel perks, metal cards may provide extra benefits like VIP hotel services, discounted airport parking, and travel-related concierge services, all designed to enhance your lifestyle and travel experiences.

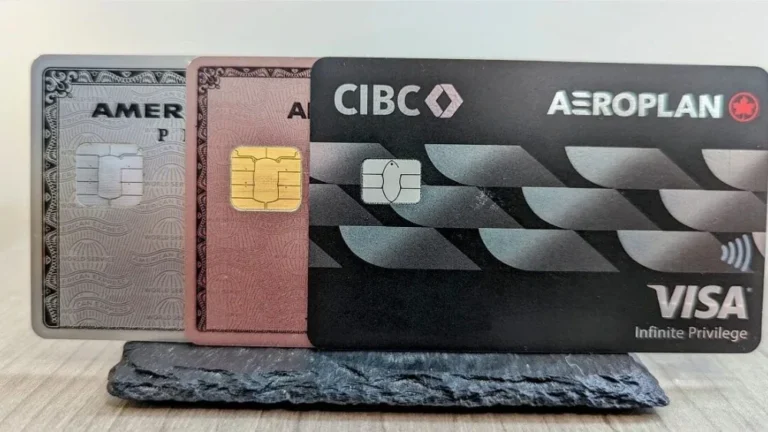

Top Metal Credit Cards Available in Canada

Metal credit cards in Canada are a luxurious option for those seeking premium benefits, exclusive rewards, and enhanced security features. Here’s a look at some of the top metal credit cards available in Canada:

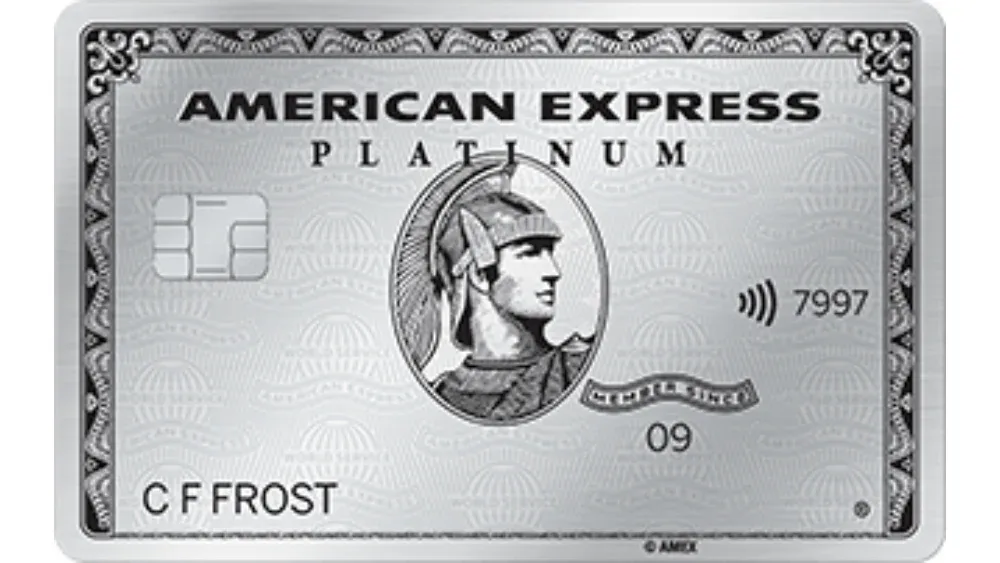

American Express Platinum Card

The American Express Platinum Card is one of the most popular metal credit cards in Canada, offering an array of benefits for frequent travelers and high spenders.

Key Features:

- 3 Membership Rewards points for every dollar spent on travel.

- Access to over 1,200 airport lounges worldwide.

- Comprehensive travel insurance coverage.

- Exclusive concierge services for travel, dining, and entertainment.

- Annual fee: $699.

Scotiabank Passport Visa Infinite Card

The Scotiabank Passport Visa Infinite Card is another premium metal credit card that caters to travelers with valuable perks, especially for those who travel abroad.

Key Features:

- 2 Scotia Rewards points for every dollar spent on travel and dining.

- No foreign transaction fees on international purchases.

- Priority airport lounge access and comprehensive travel insurance.

- Earn 25,000 Scotia Rewards points as a welcome bonus (conditions apply).

- Annual fee: $139.

TD Aeroplan Visa Infinite Privilege Card

The TD Aeroplan Visa Infinite Privilege Card is a top choice for frequent Air Canada flyers, offering exclusive Aeroplan benefits and a premium rewards program.

Key Features:

- 3 Aeroplan points for every dollar spent on Air Canada purchases and travel.

- Access to Air Canada’s Maple Leaf Lounges.

- Comprehensive travel and medical insurance coverage.

- Annual fee: $399.

RBC Avion Visa Infinite Privilege Card

The RBC Avion Visa Infinite Privilege Card is designed for those who want to maximize their travel rewards and enjoy premium privileges.

Key Features:

- 1.25 RBC Rewards points for every dollar spent on most purchases.

- Access to over 1,000 airport lounges.

- Complimentary comprehensive travel insurance.

- Earn 35,000 RBC Rewards points as a welcome bonus.

- Annual fee: $399.

BMO World Elite Mastercard

The BMO World Elite Mastercard is a metal credit card that offers premium travel benefits and rewards, making it a great option for those who travel frequently.

Key Features:

- 3 BMO Rewards points for every dollar spent on travel, dining, and entertainment.

- Priority pass for airport lounge access.

- Comprehensive travel insurance including trip cancellation and medical coverage.

- Annual fee: $150.

CIBC Aventura Visa Infinite Privilege Card

The CIBC Aventura Visa Infinite Privilege Card is a premium travel rewards card, offering a range of benefits for those who want to earn rewards on travel and everyday purchases.

Key Features:

- 2 Aventura points for every dollar spent on travel and gas.

- Access to over 1,000 airport lounges globally.

- Travel insurance and emergency medical coverage.

- Annual fee: $399.

National Bank World Elite Mastercard

The National Bank World Elite Mastercard is a premium metal credit card that offers exclusive perks and rewards, particularly for frequent travelers and luxury shoppers.

Key Features:

- 3 points for every dollar spent on travel, dining, and entertainment.

- Access to over 1,200 airport lounges worldwide.

- Comprehensive travel insurance, including trip interruption and medical coverage.

- Annual fee: $150.

Pros and Cons of Metal Credit Cards

Metal credit cards are a premium option for individuals who value luxury, exclusivity, and enhanced benefits. While they come with several advantages, there are also a few potential downsides to consider. Here’s a breakdown of the pros and cons:

Pros of Metal Credit Cards

Exclusive Perks and Benefits

Metal credit cards often offer premium benefits such as access to airport lounges, concierge services, comprehensive travel insurance, and VIP event access. These perks are tailored for individuals who want a high-end financial experience.

Higher Rewards Rates

Many metal cards provide attractive rewards programs, including cashback, points, or miles on specific categories like travel, dining, and entertainment. Cardholders can earn significant rewards for their spending, making it a great choice for frequent travelers.

Enhanced Security Features

Metal credit cards typically come with advanced security measures, such as EMV chips, two-factor authentication, and real-time transaction alerts. These features provide added protection against fraud and unauthorized use.

Prestige and Status

Carrying a metal credit card is often seen as a status symbol. The sleek, heavy design and the exclusivity of being a cardholder of certain premium cards can enhance your financial standing and offer a sense of luxury and prestige.

Durability

Unlike traditional plastic cards, metal credit cards are more durable and less prone to wear and tear. Their long-lasting design ensures they maintain their sleek look and function over time.

Cons of Metal Credit Cards

High Annual Fees

One of the main drawbacks of metal credit cards is the high annual fees, which can range from $150 to several hundred dollars. While the benefits often outweigh the costs for frequent users, these fees may not be justifiable for those who don’t fully utilize the card’s perks.

Eligibility Requirements

Metal credit cards often have stringent eligibility criteria, including a high credit score, significant income, and spending thresholds. This means that not everyone will be able to qualify for these premium cards.

Interest Rates

While many metal credit cards offer excellent rewards and benefits, they may also come with high interest rates. If you carry a balance from month to month, these high rates could lead to significant interest charges.

Exclusivity Comes with Limits

While these cards offer great perks, some of the exclusive benefits may only be useful to certain individuals, such as frequent travelers or luxury shoppers. If you don’t fully take advantage of these benefits, the card’s value might not be as high.

Risk of Overspending

With the luxury and rewards associated with metal credit cards, there may be a temptation to overspend. If not managed properly, high credit limits and attractive perks could lead to excessive debt.

Are Metal Credit Cards Eco-Friendly?

Metal credit cards are often considered more durable and luxurious compared to traditional plastic cards, but when it comes to their environmental impact, the question of whether they are truly eco-friendly is more nuanced.

Advantages of Metal Credit Cards in Terms of Sustainability

Durability and Longevity

One of the main advantages of metal credit cards is their durability. Unlike plastic cards, which can wear out over time and need to be replaced, metal cards tend to last longer, reducing the need for frequent replacements. This longevity can help reduce waste in the long run.

Recyclability

Metal credit cards are generally made from materials like stainless steel, titanium, or aluminum, which are recyclable. When a metal card reaches the end of its life, it can often be recycled, potentially contributing to a reduction in environmental impact compared to plastic cards, which may not be as easily recyclable depending on the plastic type used.

Drawbacks of Metal Credit Cards in Terms of Sustainability

Higher Carbon Footprint in Production

The manufacturing process for metal cards typically involves more energy-intensive processes than plastic cards. Extracting and refining metals like titanium and steel can have a higher carbon footprint compared to the production of plastic cards. As a result, the environmental impact of producing a metal card can be significantly greater, especially if produced in large quantities.

Limited Use and Overconsumption

Metal cards are generally targeted at high-net-worth individuals or those with premium spending habits. The production and distribution of these cards might be considered excessive for people who do not fully utilize their benefits, leading to potential overconsumption of resources.

Increased Waste in Some Cases

As many metal cards are customized with personal designs, logos, or other unique features, the materials used for these customizations can further contribute to environmental waste. Additionally, if the cards are discarded improperly or end up in landfills, they may pose an environmental challenge due to their durability.

How to Choose the Right Metal Credit Card for You

Selecting the right metal credit card involves understanding your financial needs, lifestyle preferences, and how you plan to use the card. Given that metal cards typically come with high annual fees and premium benefits, it’s important to assess their value based on the perks they offer and how well they align with your spending habits. Here are key factors to consider when choosing the best metal credit card for you:

Understand Your Spending Habits

Your spending patterns will play a significant role in determining which metal credit card is right for you. If you spend heavily on travel, dining, or entertainment, you may want to opt for a card that offers higher rewards in these categories. For example, cards like the American Express Platinum or Scotiabank Passport Visa Infinite offer elevated rewards for travel and dining, which could be ideal for frequent travelers or food enthusiasts.

Assess the Annual Fee and Its Value

Metal credit cards often come with high annual fees, which can range from $150 to over $700. It’s important to assess whether the card’s benefits outweigh the fee. Look at the rewards you’ll earn, the perks you’ll enjoy, and whether you’ll actually make use of those perks (like airport lounge access, concierge services, or travel insurance). If you aren’t likely to use these benefits frequently, you may want to consider a card with a lower annual fee.

Evaluate the Rewards Program

Rewards programs vary widely across metal credit cards. Some cards offer cashback, while others focus on earning travel points or specific brand loyalty points. Evaluate what type of rewards program aligns with your goals:

- If you’re a frequent traveler, choose a card that offers travel-related perks like miles, lounge access, and travel insurance.

- If you prefer cashback, look for a card that offers higher returns in categories where you spend the most.

- If you’re focused on maximizing points for specific brands, consider a card tied to that brand’s loyalty program.

Consider Additional Perks and Benefits

Premium metal credit cards offer exclusive perks beyond rewards, such as:

- Airport lounge access: If you travel often, this can be a significant benefit.

- Concierge services: Many metal cards offer access to concierge services that can assist with reservations, event planning, and other luxury services.

- Comprehensive insurance: Cards often come with extensive travel insurance, including trip cancellation, medical insurance, and emergency assistance.

If these perks are important to you, make sure the card you choose includes them.

Review the Interest Rates and Fees

While metal credit cards often provide high rewards, they may also carry higher interest rates. If you’re not able to pay off your balance in full each month, the interest charges could outweigh the benefits. Consider the card’s APR and whether it fits your financial habits. If you’re likely to carry a balance, you might prefer a card with a lower interest rate.

Check for Foreign Transaction Fees

If you travel internationally, consider whether the card charges foreign transaction fees. Some metal cards, like the Scotiabank Passport Visa Infinite, do not charge foreign transaction fees, which can save you money when making purchases abroad.

Look for Additional Features Like Security

Metal credit cards are known for enhanced security features such as EMV chips and two-factor authentication. These features can provide peace of mind, especially for those concerned about fraud and unauthorized transactions. Check the security measures that come with the card to ensure your spending is protected.

Review Eligibility Requirements

Metal credit cards often have stringent eligibility requirements, including a high credit score, income, and spending threshold. Ensure that you meet the card’s requirements before applying to avoid wasting time on a card you won’t qualify for.

Think About the Card’s Status and Design

Finally, consider how important the prestige and design of the card are to you. Some people value the status symbol of carrying a metal card, while others may prefer a more functional, rewards-driven choice. The design of the card itself can also reflect your personal style and preferences.

The Future of Metal Credit Cards in Canada

Metal credit cards have already made their mark as a premium financial product in Canada, offering exclusive benefits and status to those who carry them. However, as consumer preferences and financial technologies evolve, the future of metal credit cards in Canada looks poised for change. Here are some key trends and predictions about how metal credit cards might evolve in the coming years.

Increased Focus on Sustainability

As environmental concerns become more prominent, the financial industry is under increasing pressure to adopt sustainable practices. Metal credit cards, which are often made from metals like stainless steel and titanium, have a higher carbon footprint during production compared to plastic cards. In the future, there may be more efforts to make metal credit cards environmentally friendly. For example, financial institutions could introduce cards made from recyclable or eco-friendly metals, or implement sustainable manufacturing processes. Additionally, the increasing use of digital wallets and virtual cards could reduce the need for physical cards, helping to reduce environmental impact.

Integration with Digital and Mobile Payments

With the rise of mobile wallets and digital payment systems like Apple Pay, Google Pay, and Samsung Pay, the future of credit cards is becoming increasingly digital. Metal credit cards may see more integration with mobile payment solutions, allowing cardholders to seamlessly use their metal cards both physically and digitally. Some metal card providers might even offer virtual versions of their cards that work in digital wallets, while still maintaining the premium benefits associated with their physical counterparts.

Enhanced Customization and Personalization

In the future, we can expect metal credit cards to become even more personalized. As technology improves, cardholders may have more opportunities to customize the design of their metal cards, such as through unique engravings, colors, and textures. Personalization could also extend to rewards programs, with more tailored offers based on an individual’s spending patterns. AI and data analytics could be used to provide customized rewards, benefits, and discounts to cardholders, enhancing the user experience and adding further value.

Advanced Security Features

Security is always a priority with financial products, and metal credit cards are no exception. In the future, we can expect even more advanced security measures to be implemented in metal credit cards. Technologies such as biometric authentication (fingerprint or facial recognition), encrypted digital card numbers, and advanced fraud detection algorithms may become standard features. These measures will help ensure that metal credit cards remain secure in a world where digital payment fraud is becoming more sophisticated.

More Inclusive Options

As the popularity of metal credit cards grows, there may be a shift towards more inclusive options. Traditionally, metal credit cards have been aimed at high-net-worth individuals, but there may be an increased effort to make these cards accessible to a broader range of consumers. This could involve introducing lower-fee metal cards with fewer eligibility requirements while still offering some premium benefits. Financial institutions may also offer co-branded metal cards with retailers or airlines, providing even more options for those looking to enjoy the perks of metal cards without the hefty price tag.

Evolution of Rewards and Benefits

The rewards programs tied to metal credit cards will continue to evolve as consumer preferences change. In the future, we might see more flexibility in how rewards are earned and redeemed. For example, rewards may be customizable, allowing cardholders to choose which categories they want to earn points in (e.g., travel, dining, entertainment). Additionally, the value of rewards could extend beyond traditional loyalty programs, with options to redeem points for experiences, exclusive events, or even charitable donations.

Potential for Hybrid Credit Cards

In the coming years, hybrid credit cards may become more common. These cards could combine the benefits of both metal and plastic cards, offering the durability and prestige of metal cards with the flexibility and affordability of plastic cards. Hybrid models could also integrate additional features like multi-currency options, allowing cardholders to seamlessly spend in different countries without incurring foreign transaction fees.

Conclusion

Canadian metal credit cards have established themselves as a symbol of exclusivity and prestige, offering premium benefits such as enhanced rewards, travel perks, and superior customer service. As the demand for these high-end financial products grows, the future of metal credit cards in Canada appears promising, driven by advancements in technology, sustainability, and customization.

With innovations such as more eco-friendly materials, integration with digital wallets, and personalized rewards, metal credit cards are evolving to meet the changing needs of Canadian consumers. While these cards come with high annual fees, the value they provide through exclusive benefits, enhanced security features, and access to luxury services makes them an attractive option for those who can fully leverage the advantages.

FAQs About Canadian metal credit card

What is a metal credit card?

A metal credit card is a high-end, premium credit card made from metals such as stainless steel or titanium. These cards typically offer exclusive benefits like higher rewards, luxury perks, and enhanced customer service compared to traditional plastic cards.

Are metal credit cards more expensive than regular cards?

Yes, metal credit cards typically come with higher annual fees, which can range from $150 to $700 or more. However, the value of these cards comes from the premium rewards and exclusive benefits they offer, such as access to airport lounges, concierge services, and comprehensive insurance coverage.

How do I qualify for a metal credit card in Canada?

Qualification requirements for metal credit cards usually include a good to excellent credit score, a high income level, and a history of responsible credit use. Some cards may also have specific spending thresholds or additional criteria for eligibility.

Are metal credit cards accepted everywhere?

Yes, metal credit cards are generally accepted anywhere that accepts major credit card networks like Visa, Mastercard, or American Express. The material of the card does not affect its usability; it functions the same way as a plastic card.

Do metal credit cards offer rewards?

Yes, many metal credit cards offer rewards programs that provide points, cashback, or miles for every purchase. These rewards can be redeemed for travel, merchandise, statement credits, or other benefits depending on the card’s program.

Are metal credit cards secure?

Yes, metal credit cards come with advanced security features such as EMV chip technology, which protects against fraud and unauthorized transactions. Some cards also offer additional protections like purchase protection, travel insurance, and fraud alerts.

Can I use a metal credit card digitally?

Yes, metal credit cards can typically be added to mobile wallets such as Apple Pay, Google Pay, or Samsung Pay for easy and secure digital payments. This allows you to use your metal card without needing to physically carry it.

Are metal credit cards eco-friendly?

While metal credit cards are more durable than plastic cards, they have a larger environmental impact due to the manufacturing process. However, some financial institutions are working on making metal cards more eco-friendly by using recyclable materials or introducing virtual card options to reduce physical card production.

What are the benefits of having a metal credit card?

Metal credit cards offer a range of benefits, including higher rewards rates, access to luxury services (like airport lounge access), enhanced travel insurance, concierge support, and a prestigious status symbol. These benefits are designed to provide convenience, value, and exclusivity to cardholders.

Can I customize the design of my metal credit card?

Some financial institutions offer limited customization options for metal credit cards, such as personalized engravings or unique colors. However, these options vary by issuer, and not all cards provide full design customization.

Are there any drawbacks to having a metal credit card?

The primary drawback of a metal credit card is its high annual fee, which may not be worth it for everyone. Additionally, some people find that they may not fully utilize the premium benefits offered, leading to an underuse of the card’s potential value.

Do metal credit cards offer travel benefits?

Yes, many metal credit cards come with significant travel perks such as access to airport lounges, travel insurance, and concierge services. Some cards offer additional benefits like no foreign transaction fees, priority boarding, and exclusive hotel or car rental upgrades.

Are metal credit cards durable?

Yes, one of the key features of metal credit cards is their durability. Unlike plastic cards, which can wear and tear over time, metal cards are much more robust and resistant to bending, scratching, or cracking. This makes them long-lasting.

Can I get a metal credit card with cashback rewards?

Yes, some metal credit cards offer cashback rewards, in addition to travel points or miles. These cards are ideal for those who prefer straightforward rewards in the form of cashback on everyday purchases.

How do I apply for a metal credit card in Canada?

To apply for a metal credit card in Canada, you can visit the website of a financial institution offering such cards or apply in person at a bank branch. You will typically need to meet specific eligibility criteria, including having a good credit score and a stable income.

Are there any hidden fees with metal credit cards?

While metal credit cards offer premium benefits, some may come with additional fees such as foreign transaction fees, balance transfer fees, and cash advance fees. It’s important to review the terms and conditions of the card before applying to understand all associated fees.

Can I carry a metal credit card in a wallet without damaging it?

Metal credit cards are typically heavier and thicker than plastic cards, which means they can cause wear and tear on wallets over time. However, with a quality wallet, a metal card should be fine. Some people use special holders to keep their cards in pristine condition.

Are there any metal credit cards with no annual fee?

While most metal credit cards come with a high annual fee, some issuers may offer cards with lower or waived annual fees for the first year. However, these cards are usually more limited in terms of benefits and rewards compared to higher-end options.

By Paisainvests