Learn to manage finances and build credit responsibly with our student credit card course list.

Student Credit Card Course List: Your Complete Guide to Financial Education

Student credit cards have become a vital tool for young people embarking on their academic journeys. However, with the convenience of credit comes the responsibility of managing it wisely. Fortunately, a variety of student credit card courses are available, providing valuable insights into how to use credit responsibly. This guide will cover everything you need to know about student credit card course lists, including their impact on health, benefits, advantages, diet planning, and much more. By the end, you’ll understand how these courses can help you build a solid financial future while also managing a healthy lifestyle.

What Is a Student Credit Card Course List? {1}

A student credit card course list is a collection of educational programs and resources that help students learn about credit card management, financial responsibility, and the long-term implications of credit usage. These courses are designed specifically for students, as they typically face unique financial challenges like limited income and the pressure of balancing academics and personal finances.

These courses teach fundamental principles, such as:

- Understanding credit card terms and conditions

- Building and maintaining a healthy credit score

- Avoiding common credit card pitfalls (e.g., high interest rates, late fees)

- Creating and managing a budget effectively

For many students, the concept of credit is introduced when they get their first credit card. However, without proper knowledge, it’s easy to fall into debt. A student credit card course list equips students with the tools to avoid these mistakes and gain control over their financial future.

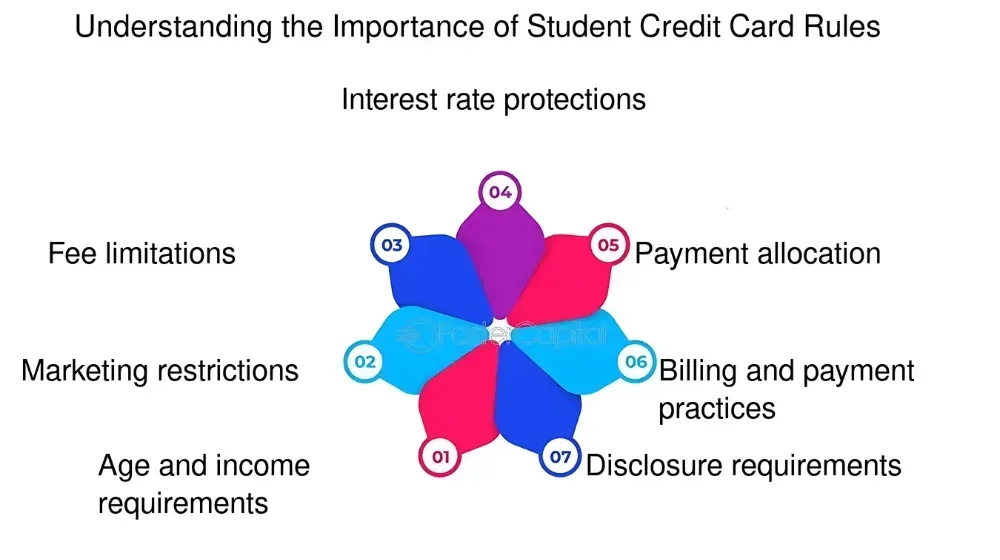

Importance of Student Credit Cards in Education {2}

Credit cards can be a valuable tool for students when used correctly. A student credit card provides an opportunity to build credit history, which will be essential in securing loans, renting apartments, and applying for car financing after graduation. Here’s why student credit cards matter in the context of education:

1. Building Credit Early

Starting to use credit responsibly while still a student helps you build a positive credit history. This is important for students who are looking to make big purchases or secure financial assistance post-graduation.

2. Financial Flexibility

While having a credit card may sound risky, when used responsibly, it can provide much-needed financial flexibility, especially in emergencies. Credit cards allow students to manage unexpected expenses, such as medical bills or school-related costs.

3. Financial Education

Courses on student credit cards teach you how to make the most of these tools. Learning how to balance spending, save for the future, and avoid unnecessary debt can set you up for financial independence down the road.

Impact of the Student Credit Card Course List on Health {3}

While financial management might not be the first thing that comes to mind when thinking about health, there is an undeniable connection between the two. Financial stress can seriously affect your well-being. Here’s how a student credit card course list can positively impact your health:

Financial Stress and Its Effect on Student Health

Many students experience financial stress due to limited budgets, student loans, and the overwhelming pressure to make ends meet. Financial stress has been linked to anxiety, depression, sleep disturbances, and other health issues. A lack of knowledge about managing money can exacerbate these problems.

Managing Stress Through Proper Credit Use

By learning how to handle credit responsibly, students can alleviate some of the financial stress that negatively impacts their health. A student credit card course teaches how to manage payments, avoid debt, and make smarter financial decisions. This reduces the anxiety associated with credit card bills and helps maintain mental and physical well-being.

Tips for Managing Stress:

- Pay your credit card bill on time to avoid late fees and penalties.

- Set a budget to keep track of your spending and ensure you don’t exceed your limits.

- Build an emergency fund to handle unexpected expenses without relying on credit cards.

By reducing financial worry, you can focus on more important aspects of student life, including your health and studies.

Benefits of a Student Credit Card Course List {4}

A student credit card course offers a variety of advantages that go beyond simple financial literacy. Let’s take a closer look at the specific benefits you can expect.

1. Learning Financial Responsibility Early

One of the most important benefits of taking a student credit card course is that it teaches you the value of financial responsibility. Students often have limited income, which makes it all the more crucial to make sound financial decisions. By learning how to budget, track spending, and save, you set yourself up for long-term success.

2. Building a Strong Credit History

A student credit card is one of the best ways to begin building your credit score. When you use your credit card wisely—by making timely payments and keeping your balance low—you can establish a strong credit history that will benefit you when applying for loans or mortgages later in life.

Building Credit: The Do’s and Don’ts

- Do make your payments on time to avoid interest charges and penalties.

- Don’t max out your credit card limit, as this can hurt your credit score.

3. Positive Effects on Future Financial Decisions

By gaining financial knowledge early on, students are better prepared for the challenges they will face after graduation. Understanding how credit works helps avoid costly mistakes, allowing students to make smarter financial decisions in the future.

Student Credit Card Courses and Diet Planning: A Surprising Connection

It might seem odd to connect a student credit card course with diet planning, but financial education can actually play a significant role in making healthier food choices. Here’s how:

Budgeting for a Healthy Diet

One of the most common concerns for students is how to eat healthily while staying within their budget. With limited funds, it can be tempting to resort to cheap, unhealthy fast food. However, by applying the budgeting skills learned in student credit card courses, students can make healthier food choices without breaking the bank.

Budget-Friendly Healthy Eating Tips:

- Plan meals in advance to avoid last-minute takeout orders.

- Buy in bulk for nutritious staples like rice, beans, and vegetables.

- Opt for frozen fruits and vegetables—they are affordable, nutritious, and have a long shelf life.

Avoiding Financial Mistakes When Choosing Foods

Financial education also extends to avoiding impulsive spending. Many students make the mistake of overspending on processed foods or unhealthy snacks. By creating a food budget that prioritizes nutrition, you can avoid making costly food-related decisions that harm both your health and finances.

Celery’s Gain or Burn in a Student Credit Card Diet Plan

Let’s talk about a simple but powerful vegetable—celery. Celery is a great example of how students can incorporate nutritious and cost-effective foods into their diet, especially when managing their finances with a student credit card.

Nutritional Benefits of Celery

Celery is low in calories but packed with important nutrients like vitamin K, fiber, and antioxidants. It’s an excellent snack for students who need to stay focused and energized without consuming too many empty calories.

Incorporating Celery into Your Diet

Celery can be used in many dishes, from salads to soups. It’s also a great snack on its own, especially when paired with peanut butter or hummus. It’s a cost-effective, nutrient-rich option for students on a tight budget.

Student Credit Card Course List Rules and Timing

Before diving into a student credit card course, it’s essential to understand the rules and timing involved. These guidelines can help you choose the right course for your needs.

How to Choose the Right Timing for Your Credit Card Course

The best time to start a credit card course is as soon as you get your first credit card or are considering applying for one. Many courses are designed for students who are just beginning to manage their finances and credit.

Course Duration and Commitment Required

Most student credit card courses are short and self-paced. You can expect to complete the course in a few weeks, depending on your schedule. Some courses are available online, making it easier to fit them into your busy life.

Conclusion

In conclusion, taking a student credit card course offers numerous benefits that go beyond just learning how to manage a credit card. By gaining a solid understanding of personal finance, students can avoid financial stress, build good credit, and make smarter spending decisions. Whether you’re looking to manage a healthy diet on a budget, reduce stress, or plan for your future, these courses provide essential knowledge that will serve you for years to come.

FAQs about Student Credit Card Course

What is the best time to start a student credit card course?

Ideally, start when you get your first credit card or as soon as you start managing personal finances.

Can I take a student credit card course without a credit card?

Yes, many courses are designed for students who haven’t yet acquired a credit card but want to learn beforehand.

How do student credit card courses help with building credit?

These courses teach responsible credit use, including how to make payments on time and keep credit utilization low, which helps build your credit history.

Are student credit card courses available online?

Yes, many student credit card courses are available online and can be taken at your own pace.

Do student credit card courses cover budgeting tips?

Yes, most courses include sections on budgeting, helping students plan and manage their finances effectively.

Can these courses help reduce financial stress?

Yes, by teaching you how to manage credit and avoid common pitfalls, these courses can help reduce financial anxiety.

How long does it take to complete a student credit card course?

Most courses take a few weeks to complete, though this depends on the provider and the course format.

Is there a cost for student credit card courses?

Some courses are free, while others may charge a fee, depending on the provider.

Can student credit card courses help me eat healthy on a budget?

Yes, by teaching budgeting skills, these courses can help you plan meals that are both nutritious and cost-effective.

Are there any prerequisites for taking a student credit card course

No, most courses have no prerequisites and are suitable for all students.

What is the difference between a regular credit card and a student credit card?

Student credit cards generally have lower credit limits and fewer fees, making them easier for students to manage.

Can I improve my credit score with a student credit card?

Yes, using your student credit card responsibly can help you build a positive credit score over time.

What happens if I miss a payment on my student credit card?

Missing a payment can lead to late fees and negatively impact your credit score. Always try to pay on time.

Can I use my student credit card abroad?

Yes, many student credit cards can be used internationally, but be sure to check for foreign transaction fees.

Do these courses teach how to handle credit card debt?

Yes, courses typically cover how to avoid debt, pay it off quickly, and prevent it from accumulating.

Are there any tips for avoiding credit card fraud as a student?

Always monitor your statements, use secure websites, and avoid sharing your card information.

Can I take multiple student credit card courses?

Yes, you can take as many as you like to deepen your financial knowledge.

Do I need to be 18 to apply for a student credit card?

Yes, you typically need to be at least 18 years old to apply for a credit card on your own.

Can I use what I learn in these courses to get a loan later?

Yes, having a good credit history and understanding credit management will help you secure loans in the future.

Can student credit cards offer rewards?

Some student credit cards offer rewards, but they are typically limited compared to regular credit cards.

How does budgeting help in avoiding overspending on food?

Budgeting helps you plan ahead and avoid impulse buys that lead to overspending on unhealthy food.

Can a student credit card help me rent an apartment after graduation?

Yes, building a good credit history can make it easier to secure housing after graduation.

Are student credit card courses available in other languages?

Some courses are available in multiple languages, but it depends on the provider.

How do I choose the best student credit card for my needs?

Look for cards with low fees, a manageable credit limit, and rewards that suit your lifestyle.

What should I do if I can’t make a payment on my student credit card?

Contact your card issuer immediately to discuss payment options or hardship programs.

By paisainvests