Introduction to Startup Accounting

Starting a new business venture is an exhilarating journey, but it’s crucial to lay a strong financial foundation from the outset. This begins with understanding the fundamentals of startup accounting.

Table of Contents

What is Startup Accounting?

Startup accounting refers to the process of managing and recording financial transactions within a newly established business. It involves organizing, analyzing, and reporting financial data to make informed business decisions.

Why is Startup Accounting Important?

Effective accounting is essential for startups for several reasons. Firstly, it provides insights into the financial health of the business, helping entrepreneurs understand their cash flow, profitability, and financial position. Additionally, accurate accounting is vital for regulatory compliance and tax obligations. Moreover, maintaining transparent financial records is crucial for attracting investors and securing funding.

———————————————————————————————————

Setting Up Your Accounting System

Setting up a robust Startup Accounting system is paramount for startups to streamline their financial processes and ensure accuracy in reporting.

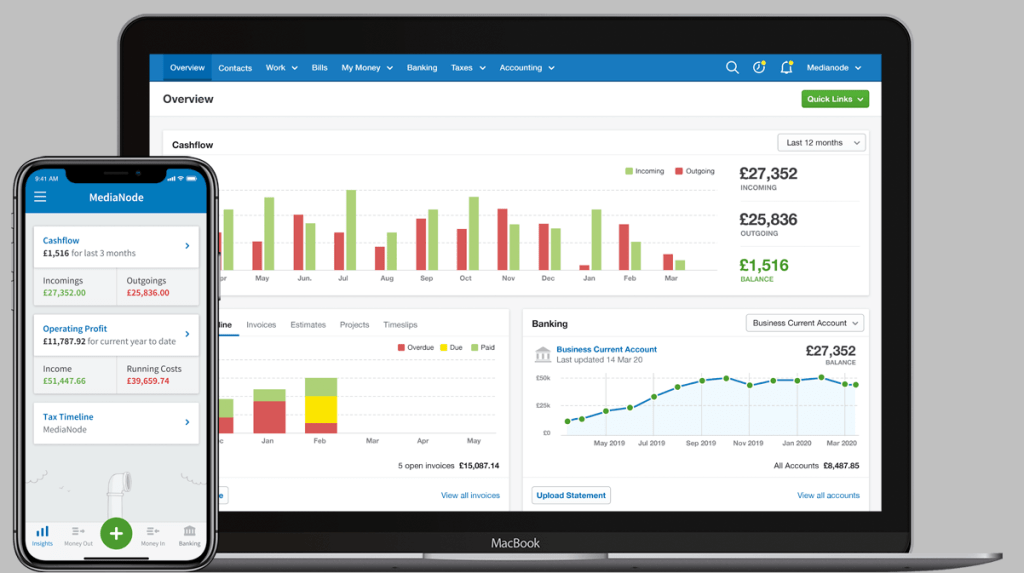

Choosing the Right Accounting Software

Selecting the appropriate accounting software is the cornerstone of an efficient accounting system for startups. Consider factors such as ease of use, scalability, and integration with other business tools. Popular options include QuickBooks, Xero, and FreshBooks.

Establishing a Chart of Accounts

A chart of accounts is a structured list of all the accounts used by a business to record financial transactions. Customize your chart of accounts to suit the specific needs of your startup, categorizing expenses, revenues, assets, and liabilities appropriately.

Understanding Basic Accounting Principles

Familiarize yourself with basic accounting principles such as accrual accounting, double-entry bookkeeping, and the matching principle. These principles form the foundation of sound financial management and reporting.

———————————————————————————————————

Managing Startup Finances

Effectively managing finances is critical for the success and sustainability of startups, especially in the early stages of growth.

Budgeting for Startup Expenses

Create a comprehensive budget that outlines all anticipated expenses, including overhead costs, salaries, marketing expenses, and product development expenditures. Monitor actual spending against budgeted amounts regularly to identify variances and adjust accordingly.

Tracking Revenue and Expenses

Implement robust systems for tracking revenue and expenses accurately. Utilize accounting software to record transactions promptly and categorize them correctly. Regularly review financial statements to assess the financial performance of your startup.

Cash Flow Management

Maintaining positive cash flow is essential for the viability of startups. Monitor cash inflows and outflows diligently, identify potential cash flow gaps, and implement strategies to mitigate them. Consider negotiating favourable payment terms with suppliers and optimizing your accounts receivable process to improve cash flow.

———————————————————————————————————

Tax Planning for Startups

Navigating the complexities of tax obligations is crucial for startups to minimize tax liabilities and ensure compliance with regulatory requirements.

Understanding Startup Tax Obligations

Educate yourself on the tax obligations specific to startups, including income taxes, payroll taxes, and sales taxes. Familiarize yourself with relevant tax laws and regulations to avoid penalties and fines.

Tax Deductions for Startups

Take advantage of available tax deductions to reduce your startup’s taxable income. Common deductions for startups include business expenses, depreciation, and research and development credits. Consult with a tax professional to maximize tax savings while remaining compliant with tax laws.

Tax Compliance Strategies

Develop robust tax compliance strategies to fulfil your startup’s tax obligations accurately and punctually. Maintain organized financial records, file tax returns promptly, and consider engaging a tax advisor to ensure compliance with tax laws and regulations.

———————————————————————————————————

Financial Reporting for Startups

Generating accurate financial reports for Startup Accounting is essential for startups to monitor their financial performance, communicate with stakeholders, and make informed business decisions.

Balance Sheets and Income Statements

Prepare comprehensive balance sheets and income statements to assess your Startup Accounting for financial health. Balance sheets provide a snapshot of your company’s assets, liabilities, and equity, while income statements detail revenues, expenses, and net income over a specific period.

Financial Ratios

Analyze key financial ratios such as liquidity ratios, profitability ratios, and solvency ratios to evaluate your startup’s financial performance and identify areas for improvement. Examples of financial ratios include the current ratio, gross profit margin, and debt-to-equity ratio.

———————————————————————————————————

Investor Reporting

If your startup has investors, provide regular financial reports to keep them informed about the company’s financial performance and progress towards key milestones. Be transparent and proactive in communicating with investors, addressing any concerns or questions promptly.

Funding and Investment

Securing funding is a significant milestone for startups, enabling them to fuel growth, expand operations, and achieve their strategic objectives.

Raising Capital Options

Explore various sources of funding for startups, including bootstrapping, crowdfunding, angel investors, venture capital, and loans. Assess the advantages and disadvantages of each option based on your startup’s stage of development, growth prospects, and funding requirements.

Venture Capital vs. Angel Investors

Understand the differences between venture capital firms and angel investors when seeking external funding. Venture capital firms typically invest larger amounts of capital in exchange for equity stakes and often provide strategic guidance and mentorship. Angel investors, on the other hand, are typically high-net-worth individuals who invest their own money in startups in exchange for equity.

Investor Relations

Nurture positive relationships with investors by providing regular updates on your startup’s progress, financial performance, and key milestones. Be transparent and responsive to investor inquiries, and leverage their expertise and networks to support your startup’s growth objectives.

———————————————————————————————————

Scaling and Growth Strategies

As your startup evolves and expands, strategic financial planning becomes increasingly critical to sustain growth and mitigate risks.

Financial Planning for Growth

Develop comprehensive financial plans that align with your startup’s growth objectives and strategic priorities. Forecast revenue projections, identify funding requirements, and assess potential risks and opportunities to inform strategic decision-making.

Scaling Operations

Implement scalable business processes and infrastructure to accommodate growth efficiently. Evaluate your startup’s operational capabilities and identify areas for optimization, automation, and expansion to support scalability.

Managing Financial Risks

Proactively identify and mitigate financial risks that could impede your startup’s growth trajectory. Conduct scenario analyses, establish risk management protocols, and maintain adequate insurance coverage to safeguard against potential threats.

Learn About How to take a Business Loan

———————————————————————————————————

Conclusion

In conclusion, Startup Accounting plays a pivotal role in the success and sustainability of startups. By establishing sound accounting practices, managing finances effectively, and adhering to tax obligations, startups can enhance their financial health, attract investors, and fuel growth. Remember to prioritize financial transparency, seek professional advice when needed, and adapt your financial strategies to align with your startup’s evolving needs and objectives.

FAQs

What accounting software is best for startups?

There are several accounting software options suitable for startups, including QuickBooks, Xero, and FreshBooks. Evaluate each based on factors such as ease of use, scalability, and integration with other business tools.

How can startups manage their cash flow effectively?

Startups can manage cash flow effectively by creating comprehensive budgets, tracking revenue and expenses diligently, and implementing strategies to improve cash flow, such as negotiating favourable payment terms with suppliers and optimizing accounts receivable processes.

What tax deductions are available for startups?

Startups can take advantage of various tax deductions, including business expenses, depreciation, and research and development credits. Consult with a tax professional to identify eligible deductions and maximize tax savings.

How should startups prepare for investor reporting?

Startups should prepare for investor reporting by generating regular financial reports, communicating transparently with investors, and addressing any concerns or questions promptly. Be proactive in providing updates on the company’s progress and financial performance.

What are some common financial ratios for startups?

Common financial ratios for startups include liquidity ratios (e.g., current ratio), profitability ratios (e.g., gross profit margin), and solvency ratios (e.g., debt-to-equity ratio). Analyze these ratios to assess your startup’s financial performance and identify areas for improvement.