Here we will discuss about the tiger credit card , benefits , rewards and who can apply. The key benefits , features of credit card.

Table of Contents

Introduction To Tiger Credit Card (1)

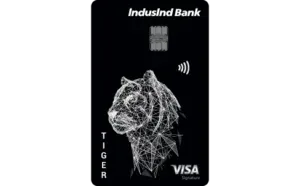

The Tiger Credit Card is a co-branded credit card introduced through a collaboration between IndusInd Bank and Tiger Fintech Private Limited, a subsidiary of the Bajaj Capital Group. Designed to cater to the evolving financial needs of consumers, the Tiger Credit Card offers a range of benefits, including reward points, exclusive offers, and seamless transaction experiences. It aims to provide cardholders with enhanced purchasing power and financial flexibility.

The Tiger Credit Card is a unique financial product designed to cater to individuals seeking enhanced financial flexibility, rewarding experiences, and convenient payment options. Offered as part of a strategic partnership between IndusInd Bank and Tiger Fintech Private Limited (a subsidiary of Bajaj Capital Group), this card aims to provide a comprehensive solution for managing daily expenses while earning rewards.

With features tailored to meet modern lifestyle needs, the Tiger Credit Card combines the banking expertise of IndusInd Bank with Tiger Fintech’s innovative approach to financial services. The card offers benefits such as reward points, cashback, exclusive deals, and seamless transaction capabilities. It is an ideal choice for individuals who value a blend of savings and convenience in their financial tools.

Designed for a broad audience, the Tiger Credit Card caters to various spending categories, including shopping, dining, entertainment, and travel, ensuring that users receive tangible value for their purchases.

History Of Tiger Credit Card (2)

The Tiger Credit Card was launched as part of a strategic partnership between IndusInd Bank and Tiger Fintech Private Limited. This collaboration leverages IndusInd Bank’s robust banking infrastructure and Tiger Fintech’s innovative financial solutions to deliver a product that addresses the diverse requirements of modern consumers. The card is tailored to offer significant rewards that increase with spending, making it an attractive option for individuals seeking value-added financial products.

Who issue this credit card? (3)

IndusInd Bank, a prominent private sector bank in India, is the official issuer of the Tiger Credit Card. The bank is known for its wide array of banking products and services, catering to both individual and corporate clients. Through this co-branded credit card, IndusInd Bank aims to expand its credit card portfolio and reach a broader customer base by offering specialized benefits in collaboration with Tiger Fintech Private Limited.

For more detailed information about the Tiger Credit Card, including its features, benefits, and application process, you can visit IndusInd Bank’s official website or contact their customer service.

Types of Credit Cards Offered by IndusInd Bank

IndusInd Bank offers a wide range of credit cards tailored to different customer needs, including cards focused on travel, shopping, lifestyle, and rewards. These cards come with a variety of benefits such as cashback, rewards points, discounts, and premium services. Below is an overview of the different types of credit cards offered by IndusInd Bank, including the Tiger Credit Card:

1. IndusInd Bank Tiger Credit Card

The Tiger Credit Card is a co-branded product in partnership with Tiger Fintech Private Limited. This card is designed for those who seek value-added rewards and premium services. It targets individuals who want to earn reward points for daily spends, while also receiving exclusive privileges in various categories.

Benefits of Tiger Credit Card:

- Welcome Benefits: Attractive rewards on first-time spending.

- Reward Points: Earn reward points for every transaction, which can be redeemed for gift vouchers, products, or flight tickets.

- Cashback Offers: Exclusive cashback on certain categories like dining, shopping, and entertainment.

- No Annual Fee: A zero annual fee for the first year, making it a cost-effective option for new users.

- Exclusive Deals: Access to special offers and discounts across various brands and retailers.

- Flexible Redemption: Points can be redeemed for a variety of rewards, including merchandise, vouchers, and travel.

2. IndusInd Bank Platinum Credit Card

The Platinum Credit Card is a premium offering from IndusInd Bank, designed for individuals who want a superior range of benefits and rewards.

Benefits of Platinum Credit Card:

- Reward Points: Earn reward points on all purchases, with accelerated points on dining and grocery spends.

- Welcome Benefits: Complimentary gift vouchers or cashback.

- Exclusive Offers: Special discounts on dining, shopping, and travel.

- Global Acceptance: Visa or Mastercard acceptance globally, making it ideal for international travelers.

- Airport Lounge Access: Complimentary access to select airport lounges, both domestic and international.

- Enhanced Security: Features like EMV chip technology and zero liability for unauthorized transactions.

3. IndusInd Bank Signature Credit Card

The Signature Credit Card is designed for high-net-worth individuals who demand premium benefits and unparalleled service.

Benefits of Signature Credit Card:

- Reward Points: Earn points on every transaction, with higher points for lifestyle and travel-related purchases.

- Airport Lounge Access: Access to over 600 airport lounges globally.

- Concierge Service: 24/7 concierge service for all your personal needs, from booking travel to getting restaurant reservations.

- Complimentary Golf Membership: Exclusive golf privileges at select courses across the country.

- Exclusive Travel Benefits: Complimentary flight and hotel discounts and upgrades, along with travel insurance.

4. IndusInd Bank Super Premium Credit Card

The Super Premium Credit Card is designed for individuals with a high disposable income, offering elite privileges and unmatched benefits.

Benefits of Super Premium Credit Card:

- Unlimited Reward Points: Earn unlimited points on every transaction.

- Luxury Benefits: Access to luxury services such as personalized concierge, golf benefits, and luxury hotel bookings.

- Exclusive Airport Lounge Access: Complimentary access to international and domestic airport lounges.

- Premium Travel Insurance: Coverage for trip cancellations, lost luggage, and medical emergencies.

- Cashback Offers: Special cashback offers for frequent users.

5. IndusInd Bank Miles & More Credit Card

The Miles & More Credit Card is ideal for frequent flyers, offering travel-related rewards, miles, and benefits.

Benefits of Miles & More Credit Card:

- Frequent Flyer Miles: Earn miles on every transaction, with bonus miles for travel-related purchases.

- Free Airport Lounge Access: Complimentary lounge access in India and abroad.

- Exclusive Travel Deals: Discounts on flights, hotels, and vacation packages.

- Special Travel Insurance: Coverage for flight cancellations, medical emergencies, and lost baggage.

6. IndusInd Bank Commerce Credit Card

The Commerce Credit Card is designed for business owners and professionals who require a credit card that helps manage both personal and business finances.

Benefits of Commerce Credit Card:

- Expense Management: Simplified tracking of business and personal expenses.

- Cashback and Rewards: Earn cashback and rewards points on business-related purchases.

- Expense Reports: Customizable expense reports for tax filing and accounting.

- Dedicated Support: 24/7 customer support for business owners.

- Global Acceptance: Accepted globally for all types of business transactions.

History of IndusInd Bank Credit Cards

IndusInd Bank, established in 1994, is one of India’s leading private sector banks, offering a wide range of financial products including credit cards. Over the years, the bank has developed a comprehensive credit card portfolio to meet the diverse needs of its customers. These cards are designed to offer a blend of convenience, rewards, and premium benefits.

- Early Years: IndusInd Bank introduced its first credit card offerings as part of its expansion into retail banking. The cards focused on providing simple and accessible benefits for middle-class consumers.

- Partnership with Global Card Networks: As the bank’s credit card offerings grew, it formed partnerships with global payment networks like Visa and Mastercard to ensure broad acceptance and enhanced security for cardholders.

- Innovation and Product Diversification: The bank’s product range evolved over time to include co-branded credit cards like the Tiger Credit Card, as well as high-end cards catering to affluent consumers. These cards incorporated additional perks like lounge access, rewards programs, concierge services, and travel-related benefits.

Benefits of IndusInd Bank Credit Cards

IndusInd Bank’s credit cards come with a variety of benefits designed to meet the needs of different customer segments:

1. Reward Programs

- Customers can earn reward points for every purchase made with the card. Points can be redeemed for a range of products, services, or travel-related benefits.

2. Cashback Offers

- Cashback is offered on certain categories such as dining, groceries, fuel, and entertainment, making these cards attractive for everyday use.

3. Airport Lounge Access

- Most premium cards offer free access to both domestic and international airport lounges, improving the travel experience for cardholders.

4. Exclusive Discounts and Offers

- Cardholders have access to exclusive discounts on shopping, dining, and travel, both online and at partner outlets.

5. Travel Insurance

- Several credit cards come with built-in travel insurance, covering trip cancellations, lost luggage, and medical emergencies during travel.

6. Enhanced Security Features

- IndusInd Bank credit cards are equipped with EMV chip technology and provide zero liability protection for unauthorized transactions.

7. Concierge Service

- For premium cards, a concierge service is available to assist with bookings, reservations, and personalized requests.

8. Flexibility and Control

- IndusInd credit cards provide flexible payment options, allowing cardholders to manage their finances effectively with customizable payment plans.

Advantages of IndusInd Bank Credit Cards

IndusInd Bank offers a variety of credit cards, each designed to cater to different customer needs. While these cards come with a range of benefits, they also have some potential drawbacks. Below is a breakdown of the advantages and disadvantages of IndusInd Bank Credit Cards

1. Reward Programs and Points Accumulation

- IndusInd Bank credit cards, including the Tiger Credit Card, allow cardholders to earn reward points on every purchase. These points can be redeemed for a wide range of rewards like gift vouchers, electronics, flight tickets, and more.

- The accumulation of reward points encourages customers to use the card frequently, offering tangible value for their spending.

2. Cashback Offers

- Many IndusInd Bank credit cards offer cashback on specific categories such as dining, groceries, and fuel.

- Cashback helps customers save money on their everyday expenses, making it an attractive feature for regular card users.

3. Airport Lounge Access

- Higher-tier cards, such as the Signature and Super Premium cards, come with complimentary access to both domestic and international airport lounges.

- For frequent travelers, this perk significantly enhances their airport experience by offering comfort and convenience during layovers.

4. Travel Insurance

- IndusInd Bank credit cards, particularly premium ones, come with built-in travel insurance that covers flight delays, lost baggage, medical emergencies, and trip cancellations.

- This insurance provides peace of mind to frequent travelers, offering protection against the unexpected.

5. Exclusive Deals and Discounts

- It provides discounts and deals across a wide range of categories, including shopping, dining, and travel.

- These exclusive offers provide additional savings and make cardholders feel valued through customized promotions.

6. Concierge Service

- Premium IndusInd Bank credit cards, such as the Signature and Super Premium cards, provide 24/7 concierge services for booking travel, making reservations, or fulfilling personal requests.

- This is particularly useful for individuals with a busy lifestyle who need assistance with day-to-day activities, from travel planning to restaurant reservations.

7. Global Acceptance

- IndusInd Bank credit cards are issued in partnership with global card networks like Visa and Mastercard, ensuring worldwide acceptance.

- Whether traveling internationally or shopping online, users can rely on the widespread acceptance of their cards.

8. Flexibility in Payments

- IndusInd credit cards offer flexibility in repaying bills, including options to convert large purchases into easy EMIs (Equated Monthly Installments).

- This feature helps in managing large expenditures without straining the budget in a single payment cycle.

Disadvantages of IndusInd Bank Credit Cards

1. High Annual Fees

- Premium cards, like the Signature and Super Premium variants, come with high annual fees, which can be a drawback for users who do not fully utilize the card’s benefits.

- If you don’t frequently use the card or take full advantage of the rewards and perks, the high annual fees can diminish the overall value of the card.

2. Limited Lounge Access for Lower-Tier Cards

- While higher-tier cards offer complimentary access to airport lounges, lower-tier cards like the Tiger Credit Card may not have this benefit.

- Frequent travelers who opt for a basic card may miss out on this valuable perk.

3. Reward Points Redemption Restrictions

- The redemption of reward points is often limited to a specific catalog or certain categories, which may not always align with the cardholder’s preferences.

- Cardholders may find themselves accumulating points they can’t easily redeem for items of their choice, reducing the flexibility of the rewards system.

4. Foreign Transaction Fees

- IndusInd Bank credit cards may charge a foreign transaction fee for purchases made outside India or in foreign currencies.

- Frequent international travelers may find this additional fee burdensome, especially if they make many foreign transactions.

5. High Interest Rates on Revolving Credit

- If you do not pay off your credit card bill in full, IndusInd Bank may charge high interest rates on the outstanding balance.

- Carrying a balance over multiple billing cycles can quickly lead to significant debt due to the high interest charges, making the card less beneficial for users who carry over balances.

6. Eligibility Criteria

- IndusInd Bank credit cards, particularly the premium variants, have strict eligibility criteria, including high-income requirements and a good credit score.

- This limits the number of people who can apply for these cards, especially those with moderate income or limited credit history.

7. Limited Cash Withdrawal Benefits

- While IndusInd credit cards offer the option to withdraw cash from ATMs, this feature typically comes with a higher interest rate and additional fees.

- Cash withdrawals from credit cards can be costly, making it an unfavorable option for emergency cash needs.

8. Redemption of Rewards May Require Spending Thresholds

- Some credit cards from IndusInd require cardholders to reach a specific annual spending threshold to unlock higher rewards or exclusive perks.

- If you don’t meet these spending thresholds, you might not fully benefit from the card’s rewards program.

Who Can Apply for IndusInd Bank Credit Cards

IndusInd Bank credit cards, including the Tiger Credit Card, are designed for individuals who meet certain eligibility criteria. Generally, applicants should be above 18 years of age and meet the financial requirements specified by the bank. Below are the basic criteria:

Eligibility Criteria:

- Age:

- Primary Cardholder: Must be between 21 to 60 years of age.

- Supplementary Cardholder: Can be above 18 years of age.

- Income:

- Salaried Individuals: Monthly income typically should be ₹30,000 or more for basic cards and higher for premium cards.

- Self-Employed Individuals: Must have a stable source of income and meet the minimum annual income requirements, which can vary by card type.

- Credit Score:

- A good credit score (typically above 750) is generally required to increase the chances of approval. A good credit history reflects a responsible borrowing behavior.

- Residency:

- Applicants must be Indian citizens or residents. Non-residents (NRIs) may also apply, subject to specific conditions and requirements.

- Other Requirements:

- The applicant must not have any overdue debts with any financial institution and should maintain a stable financial standing.

How to Apply for IndusInd Bank Credit Cards

There are several ways you can apply for an IndusInd Bank credit card, including the Tiger Credit Card:

1. Online Application:

- Visit the Official Website: Go to the official IndusInd Bank website (https://www.indusind.com) and navigate to the section for credit cards.

- Choose the Card: Select the credit card you wish to apply for (e.g., Tiger Credit Card, Platinum Credit Card, etc.).

- Fill in the Application Form: You’ll be asked to provide personal details such as name, address, phone number, email, employment details, income, etc.

- Submit the Form: After filling out the application, submit it online.

- Verification Process: After submission, the bank will verify your information and may request additional documents for confirmation.

2. In-Branch Application:

- Visit a Branch: You can visit any IndusInd Bank branch to apply for a credit card. The bank representatives will guide you through the application process.

- Fill the Application Form: Complete the credit card application form available at the branch.

- Submit Documents: You will need to provide the required documents for identity and income verification.

- Verification Process: The bank will process your application, and you will be informed about the approval status.

3. Call for Application:

- Call Customer Care: You can also contact IndusInd Bank’s customer care or their toll-free number and request a credit card application. A bank representative may assist you in the application process.

4. Email Application:

- Some customers may be able to apply via email, depending on specific offers or bank policies. You may need to request this option from the bank or its customer service.

Documents Required for IndusInd Bank Credit Cards

When applying for an IndusInd Bank credit card, you’ll need to submit a set of documents for identity, address, and income verification. The required documents vary slightly depending on the type of applicant (salaried, self-employed, or NRI), but generally include:

For Salaried Individuals:

- Identity Proof:

- Passport

- Aadhar card

- Voter ID card

- Driver’s license

- PAN card

- Address Proof:

- Utility bill (Electricity/Water/Gas)

- Aadhar card (if not used as identity proof)

- Passport

- Rent agreement or lease deed

- Income Proof:

- Latest salary slips (usually last 3 months)

- Bank statement (last 3-6 months)

- Income Tax Return (ITR) or Form 16

- Recent Form 16 or a certified copy of the salary certificate

- Photographs:

- Passport-sized photographs (usually 2-3 copies)

For Self-Employed Individuals:

- Identity Proof:

- Passport

- PAN card

- Aadhar card

- Driver’s license

- Address Proof:

- Utility bills (Electricity/Water/Gas)

- Passport

- Rent agreement

- Income Proof:

- Latest ITR (Income Tax Return) with income details

- Bank statement (last 6 months)

- Profit and Loss account and balance sheet (for business owners)

- Business Proof (for business owners):

- Business registration certificate

- GST registration document (if applicable)

- Photographs:

- Passport-sized photographs (usually 2-3 copies)

For NRIs:

- Identity Proof:

- Passport (valid)

- Visa/OCI card (if applicable)

- Address Proof:

- Valid passport with address

- Overseas utility bills (phone, electricity, etc.)

- Income Proof:

- Salary slips (if employed)

- Bank statements from an overseas bank (last 6 months)

- ITR or Form 16 (if available)

- Photographs:

- Passport-sized photographs (usually 2-3 copies)

Credit Card Application Process

- Application Submission:

After submitting the required documents either online or at the branch, your application will be processed by IndusInd Bank. - Verification and Evaluation:

The bank will verify your submitted documents and evaluate your eligibility based on factors like income, credit score, and financial stability. This process usually takes a few days to a week. - Approval/Disapproval:

Once your application is reviewed, you will be notified of the bank’s decision. If approved, your credit card will be dispatched to your registered address. - Receiving the Card:

Upon approval, your IndusInd Bank credit card (including the Tiger Credit Card) will be delivered to your address within a few business days. You will receive the PIN and other details separately for security reasons. - Activation:

To activate your card, you can call the customer care number provided, or you may activate it via IndusInd Bank’s internet banking portal or mobile app.

Conclusion

IndusInd Bank offers a wide variety of credit cards, including the popular Tiger Credit Card, catering to different customer needs, from frequent travelers to everyday shoppers. With benefits such as rewards points, cashback offers, exclusive discounts, and premium services like airport lounge access and travel insurance, these cards are designed to enhance your purchasing power and overall lifestyle.

The application process for IndusInd credit cards is simple and convenient, with multiple ways to apply, including online, in-branch, or over the phone. However, it is important to meet the eligibility criteria, such as a good credit score, stable income, and required documentation, to improve your chances of approval.

While there are numerous advantages, including flexible payment options and attractive perks, some drawbacks like high annual fees or foreign transaction charges may affect certain users. Therefore, it’s essential to choose a credit card that aligns with your spending habits and financial goals.

In conclusion, IndusInd Bank credit cards, including the Tiger Credit Card, offer a great opportunity for individuals to enjoy a blend of convenience, rewards, and exclusive services. If you meet the eligibility criteria and can take full advantage of the benefits, these cards can enhance your financial flexibility and elevate your lifestyle.

FAQs

1. What are the eligibility criteria for applying for an IndusInd Bank credit card?

To apply for an IndusInd Bank credit card, including the Tiger Credit Card, the general eligibility criteria are:

Age: You must be between 21 and 60 years for the primary cardholder. Supplementary cardholders must be above 18 years.

Income: Salaried individuals should have a monthly income of ₹30,000 or more. Self-employed individuals need to meet the income requirements, which can vary by the card type.

Credit Score: A good credit score (typically above 750) is recommended for approval.

Residency: You must be an Indian citizen or resident, although NRIs can apply as well.

How can I apply for an IndusInd Bank credit card?

You can apply for an IndusInd Bank credit card in several ways:

Online Application: Visit the official IndusInd Bank website, choose the credit card, and fill out the online application form.

In-Branch Application: Visit any IndusInd Bank branch and apply for the card in person.

Call Customer Care: You can contact customer service and request an application form to be sent to you.

Email Application: Some users can apply via email based on specific offers or customer requests.

What documents are required to apply for an IndusInd Bank credit card?

The typical documents required for applying for an IndusInd Bank credit card include:

Identity Proof: Aadhar card, passport, voter ID, PAN card, etc.

Address Proof: Utility bills, passport, rental agreement, etc.

Income Proof: Recent salary slips, bank statements, ITR, or Form 16.

Photographs: Passport-sized photographs.

What are the benefits of the Tiger Credit Card?

The Tiger Credit Card offers several benefits:

Reward Points: Earn points on every purchase that can be redeemed for a variety of rewards.

Dining Discounts: Get discounts at partnered restaurants and dining outlets.

Fuel Surcharge Waiver: Enjoy a waiver on fuel surcharge at fuel stations.

Cashback Offers: Cashbacks on specific categories like groceries and fuel.

Access to Offers and Discounts: Enjoy exclusive discounts and offers across various categories, including shopping and travel.

Is there any annual fee for the IndusInd Bank credit card?

Yes, IndusInd Bank credit cards, including the Tiger Credit Card, come with an annual fee. The exact fee depends on the card type:

Basic Cards: Generally have a lower annual fee.

Premium Cards: May have a higher annual fee but offer more extensive benefits.

The annual fee can often be waived or reduced if you meet specific spending thresholds or if you are a high-spending customer.

Can I convert my credit card purchases into EMIs?

Yes, IndusInd Bank offers an EMI conversion option for large purchases. You can convert any purchase above a certain amount into easy monthly installments. The terms, interest rates, and tenure options vary based on the type of card and purchase.

How can I redeem reward points on my IndusInd credit card?

Reward points accumulated on IndusInd Bank credit cards, including the Tiger Credit Card, can be redeemed through the following methods:

Online Portal: You can log in to the IndusInd Bank rewards portal to browse the available rewards and redeem points for products, vouchers, or services.

Mobile App: The IndusInd Bank mobile app also allows you to redeem points.

Catalog: Some cards come with a physical catalog for redemption.

Points can typically be redeemed for gifts, travel vouchers, merchandise, or discounts at partnered outlets.

What is the interest rate on outstanding balances?

IndusInd Bank charges interest on outstanding credit card balances, typically ranging from 3.5% to 3.75% per month (approximately 42%-45% annual interest). This interest is applied if you fail to pay the total outstanding balance before the due date. It is advisable to pay off your bill in full to avoid high-interest charges.

Are there any foreign transaction fees on the IndusInd credit card?

Yes, IndusInd Bank charges a foreign transaction fee (usually 3% of the transaction value) on purchases made in foreign currency or international transactions. This fee applies to both domestic and international purchases.

How can I cancel my IndusInd Bank credit card?

To cancel your IndusInd Bank credit card, you need to contact customer care via phone or email. You may also visit the branch for assistance. The bank will guide you through the cancellation process. Ensure that you pay off any outstanding balance on the card before initiating the cancellation to avoid extra charges or penalties.

What is the Tiger Credit Card from IndusInd Bank?

The Tiger Credit Card is a co-branded credit card offered by IndusInd Bank in partnership with the Wildlife Conservation Trust (WCT). It is designed for wildlife enthusiasts, frequent travelers, and those who wish to support wildlife conservation initiatives while enjoying various rewards and benefits. The card provides exclusive benefits like reward points, dining discounts, and special offers tailored to the cardholder’s lifestyle.

What are the benefits of the Tiger Credit Card?

The Tiger Credit Card offers several benefits, including:

Reward Points: Earn points on all purchases which can be redeemed for a wide range of rewards, such as travel vouchers, electronics, or merchandise.

Fuel Surcharge Waiver: Get a waiver on the fuel surcharge at select fuel stations.

Dining Discounts: Enjoy discounts at various dining outlets across the country.

Exclusive Wildlife Offers: Avail exclusive offers and discounts related to wildlife activities and experiences.

Support Wildlife Conservation: A portion of the cardholder’s spending contributes to wildlife conservation efforts, making it ideal for those passionate about environmental causes.

How can I apply for the Tiger Credit Card?

To apply for the Tiger Credit Card, you can follow these steps:

Online Application: Visit the official IndusInd Bank website, select the Tiger Credit Card, and fill out the application form online.

Branch Application: Visit your nearest IndusInd Bank branch, and request an application form to apply for the Tiger Credit Card.

Customer Care: Call the customer service helpline or email the bank to inquire about the application process.

What are the eligibility requirements for the Tiger Credit Card?

The eligibility requirements for the Tiger Credit Card include:

Age: The primary cardholder should be between 21 and 60 years of age.

Income: A stable income source is required. Salaried individuals typically need to have a monthly income of ₹30,000 or more. Self-employed individuals must meet the required income standards.

Credit Score: A good credit score (usually 750 or higher) is preferred for approval.

Other Criteria: The applicant must be an Indian resident and should not have any overdue loans or debts.

How much is the annual fee for the Tiger Credit Card?

The Tiger Credit Card comes with an annual fee that is generally around ₹500 to ₹1,000, depending on the specific offer. This fee may vary, and certain conditions or spending thresholds could allow you to waive the annual fee for the subsequent year.

Can I earn reward points on all purchases made with the Tiger Credit Card?

Yes, the Tiger Credit Card allows you to earn reward points on all eligible purchases made with the card. These points can then be redeemed for various rewards, such as merchandise, gift cards, travel bookings, and more.

What types of rewards can I redeem with the Tiger Credit Card’s reward points?

The reward points accumulated with the Tiger Credit Card can be redeemed for a wide range of rewards:

Gift Vouchers: Redeem points for gift cards from popular retailers.

Travel Vouchers: Use points to get discounts on flight bookings, hotel stays, or vacation packages.

Electronics and Merchandise: Exchange points for electronics, gadgets, and other lifestyle products.

Wildlife Experiences: Avail of special offers related to wildlife-related activities or experiences.

How can I redeem my reward points from the Tiger Credit Card?

You can redeem your reward points through the IndusInd Bank rewards portal or the IndusInd Bank mobile app. Simply log in, browse the available rewards catalog, and select your desired reward. Points can be redeemed for travel vouchers, products, or services based on the number of points you have accumulated.

Is there a fuel surcharge waiver on the Tiger Credit Card?

Yes, the Tiger Credit Card offers a fuel surcharge waiver at select fuel stations. The waiver is typically offered when you make fuel purchases using the credit card, but the exact terms and conditions may vary.

How long will it take to receive my Tiger Credit Card after approval?

Once approved, your Tiger Credit Card should be delivered to your registered address within 7 to 10 business days. You will also receive a separate PIN for secure usage of your card.

Can I convert my Tiger Credit Card purchases into EMIs?

Yes, you can convert your purchases above a certain amount into EMIs (Equated Monthly Installments). IndusInd Bank offers flexible EMI options on eligible transactions, allowing you to spread the cost of large purchases over several months.

Does the Tiger Credit Card come with an interest-free period?

Yes, like most IndusInd Bank credit cards, the Tiger Credit Card comes with an interest-free period (typically between 20 to 50 days). If you pay your outstanding balance in full before the due date, you will not be charged any interest. However, if you carry a balance, interest will be charged on the outstanding amount.

What should I do if my Tiger Credit Card is lost or stolen?

If your Tiger Credit Card is lost or stolen, immediately call IndusInd Bank’s customer service or their helpline to block the card. The bank will block the card to prevent any unauthorized transactions and issue a replacement card.

Are there any exclusive wildlife-related offers with the Tiger Credit Card?

Yes, the Tiger Credit Card offers exclusive wildlife-related offers, including discounts on wildlife safaris, zoo visits, and other conservation-related activities. A portion of your spending also supports wildlife conservation initiatives through Wildlife Conservation Trust.

Can I add supplementary cardholders to my Tiger Credit Card?

Yes, you can add supplementary cardholders to your Tiger Credit Card. These supplementary cardholders can be family members, typically above 18 years of age. They will also be able to earn reward points and enjoy the benefits associated with the card.