Here you will get the full information related to heb credit cards , benefits and features of this credit card. And who can apply for this credit card.

Table of Contents

Introduction (1)

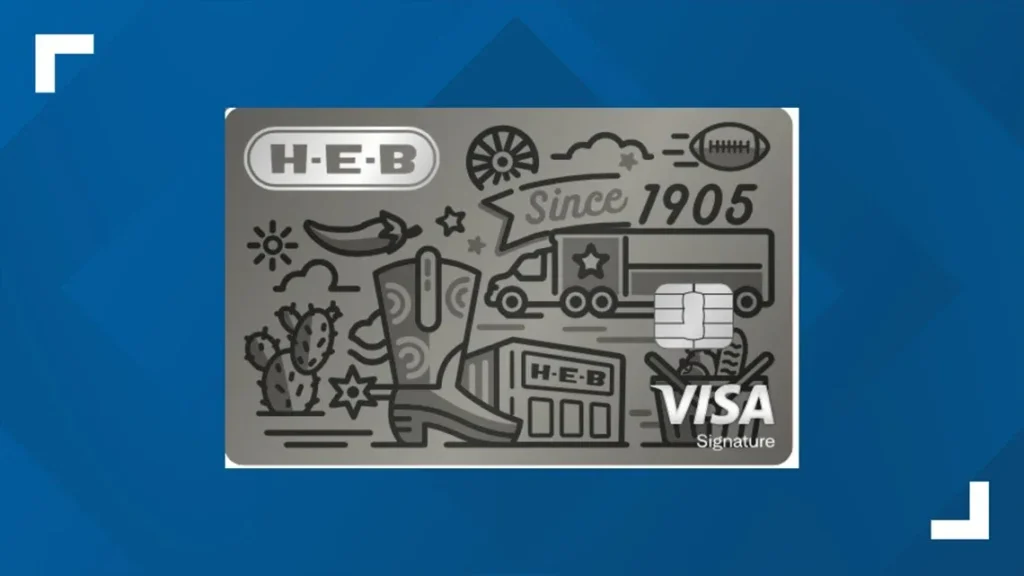

H-E-B, short for Howard E. Butt, is a Texas-based supermarket chain renowned for its commitment to quality, innovation, and community engagement. Founded in 1905, H-E-B has grown to become one of the largest private companies in the United States, with over 400 locations serving millions of customers. Known for its diverse product offerings, exceptional customer service, and community initiatives, HEB has established itself as a trusted name in grocery retail, consistently ranked among the top retailers in the nation.

HEB credit cards are designed to provide customers with financial convenience while enhancing their shopping experience. These cards cater specifically to HEB shoppers, offering tailored rewards, exclusive discounts, and seamless integration with the HEB ecosystem. Whether you’re a frequent grocery shopper or someone looking to maximize your savings, HEB credit cards aim to provide value through a combination of cashback rewards, flexible payment options, and added perks.

The primary purpose of H-E-B credit cards is to reward loyal customers while simplifying their purchasing journey. With these cards, users can enjoy:

- Exclusive Discounts: Special savings on H-E-B brand products and promotions.

- Cashback Rewards: Earn points or cashback on everyday purchases, including groceries, fuel, and more.

- Convenience: A streamlined checkout process and easy online account management.

- Financial Flexibility: Competitive interest rates, payment plans, and credit-building opportunities.

- Additional Perks: Access to partner benefits, seasonal offers, and bonus rewards.

Understanding H-E-B Credit Cards

What Are H-E-B Credit Cards?

H-E-B credit cards are specialized financial products designed to enhance the shopping experience for H-E-B customers. These cards operate like standard credit cards but are tailored to offer unique rewards, savings, and benefits when used at H-E-B stores and partner locations. They combine convenience with value, allowing customers to make purchases while earning rewards that directly benefit their lifestyle and shopping habits.

- Features and Functionality: H-E-B credit cards typically include benefits such as cashback on grocery purchases, discounts on H-E-B brand products, and exclusive access to promotions and events.

- Partnership with Financial Institutions: H-E-B credit cards may be issued in collaboration with a financial institution, such as a bank or credit card provider. This partnership ensures secure processing, competitive interest rates, and access to additional cardholder benefits, such as fraud protection, contactless payments, and online account management.

Types of H-E-B Credit Cards

H-E-B offers a variety of credit card options tailored to different customer needs. Common categories include:

- Rewards Cards: Designed for frequent shoppers, these cards offer cashback or points on purchases made at H-E-B stores, including groceries, fuel, and pharmacy items.

- Premium Cards: These cards may provide enhanced benefits, such as higher cashback rates, complimentary services, or exclusive offers for H-E-B brand products.

- Basic Cards: Ideal for those seeking straightforward savings, these cards focus on core benefits like discounts and manageable credit terms.

- Co-branded Cards: If applicable, co-branded cards may offer additional perks from partner companies, such as fuel rewards or travel benefits.

Eligibility Criteria

To qualify for an H-E-B credit card, applicants must meet basic eligibility requirements, including:

- Age: Applicants must be at least 18 years old (or the legal age of majority in their state).

- Residency: Proof of U.S. residency, typically via a government-issued ID or utility bill.

- Creditworthiness: A credit check is often required to determine eligibility. A good credit score improves the likelihood of approval for premium or rewards cards, while basic cards may be accessible to those building or rebuilding credit.

- Income: Demonstrable income or financial stability to ensure the ability to meet payment obligations.

- Bank Account: Some cards may require applicants to have an active checking or savings account for payments.

Benefits of H-E-B Credit Cards

-Rewards Program

The rewards program of H-E-B credit cards is a standout feature, offering various benefits to ensure every purchase contributes to savings and value:

1. Discounts and Cashback Options

- Cashback on Purchases: Cardholders earn cashback on everyday purchases, typically ranging from:

- Tiered Rewards: Some premium cards may have tiered reward structures, allowing users to unlock higher cashback rates based on spending thresholds.

2. Special Points for H-E-B Purchases

- Accelerated Points: Shopping at H-E-B stores earns more points per dollar spent than at other retailers, incentivizing cardholders to use their card for grocery shopping. For example:

- Earn 2x, 3x, or even 5x points on H-E-B brand items.

- Bonus points during promotional periods or special events (e.g., holidays or back-to-school seasons).

- Redemption Flexibility: Points can often be redeemed for:

- Statement credits to reduce card balances.

- Gift cards for future H-E-B purchases.

- Merchandise or services offered by H-E-B or its partners.

-Exclusive Offers

H-E-B credit cards grant access to offers and perks that go beyond standard shopping discounts, creating additional savings opportunities:

1. Partner Offers

- Fuel Rewards: Discounts on fuel purchases at H-E-B gas stations or partner stations. For instance, cardholders may receive $0.10 off per gallon or additional points on fuel purchases.

- Travel and Dining Deals: Partnerships with travel agencies, airlines, and restaurants may provide cardholders with discounted bookings, dining rewards, or bonus points for purchases made in these categories.

2. Limited-Time Promotions

- Seasonal Sales Access: Cardholders often receive early access or exclusive discounts during major sales, such as Black Friday, holiday events, or anniversary celebrations.

- Promotional Campaigns: H-E-B occasionally runs limited-time campaigns offering higher rewards rates (e.g., double cashback or extra points) on specific categories or products.

- Bonus Sign-Up Rewards: New cardholders may qualify for a welcome bonus, such as $50-$100 cashback or 10,000 points after spending a certain amount within the first few months.

3. Exclusive Events and Memberships

- Invitations to cardholder-only events, cooking classes, or product tastings.

- Free or discounted memberships to services like delivery subscriptions (e.g., H-E-B curbside or home delivery).

-Convenience Features

H-E-B credit cards prioritize user convenience, making them a practical choice for everyday spending:

1. Payment Flexibility

- Variety of Payment Options: Cardholders can pay their balance in full, make minimum payments, or set up custom payment plans to suit their financial needs.

- Competitive Interest Rates: H-E-B cards are designed with reasonable interest rates, ensuring affordability for customers carrying a balance.

- Zero Fees for H-E-B Transactions: Many cards waive fees such as foreign transaction charges or annual fees for exclusive in-store use.

2. Online and Mobile App Management

- User-Friendly Platforms: Cardholders can manage their account seamlessly through an online portal or mobile app.

- View real-time account balances and transaction histories.

- Redeem rewards or transfer points to other accounts.

- Set up auto-pay, payment reminders, or recurring bill payments.

- Spending Insights: Tools that categorize purchases and provide budgeting insights, helping users track expenses and maximize rewards.

- Enhanced Security: Real-time alerts for suspicious transactions, fraud protection, and secure login features, such as biometric authentication.

3. Contactless Payments

- Tap-to-Pay Convenience: H-E-B credit cards support contactless payments, allowing customers to simply tap their card at checkout for quick and secure transactions.

- Digital Wallet Integration: Cards are compatible with popular digital wallets like Apple Pay, Google Pay, and Samsung Pay, providing additional payment flexibility.

4. Customer Support

- Dedicated Helpline: 24/7 customer service for inquiries, troubleshooting, or reporting lost or stolen cards.

- Dispute Resolution: Streamlined processes for resolving billing disputes or fraudulent charges.

Comparing H-E-B Credit Cards with Other Retail Credit Cards (2)

-Features and Rewards

When comparing H-E-B credit cards to those offered by competitors like Walmart, Kroger, and Target, it’s clear that each program tailors its benefits to its specific audience. Here’s how H-E-B credit cards stack up:

1. Rewards Program

- H-E-B Credit Cards: Focus on in-store rewards with accelerated cashback or points on H-E-B brand products, groceries, and fuel. Some cards also provide bonus points during promotional periods and exclusive access to sales events.

- Walmart Credit Card: Offers broader rewards, such as 5% cashback on Walmart.com, including grocery pickup and delivery orders, and 2% cashback on in-store purchases. Rewards extend to fuel at Walmart gas stations and partner locations.

- Kroger Credit Card: Provides fuel rewards as a primary feature, with up to 55¢ off per gallon at Kroger gas stations (based on rewards points). Cashback is generally limited to groceries and select categories.

- Target REDcard: Simplifies its benefits with a straight 5% discount on almost all Target purchases, including in-store and online.

- H-E-B credit cards excel for loyal H-E-B shoppers who prioritize groceries, fuel, and H-E-B-branded products.

- Walmart and Kroger cards cater to a broader range of needs, with Walmart offering versatile rewards and Kroger emphasizing fuel discounts.

- Target’s REDcard is ideal for shoppers looking for a flat, easy-to-understand discount on all purchases.

2. Exclusive Offers and Partnerships

- H-E-B credit cards frequently offer partner discounts, such as fuel savings and travel perks, but these may vary by card type.

- Walmart and Kroger credit cards also have partnerships, but Walmart’s online shopping focus offers more widespread discounts.

- Target REDcard does not emphasize partnerships but provides free shipping and extended return policies as exclusive perks.

– Fees and Interest Rates

Comparing fees and APRs helps determine which card is the most cost-effective:

1. Annual Fees

- H-E-B Credit Cards: Many H-E-B cards have no annual fee, making them accessible for all shoppers.

- Walmart Credit Card: No annual fee for the Walmart Rewards card.

- Kroger Credit Card: Also typically comes with no annual fee.

- Target REDcard: No annual fee.

2. Interest Rates (APRs)

- H-E-B Credit Cards: Offer competitive APRs, typically between 16.99% – 25.99%, based on creditworthiness.

- Walmart Credit Card: Similar APR range of 17.99% – 26.99%, with variable rates.

- Kroger Credit Card: Slightly higher APRs, averaging around 18.99% – 27.49%.

- Target REDcard: Fixed APR of 26.90%, slightly higher than competitors but offers significant discounts upfront.

– Customer Satisfaction Ratings

Customer reviews provide valuable insights into user experiences with these cards:

1. H-E-B Credit Cards

- Customers appreciate the dedicated rewards for H-E-B purchases, the ease of redeeming points, and the ability to save on groceries and fuel.

- Some users mention limited reward versatility compared to cards like Walmart’s, which offer broader benefits across more categories.

2. Walmart Credit Card

- Users value the online shopping rewards and compatibility with Walmart’s grocery delivery and pickup services.

- Lower cashback rates for in-store purchases compared to online rewards frustrate some customers.

3. Kroger Credit Card

- Highly rated for its fuel rewards program and straightforward cashback on groceries.

- Limited to Kroger-related spending; rewards don’t extend to non-Kroger purchases.

4. Target REDcard

- Universally praised for the simple 5% discount and free shipping on Target.com orders.

- Lacks versatility outside of Target, and no rewards are offered beyond the immediate discount.

Summary

- H-E-B Credit Cards: Best for loyal H-E-B shoppers focused on groceries, fuel savings, and in-store perks.

- Walmart Credit Card: Offers more versatile rewards, ideal for online shopping and a mix of retail needs.

- Kroger Credit Card: Excellent for those prioritizing fuel savings and grocery rewards.

- Target REDcard: Simplest for upfront savings but lacks versatility and broad rewards

How to Apply for an H-E-B Credit Card

-Online Application Process

Step-by-Step Guide to Applying Online

- Visit the official H-E-B website or the designated credit card application portal.

- Navigate to the credit card section and click on the “Apply Now” button.

- Fill out the online application form with the required personal information, such as:

- Full name

- Date of birth

- Social Security Number (SSN)

- Contact details (phone number and email address)

- Provide employment and income details as requested.

- Review the terms and conditions of the credit card before submitting your application.

- Submit the application and await confirmation. You may receive instant approval or be asked for additional information.

– In-Store Application

Process of Applying at an H-E-B Store

- Visit your nearest H-E-B store that offers credit card applications.

- Request assistance from the customer service desk or an authorized representative.

- Complete the paper or digital application form provided.

- Provide the necessary documents (see Section 5.3).

- Submit your application to the representative, who will guide you through the process.

- Await approval notification, which may take a few days depending on the review process.

-Required Documents

List of Necessary Documentation

To apply for an H-E-B credit card, you will typically need the following:

- A valid government-issued photo ID (e.g., driver’s license, passport)

- Social Security Number or Individual Taxpayer Identification Number (ITIN)

- Proof of income (e.g., recent pay stubs or tax returns)

- Proof of address (e.g., utility bill or bank statement)

Tips for Maximizing H-E-B Credit Card Benefits

1. Shopping During Promotional Periods

- Keep an eye out for special promotions and limited-time offers at H-E-B. These promotions often include:

- Extra cashback rewards

- Discounted prices on selected items

- Bonus points for spending in specific categories

- Plan your shopping around these events to maximize the rewards and savings.

- Sign up for H-E-B newsletters or follow their social media channels to stay informed about upcoming promotions. heb credit cards

2. Paying Off Balances on Time

- Avoid interest charges by paying off your credit card balance in full every month.

- Set up automatic payments to ensure you never miss a due date.

- Regular, timely payments not only save money but also improve your credit score, which can lead to better credit opportunities in the future.

- Check your statement regularly to ensure no errors or unauthorized charges. heb credit cards

3. Utilizing Online Rewards Calculators

- Use an online rewards calculator (if available) to estimate the cashback or points you can earn based on your spending habits.

- Input your typical grocery and household spending to identify the categories where you can maximize rewards.

- Adjust your shopping habits to focus on purchases that yield the highest benefits, such as buying H-E-B brand products or using your card for eligible promotions. heb credit cards

Advantages Of HEB Credit Card

- Rewards on Purchases

- Earn cashback or rewards points on groceries and other eligible purchases, especially when shopping at H-E-B stores. heb credit cards

- Special Promotions

- Exclusive discounts, bonus rewards, and promotional offers for cardholders during specific periods.

- No Annual Fee

- Many H-E-B credit cards come with no annual fee, making them cost-effective for regular H-E-B shoppers.

- Convenient Payment Options

- Use the card for both in-store and online purchases, with rewards accumulating automatically.

- Improved Budgeting

- Monthly statements can help you track your spending habits and better manage your budget.

- Credit-Building Opportunity

- Regular, on-time payments can help build or improve your credit score.

Disadvantages Of HEB Credit Card

- Limited Usability Outside H-E-B

- Rewards and cashback may be more beneficial for H-E-B purchases but less competitive for other spending categories.

- Interest Rates

- Like most credit cards, carrying a balance can result in high-interest charges, reducing the value of rewards earned.

- Rewards Restrictions

- Some rewards may have expiration dates or be limited to specific items or purchase categories.

- Approval Criteria

- Requires a good credit score for approval, which may exclude some applicants.

- No Major Travel or Lifestyle Perks

- Unlike other credit cards, it may lack benefits such as travel insurance, concierge services, or global acceptance perks.

- Potential for Overspending

- The lure of earning rewards can lead to overspending if not carefully managed.

Conclusion

The H-E-B Credit Card is a great option for loyal H-E-B shoppers looking to maximize savings and earn rewards on everyday purchases. Its benefits, such as cashback, exclusive promotions, and no annual fee, make it a cost-effective tool for those who frequently shop at H-E-B. However, the card’s rewards are most advantageous for in-store purchases and may not provide as much value for broader spending needs or travel perks. heb credit cards

To fully benefit from this card, it’s important to shop strategically, pay off balances on time to avoid interest charges, and monitor reward opportunities. If you primarily shop at H-E-B and want a straightforward way to save on groceries and household essentials, this card could be an excellent addition to your wallet. However, for those seeking a more versatile or travel-focused card, exploring other credit card options may be a better fit. heb credit cards

FAQs About HEB Credit Cards

What is the H-E-B Credit Card?

The H-E-B Credit Card is a store-branded card designed to offer rewards and benefits to frequent H-E-B shoppers.heb credit cards

Who is eligible to apply for the H-E-B Credit Card?

U.S. residents with a valid government-issued ID, Social Security Number (SSN) or ITIN, and a satisfactory credit history are eligible to apply.heb credit cards

How can I apply for the H-E-B Credit Card?

You can apply online through the H-E-B website or in-store at participating locations.heb credit cards

Is there an annual fee for the H-E-B Credit Card?

Most H-E-B Credit Cards come with no annual fee.heb credit cards

How long does it take to get approved?

Approval may be instant, but in some cases, it can take a few days if additional verification is required.heb credit cards

What kind of rewards can I earn?

Cardholders typically earn cashback, points, or exclusive discounts on eligible H-E-B purchases.heb credit cards

Can I use the rewards outside of H-E-B?

Rewards are usually designed for use at H-E-B stores, but some programs may allow broader redemption options.heb credit cards

Do rewards expire?

Yes, rewards may have an expiration date. Check your rewards program terms for specifics.heb credit cards

Can I track my rewards balance?

Yes, you can track your rewards balance online or through your monthly credit card statement.heb credit cards

Where can I use the H-E-B Credit Card?

The card is primarily for use at H-E-B stores, but depending on the issuer, it may also be accepted wherever major credit cards are used.heb credit cards

Can I add authorized users to my card?

Yes, most H-E-B Credit Cards allow you to add authorized users.heb credit cards

Is there a spending limit on the rewards program?

Some rewards programs may have caps on earnings; review the terms of your card agreement for details.heb credit cards

Can I use the card for online purchases at H-E-B?

Yes, the card can be used for online purchases through H-E-B’s website or app.heb credit cards

What happens if I return an item purchased with the card?

The refund will be credited back to your card, but any rewards earned on that purchase may be deducted.heb credit cards

What are the interest rates for the card?

Interest rates vary depending on your creditworthiness. Check your card agreement for details.heb credit cards

How do I make payments?

You can pay online, via mail, over the phone, or in-store (if available).heb credit cards

Are there any late payment fees?

Yes, late payments may incur fees and impact your credit score.heb credit cards

Can I set up autopay?

Yes, autopay options are typically available to ensure on-time payments.heb credit cards

Is there a foreign transaction fee?

This depends on the card issuer. Some H-E-B Credit Cards may charge a fee for transactions made outside the U.S.heb credit cards

How can I check my account balance?

You can check your balance online, through a mobile app (if available), or by calling customer service.heb credit cards

What should I do if my card is lost or stolen?

Contact the card issuer immediately to report the loss and request a replacement.heb credit cards

Can I increase my credit limit?

You can request a credit limit increase by contacting customer service, though approval depends on your credit history and card issuer policies.heb credit cards

How do I cancel my card?

Contact the card issuer’s customer service to close your account. Ensure any outstanding balance is paid off before canceling.heb credit cards

How does this card affect my credit score?

Regular on-time payments can positively impact your credit score, while missed payments or high balances can negatively affect it.heb credit cards