Discover American Savings Bank Credit Cards with rewards, low rates, and no annual fees. Apply today to enjoy financial flexibility and exclusive benefits.

Table of Contents

Introduction

The American Savings Bank Credit Card offers a variety of benefits designed to meet the financial needs of customers while providing flexibility, rewards, and convenient payment options. Whether you’re looking to earn cashback on everyday purchases, build your credit score, or enjoy exclusive perks, American Savings Bank provides several credit card options tailored to fit your lifestyle. With competitive interest rates, no annual fees on select cards, and access to online account management, the bank’s credit card offerings are a smart choice for anyone seeking a reliable and user-friendly payment solution.

What is an American Savings Bank Credit Card?

The American Savings Bank Credit Card is a financial product provided by American Savings Bank, designed to offer flexibility and convenience for both personal and business use. It allows cardholders to make purchases on credit and pay off the balance over time, making it an essential tool for managing expenses.

American Savings Bank offers several types of credit cards to meet the varying needs of its customers. These cards may include features like cashback rewards, travel perks, low-interest rates, and no annual fees on select cards. Cardholders can use their American Savings Bank Credit Card for everyday purchases, such as groceries, dining, gas, and more.

In addition to its rewards programs, the card comes with enhanced security features like fraud protection, chip card technology, and zero liability for unauthorized transactions. Customers also benefit from the bank’s online and mobile banking tools, making it easy to manage payments, track spending, and view account activity at any time.

Why Choose an American Savings Bank Credit Card?

Flexible Credit Options

American Savings Bank offers a range of credit card options to suit different financial needs and spending habits. Whether you’re a frequent shopper, a business owner, or someone who simply needs a credit card for everyday expenses, they provide a variety of choices, including cashback rewards, low-interest rates, and more. This flexibility ensures that there’s a card for everyone.

Rewards and Cashback Programs

One of the key reasons to choose an American Savings Bank Credit Card is the opportunity to earn rewards on your purchases. Depending on the card, you can earn cashback on everyday purchases, such as groceries, gas, and dining. This allows you to get more value from your spending, whether you’re using your card for personal or business expenses.[1]

No Annual Fees on Select Cards

Many of the American Savings Bank Credit Cards come with no annual fees, allowing you to enjoy the benefits of having a credit card without the extra cost. This makes their cards a cost-effective option for those who want to maximize rewards and manage their finances without incurring unnecessary fees.

Competitive Interest Rates

American Savings Bank offers competitive interest rates on its credit cards, which can help you save money if you carry a balance. With lower rates than some other cards on the market, it’s easier to manage payments and avoid high-interest charges.

Access to Digital Banking Tools

Managing your American Savings Bank Credit Card is made simple with their online and mobile banking tools. You can easily track your spending, make payments, and view your balance at any time, giving you full control over your account and helping you stay on top of your financial goals.

Security and Fraud Protection

American Savings Bank Credit Cards come with advanced security features to protect you against fraud. They offer zero liability for unauthorized transactions, chip card technology, and real-time account alerts, ensuring that your purchases and personal information are secure.

Build or Improve Your Credit Score

If you’re looking to build or improve your credit score, an American Savings Bank Credit Card can help. By making regular payments on time, you can establish a positive credit history, which is essential for securing future loans or credit cards with better terms.

Exclusive Offers and Discounts

Cardholders often have access to exclusive offers and discounts with American Savings Bank Credit Cards. These can include special deals on travel, shopping, and entertainment, providing added value and savings for cardholders.

Customer Support and Assistance

American Savings Bank provides reliable customer service to assist with any questions or issues you may have. Whether you need help with making a payment, reporting a lost card, or understanding your rewards, their support team is always available to ensure your experience is as smooth as possible.

Benefits of ASB Credit Cards

American Savings Bank (ASB) Credit Cards offer a variety of advantages that make them an attractive choice for consumers looking to manage their finances effectively. Here are some key benefits of ASB Credit Cards:

Cashback Rewards

Many ASB credit cards offer cashback on everyday purchases, such as groceries, gas, and dining. This allows cardholders to earn money back on their spending, which can be redeemed for statement credits, gift cards, or other rewards, making it a great way to maximize your spending.

No Annual Fees on Select Cards

ASB offers credit cards with no annual fees, which means you can enjoy the benefits of having a credit card without the extra cost. This is especially beneficial for those who want to keep their expenses low while still earning rewards and enjoying other perks.

Competitive Interest Rates

ASB Credit Cards come with competitive interest rates, which can help you save money if you carry a balance. With lower rates compared to many other credit cards on the market, ASB provides a cost-effective way to manage your credit and avoid high interest charges.

Easy Online and Mobile Account Management

With ASB’s online banking and mobile app, you can easily manage your credit card account. You can check balances, make payments, track spending, and monitor your rewards all in one place. This convenience ensures you have full control over your finances.

Security Features

ASB Credit Cards come with advanced security features, including fraud protection and zero liability for unauthorized transactions. With chip technology and real-time account alerts, you can shop with peace of mind knowing your information is protected.

Exclusive Offers and Discounts

Cardholders often gain access to exclusive discounts, promotions, and offers from a variety of partners. These deals may include discounts on travel, entertainment, and retail purchases, giving you additional value for using your ASB Credit Card.

Build or Improve Your Credit Score

ASB Credit Cards are an excellent way to build or improve your credit score. By making timely payments and maintaining a low balance, you can establish a positive credit history, which can lead to better terms on future loans and credit cards.

Flexible Payment Options

ASB provides flexible payment options, including the ability to make minimum payments, pay in full, or set up automatic payments. This flexibility helps you manage your finances in a way that fits your budget and payment preferences.

Special Financing Options

Some ASB credit cards offer special financing options on larger purchases, such as 0% interest for a certain period. This feature can help you manage big-ticket items by spreading payments over time without incurring high interest charges.

Access to Travel Perks

Certain ASB credit cards offer travel rewards, including discounts on flights, hotel bookings, and car rentals. These cards may also provide travel insurance, helping you protect your purchases and enjoy peace of mind during your trips.

Types of American Savings Bank Credit Cards

American Savings Bank offers a variety of credit card options to meet the needs of different consumers. These cards come with various benefits, such as rewards, low interest rates, and flexible payment options, giving you the flexibility to choose the one that best suits your financial goals. Below are the main types of American Savings Bank Credit Cards:

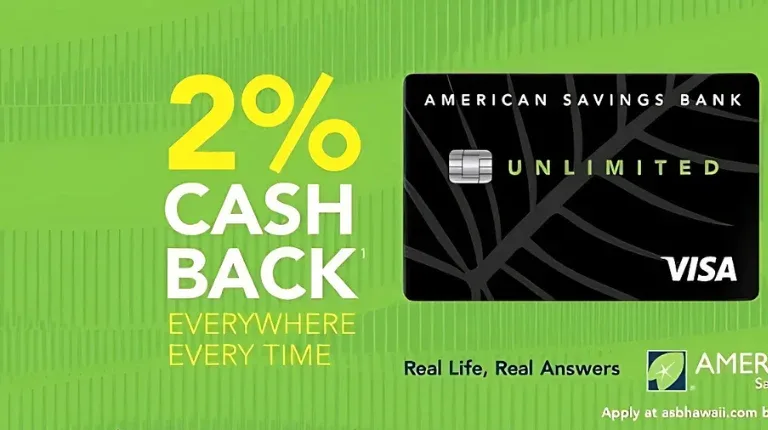

Cashback Credit Cards

ASB offers credit cards that allow you to earn cashback on your everyday purchases. These cards reward you for spending on categories like groceries, dining, gas, and more. The cashback earned can be redeemed for statement credits, gift cards, or other rewards, helping you get more value out of your purchases.

Rewards Credit Cards

The Rewards Credit Cards from ASB let you earn points for every dollar spent. These points can be redeemed for a variety of rewards, such as travel, merchandise, and other exclusive offers. Ideal for those who prefer earning points over cashback, these cards provide added flexibility when it comes to rewards redemption.

Low-Interest Credit Cards

ASB offers credit cards with competitive, low-interest rates. These cards are ideal for those who tend to carry a balance month-to-month, as they help minimize the cost of interest payments. With low APRs, you can save money on finance charges and pay down your balance more effectively.

Business Credit Cards

American Savings Bank provides credit cards designed for businesses, offering benefits like expense tracking, higher credit limits, and business-specific rewards programs. These cards are perfect for entrepreneurs who need to manage their business expenses while enjoying the same perks and flexibility available to individual cardholders.

Student Credit Cards

ASB offers credit cards that are tailored for students looking to establish or build their credit. These cards typically have lower credit limits and more forgiving terms, allowing students to develop responsible credit habits. Some student cards may also offer rewards or cashback for common purchases, providing an opportunity to earn while learning about personal finance.

Travel Rewards Credit Cards

For frequent travelers, ASB offers Travel Rewards Credit Cards that let you earn points for travel-related purchases such as flights, hotel stays, and car rentals. These cards often come with travel-specific perks, such as discounts, travel insurance, and no foreign transaction fees, making them an excellent choice for those who travel often.

Secured Credit Cards

For individuals looking to build or rebuild their credit, ASB’s Secured Credit Cards are a great option. These cards require a security deposit, which serves as your credit limit. By using the card responsibly and making timely payments, you can improve your credit score over time and eventually qualify for an unsecured card.

Features That Set ASB Credit Cards Apart

American Savings Bank (ASB) offers credit cards that stand out from other financial institutions by providing unique features designed to meet the diverse needs of consumers. Here are some key features that make ASB Credit Cards an attractive choice:

Cashback and Rewards Programs

ASB Credit Cards offer lucrative cashback and rewards programs, allowing you to earn valuable rewards for every purchase you make. Whether it’s cashback on everyday spending or points for travel and shopping, you can enjoy the benefit of earning while you spend.

No Annual Fees on Select Cards

Many of ASB’s credit cards come with no annual fee, meaning you get to enjoy all the benefits of having a credit card without the added cost. This makes it easier for cardholders to maximize their rewards and enjoy financial flexibility without worrying about additional fees.

Competitive Interest Rates

ASB provides competitive interest rates on their credit cards, making them a cost-effective option for users who may carry a balance. Lower interest rates help minimize the amount of interest paid on outstanding balances, giving you more control over your finances.

Advanced Security Features

ASB Credit Cards are equipped with advanced security features, such as chip technology, fraud protection, and real-time transaction alerts. These features provide extra protection against unauthorized transactions and help safeguard your personal information.

Convenient Online and Mobile Banking

ASB’s digital tools allow you to manage your credit card account seamlessly. Through online banking or the mobile app, you can check balances, track spending, make payments, and redeem rewards at any time, from anywhere. This convenience gives you full control over your account.

Flexible Payment Options

ASB offers flexible payment options to suit different financial situations. You can choose to make minimum payments, pay your balance in full, or set up automatic payments, making it easier to manage your credit card balance according to your budget.

Travel and Purchase Protection

Many ASB Credit Cards come with added benefits like travel insurance, purchase protection, and extended warranties. These protections ensure that you’re covered in case of lost luggage, rental car damage, or purchase issues, providing peace of mind during your travels or shopping.

Build or Rebuild Your Credit

ASB offers credit cards that can help you build or rebuild your credit score. Whether you’re a student, new to credit, or looking to improve your credit history, ASB’s secured credit cards and other offerings provide opportunities to establish responsible credit behavior.

Customer Support

ASB offers excellent customer service to assist with any inquiries or concerns. Their dedicated support team is available to help you with everything from reporting a lost card to understanding your rewards, ensuring a smooth and positive experience with their credit cards.

Special Financing Offers

ASB Credit Cards may include special financing options, such as 0% interest for a certain period on purchases or balance transfers. This feature helps you make larger purchases or manage debt without incurring high interest, making it easier to pay off over time.

How to Apply for an American Savings Bank Credit Card

Applying for an American Savings Bank (ASB) Credit Card is a simple and straightforward process. Whether you’re looking to earn rewards, manage your expenses, or build your credit, here’s how you can apply for an ASB Credit Card:

Choose the Right Card for You

ASB offers a variety of credit cards to suit different financial needs. Before applying, take the time to research the different types of cards available, such as cashback cards, rewards cards, low-interest cards, or travel cards. Consider factors like rewards programs, interest rates, and fees to find the card that best aligns with your financial goals.

Visit the ASB Website

To begin the application process, visit the official American Savings Bank website. You can find a detailed overview of the available credit card options and their features. There, you can also find an “Apply Now” button for the card you want to apply for.

Complete the Online Application

Once you’ve selected your preferred credit card, click on the “Apply Now” button to begin the application. You will be prompted to provide personal information, such as:

- Full name

- Address

- Date of birth

- Social Security Number (SSN)

- Employment details

- Annual income

- Other financial information (e.g., monthly expenses)

Submit Identification and Financial Documents (If Required)

Depending on the type of credit card you’re applying for, ASB may ask for additional documentation. This could include proof of identity (e.g., a government-issued ID) and income (e.g., pay stubs or tax returns). Ensure that you have these documents ready to submit, if necessary.

Review and Agree to Terms

Before finalizing your application, carefully review the terms and conditions of the credit card. This includes understanding the interest rates (APR), fees, rewards program details, and any other relevant information. You will need to agree to these terms before you can submit your application.

Submit Your Application

Once all the required information is filled out and reviewed, submit your application for processing. ASB will typically conduct a credit check as part of the approval process, which may include reviewing your credit history and score.

Wait for Approval

After submitting your application, ASB will review your information and make a decision. The approval process typically takes a few business days, but in some cases, it may take longer. You will receive a response via email or mail, informing you whether you’ve been approved or not.

Activate Your Card

If your application is approved, you will receive your ASB Credit Card in the mail. Once it arrives, follow the instructions included with your card to activate it. This typically involves calling a toll-free number or activating it online.

Start Using Your ASB Credit Card

After activation, you can begin using your ASB Credit Card to make purchases, earn rewards, and manage your finances. Make sure to stay within your credit limit and pay your bill on time to avoid interest charges and late fees.

Tips for Maximizing Your ASB Credit Card

To get the most out of your American Savings Bank (ASB) Credit Card, it’s important to make smart and informed decisions about how you use it. Whether you’re earning rewards, building credit, or simply managing your finances, here are some tips to help you maximize the benefits of your ASB Credit Card:

Pay Your Balance in Full Each Month

One of the most effective ways to maximize your ASB Credit Card is by paying off your balance in full each month. This helps you avoid interest charges and keep your finances under control. By not carrying a balance, you also maintain a positive credit utilization ratio, which can improve your credit score.

Take Advantage of Rewards Programs

ASB offers various rewards programs, including cashback and points for purchases. Be sure to familiarize yourself with the earning categories and redemption options. For example, if your card offers higher rewards for specific categories like groceries or dining, focus on spending in those areas to earn more rewards. Redeem your points or cashback regularly to make the most of these benefits.

Use Your Card for Everyday Purchases

Maximize your rewards by using your ASB Credit Card for everyday purchases such as groceries, gas, and online shopping. By making your regular payments with your card, you can accumulate rewards or cashback without changing your spending habits.

Take Advantage of Special Financing Offers

If you need to make a larger purchase, check if your ASB Credit Card offers any special financing options, such as 0% APR for a limited time. Using this feature allows you to spread out the cost of big-ticket items without incurring interest charges, giving you more time to pay off the balance.

Set Up Automatic Payments

To avoid late fees and maintain a good credit score, set up automatic payments for at least the minimum payment amount. This ensures you never miss a due date and helps you stay on top of your payments, even if you forget to manually make them.

Monitor Your Account Regularly

Use ASB’s online banking or mobile app to track your spending, monitor your rewards, and keep an eye on any unusual transactions. Regularly reviewing your credit card activity can help you stay on budget and spot any potential fraudulent activity early on.

Take Advantage of Additional Perks

Some ASB Credit Cards come with extra perks such as travel insurance, purchase protection, or extended warranties. Make sure you understand these benefits and take advantage of them when necessary. For example, using your card to book travel might give you additional coverage for rental car insurance or trip cancellations.

Avoid Carrying a High Balance

While it’s okay to carry a balance occasionally, consistently carrying a high balance on your ASB Credit Card can negatively affect your credit score due to high credit utilization. Try to keep your balance low and pay it off quickly to avoid paying high interest rates.

Utilize Alerts and Notifications

Set up transaction alerts through the ASB mobile app or online banking to receive notifications about your spending. This can help you stay on top of your budget and prevent overspending. Alerts can also notify you of due dates, so you don’t miss any payments.

Know Your Credit Limit

Be aware of your credit limit and try not to exceed it, as doing so may incur over-limit fees. Keeping your spending below your credit limit is also beneficial for maintaining a low credit utilization ratio, which can positively impact your credit score.

Take Advantage of Introductory Offers

If your ASB Credit Card offers an introductory sign-up bonus or 0% APR for purchases and balance transfers, make sure to take advantage of these offers within the specified time frame. These promotions can provide extra value, especially if you have larger purchases planned.

Conclusion

The American Savings Bank Credit Card offers a comprehensive range of features and benefits designed to meet the needs of diverse consumers. Whether you’re looking to earn rewards, manage your finances, or take advantage of special financing options, ASB Credit Cards provide a reliable and flexible solution. With competitive interest rates, no annual fees on select cards, and a variety of rewards programs, ASB makes it easy to maximize your card’s value.

Additionally, the security features, such as fraud protection and real-time alerts, ensure peace of mind when making purchases. By selecting the right card, managing your payments responsibly, and utilizing the available perks, you can enhance your financial flexibility and make the most of your ASB Credit Card.

FAQs About American Savings Bank Credit Card

What types of credit cards does American Savings Bank offer?

American Savings Bank offers a variety of credit cards, including cashback cards, rewards cards, travel cards, and low-interest cards. Each card is designed to meet different financial needs, with options to earn rewards on purchases or enjoy low-interest rates for balance transfers.

Are there any annual fees for ASB credit cards?

Some ASB Credit Cards come with no annual fee, while others may have a fee depending on the card type and its features. Be sure to check the specific details of the card you choose to understand any applicable fees.

How can I apply for an ASB Credit Card?

To apply for an ASB Credit Card, visit the official ASB website and choose the card that best suits your needs. You can then complete the online application by providing personal information such as income, employment details, and other financial data.

What are the benefits of using an ASB Credit Card?

ASB Credit Cards offer several benefits, including cashback or rewards points on purchases, low-interest rates on certain cards, travel and purchase protection, and special financing offers like 0% APR for a limited time. These benefits can help you save money and earn rewards as you spend.

How can I maximize my ASB Credit Card rewards?

To maximize your rewards, use your ASB Credit Card for everyday purchases such as groceries, gas, and dining. Focus on earning rewards in high-reward categories, redeem points regularly, and take advantage of any special offers or bonuses available.

Is there a way to track my ASB Credit Card activity?

Yes, ASB provides online banking and a mobile app where you can track your credit card activity, check your balance, view recent transactions, and manage your payments. You can also set up alerts to monitor spending and ensure you never miss a payment.

How can I make payments on my ASB Credit Card?

Payments can be made online through ASB’s online banking portal or mobile app. You can also set up automatic payments to ensure your balance is paid on time, avoiding late fees and interest charges.

Does ASB offer special financing or promotional offers?

Yes, ASB Credit Cards often come with special financing offers, such as 0% APR for a limited time on purchases or balance transfers. These offers help you save on interest while paying off larger purchases.

How do I protect my ASB Credit Card from fraud?

ASB offers several security features, such as chip technology, fraud protection, and real-time transaction alerts. It’s important to monitor your account regularly and report any suspicious activity immediately to ASB customer support.

Can I increase my credit limit on my ASB Credit Card?

You can request a credit limit increase by contacting ASB customer service or through your online banking account. However, your eligibility for a limit increase may depend on factors like your credit history, income, and account usage.

How do I redeem rewards on my ASB Credit Card?

Rewards can be redeemed through ASB’s online banking system or mobile app. You can choose to redeem your points for cashback, travel, gift cards, or other items available in the rewards catalog, depending on your card’s program.

What should I do if my ASB Credit Card is lost or stolen?

If your ASB Credit Card is lost or stolen, immediately contact ASB customer service to report it. They will assist you in freezing your account and issuing a replacement card to prevent unauthorized transactions.

Can I use my ASB Credit Card internationally?

Yes, ASB Credit Cards can be used internationally wherever Visa or Mastercard is accepted. However, keep in mind that some transactions may be subject to foreign transaction fees, depending on the card.

How do I check my credit card balance and statement?

You can check your ASB Credit Card balance and view your statements through ASB’s online banking platform or mobile app. Statements are typically available each month, showing your balance, payments, and transaction history.

Are there any rewards categories with ASB Credit Cards?

Yes, depending on the card type, ASB offers different rewards categories such as cashback on grocery purchases, dining, travel, and gas. Be sure to review your card’s rewards structure to take full advantage of these categories.

What happens if I miss a payment on my ASB Credit Card?

If you miss a payment, you may incur late fees and interest charges on your outstanding balance. Additionally, missing payments could negatively impact your credit score. To avoid this, consider setting up automatic payments or reminders.

How can I cancel my ASB Credit Card?

If you wish to cancel your ASB Credit Card, contact customer service or visit your nearest ASB branch. Ensure that you pay off any remaining balance and review any potential cancellation fees before proceeding with the request.

By Paisainvests