Curious about how to maximize your savings with a CD? Learn everything about using a CD calculator to calculate interest, make smart decisions, and boost your financial growth in this beginner-friendly guide!

Table of Contents

Introduction

Ever found yourself scratching your head when it comes to making sense of financial terms and tools? You’re not alone. Let’s face it, banks throw around terms like “CD” and “APY” like everyone’s a financial wizard. But don’t sweat it. In this guide, I’m breaking it down to make things simple—starting with the CD calculator.

A CD (Certificate of Deposit) might sound a bit old school, but it’s still one of the most reliable ways to grow your savings. Whether you’re eyeing a short-term or long-term investment, a CD calculator is the go-to tool for figuring out how much money you’ll end up with after the interest piles up. It’s like having a sneak peek into the future of your bank account. Ready to dive in? Let’s get to it.

What the Heck is a CD Anyway?

If you’ve never heard of a CD (and I’m not talking about the discs we used for music in the ’90s), let’s get that cleared up first. A Certificate of Deposit is like a savings account, but better. Why? Well, because it offers higher interest rates! The catch? You have to leave your money in there for a fixed period—no early withdrawals without penalties, folks.

So, why would you want one? A CD is great if you’ve got some cash that you don’t need right away and want to see it grow steadily. Banks are willing to reward you with a higher interest rate because you’re not pulling your money out every other day.

But how do you know just how much that interest is going to grow your money? That’s where the trusty CD calculator comes in.

What is a CD Calculator?

A CD calculator is a simple tool that lets you calculate the interest you’ll earn on a Certificate of Deposit over time. Think of it like this: You pop in a few numbers—your initial deposit, the interest rate, and the term length—and the calculator spits out how much you’ll end up with once your CD matures.

It’s like a crystal ball for your bank account. You get a snapshot of the future value of your investment without having to do any messy math. No formulas, no guesswork—just straightforward numbers.

Why Should You Use a CD Calculator?

Alright, so you might be asking, “Why bother with a CD calculator? Can’t I just wait and see what happens?” Sure, you could do that, but it’s always smart to have a clear picture of what you’re getting into financially. Here’s why you need a CD calculator:

- Predict Your Returns: It shows you exactly how much interest you’ll earn, so you’re not left wondering.

- Compare Different CDs: You can test different interest rates, terms, and deposit amounts to see what works best for you.

- Avoid Penalties: Some CD calculators also show the penalties for early withdrawal—this can help you avoid making any costly mistakes.

- Stay Financially Savvy: A CD calculator empowers you to make informed decisions about your savings.

Using a CD calculator is a no-brainer. It’s your financial planning sidekick, ready to help you weigh the pros and cons of different savings options.

How to Use a CD Calculator

Using a CD calculator is easy-peasy. Here’s a step-by-step guide to help you navigate it:

- Enter Your Initial Deposit: This is how much money you’re putting into the CD at the start. Whether it’s $500 or $10,000, punch in that number.

- Select the Interest Rate: The interest rate varies based on the bank and the term length of your CD. Choose the rate offered by your bank.

- Choose the Term Length: CDs typically come in different lengths—6 months, 1 year, 5 years, etc. You need to select the one you’re considering.

- Pick the Compounding Frequency: Some CDs compound monthly, some annually. This means that the interest you earn can itself earn interest at certain intervals.

- Hit Calculate: Boom! The calculator will now display your total earnings, showing you how much money you’ll walk away with at the end of the CD term.

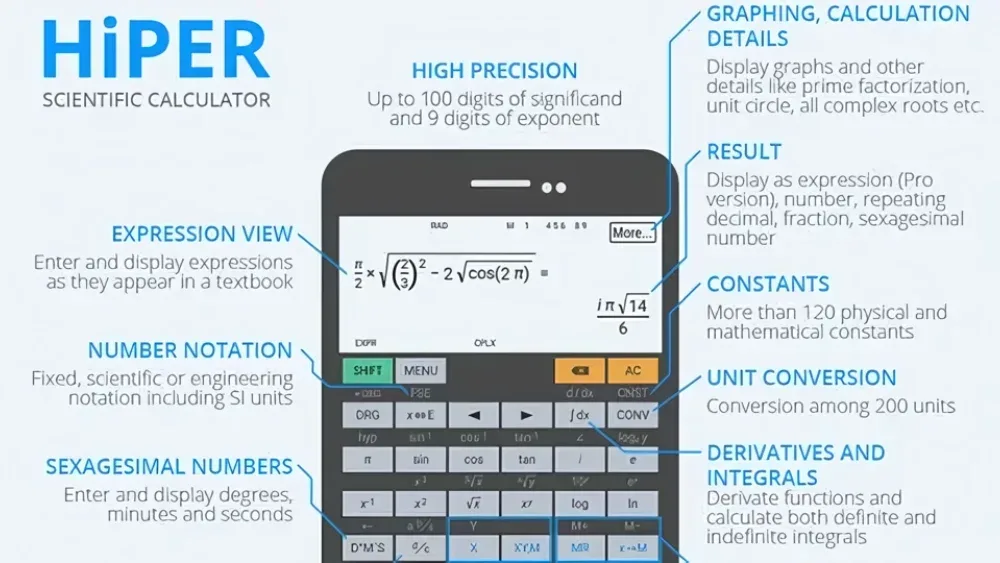

Types of CD Calculators

Yep, there’s more than one type of CD calculator. Here’s a quick breakdown:

- Basic CD Calculator: This is the straightforward tool most people use. It calculates how much interest you’ll earn based on your initial deposit, interest rate, and term length.

- CD Ladder Calculator: If you’re using a CD laddering strategy (where you invest in multiple CDs with varying terms), this calculator helps you plan out your staggered investments.

- APY (Annual Percentage Yield) Calculator: This one focuses on the effect of compound interest over the year. It’s handy if you want to see how much your CD earns annually.

What Factors Affect Your CD Earnings?

While a CD calculator makes things simple, there are still a few factors that can tweak your earnings. Here’s what to watch out for:

- Interest Rate: Obviously, the higher the rate, the more interest you earn. CD rates vary across banks, so shop around for the best deal.

- Term Length: A longer term means more time for your money to grow. But be careful! You don’t want to lock up your cash for too long if you think you’ll need it sooner.

- Compounding Frequency: Interest compounding can make a big difference. Monthly compounding means you earn interest on your interest more frequently than annual compounding.

- Initial Deposit: The more you start with, the more interest you can potentially earn. Simple, right?

CD Laddering: A Smart Strategy for Better Returns

Now, if you’re feeling a bit more advanced with your savings strategy, let me introduce you to CD laddering. It’s not as intimidating as it sounds, I promise.

What’s CD Laddering?

CD laddering is a strategy where you split your investment into several CDs with staggered maturity dates. This way, you’re not locking up all your money in one long-term CD. Instead, you have CDs maturing at different times, giving you access to some of your cash every few months or years.

How to Build a CD Ladder

Here’s a quick breakdown of how to create your own CD ladder:

- Split your total investment into smaller chunks.

- Invest each chunk in CDs with different maturity dates. For example:

- $1,000 in a 1-year CD

- $1,000 in a 2-year CD

- $1,000 in a 3-year CD

- As each CD matures, reinvest the money into a new CD with a longer term.

This way, you benefit from higher interest rates on longer-term CDs while still having regular access to some of your funds.

Conclusion

And there you have it! A CD calculator is one of the simplest tools you can use to make smarter financial decisions. It helps you predict your savings growth, compare different CD options, and avoid any nasty surprises from early withdrawals. Whether you’re just starting out with a CD or thinking of using a laddering strategy, the right calculator can be a game-changer.

So, what are you waiting for? Give that CD calculator a spin and see where your savings can take you!

PPF Calculator(Calculate PPF Maturity Amount)

FAQ: CD Calculator

1. What is a CD calculator?

Answer: A CD calculator is an online tool used to estimate the interest earned and the future value of a Certificate of Deposit (CD) based on inputs such as the principal amount, interest rate, term length, and compounding frequency. It helps investors determine how much their CD investment will grow over time.

2. How does a CD calculator work?

Answer: A CD calculator uses a formula to compute the future value of a CD based on:

- Principal Amount: The initial amount of money deposited into the CD.

- Interest Rate: The annual interest rate offered by the CD.

- Term Length: The duration for which the money is deposited (e.g., 6 months, 1 year).

- Compounding Frequency: How often interest is compounded (e.g., daily, monthly, quarterly, or annually).

The formula used generally is:

Future Value=Principal×(1+Annual Interest RateNumber of Compounding Periods per Year)Number of Compounding Periods per Year×Term Length in Years\text{Future Value} = \text{Principal} \times \left(1 + \frac{\text{Annual Interest Rate}}{\text{Number of Compounding Periods per Year}}\right)^{\text{Number of Compounding Periods per Year} \times \text{Term Length in Years}}Future Value=Principal×(1+Number of Compounding Periods per YearAnnual Interest Rate)Number of Compounding Periods per Year×Term Length in Years

3. What information do I need to use a CD calculator?

Answer: To use a CD calculator, you typically need to input:

- Principal Amount: The amount of money you plan to deposit.

- Interest Rate: The annual interest rate offered by the CD.

- Term Length: The length of time you plan to keep the money in the CD.

- Compounding Frequency: How often the interest is compounded (e.g., daily, monthly).

4. What is compounding frequency, and why does it matter?

Answer: Compounding frequency refers to how often the interest on the CD is calculated and added to the principal. Common compounding frequencies include daily, monthly, quarterly, and annually. The more frequently interest is compounded, the higher the overall return on the CD because interest is calculated on an increasingly larger balance more often.

5. How can I interpret the results from a CD calculator?

Answer: The CD calculator will provide:

- Future Value: The total amount you will have at the end of the CD term, including the principal and interest earned.

- Total Interest Earned: The amount of interest earned over the term of the CD.

Understanding these results helps you evaluate how much your investment will grow and compare different CD options.

6. Are CD calculators accurate?

Answer: CD calculators are accurate in estimating the future value of a CD based on the inputs provided. However, the actual interest earned may vary slightly due to rounding or differences in the exact compounding method used by the bank. Always check with your financial institution for precise details.

7. Can a CD calculator help me compare different CDs?

Answer: Yes, a CD calculator can help compare different CDs by allowing you to input varying interest rates, terms, and compounding frequencies. This comparison can help you choose the CD that offers the best return based on your investment goals.

8. What are the limitations of a CD calculator?

Answer: Limitations include:

- Fixed Rates: CD calculators assume that the interest rate is fixed for the entire term. In reality, rates might change if you roll over your CD or invest in a new one.

- Early Withdrawal Penalties: Calculators typically do not account for penalties if you withdraw funds before the CD matures.

- Additional Fees: Any additional fees or charges associated with the CD might not be factored in.

9. How can I use the results from a CD calculator to make investment decisions?

Answer: Use the results to:

- Evaluate Returns: Determine which CD offers the best return based on your investment goals and compare it with other savings or investment options.

- Plan for Future Needs: Understand how much you will have at the end of the term to help plan for future expenses or investment strategies.

10. Are there online CD calculators available?

Answer: Yes, there are numerous online CD calculators available for free. Many financial institutions and personal finance websites offer these tools. Simply search for “CD calculator” online to find various options.

11. How often should I use a CD calculator?

Answer: It’s useful to use a CD calculator when considering a new CD investment, comparing multiple CDs, or planning your financial goals. Regularly using the calculator can help you stay informed about how different rates and terms impact your returns.

12. Can a CD calculator help with laddering strategies?

Answer: Yes, a CD calculator can assist with CD laddering strategies by allowing you to calculate the returns for CDs with different maturities. This helps in planning a staggered investment approach to take advantage of varying interest rates and maintain liquidity.

13. Do CD calculators account for taxes?

Answer: Most CD calculators do not account for taxes. The interest earned on CDs may be subject to federal and state taxes, which can affect your actual return. Be sure to factor in potential taxes when evaluating your investment.

14. What should I do if I have specific questions about my CD calculations?

Answer: If you have specific questions or need detailed information about your CD investment, consult with a financial advisor or representative from your bank. They can provide personalized assistance and clarify any details that calculators may not cover.

By: Paisainvests