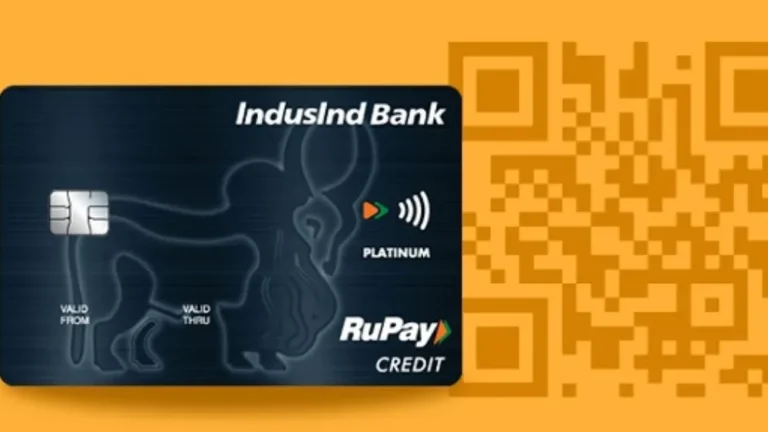

Get the IndusInd RuPay Credit Card for rewarding benefits, low fees, travel perks, and enhanced security. Apply today for exclusive rewards and lifestyle privileges.

Table of Contents

Introduction

The IndusInd RuPay Credit Card is a perfect blend of convenience, rewards, and security, catering to the diverse needs of modern-day users. Powered by the robust RuPay payment network, this credit card offers seamless access to domestic and international transactions, making it ideal for both everyday purchases and high-value expenditures.

With a host of benefits ranging from attractive reward points, exclusive dining privileges, and lifestyle perks to complimentary insurance coverage, the IndusInd RuPay Credit Card ensures that every swipe is packed with value. Additionally, its advanced security features provide peace of mind while transacting online or offline.

Features of IndusInd RuPay Credit Card

Reward Points Program

- Earn attractive reward points on every transaction, whether shopping, dining, or traveling.

- Redeem points for exciting options like cashback, travel bookings, or exclusive merchandise.

Lifestyle Benefits

- Access exclusive deals and discounts on dining, shopping, and entertainment.

- Complimentary memberships and offers for premium lifestyle services.

Travel Benefits

- Complimentary access to domestic and international airport lounges.

- Travel insurance coverage for peace of mind during journeys.

Security Features

- Advanced security with RuPay’s contactless technology for safe and swift transactions.

- Fraud protection and zero liability on unauthorized transactions when reported promptly.

Easy EMI Options

- Convert high-value purchases into affordable EMIs with flexible tenure options.

Low Forex Markup

- Enjoy competitive foreign exchange rates and lower markup fees for international transactions.

Bill Payments and Utility Services

- Set up standing instructions for recurring bills and utilities.

- Earn rewards on timely payments for essential services.

24/7 Customer Support

- Round-the-clock assistance for any queries or concerns related to the card.

Benefits of IndusInd RuPay Credit Card

The IndusInd RuPay Credit Card is designed to offer unparalleled benefits across various aspects of your financial and lifestyle needs. Here’s an in-depth look at its benefits:

Exceptional Rewards

- Earn More on Every Spend: Every transaction, whether shopping, dining, or traveling, earns you valuable reward points. The card ensures that your daily expenses are both rewarding and fulfilling.

- Flexible Redemption Options: Redeem your reward points for a wide range of benefits, including cashback, exclusive merchandise, flight tickets, or hotel stays, giving you the freedom to choose what suits you best.

Lifestyle Privileges

- Dining Discounts: Enjoy exclusive offers and discounts at top restaurants, making every meal a memorable experience.

- Premium Memberships: Gain complimentary or discounted access to premium lifestyle services such as health and wellness programs, concierge services, and entertainment platforms.

- Exclusive Shopping Deals: Avail deals and offers on leading e-commerce platforms and retail outlets, ensuring savings and satisfaction with every purchase.

Travel Comforts

- Airport Lounge Access: Gain complimentary access to select domestic and international airport lounges, providing a luxurious and comfortable travel experience.

- Travel Insurance: Comprehensive travel insurance coverage, including protection against flight delays, loss of luggage, or personal accidents, ensures you travel with peace of mind.

- Global Acceptance: With the RuPay international network, you can use your card seamlessly for transactions across the globe.

Enhanced Security

- Advanced Fraud Protection: State-of-the-art security features protect against unauthorized transactions. In case of a reported loss, you benefit from zero liability for fraudulent usage.

- Contactless Transactions: Tap-and-pay technology ensures quick and secure payments without the need to hand over your card.

- Card Control Features: Manage transaction limits, block or unblock your card, and track spending in real-time through a user-friendly app.

Cost-Effective Transactions

- Low Forex Markup: Save significantly on foreign currency transactions with competitive foreign exchange markup fees, making it ideal for international travelers.

- Flexible EMI Options: Convert big-ticket purchases into easy and affordable monthly installments with flexible repayment tenures, helping you manage finances effortlessly.

Utility and Bill Payment Convenience

- Automated Payments: Set up standing instructions for recurring bills such as utilities, phone bills, and subscriptions, ensuring timely payments without the hassle of manual intervention.

- Rewarded Payments: Earn reward points on bill payments, turning routine expenses into rewarding opportunities.

Comprehensive Insurance Coverage

- Personal Accident Insurance: Provides financial protection for you and your family in case of unforeseen incidents.

- Purchase Protection: Coverage for items purchased using the card against accidental damage or theft within a specified period.

Unmatched Customer Support

- 24/7 Assistance: A dedicated customer service team is available round-the-clock to address any issues, answer queries, or assist with emergencies.

- Quick Dispute Resolution: Hassle-free resolution of disputes or transaction issues, ensuring a smooth cardholder experience.

Exclusive RuPay Network Benefits

- As a RuPay-powered credit card, enjoy additional benefits such as access to special events, cashback offers, and discounts curated by RuPay for its cardholders.

Digital-Friendly Features

- App Integration: Manage your card, track transactions, and redeem rewards through the dedicated mobile app or online portal.

- Contactless Payments: Pay quickly and securely with just a tap, making it ideal for busy lifestyles.

How to Apply for IndusInd RuPay Credit Card

Applying for the IndusInd RuPay Credit Card is a simple and hassle-free process. Here’s a step-by-step guide to help you get started:

Step 1: Check Eligibility

Before applying, ensure that you meet the eligibility criteria, which typically include:

- Minimum age requirement (usually 21 years or above).

- Stable income source to meet the credit card’s financial requirements.

- A good credit score to improve approval chances.

Step 2: Gather Required Documents

Prepare the necessary documents for a smooth application process. These generally include:

- Identity Proof: Aadhaar Card, PAN Card, Passport, or Driving License.

- Address Proof: Utility bill, rental agreement, or Passport.

- Income Proof: Salary slips, bank statements, or Income Tax Return (ITR) documents.

- Photographs: Recent passport-sized photographs.

Step 3: Choose Your Application Method

You can apply for the IndusInd RuPay Credit Card through one of the following methods:

- Online Application:

- Visit the official IndusInd Bank website.

- Navigate to the “Credit Cards” section and select the RuPay Credit Card.

- Click on “Apply Now” and fill out the online application form with the required details.

- Upload the necessary documents and submit the application.

- Offline Application:

- Visit the nearest IndusInd Bank branch.

- Request a credit card application form.

- Fill in your details and attach the required documents.

- Submit the completed form to the bank representative.

Step 4: Verification Process

Once your application is submitted, the bank will:

- Verify the details and documents provided.

- Conduct a credit score check to assess your financial history.

- Contact you for any additional information, if required.

Step 5: Approval and Card Issuance

Upon successful verification:

- You will receive an approval notification via email or SMS.

- The credit card will be dispatched to your registered address.

- Activation instructions will be provided along with the card.

Tips for a Smooth Application

- Ensure all information provided is accurate and matches the documents submitted.

- Maintain a good credit score to improve approval chances.

- Respond promptly to any queries or follow-ups from the bank during the verification process.

Comparing IndusInd RuPay Credit Card with Others

When selecting a credit card, it’s essential to evaluate how the IndusInd RuPay Credit Card stacks up against other cards in the market. Here’s a comparison based on key features:

Payment Network

- IndusInd RuPay Credit Card: Powered by the RuPay network, known for its robust domestic presence, lower transaction fees, and exclusive partnerships with Indian merchants.

- Other Cards: Cards powered by Visa or Mastercard offer extensive global acceptance and premium features, but often come with higher fees.

Rewards and Benefits

- IndusInd RuPay Credit Card: Focused on rewarding domestic spending, including shopping, dining, and travel, with attractive redemption options.

- Other Cards: Often provide higher rewards for international transactions, travel bookings, and luxury spending, making them suitable for frequent travelers.

Fees and Charges

- IndusInd RuPay Credit Card: Typically lower annual fees and reduced forex markup, making it a cost-effective option for domestic users.

- Other Cards: Premium cards like Visa Signature or Mastercard World may have higher annual fees but offer extensive perks like concierge services and higher reward rates.

Lifestyle Privileges

- IndusInd RuPay Credit Card: Offers curated deals and discounts for dining, shopping, and entertainment, along with access to select lounges.

- Other Cards: Compete by offering complimentary lounge access globally, hotel bookings, and exclusive event invitations.

Security Features

- IndusInd RuPay Credit Card: Provides advanced fraud protection, zero liability for unauthorized transactions, and enhanced security for domestic use.

- Other Cards: Offer similar features but may include global fraud monitoring systems, making them more suitable for international usage.

Ease of Access

- IndusInd RuPay Credit Card: Simplified application process and better availability for domestic users, especially in semi-urban and rural areas.

- Other Cards: May have stricter eligibility criteria, particularly for premium cards with extensive benefits.

Customer Support

- IndusInd RuPay Credit Card: Offers 24/7 assistance tailored to domestic users’ needs.

- Other Cards: May offer multilingual support and a global helpline for frequent travelers.

Target Audience

- IndusInd RuPay Credit Card: Ideal for individuals looking for cost-effective domestic benefits, moderate spending rewards, and RuPay-specific perks.

- Other Cards: Cater to frequent travelers, high spenders, and those seeking luxury experiences.

Tips to Maximize Benefits of IndusInd RuPay Credit Card

To get the most out of your IndusInd RuPay Credit Card, consider these tips to optimize rewards, privileges, and financial management:

Leverage Reward Points

- Use for Everyday Purchases: Maximize reward points by using your card for regular expenses like groceries, bills, dining, and travel.

- Redeem Points Smartly: Redeem accumulated points for high-value rewards such as flight tickets, hotel stays, or cashback instead of just merchandise.

- Look for Bonus Offers: Keep an eye on promotional offers that provide bonus points for specific categories or merchants.

Take Advantage of Lifestyle Privileges

- Dining Offers: Use your card at partner restaurants and cafes to avail discounts or cashback offers, enhancing your dining experiences.

- Exclusive Deals: Check for special deals on shopping platforms, health and wellness services, and entertainment venues, where you can save money or gain additional rewards.

- Access Premium Services: Utilize any complimentary memberships or concierge services offered with your card to elevate your lifestyle and access exclusive privileges.

Make the Most of Travel Benefits

- Airport Lounge Access: When traveling, make use of your complimentary access to domestic and international airport lounges for a relaxing pre-flight experience.

- Travel Insurance: Take advantage of travel insurance coverage, ensuring you’re protected in case of delays, cancellations, or emergencies while traveling.

- Global Spending: For international purchases, use your card to benefit from RuPay’s low forex markup fees, which can save you money on foreign transactions.

Monitor and Manage Spending

- Track Transactions: Regularly check your transactions using the mobile app or online portal to ensure you’re earning rewards and to avoid unnecessary spending.

- Set Payment Alerts: Enable payment reminders or automatic bill payments to stay on top of due dates and avoid late fees.

- Use EMIs for Big Purchases: Convert high-value purchases into easy EMIs to manage your finances without straining your budget.

Use Card for Recurring Payments

- Bill Payments: Set up your utility bills and subscriptions for automatic payments with your credit card, earning rewards on routine payments.

- Membership Renewals: Pay for memberships, insurance premiums, or streaming subscriptions using your card to earn reward points and take advantage of automatic renewals.

Keep Security Features in Mind

- Enable Alerts: Activate transaction alerts and fraud protection features to stay updated and safeguard your card from unauthorized activity.

- Use Contactless Payments: For quicker and secure payments, take advantage of the contactless feature whenever possible.

Optimize Credit Limits and Repayment

- Timely Payments: Always make timely payments to avoid interest charges and build a good credit history, which can help you qualify for higher credit limits or better offers.

- Pay More than the Minimum: To reduce interest charges, aim to pay more than the minimum due amount each month, paying off your balance faster.

Conclusion

The IndusInd RuPay Credit Card offers a compelling blend of rewards, cost-effective features, and security, making it an excellent choice for domestic users looking to maximize their spending potential. With its easy accessibility, lower fees, and numerous privileges, it stands out as a practical solution for daily purchases, travel, and lifestyle enhancements. The card’s robust rewards program, coupled with lifestyle discounts, airport lounge access, and enhanced fraud protection, makes it a well-rounded option for those seeking both convenience and value.

Whether you’re looking to earn points on everyday expenses, enjoy exclusive offers, or simplify your finances with bill payments, the IndusInd RuPay Credit Card ensures a seamless and rewarding experience. By strategically using its features, you can easily unlock its full potential and make the most out of every transaction. For anyone seeking a versatile, secure, and rewarding credit card, this offering is a top contender in the Indian market.

FAQs About IndusInd RuPay Credit Card

What is the IndusInd RuPay Credit Card?

The IndusInd RuPay Credit Card is a financial product offered by IndusInd Bank, powered by the RuPay network. It provides a range of benefits including rewards points, lifestyle privileges, travel perks, and enhanced security features for both domestic and international transactions.

How can I apply for the IndusInd RuPay Credit Card?

You can apply for the card online by visiting the IndusInd Bank website, filling out the application form, and uploading necessary documents. Alternatively, you can visit a nearby IndusInd Bank branch to apply offline.

What documents are required to apply for the IndusInd RuPay Credit Card?

Typically, you will need:

Identity Proof: Aadhar Card, PAN Card, Passport, or Driving License.

Address Proof: Utility bill, passport, or rental agreement.

Income Proof: Salary slips, bank statements, or Income Tax Returns (ITR).

Photographs: Recent passport-sized photographs.

What are the eligibility criteria for the IndusInd RuPay Credit Card?

The eligibility criteria generally include:

A minimum age of 21 years.

A stable income source.

A good credit score for better approval chances. Specific criteria may vary, so it’s advisable to check with the bank before applying.

What are the key benefits of the IndusInd RuPay Credit Card?

Key benefits include:

Reward Points on everyday spending.

Dining Discounts and Exclusive Shopping Deals.

Airport Lounge Access.

Travel Insurance and Personal Accident Insurance.

Low Forex Markup for international transactions.

Contactless Payments and enhanced security features.

How can I redeem my reward points?

You can redeem your reward points for various options, including cashback, flight tickets, hotel stays, or exclusive merchandise. Redemption can be done through the bank’s online portal or mobile app.

Is there an annual fee for the IndusInd RuPay Credit Card?

Yes, the card comes with an annual fee. However, the fee is generally lower compared to international cards like Visa or Mastercard, making it a cost-effective option for domestic users. You may also be eligible for fee waivers based on spending.

How does the IndusInd RuPay Credit Card compare with other cards?

The IndusInd RuPay Credit Card offers lower annual fees and forex markup compared to international cards, making it ideal for domestic spenders. While it provides exclusive domestic rewards and privileges, global travelers may find cards from Visa or Mastercard more beneficial due to wider international acceptance.

What is the interest rate on the IndusInd RuPay Credit Card?

The interest rate on outstanding balances is typically around 3.5% to 4% per month, depending on your credit profile. It’s recommended to pay the full bill amount on time to avoid interest charges.

Can I use the IndusInd RuPay Credit Card internationally?

Yes, the IndusInd RuPay Credit Card can be used internationally through the RuPay international network, offering competitive forex markup fees.

How can I manage my IndusInd RuPay Credit Card account?

You can manage your card through the IndusInd Bank mobile app or online banking portal, where you can track transactions, redeem rewards, pay bills, and set spending limits.

How can I cancel or block my IndusInd RuPay Credit Card?

If you wish to cancel or block your card, contact IndusInd Bank’s customer support team. They will guide you through the process and ensure your card is properly blocked to prevent unauthorized transactions.

Is there any travel insurance included with the card?

Yes, the IndusInd RuPay Credit Card offers travel insurance that covers flight delays, baggage loss, and personal accidents during travel.

How secure is the IndusInd RuPay Credit Card?

The card offers enhanced security features, including fraud protection, zero liability for unauthorized transactions, and contactless payments for quick and secure transactions.

What should I do if I lose my IndusInd RuPay Credit Card?

If your card is lost or stolen, immediately report it to IndusInd Bank’s customer service or block it via the mobile app to prevent fraudulent transactions. The bank will assist in issuing a new card and resolving any issues.

By Paisainvests