Unlock exclusive rewards and benefits with the ICICI American Express Credit Card. Enjoy travel perks, dining offers, and more for an enhanced experience!

Table of Contents

Introduction

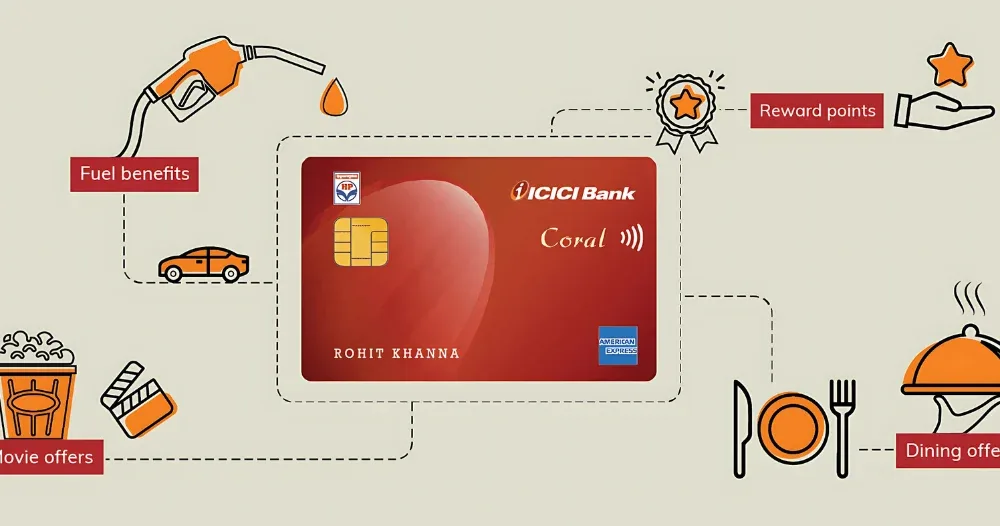

The ICICI American Express Credit Card combines the trusted service of ICICI Bank with the premium experience of American Express. Designed for those who seek exceptional rewards and benefits, this card offers a range of features tailored to elevate your lifestyle. Enjoy exclusive travel perks, enticing dining offers, and a suite of privileges that enhance every purchase. Whether you’re a frequent traveler or a dining enthusiast, this card provides the tools to make the most of your spending. Discover a world of possibilities with the ICICI American Express Credit Card!

ICICI American Express Credit Card Benefits

- Reward Points: Earn points on every purchase, which can be redeemed for travel, shopping, and more.

- Travel Benefits: Enjoy complimentary lounge access, travel insurance, and discounts on hotel bookings.

- Dining Offers: Get exclusive discounts and cashback at partner restaurants and online food delivery services.

- Global Acceptance: Use your card internationally with ease, backed by American Express’s wide network.

- Flexible Payment Options: Manage your expenses with flexible payment plans and easy EMI options.

- Contactless Payments: Experience fast and secure transactions with contactless technology.

- Insurance Coverage: Benefit from various insurance policies, including purchase protection and travel insurance.

- 24/7 Customer Support: Access dedicated customer service for assistance anytime you need it.

- Special Promotions: Enjoy exclusive access to events, sales, and offers tailored for cardholders.

- Online Account Management: Easily track your spending, pay bills, and manage your account online or via the mobile app.

These benefits make the ICICI American Express Credit Card a versatile choice for enhancing your financial experience.

ICICI American Express Credit Card Apply

- Check Eligibility: Ensure you meet the eligibility criteria, including age, income, and credit score.

- Visit the Website: Go to the ICICI Bank official website or the American Express site to find the credit card section.

- Select the Card: Choose the ICICI American Express Credit Card that suits your needs.

- Fill Out the Application Form: Complete the online application form with accurate personal and financial information.

- Upload Documents: Provide necessary documents, such as identity proof, address proof, income statements, and photographs.

- Submit the Application: Review your application and submit it online.

- Track Your Application: Use the application reference number to track the status of your application online.

- Receive Approval: If approved, you’ll receive your card by mail, along with details on activation.

- Activate Your Card: Follow the instructions to activate your card and start enjoying its benefits.

By following these steps, you can easily apply for the ICICI American Express Credit Card and begin reaping its rewards!

ICICI American Express Credit Card Limit

The credit limit for the ICICI American Express Credit Card varies based on several factors, including:

- Income: Your annual income plays a crucial role in determining your credit limit. Higher incomes typically lead to higher limits.

- Credit History: A strong credit score and history of timely repayments can result in a more favorable credit limit.

- Existing Relationship with ICICI: If you have an existing account or other products with ICICI Bank, it may positively influence your limit.

- Card Type: Different variants of the ICICI American Express Credit Card may offer varying limits based on their benefits and target audience.

- Bank Policies: ICICI Bank’s internal policies and assessment criteria will also impact the final credit limit assigned.

For precise details regarding your credit limit, it’s best to consult directly with ICICI Bank during the application process or review your account information online once your card is activated.

ICICI American Express Credit Card Eligibility

To qualify for the ICICI American Express Credit Card, applicants generally need to meet the following criteria:

- Age: Must be at least 21 years old and typically not more than 65 years old.

- Income: A minimum annual income requirement is usually specified (varies by card variant). Salaried and self-employed individuals can apply, but proof of income is necessary.

- Credit Score: A good credit score (usually above 750) is often required to increase the chances of approval.

- Employment Status: Applicants should be employed with a stable job or own a business for a certain period.

- Residential Status: Must be a resident of India and provide valid address proof.

- Documentation: Submission of necessary documents, such as identity proof, address proof, income proof, and photographs, is essential.

Always check the latest eligibility criteria on the ICICI Bank website or contact customer service for specific details related to the card you’re interested in.

ICICI American Express Credit Card Charges

- Annual Fee: A yearly fee may apply, which can vary based on the specific card variant.

- Interest Rate: If the outstanding balance is not paid in full, an interest rate (APR) is charged on the remaining balance.

- Late Payment Fee: A fee is incurred for late payments, which varies depending on the outstanding amount.

- Cash Withdrawal Fee: Charges apply for cash withdrawals using the credit card, including interest on the withdrawn amount.

- Foreign Transaction Fee: A fee is levied on transactions made in foreign currencies.

- Overlimit Fee: If you exceed your credit limit, an overlimit fee may be charged.

- Card Replacement Fee: A fee may apply if you request a replacement card due to loss or theft.

- Reward Redemption Fee: Some card variants may charge a fee when redeeming reward points.

It’s important to review the terms and conditions or the specific fee schedule provided by ICICI Bank for the most accurate and updated information.

ICICI American Express Credit Card Lounge Access

The ICICI American Express Credit Card offers exclusive lounge access as one of its premium benefits. Here are key details:

- Airport Lounge Access: Cardholders can enjoy complimentary access to select domestic and international airport lounges.

- Membership Program: Access is often provided through the Priority Pass or a similar membership program, allowing cardholders to relax before flights.

- Guest Policy: Depending on the card variant, you may be allowed to bring a guest, sometimes with a fee.

- Limitations: Access may be subject to specific terms, such as the number of visits per year or availability at certain lounges.

- Lounge Amenities: Lounges typically offer amenities like comfortable seating, complimentary snacks and beverages, Wi-Fi, and more.

To fully understand the lounge access details, including participating lounges and any applicable conditions, it’s best to check the ICICI Bank website or contact customer service.

ICICI American Express Credit Card Offers

The ICICI American Express Credit Card comes with a variety of attractive offers and benefits designed to enhance your spending experience. Here are some key offers you can typically expect:

- Welcome Bonus: New cardholders often receive a welcome bonus of reward points or cashback upon activation and first-use of the card.

- Reward Points: Earn points for every purchase, which can be redeemed for travel, shopping, or gift vouchers.

- Cashback Offers: Enjoy special cashback deals on select categories like groceries, dining, and online shopping.

- Travel Benefits: Discounts on flight bookings, hotel stays, and car rentals, along with complimentary travel insurance.

- Dining Offers: Access to exclusive dining discounts at partner restaurants and cashback on food delivery services.

- Shopping Promotions: Special discounts and offers with popular retail brands, both online and offline.

- Festival Offers: Seasonal promotions providing extra rewards or discounts during festive periods.

- Membership Rewards: Join the American Express Membership Rewards program for additional perks and exclusive experiences.

- Insurance Benefits: Coverage for various travel-related risks and purchase protection for items bought with the card.

- Flexible EMI Options: Convert large purchases into manageable monthly installments at attractive interest rates.

For the latest and most specific offers, it’s recommended to check the ICICI Bank website or the American Express portal regularly.

ICICI American Express Credit Card Login

ICICI American Express Credit Card Login

To access your ICICI American Express Credit Card account online, follow these steps:

- Visit the Official Website: Go to the ICICI Bank website or the American Express website.

- Locate the Login Section: Find the login option on the homepage, usually labeled as “Login” or “Net Banking.”

- Select Card Type: Choose “Credit Card” or “American Express” from the list of options.

- Enter Credentials: Input your User ID and Password. If you’re a first-time user, you may need to register for online access.

- Security Verification: Complete any security checks, such as OTP (One-Time Password) verification, if prompted.

- Access Your Account: Once logged in, you can view your account details, check statements, make payments, and manage your rewards.

Registration (If Needed)

If you haven’t registered yet:

- Click on “New User? Register Here”: Follow the prompts to enter your details, including your card number and other personal information.

- Set Up Your Login Credentials: Create a User ID and Password.

- Complete Registration: Once registered, you can log in using your new credentials.

For assistance or issues with logging in, consider contacting customer support for help.

Conclusion

The ICICI American Express Credit Card is an attractive option for those looking to enhance their spending experience with premium rewards and benefits. With features such as generous reward points, complimentary lounge access, and exclusive dining and shopping offers, it caters well to frequent travelers and savvy shoppers alike.

However, potential applicants should weigh the associated annual fees and eligibility requirements against their personal spending habits. Overall, for individuals who can maximize its benefits, this card offers significant value and a rewarding experience, making it a worthwhile addition to your financial toolkit.

American Express Platinum Reservesm Credit Card

ICICI American Express Credit Card FAQ

What is the ICICI American Express Credit Card?

The ICICI American Express Credit Card is a premium credit card that offers a range of rewards, travel benefits, and exclusive offers, combining the services of ICICI Bank and American Express.

How can I apply for the ICICI American Express Credit Card?

You can apply online through the ICICI Bank or American Express website by filling out the application form and submitting the required documents.

What are the eligibility criteria for ICICI American Express Credit Card?

Eligibility typically includes being at least 21 years old, having a good credit score, and meeting the minimum income requirements. Specific criteria may vary based on the card variant.

What fees are associated with ICICI American Express Credit Card?

Common fees include an annual fee, late payment charges, cash withdrawal fees, and foreign transaction fees. Check the specific fee schedule for details.

How do I earn reward points with ICICI American Express Credit Card?

You earn reward points on every purchase made with the card, with bonus points for specific categories like dining, travel, and online shopping.

How do I earn reward points with ICICI American Express Credit Card??

Cardholders enjoy complimentary access to select airport lounges, providing amenities like comfortable seating, snacks, beverages, and Wi-Fi.

Can I redeem my reward points with ICICI American Express Credit Card?

Yes, reward points can be redeemed for various options, including travel, shopping vouchers, and exclusive experiences. Check the rewards portal for specific redemption options.

How can I manage my ICICI American Express Credit Card account online?

You can log in to your account on the ICICI Bank or American Express website to view statements, make payments, and manage your rewards.

What should I do if I lose my ICICI American Express Credit Card?

Immediately report the loss to customer service to block the card and request a replacement.

Is there customer support available for ICICI American Express Credit Card?

Yes, ICICI Bank offers 24/7 customer support for any queries or issues related to your credit card.

If you have more specific questions, feel free to reach out to ICICI Bank’s customer service or visit their website for additional information.

By: Paisainvests