Filing your income tax return online can feel like navigating a labyrinth, but with the right guide, it’s more like a walk in the park. We’ll break down each step, simplify the jargon, and get you filing with confidence. Let’s dive in!

Why File Your Income Tax Return Online?

Filing your income tax return online isn’t just about following trends; it’s about leveraging modern technology to make your life easier. Here’s why you should consider it.

Convenience and Accessibility

Gone are the days of standing in long queues or filling out mountains of paperwork. Online filing lets you submit your return from the comfort of your home, anytime. It’s like having a tax office at your fingertips!

Accuracy and Efficiency

Online portals are designed to minimize errors. With built-in calculators and validation checks, you’re less likely to make mistakes. Plus, it speeds up the whole process, so you can get your refund quicker.

Step-by-Step Guide to Filing Your Income Tax Return Online

Ready to get started?

Follow these steps to file your income tax return online efficiently and correctly.

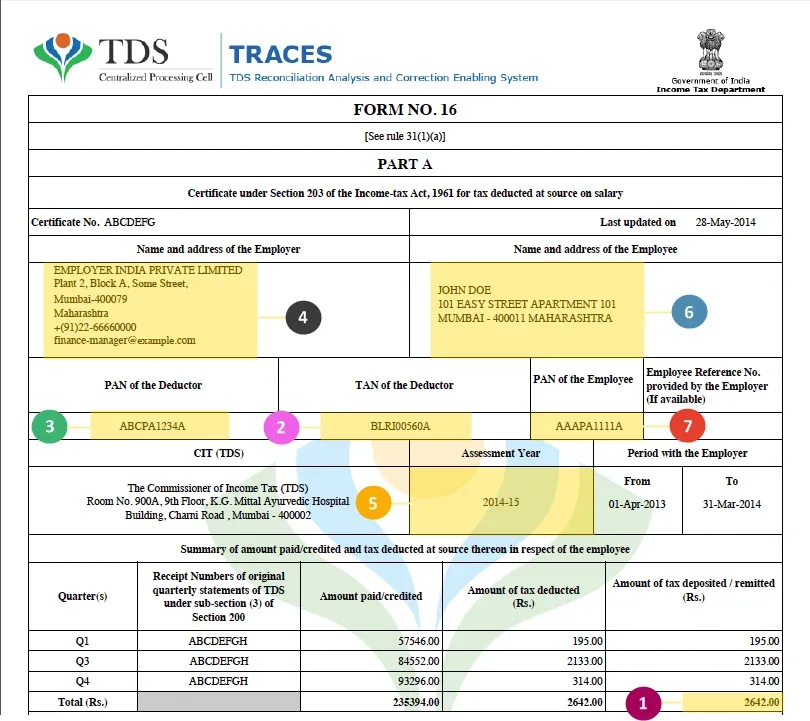

Step 1: Gather Necessary Documents

Before you begin, ensure you have all the required documents: PAN card, Form 16, investment proofs, bank statements, and any other relevant paperwork. Think of it as your tax toolkit.

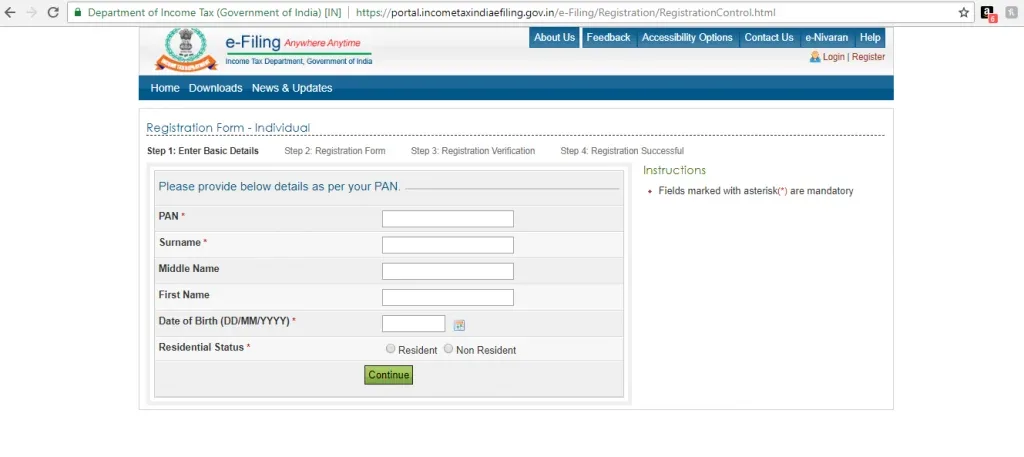

Step 2: Register or Login into the Income Tax Portal

Head to the official Income Tax e-filing website. If you’re a first-timer, you’ll need to register using your PAN. If you’re a returning user, just log in. Simple as logging into your social media account!

Step 3: Select the Appropriate ITR Form

Different forms cater to different types of income. Choose the one that fits your financial situation best. It’s like picking the right tool for the job.

Step 4: Fill in Your Personal Details

Enter your name, address, and other personal information. Double-check for accuracy—small mistakes can lead to big headaches later.

Step 5: Provide Income Details

This is where you enter your salary, interest income, rental income, and any other earnings. Make sure everything adds up!

Step 6: Claim Deductions and Exemptions

Don’t miss out on deductions and exemptions. From Section 80C investments to HRA exemptions, ensure you claim what’s rightfully yours.

Step 7: Review and Verify Your Return

Give your return a thorough once-over. Check for any errors or missing information. Think of it as proofreading an important email.

Step 8: Submit Your Return

Once satisfied, hit the submit button.

Congratulations, you’ve filed your return!

Step 9: E-Verify Your Return

E-verification is the final step to validate your return. You can do this through methods like Aadhaar OTP, net banking, or EVC. It’s like signing off on your work.

Common Mistakes to Avoid

Even with the best tools, mistakes happen. Here are common pitfalls to watch out for.

Incorrect Personal Information

Ensure all personal details are correct. Errors in your name, PAN, or bank details can lead to processing delays.

Misreporting Income

Be accurate with your income details. Misreporting can trigger unwanted scrutiny and penalties.

Not Claiming All Deductions

Maximize your tax savings by claiming all eligible deductions. Missing out means paying more tax than necessary.

Benefits of E-Verifying Your Return

Why bother with e-verification?

It’s not just a formality—it comes with real benefits.

Faster Processing

E-verified returns are processed quickly, meaning you’ll get your refund sooner. Who doesn’t like faster refunds?

Reduced Chances of Manual Errors

E-verification reduces the chances of manual errors in data entry, making your filing experience smoother and more reliable.

Conclusion

Filing your income tax return online doesn’t have to be daunting. With the right preparation and a systematic approach, you can navigate the process smoothly.

Happy filing!

Related Blogs

FAQs

What is the deadline for filing an online income tax return?

The usual deadline for filing an online income tax return is 31st July of the assessment year. However, this can sometimes be extended, so keep an eye out for announcements.

Can I file my income tax return without Form 16?

Yes, you can file your return without Form 16. You’ll need to gather your income details from salary slips, bank statements, and other sources.

How do I know which ITR form to use?

The Income Tax Department’s website provides detailed guidelines on which form to use based on your income sources. It’s crucial to choose the correct form to avoid issues.

What happens if I miss the deadline for filing my return?

Missing the deadline can result in penalties and interest on any tax due. However, you can still file a belated return with some late fees.

Can I correct mistakes in my filed return?

Absolutely! If you discover errors after filing, you can file a revised return. It’s better to correct mistakes promptly than to let them linger.