Earn exclusive rewards, VIP access, and special financing with the Neiman Marcus Credit Card. Enjoy InCircle points, no foreign fees, and early event access.

Table of Contents

Introduction

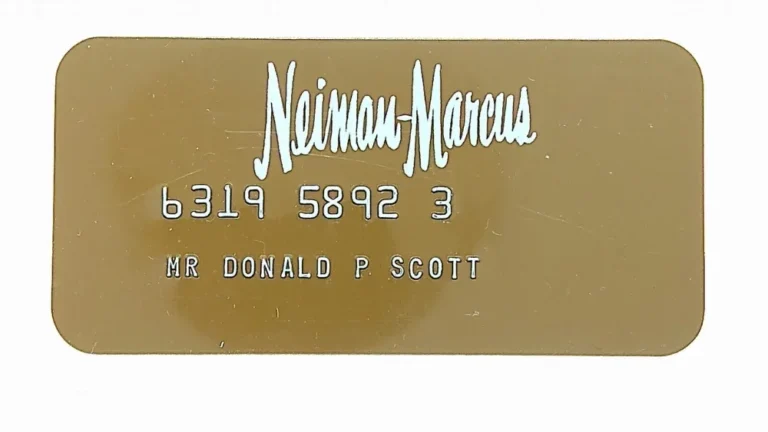

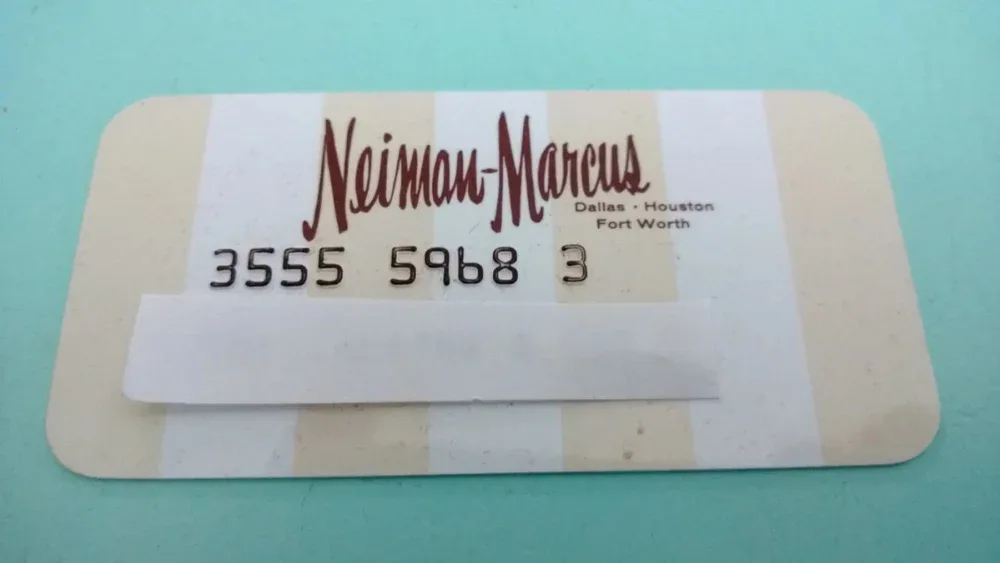

The Neiman Marcus Credit Card is your gateway to a world of luxury, offering exclusive benefits tailored to your shopping experience. As a cardholder, you’ll enjoy premier perks, including early access to sales, special financing options, and invitations to exclusive events. The more you shop, the more rewards you earn, giving you access to elite services and luxury gifts. Elevate your style and experience the exceptional with the Neiman Marcus Credit Card.

Understanding the Neiman Marcus Credit Card

The Neiman Marcus Credit Card is your gateway to a world of luxury, offering exclusive benefits designed to enhance your shopping experience. As a valued cardholder, you’ll receive premier perks such as early access to sales, flexible financing options, and invitations to members-only events. With every purchase, you accumulate rewards that can be redeemed for exceptional gifts and services, making your shopping journey even more rewarding. Discover how the Neiman Marcus Credit Card can elevate your lifestyle and provide a truly exclusive experience.

Key Benefits of the Neiman Marcus Credit Card

Early Access to Sales

Be among the first to shop special events and seasonal sales before they open to the public.

Flexible Financing Options

Enjoy special financing plans that make luxury shopping more convenient.

Reward Points

Earn points on every purchase and redeem them for exclusive rewards and luxury gifts.

Exclusive Invitations

Receive invites to cardholder-only events, fashion shows, and private shopping experiences.

Personalized Services

Experience complimentary alterations, in-store styling sessions, and more.

These benefits are designed to elevate your experience at Neiman Marcus, making your luxury shopping both enjoyable and rewarding.{1}

InCircle Rewards Program

Exclusive Rewards for Neiman Marcus Shoppers

The InCircle Rewards Program is designed to enhance your shopping experience by rewarding loyalty with valuable points and exclusive benefits. As a member, you can earn points on every purchase, which can be redeemed for a variety of rewards, including luxury gifts, private events, and even travel experiences. The more you shop, the more you earn, allowing you to enjoy perks like personalized services and special promotions.

Whether you’re shopping for high-end fashion, home décor, or beauty products, the InCircle Rewards Program ensures that every purchase brings you closer to your next reward.

Point Redemption and Rewards Perks

Redeem Points for Exclusive Rewards

With the InCircle Rewards Program, every purchase brings you closer to exciting rewards. Points earned can be redeemed for a variety of exclusive gifts, luxury products, or private shopping experiences. Whether it’s upgrading your wardrobe or enjoying a special treat, your points offer endless possibilities.

Access to Special Perks and Benefits

As an InCircle member, you’ll unlock premium perks, such as:

- VIP Invitations: Exclusive access to private events, fashion shows, and in-store experiences.

- Birthday Gifts: Celebrate your special day with personalized gifts and surprises.

- Special Discounts: Enjoy additional savings on select products and services.{2}

InCircle Membership Tiers

Exclusive Levels for Enhanced Benefits

The InCircle Rewards Program offers different membership tiers that provide increasing levels of exclusive benefits, allowing you to enjoy even greater rewards as you shop at Neiman Marcus.

Silver

The entry-level tier where you begin earning points with every purchase, unlocking access to basic rewards and occasional promotions.

Gold

Once you reach this tier, you’ll enjoy more points per purchase, along with invitations to select events and special access to seasonal sales.

Platinum

The highest level of membership, offering the most prestigious perks, including VIP treatment, complimentary services, and invitations to private, members-only experiences.{3}

Fees and Interest Rates

Here is a summary of the key fees and interest rates associated with the Neiman Marcus Credit Card:

| Fee Type | Amount |

|---|---|

| Annual Percentage Rate (APR) | 27.99% Variable APR for purchases |

| Cash Advance APR | 29.99% Variable APR |

| Cash Advance Fee | $10 or 5% of the amount of each cash advance, whichever is greater |

| Late Payment Fee | Up to $40 |

| Returned Payment Fee | Up to $40 |

| Foreign Transaction Fee | None |

| Balance Transfer Fee | $5 or 3% of the amount of each balance transfer, whichever is greater |

Pros of the Neiman Marcus Credit Card

Exclusive Luxury Rewards

Earn points on every purchase, which can be redeemed for exclusive gifts, luxury products, and private events.

Access to VIP Shopping Experiences

Enjoy early access to sales, special promotions, and invitations to members-only events, fashion shows, and private shopping experiences.

No Foreign Transaction Fees

Use your card globally without worrying about foreign transaction fees, making it ideal for international travelers.

Special Financing Options

Take advantage of flexible financing options on purchases, helping you manage larger expenses with ease.

Personalized Services

Benefit from complimentary services, such as in-store styling, alterations, and more, enhancing your shopping experience.{4}

Cons of the Neiman Marcus Credit Card

High Interest Rates

The Neiman Marcus Credit Card comes with a relatively high APR, which can lead to significant interest charges if balances are not paid off in full each month.

Limited Redemption Options

While the InCircle rewards points can be redeemed for luxury items and experiences, the redemption options may be more limited compared to other general rewards credit cards.

Annual Fee

There may be an annual fee associated with the card, which could be a consideration if you’re not utilizing the card’s full range of benefits.

High Late Payment Fees

Late payment fees can be high, up to $40, which can add up quickly if payments are missed.

Limited Use Outside Neiman Marcus

Although it provides rewards for purchases, the Neiman Marcus Credit Card is best used for shopping at Neiman Marcus, meaning you may not earn as much value if used elsewhere.

How to Apply for a Neiman Marcus Credit Card

Step 1: Visit the Neiman Marcus Website

Go to the Neiman Marcus website or the official Neiman Marcus Credit Card page to access the application form.

Step 2: Complete the Online Application

Fill out the required personal and financial information, including your name, address, income, and employment details.

Step 3: Review the Terms and Conditions

Before submitting your application, carefully review the card’s terms, including interest rates, fees, and rewards program details.

Step 4: Submit Your Application

Once you’ve filled out the form and reviewed the terms, submit your application for review.

Step 5: Wait for Approval

The approval process typically takes a few minutes, but it may take longer in some cases. You will be notified of your approval status via email or phone.

Step 6: Receive Your Card

If approved, you will receive your Neiman Marcus Credit Card in the mail along with your account details.

Managing Your Neiman Marcus Credit Card Online

Step 1: Create an Online Account

Visit the Neiman Marcus website and register for an online account using your card details. You’ll need to provide your credit card number and personal information to get started.

Step 2: Access Your Account Dashboard

Once registered, you can log in to your account to manage your credit card. The dashboard will give you an overview of your balance, available credit, recent transactions, and rewards points.

Step 3: Make Payments

You can easily make payments online through your account. Set up automatic payments or make one-time payments by linking a bank account or debit card.

Step 4: Track Rewards Points

View and track your InCircle Rewards points directly from your account. You can also check your available rewards and redeem them for exclusive gifts or experiences.

Step 5: Update Personal Information

Keep your account details up to date by updating your personal information, such as your address, phone number, and email preferences.

Step 6: Monitor Transactions

Keep track of your purchases and review your monthly statements to ensure there are no discrepancies. You can also set up transaction alerts to stay informed of your spending.

Step 7: Request Customer Support

For any account issues or inquiries, you can contact Neiman Marcus customer service directly through your online account for quick support.

Security Features and Fraud Protection

Advanced Security for Online Shopping

The Neiman Marcus Credit Card uses the latest encryption technologies to ensure secure transactions when shopping online. Your personal and payment information is protected with industry-standard security protocols.

Fraud Protection Alerts

Neiman Marcus offers fraud detection systems that monitor your account for suspicious activity. You’ll receive alerts via email or text if any unauthorized transactions are detected.

Zero Liability Policy

If your card is lost or stolen, Neiman Marcus provides a Zero Liability Policy, which ensures you are not held responsible for unauthorized charges once you report the issue.

Secure Account Access

Your online account is protected by secure login features, including multi-factor authentication (MFA) for added security, ensuring only you have access to your account.

Card Lock and Unlock Feature

If you lose your card or suspect fraud, you can lock your Neiman Marcus Credit Card instantly through your online account, preventing unauthorized use until the issue is resolved.

Identity Protection Services

Neiman Marcus offers identity protection services to monitor and alert you of any suspicious activity that may affect your personal information.

Customer Service and Support

Contacting Neiman Marcus Customer Service

Neiman Marcus offers a variety of ways to get in touch with their customer service team for assistance with your credit card account, including inquiries about billing, rewards, and account management.

Phone Support

You can reach Neiman Marcus Customer Service by calling their dedicated support line. The number is typically available on the back of your credit card or on the Neiman Marcus website.

Online Chat

For immediate assistance, Neiman Marcus offers an online chat option where you can chat with a customer service representative in real time.

Email Support

You can also contact Neiman Marcus by sending an email to their customer support team. They typically respond within 24-48 hours.

FAQs and Self-Service Tools

Visit the Neiman Marcus website to access helpful FAQs and online resources. These include guides on how to manage your credit card, redeem rewards, and make payments.

Account Assistance

If you need help with managing your account, such as updating personal information, reporting a lost or stolen card, or disputing charges, customer service is available to guide you through the process.

Comparing Neiman Marcus Credit Card to Other Luxury Store Cards

When choosing a luxury store credit card, it’s important to understand the benefits, rewards, and fees that differentiate each one. Below is a comparison of the Neiman Marcus Credit Card with other popular luxury store cards:

| Feature | Neiman Marcus Credit Card | Nordstrom Credit Card | Saks Fifth Avenue Credit Card | Bloomingdale’s Credit Card |

|---|---|---|---|---|

| Rewards Program | InCircle Rewards (points for purchases) | Nordy Club (points for purchases) | SaksFirst Rewards (points for purchases) | Loyallist Program (points for purchases) |

| Annual Fee | No annual fee | $0 for the basic card, $49 for Visa | No annual fee | No annual fee |

| Sign-Up Bonus | Exclusive rewards and perks | $40 Nordstrom Note for $100+ spend | Up to 3,000 bonus points on first purchases | $25 gift card after first purchase |

| VIP/Exclusive Access | Early access to sales, private events | Early access to sales and exclusive offers | Invitations to private events | Early access to sales, VIP events |

| Interest Rate (APR) | 27.99% variable | 25.24% variable | 25.24% variable | 25.24% variable |

| Foreign Transaction Fee | None | 3% | None | None |

| Rewards Redemption | Redeem for luxury gifts, experiences | Redeem points for Nordstrom Notes | Redeem for Saks gift cards and rewards | Redeem for merchandise and exclusive offers |

| Financing Options | Special financing on large purchases | Special financing offers on purchases | Special financing offers on purchases | Special financing options available |

| Additional Benefits | Free shipping, alterations, styling services | Free alterations, personalized services | Free alterations, exclusive sales access | Free shipping, exclusive promotions |

Who Should Get the Neiman Marcus Credit Card?

Frequent Shoppers at Neiman Marcus

If you regularly shop at Neiman Marcus for luxury clothing, accessories, home décor, or beauty products, the Neiman Marcus Credit Card is ideal. The card offers valuable rewards points through the InCircle Rewards Program, which can be redeemed for exclusive gifts and experiences.

Luxury Shoppers Who Enjoy VIP Access

If you love attending private sales, fashion shows, and members-only events, the Neiman Marcus Credit Card offers early access to these events. It’s perfect for those who want to experience exclusive perks that elevate their shopping experience.

Those Who Can Pay Off Their Balance Each Month

With a high APR of 27.99%, the Neiman Marcus Credit Card is best suited for those who can pay off their balance in full each month to avoid accruing interest. If you carry a balance, the interest charges can quickly add up.

People Who Value Special Financing Options

If you’re planning a large purchase at Neiman Marcus, the card offers special financing plans that allow you to spread out payments without incurring high-interest charges, making it a great option for big-ticket items.

Luxury Gift Seekers

For individuals who enjoy receiving or gifting luxury items, the Neiman Marcus Credit Card provides access to exclusive rewards that can be redeemed for high-end merchandise, unique gifts, and premium experiences.

Frequent International Travelers

With no foreign transaction fees, the Neiman Marcus Credit Card is a good choice for those who travel internationally and want to use their card without worrying about extra charges when making purchases abroad.

Those Who Prefer a No Annual Fee Card

The Neiman Marcus Credit Card does not charge an annual fee, making it an attractive option for those who want to enjoy the benefits of a luxury store credit card without paying an extra cost for membership.

Conclusion

The Neiman Marcus Credit Card is an excellent choice for those who enjoy shopping at luxury retailers and want to earn exclusive rewards and benefits. With its InCircle Rewards program, early access to sales, and personalized services, it caters to individuals who value premium shopping experiences. Additionally, the lack of foreign transaction fees and special financing options make it a great option for international travelers and those planning larger purchases.

However, the high APR and limited redemption options may not make it suitable for everyone. It’s best suited for those who can pay off their balance monthly and make the most of its rewards and exclusive perks. Whether you are a loyal Neiman Marcus shopper or looking for a credit card that enhances your luxury shopping experience, the Neiman Marcus Credit Card offers substantial rewards for frequent users.

Before applying, make sure to evaluate your spending habits and ensure you’ll be able to leverage its benefits effectively. If you align with the card’s offerings, it could be a valuable addition to your wallet.

Macy’s Credit Card

FAQs About Neiman Marcus Credit Card

What is the Neiman Marcus Credit Card?

The Neiman Marcus Credit Card is a store-specific credit card that offers exclusive benefits and rewards for shopping at Neiman Marcus, including the InCircle Rewards program, special financing options, and VIP access to events.

How does the InCircle Rewards program work?

The InCircle Rewards program allows cardholders to earn points for every dollar spent at Neiman Marcus. Points can be redeemed for luxury gifts, experiences, and exclusive offers. The more you shop, the higher your rewards.

Is there an annual fee for the Neiman Marcus Credit Card?

No, the Neiman Marcus Credit Card does not charge an annual fee, making it a cost-effective option for those who shop at Neiman Marcus frequently.

What are the interest rates on the Neiman Marcus Credit Card?

The Neiman Marcus Credit Card has a variable APR of 27.99%. It’s important to pay off your balance in full each month to avoid high interest charges.

Are there any foreign transaction fees?

No, the Neiman Marcus Credit Card does not charge foreign transaction fees, which makes it ideal for international shoppers.

Can I use the Neiman Marcus Credit Card at other stores?

While the Neiman Marcus Credit Card is primarily designed for use at Neiman Marcus, it can be used for purchases outside the store, but you will only earn the highest rewards for Neiman Marcus purchases.

How do I apply for the Neiman Marcus Credit Card?

You can apply online on the Neiman Marcus website by filling out an application form with your personal and financial information. You will receive an approval decision shortly after submitting your application.

What are the benefits of the Neiman Marcus Credit Card?

Key benefits include earning InCircle Rewards points, exclusive access to sales and events, special financing on large purchases, and no foreign transaction fees.

How can I manage my Neiman Marcus Credit Card online?

You can manage your card online by creating an account on the Neiman Marcus website. From there, you can track purchases, make payments, redeem rewards, and update account information.

What should I do if my Neiman Marcus Credit Card is lost or stolen?

Immediately report the loss or theft to Neiman Marcus customer service to lock your account and prevent unauthorized transactions. They will guide you through the process of issuing a replacement card.

How can I redeem my InCircle Rewards points?

Points can be redeemed for exclusive gifts, experiences, and merchandise from Neiman Marcus. Log into your account to view available redemption options and select your reward.

What happens if I miss a payment on my Neiman Marcus Credit Card?

If you miss a payment, you may incur a late payment fee and interest charges. It’s important to make payments on time to avoid penalties and negative impacts on your credit score.

Can I earn InCircle Rewards on all purchases?

You can earn InCircle Rewards points on purchases made at Neiman Marcus and NeimanMarcus.com. However, rewards for purchases outside of Neiman Marcus are limited, and you may not earn points at the same rate for non-Neiman Marcus purchases.

How do I check my InCircle Rewards balance?

You can easily check your InCircle Rewards balance by logging into your account on the Neiman Marcus website or by calling customer service. Your balance is also displayed on your credit card statement.

What can I redeem my InCircle Rewards points for?

You can redeem your points for luxury merchandise, exclusive experiences, and invitations to special events hosted by Neiman Marcus. There are also options for redeeming points for gift cards or other rewards.

Is it possible to upgrade to a Neiman Marcus Visa card?

Yes, Neiman Marcus offers the option to upgrade to a Neiman Marcus Visa Credit Card, which allows you to use the card outside of Neiman Marcus stores while still earning InCircle Rewards.

Does the Neiman Marcus Credit Card offer any protections for purchases?

Yes, the Neiman Marcus Credit Card offers purchase protection benefits, such as extended warranties and purchase security, which can help cover certain items in the event of damage or theft.

Can I use my Neiman Marcus Credit Card at other stores or online retailers?

If you have a Neiman Marcus Visa Credit Card, you can use it anywhere Visa is accepted. The store-specific Neiman Marcus Credit Card can only be used at Neiman Marcus locations or online at NeimanMarcus.com.

How do I earn additional rewards or benefits?

You can earn bonus rewards by reaching higher spending tiers or participating in special promotions and events that offer accelerated points or bonus opportunities. Neiman Marcus may send out promotional offers to earn more points during limited-time events.

What happens if I return an item purchased with the Neiman Marcus Credit Card?

If you return an item purchased with your Neiman Marcus Credit Card, your rewards points for the returned item will be deducted from your account. Refunds will typically be processed back to your credit card.

How can I request a credit limit increase?

To request a credit limit increase, you can contact Neiman Marcus customer service or log into your online account and submit a request. Keep in mind that the request is subject to approval based on your creditworthiness.

How do I make a payment on my Neiman Marcus Credit Card?

You can make a payment online through your Neiman Marcus account, by phone, or by mailing a check. You can also set up automatic payments to ensure your bill is paid on time.